Wall Street's expectations are overly optimistic, Tesla's Q1 sales saw the largest drop in history

特斯拉第一季度销量大幅下降,华尔街分析师的预期过于乐观。特斯拉股价下跌 4.9%,跌幅在标普 500 指数成分股中排名第二。特斯拉警告称,今年增长速度将明显下降,原因是利率上升和消费者购买力不足。特斯拉在德国的生产受到延误和纵火袭击的影响,导致交付量下降 8.5%。尽管如此,特斯拉在本季度仍多生产了 46561 辆汽车。分析师认为,特斯拉可能面临严重的需求问题。

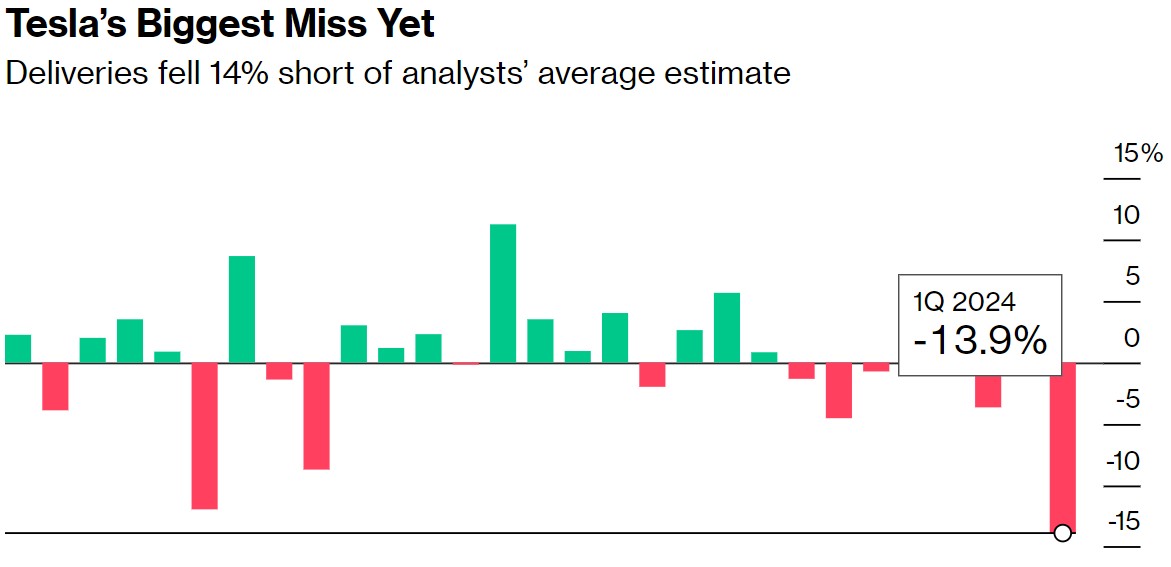

随着第一季度接近尾声之际,华尔街分析师对特斯拉 (TSLA.US)交付量进行了预测。大量分析师降低了他们对车辆交付的预期,随着数据公布,华尔街的预期还是过于乐观了。

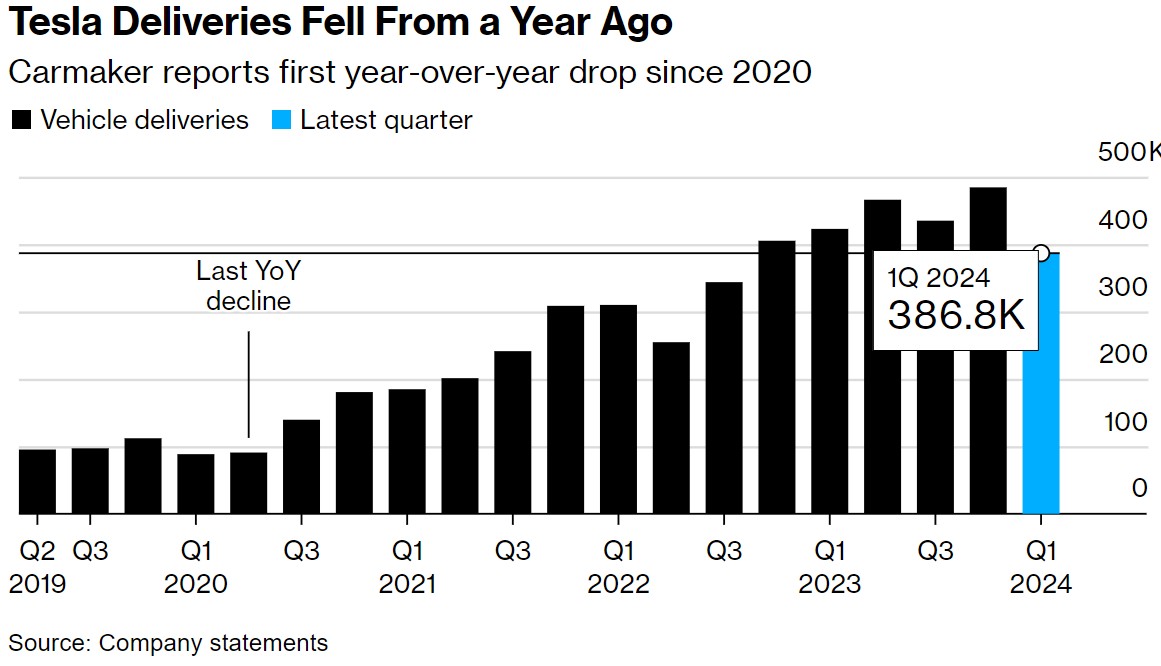

智通财经 APP 获悉,特斯拉在今年头三个月仅交付了 386810 辆汽车,与 7 年来的平均预测差距最大。周二特斯拉股价下跌利 4.9%,将其 2024 年的跌幅扩大至 33%,跌幅在标普 500 指数成分股中排名第二。

特斯拉警告称,今年的增长速度将 “明显下降”,并将原因归咎于利率上升,尽管特斯拉大幅降价,但许多消费者还是买不起特斯拉的汽车。该公司在柏林郊外的工厂处理了多次中断。马斯克在 X 上的发言赶走了潜在的买家,中国电动汽车市场的竞争变得更加激烈。

尽管存在这些明显的不利因素,但大多数分析师仍预计特斯拉的汽车销量将超过一年前。但结果相反,其交付量最终下降了 8.5%。

深水资产管理公司的管理合伙人 Gene Munster 表示,“不管你怎么说,数据都很难看。需求疲软。利率仍然很高。马斯克的形象是否损害了特斯拉在美国的销售?它的方向是消极的。”

特斯拉将销量下降的部分原因归咎于向升级版 Model 3 轿车的转变,这款车和 Model Y 占该季度交付量的 96%。该公司还提到了与红海有关的航运延误,以及涉嫌纵火袭击,导致该公司在德国的生产损失了数天。

尽管如此,特斯拉在本季度还是比交付给客户的汽车多生产了 46561 辆,这是该公司历史上最大的不匹配之一。

德银分析师埃 Emmanuel Rosner 表示,“除了已知的生产瓶颈之外,可能还存在严重的需求问题。”Rosner对特斯拉股票的评级为 “买入”。在特斯拉公布数据前两周多的时间里,他两次下调了交付量预期,但仍将特斯拉的销量高估了 2.4 万多辆。

特斯拉没有按地区公布季度汽车销量,但美国和中国长期以来一直是其最大的市场。该公司在加州弗里蒙特生产 Model S、X、3 和 Y,在上海生产 Model 3 和 Y。它还在奥斯汀和柏林以外的工厂生产Model Y。

去年年底,马斯克又推出了不锈钢外壳的 Cybertruck。该公司尚未公布其生产和交付了多少辆皮卡,将它们与包括Model S 和Model X 在内的其他车型数据混淆。与过去几个季度相比,特斯拉汽车租赁交付的份额仍然很低。

尽管面临诸多挑战,特斯拉还是从中国的比亚迪手中夺回了全球最大电动汽车销售商的头衔。今年第一季度,比亚迪在全球交付了 300114 辆纯电动汽车。包括插电式混合动力车在内,比亚迪共售出 626263 辆汽车。