Inverse and equal-weighted ETFs are lackluster, with historical low volatility, as the US stock market refuses to "question"!

美股涨得越高,有人就越想做空。那些看跌美股和赌波动率上升的投资者,这个月都亏惨了。

美股涨得越高,有人就越想做空。

本周美联储降息预期又熄火,鉴于美国 5 月份制造业数据强劲、首次申请失业金人数又下降,高盛预计美联储首次降息时间会从 7 月推迟至 9 月。

“估值过高” 的美股持续上涨,美股玩家接着奏乐接着舞。

但做空美股的人可就亏惨了。

看跌纳指的 ETF,ProShares UltraPro Short QQQ(代码 SQQQ)仅在 5 月份就亏损近 20%,年度累计亏损超 27%。

SQQQ 是一种三倍杠杆押注纳斯达克 100 指数下跌的 ETF,本月初就吸引了 5 亿美元资金买入。只要纳指下跌,投资者就赚,反之就亏。

还有另一波人,赌美股波动率会上升的,也亏惨了。

像是 UVIX 这只两倍杠杠做多 VIX 期货的 ETF,仅仅是 5 月就亏了 33%,今年累计亏损 55%,

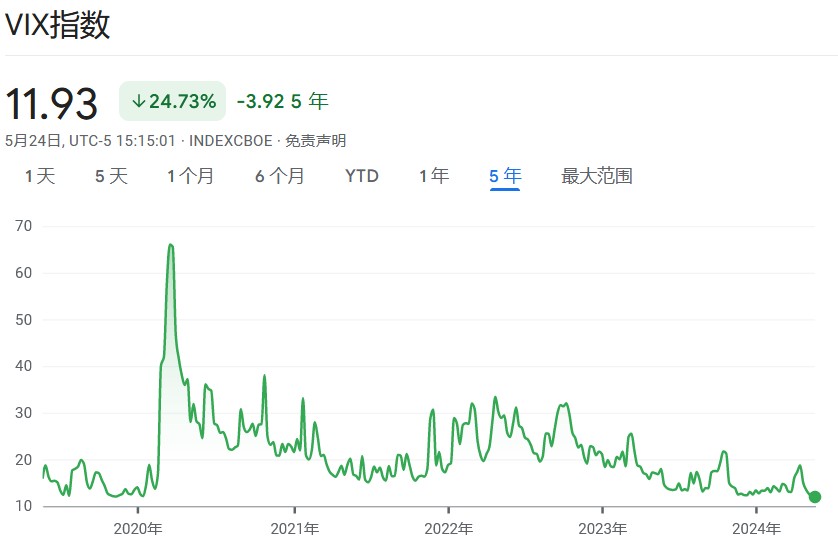

因为近期的债券波动率维持在两年来的最低水平,Cboe 波动率指数(VIX)本周跌破 12 点,市场波动率甚至接近 2019 年的低水平。

买 SQQQ 和 UVIX 的投资者,本质都是和美股的单边上涨行情对赌,采取偏防御性的对冲策略,但他们万万没想到,英伟达炸裂的新财报,能助攻纳指连续第五周上涨,美股股民的狂热给他们好好上了一课。

痛,多么痛的领悟。

这个故事告诉你,投资世界里,不要头铁和站在趋势一边的赢家对赌。

花旗研究的量化宏观团队负责人 Alex Saunders 说:"尽管一些经济数据疲软,但现在考虑防御性交易策略还为时过早,美联储今年的减息预期仍在发挥作用,可以减少美股回调风险,市场偏好科技股及板块是有道理的。”

其实,这部分采取防御性策略的投资者并没大问题,他们是想尽办法来对冲经济下行的风险,只不过现在形势比人强,很多采取看跌期权和高波动性策略的投资者都要开始想别的法子。

例如部分投资者从去年起就把美国地区性银行股、小盘股和零售股来作为做空对象,因为经济降温将首先打击这些领域。

这个策略在去年夏天美股的回调行情中还算有效,但今年就不太行了,没想到这些对经济敏感的行业板块今年都涨得不错。还有 5 月上演的 Meme 股逼空行情,连做空小盘股的空头也亏得很惨。

野村证券衍生品策略师 Charlie McElligott 指出,买看跌期权现在是让人非常沮丧的一件事,这使得一些投资者不得不采用股指期货和 ETF 等更为简单的对冲工具。虽然与期权相比,期货和 ETF 提供的杠杆和微调头寸的机会较少,起码它们的价值也不会每月缓慢递减。

"虽然大部分期货仓位的持仓时间 "极短",但期货现在也是对冲基金们首选的对冲工具,因为期权已经 “死” 了"。