Just one cooling CPI data away from the Fed's rate cut in September

目前市場預計美聯儲 9 月降息概率為 72%。6 月非農強化了市場對 9 月降息的預期,而本週的 CPI 報告有望成為另一個信心增強劑。

非農就業報告顯示勞動力市場有所放緩,市場的焦點轉向了將於本週四公佈的 6 月 CPI 數據。

上週五非農數據公佈後,互換市場定價加大押注美聯儲將在 9 月開啓年內首次降息。芝商所的 FedWatch 工具顯示,互換市場預計美聯儲有 71.6% 的概率在 9 月降息 25 個基點。

分析認為,6 月非農強化了市場對 9 月降息的預期,而本週的 CPI 報告有望成為另一個信心增強劑。

6 月 CPI 拉滿 9 月降息預期?

美國 6 月非農就業報告顯示,新增就業人數較上月有所下滑,並且失業率由 4% 升至 4.1%,為 2021 年 11 月以來最高水平,4 月、5 月的新增就業人數也共計下修 11.1 萬人,均顯示出勞動力市場的降温跡象。

牛津經濟研究院首席美國經濟學家 Nancy Vanden Houten 在一份報告中表示:

“美聯儲官員越來越關注勞動力市場的下行風險,6 月的數據支持了我們對美聯儲在 9 月及此後每次會議上降息的預測。”

Renaissance Macro 的經濟主管 Neil Dutta 也表示,6 月非農就業報告 “使 9 月降息的預期更為堅定”。

不過,此次非農數據反映出來的只是經濟降温,通脹仍是攔在美聯儲降息道路上的一大關鍵因素。

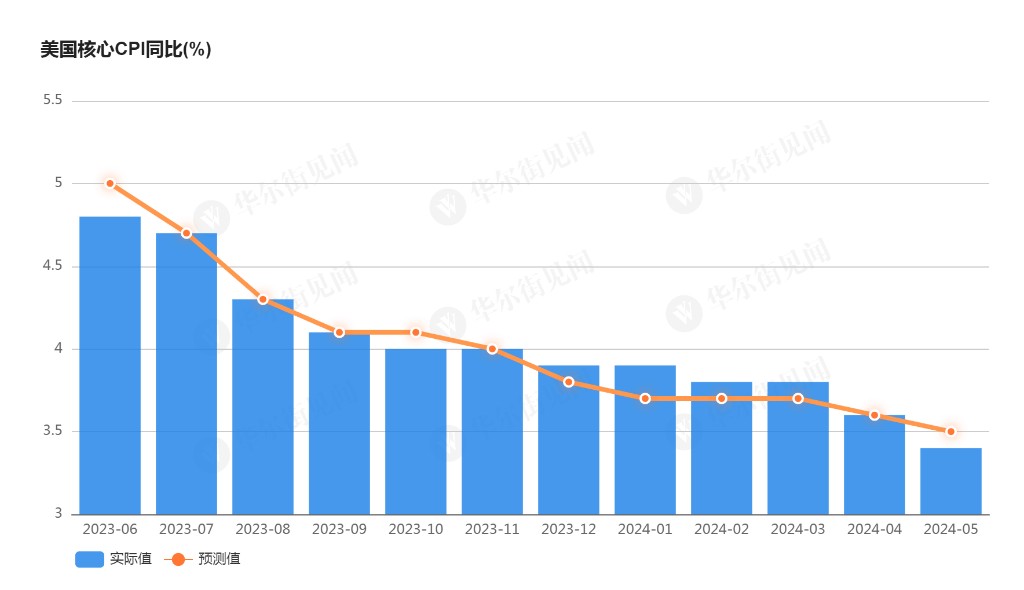

5 月數據顯示,核心 CPI 同比增速降至三年低位,顯示抗通脹卓有成效,這意味着週四的 CPI 數據將可能在很大程度上影響美聯儲能否在 9 月降息。

根據彭博調查的經濟學家預計中值,6 月核心 CPI 同比增速將持平上月,為 3.4%;6 月 CPI 同比增速將進一步放緩至 3.1%,顯示出通脹正朝着目標穩步下行的趨勢。

美銀經濟學家 Stephen Juneau 預計:

“繼五月報告完全良好的表現之後,六月 CPI 報告將成為又一個信心增強劑。”

芝商所的 FedWatch 工具顯示,截至發稿,互換市場預計美聯儲有 71.6% 的概率在 9 月降息 25 個基點。

此外,本週二和週三,鮑威爾將前往國會山進行半年度貨幣政策證詞,屆時投資者將密切關注他任何有關貨幣政策的言論。