Powell says waiting for further data to boost confidence, rate cuts should not be too little or too late

美聯儲主席鮑威爾表示,更多良好數據將增強對通脹目標的信心。降息過少或過晚可能面臨經濟和勞動力市場風險。美聯儲官員對最近的數據表示歡迎,但需要更多信心才能確認通脹趨勢。美聯儲預計在 9 月份首次降息的概率略高於 70%。鮑威爾的言論表明,本月底的會議上不太可能降低利率。股市在鮑威爾證詞發佈後仍保持上漲。

智通財經 APP 獲悉,美聯儲主席鮑威爾表示,“更多的良好數據” 將增強對通脹正在向美聯儲 2% 目標移動的信心,最近的數據顯示物價 “取得了適度的進一步進展”。

在為週二參議院聽證會準備的證詞中,鮑威爾警告説,降息過少或過晚可能會使經濟和勞動力市場面臨風險。

他在為期兩天的國會證詞的第一天對立法者説:“高通脹不是我們面臨的唯一風險。過晚或過少地減少政策約束可能會過度削弱經濟活動和就業。”

鮑威爾還表示,過早或過多地降息可能會阻礙或逆轉通脹進展。“更多的良好數據將增強我們對通脹正朝着 2% 可持續移動的信心。” 他將在週三向眾議院金融服務委員會作證。

美聯儲官員們的目標是將通脹恢復到 2% 的目標,此前新冠疫情後價格飆升。儘管勞動力市場在高利率壓力下保持了韌性,失業率的上升增加了對美聯儲官員降低借貸成本的政治壓力。

鮑威爾的言論表明,聯邦公開市場委員會在本月底召開的會議上不太可能降低利率。

儘管美債收益率波動,今日總體上升,標普 500 指數在鮑威爾證詞發佈後仍保持上漲。交易員們預計美聯儲在 9 月份首次降息的概率略高於 70%。他們預計 2024 年會有兩次 25 個基點的降息。

美聯儲官員對最近的數據表示歡迎,繼年初價格跳漲後,通脹再次放緩,儘管一些其他政策制定者也表示,他們需要更多的信心才能確認這一趨勢會繼續,然後才會降低借貸成本。

美聯儲偏愛的通脹指標在截至 5 月的 12 個月中上漲了 2.6%,低於 2022 年 6 月的 7.1%。儘管失業率仍然低至 4.1%,但在過去三個月中每個月都有所上升。

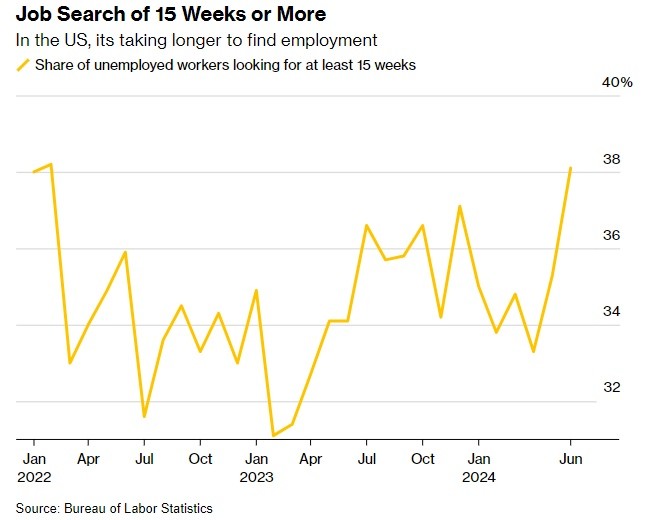

一些經濟學家警告説,勞動力市場可能正在放緩,情況可能會惡化。6 月,找工作超過 15 周的人數上升到自 2022 年初以來的最高水平。

鮑威爾稱勞動力市場 “強勁但不過熱”,並補充説,央行的限制性立場正在努力使供需更好地平衡。

BNP Paribas 高級經濟學家 Yelena Shulyatyeva 稱:“7 月份報告中失業率的再次上升可能會挑戰我們 12 月一次降息的基本預測,增加從 9 月開始兩次降息的可能性。”

美聯儲今年來一直將政策利率維持在 5.25% 至 5.5% 的限制性水平,期貨交易員押注該行將於 9 月宣佈降息,這距離美國大選不到兩個月。

“美聯儲傳聲筒” Nick Timiraos 發表文章稱,去年下半年,儘管支出和招聘都很強勁,但物價增長放緩速度卻如此之快,令官員們感到意外,這促使他們將注意力從加息到多高,轉向降息需要多久。鮑威爾上一次出現在國會議員面前是在 3 月初,他暗示美聯儲可能在 6 月前降息。在那之後,通脹出現了逆轉,使任何此類計劃脱軌。鮑威爾今日表示,最近的通脹數據 “顯示出一些温和的進一步進展,更多的良好數據將增強我們的信心,即通脹正持續向 2% 邁進。” 通脹的劇烈波動讓美聯儲陷入了尷尬的觀望局面,政策制定者要麼等待幾個月令人信服的温和通脹數據,要麼等待就業和經濟活動明顯放緩的證據,然後再降息。