Shipments surged by 21% in the second quarter! Apple leads the global PC market recovery

IDC 數據顯示,二季度全球 PC 出貨量同比增長 3%,蘋果在主要廠商中出貨量增速居首。IDC 稱,面向消費者 AI PC 故事尚未完全講述,大家都在關注蘋果今年新品傳遞這一信息,但高通、英特爾和 AMD 都可能在消費和商業 AI PC 方面引起轟動。

研究機構 IDC 數據顯示,剛剛過去的今年第二季度,全球個人電腦(PC)繼續復甦,蘋果公司的 PC 出貨增長勢頭最猛。

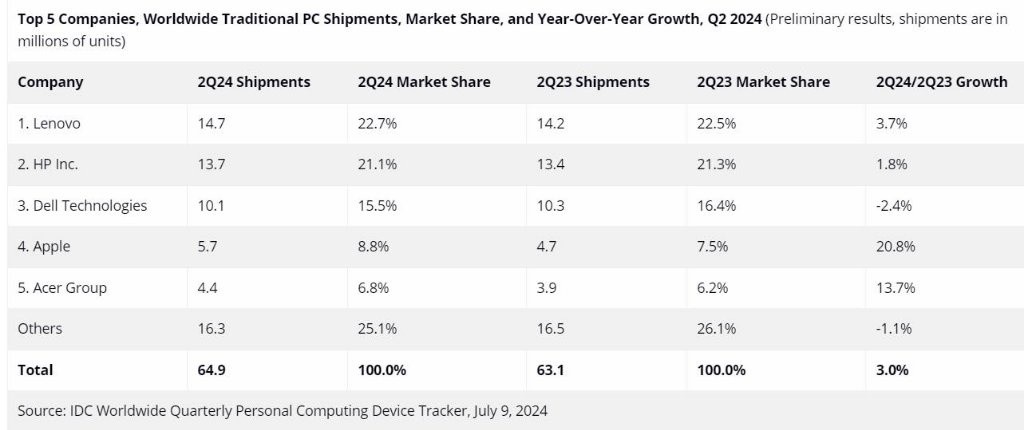

美東時間 7 月 8 日週二,IDC 公佈季度 PC 設備追蹤初步數據,顯示包括台式機、筆記本電腦和工作站的分項渠道及終端用户發貨量在內,二季度全球 PC 合計出貨 6490 萬台,同比增長 3%,增速為一季度的兩倍。

IDC 指出,相比去年,今年全球 PC 市場的整體表現良好,但台式機 PC 最大消費國中國的市場表現疲軟,繼續拖累整體市場。除中國外,全球 PC 的出貨量二季度同比增長超過 5%。

IDC 數據顯示,在全球五大 PC 廠商中,聯想二季度出貨 1470 萬台,出貨量保持榜首,同比增長 3.7%;惠普以出貨 1370 萬台位居次席,出貨量增長 1.8%;排在第三的戴爾出貨 1010 萬台,同比下降 2.4%;蘋果當季出貨 570 萬台,出貨量名列第四,僅佔戴爾的 56%,但同比增長 20.8%,增幅最大;增幅緊隨其後的宏碁當季出貨 440 萬台,同比增長 14%。

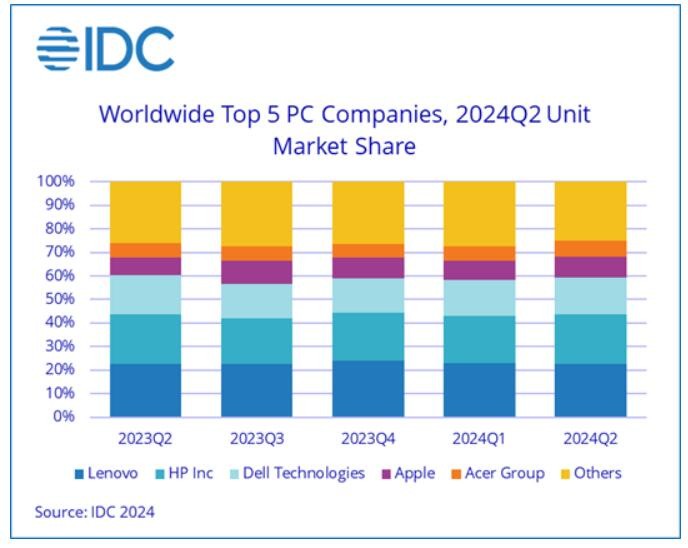

以市場份額看,二季度聯想佔 PC 市場的 22.7%,份額略高於一年前的 22.5%,惠普的份額從一年前的 21.3% 小幅下降至 21.1%,戴爾的份額從 16.4% 降至 15.5%,蘋果則是從 7.5% 升至 8.8%,宏碁從 6.2% 升至 6.8%。

IDC 的全球設備追蹤副總裁 Ryan Reith 表示,PC 市場無疑與其他科技領域的市場一樣,由於成熟度和逆風因素,它短期內面臨挑戰。然而,連續兩個季度的增長,加上圍繞人工智能(AI)PC 的大量市場炒作,以及不那麼吸引人但可能更重要的商用更新週期,似乎正是 PC 市場需要的。人們的注意力顯然都集中在 AI 上,但非 AI PC 的購買也發生了許多變化,使這個成熟的市場顯示出積極的跡象。

IDC 指出,近幾個月來,大多數 PC 行業的參與者已經制定 AI PC 的初步戰略,這些戰略主要側重於組件方面和商用市場的潛力。IDC 認為,在 PC 行業中,AI 對商用 PC 市場的短期提升最大,不過,對消費者的 AI PC 故事尚未完全講述。大家都在關注蘋果今年晚些時候發佈預期的產品來傳遞這一信息,但不應忽視的是,高通、英特爾和 AMD 都可能在消費 AI PC 和商用 AI PC 方面引起轟動。

IDC 的全球移動設備追蹤研究經理 Jitesh Ubrani 表示,除了商用更新週期,面向消費者的品牌和渠道的促銷活動也有助於推動消費 PC 這一細分市場的發展。市場也已走出去年庫存過剩導致的價格低谷,由於配置更豐富以及折扣減少,PC 平均售價有所上漲。