Hang Seng TECH Index surged by 2%, with the autonomous driving concept bucking the trend and strengthening, Baidu soared by 10%

無人駕駛概念爆發,多股掀起漲停潮,天邁科技 20CM 漲停。能源、有色及貴金屬板塊股集體走低。港股也衝高回落,收盤轉跌。科網股領漲,百度港股大漲 10%。

週三,A 股全日震盪走低,上證指數收跌 0.68%,深成指跌 0.1%,創業板指跌 0.06%。滬深兩市成交額 6775 億元,上漲股票數量超過 1500 只。煤炭、教育、油氣、文化傳媒、有色金屬、房地產、電力板塊跌幅居前;無人駕駛、新能源車、鋰礦概念股逆勢活躍。

港股衝高回落,恒指收跌 0.29%,恒生科技指數幾近收平。原材料、能源股下挫,中國宏橋跌近 7% 領跌藍籌,中國神華跌近 5%。百度集團逆市漲逾 10%,旗下蘿蔔快跑有望在 2025 年實現盈利。比亞迪港股漲 0.7%,盤初一度漲 2.6%,觸及逾兩週高位,此前摩根大通將比亞迪未來 12 月的 H 股和 A 股的目標價分別上調 86% 和 83%,至 475 港元和 440 元;上調 2024 年度的銷量預估至 400 萬輛;預計到 2026 年全球交付量將達到 600 萬輛,其中約 150 萬輛來自海外市場。

A 股板塊方面,車路雲、無人駕駛概念股爆發,多股掀起漲停潮,天邁科技 20CM 漲停,星網宇達、華陽集團等漲停。

新能源汽車股也集體走強,江鈴汽車漲停。

消費電子板塊也上漲。

煤炭股大跌,華陽股份跌停,中國神華跌 3.8%。

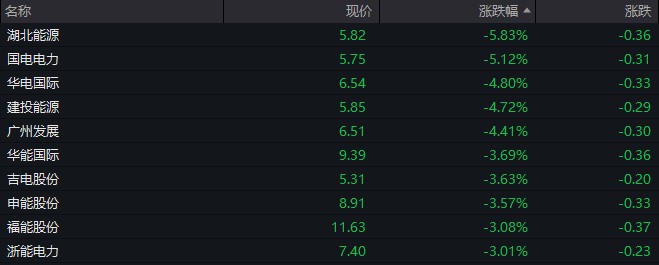

電力股也持續下跌。

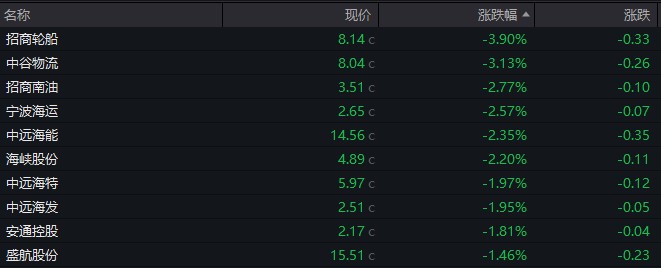

海運股也紛紛走弱。

有色、貴金屬板塊集體下挫,中國鋁業跌超 6%,資金礦業跌超 2% 。

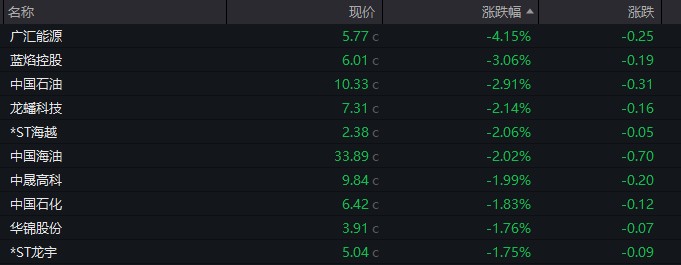

油氣股也表現不佳,中石油跌近 3%,中海油跌 2% ,中石化跌 1.8% 。

港股板塊方面,有色金屬板塊大跌,中國鋁業跌超 8%。

煤炭股也下挫,中國神華跌近 5%。

生物製藥板塊也下跌。

半導體板塊走弱。

鋰電股也走強。贛鋒鋰業漲 5%,比亞迪股份漲 1.5%。

煤炭股也重挫。

電力股普遍下跌。

國債期貨

週三,國債期貨收盤集體上漲,30 年期主力合約漲 0.11%,10 年期主力合約漲 0.04%,5 年期主力合約漲 0.02%,2 年期主力合約漲 0.02%。

消息面

統計局:6 月 CPI 同比上漲 0.2% PPI 同比下降 0.8%

2024 年 6 月份,全國居民消費價格同比上漲 0.2%。其中,城市上漲 0.2%,農村上漲 0.4%;食品價格下降 2.1%,非食品價格上漲 0.8%;消費品價格下降 0.1%,服務價格上漲 0.7%。1--6 月平均,全國居民消費價格比上年同期上漲 0.1%。2024 年 6 月份,全國工業生產者出廠價格同比下降 0.8%,降幅比上月收窄 0.6 個百分點,環比由上月上漲 0.2% 轉為下降 0.2%;工業生產者購進價格同比下降 0.5%,環比上漲 0.1%。上半年,工業生產者出廠價格比上年同期下降 2.1%,工業生產者購進價格下降 2.6%。

無人出租車迎多重利好!自動駕駛站上風口

近日,無人出租車領域迎來多重利好,多個城市相繼釋放新進展。北京市高級別自動駕駛示範區工作辦公室近日宣佈,正式開放智能網聯乘用車 “車內無人” 商業化試點,這意味着,北京自動駕駛創新發展再登上一個台階。

限制融券變相 “T+0” 又見券商出手!已有多家券商跟進

7 月 9 日,有投資者稱,收到東興證券通知,將於 7 月 15 日起,啓用融券變相 T+0 交易限制功能。據券商中國記者瞭解,前一日,東興證券就已在官網發佈相關通知。自監管頻頻發聲優化融券機制以來,已有多家券商跟進。不過,不同券商在這方面的動作和節奏並不一致。以利用融券實施日內迴轉交易為例,目前仍有部分券商支持,兩融標的融券賣出當日,就同一標的進行擔保品買入或融資買入。不過,有營業部人士稱,雖然尚未實施相關限制,但由於目前可出借的券源很少,其實對交易影響不大。

罐車 “拉完煤制油又拉食用油” 國務院食安辦:徹查!

7 月 9 日晚間,針對媒體反映的 “罐車運輸食用油亂象問題”,國務院食安辦發佈通知,成立聯合調查組徹查罐車運輸食用油亂象問題。

中證協就程序化交易徵求意見 擬賦予券商更大處置權限

7 月 9 日,一則關於程序化交易委託協議示範文本的徵求意見稿在私募圈廣泛傳播。記者從券商人士處瞭解到,主要為配合落實《證券市場程序化交易管理規定(試行)》的相關規定,中證協起草了《程序化交易委託協議(示範文本)(徵求意見稿)》。該文件包括程序化交易報告、交易行為、高頻交易管理、違約責任等內容,對雙方的權利義務和責任也作出約定。有量化私募人士告訴記者,該文件對程序化交易和券商之間的權責作了更加細化的劃分,進一步明確了券商對程序化交易的一線監測責任,也賦予券商更大的處置權限。