After the Fed rate cut, high valuation becomes a major concern for the market

After the Federal Reserve cut interest rates by 50 basis points, Wall Street traders' speculative preferences intensified, but high valuations became the main challenge for the market. Despite the stock market hitting historic highs, valuations may lead to market fragility, especially if large companies report poor financial results or if inflation rises. The S&P 500 Index's total return rate exceeded 20% in 2024, indicating that risk assets have absorbed policy benefits. The continuous rise of the U.S. stock market and government bonds marks the longest simultaneous uptrend since 2006

For increasingly bold Wall Street traders with a penchant for speculation, last week's 50 basis point rate cut by the Federal Reserve was a moment of vindication.

Now, with the Fed's new round of easing supporting economic prospects, another variable — valuation is becoming a bigger challenge in determining how far this optimistic sentiment can go.

Last week, a series of high-profile moves by the Fed buoyed the bulls, with the US stock market hitting historic highs and the Nasdaq 100 index posting its largest two-week gain since November last year.

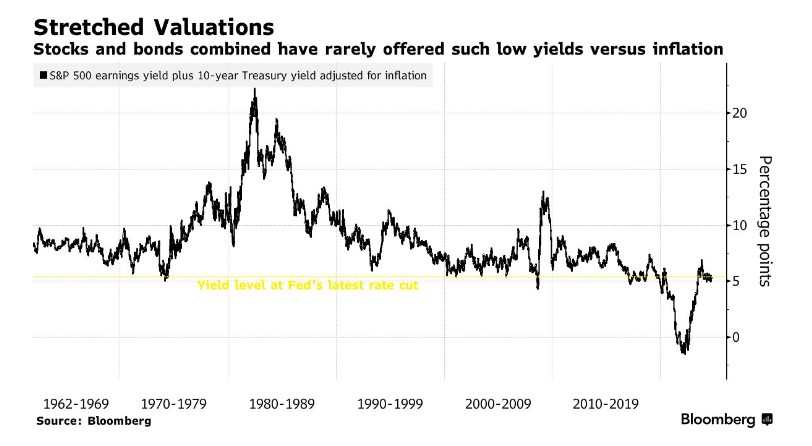

While valuation itself has long been an obstacle to market upside, in the current scenario, there is little room for error if something were to disrupt investors' big bets. A model adjusting the S&P 500 index return and the 10-year US Treasury yield for inflation shows that current cross-asset prices are higher than at the start of all 14 previous Fed easing cycles, which are typically associated with economic recessions.

An indicator shows that current cross-asset prices exceed levels seen at the start of all 14 previous Fed easing cycles

An indicator shows that current cross-asset prices exceed levels seen at the start of all 14 previous Fed easing cycles

According to Lauren Goodwin, economist and chief market strategist at New York Life Investments, high valuations are just one of the many factors making the market environment particularly complex, with various potential outcomes including continued stock market gains. She said, "While high valuations are not a good tool for timing the market, they increase the market's vulnerability if other aspects go wrong."

She said, "Any substantial disappointments in the earnings of any of the seven giants would pose a risk to valuations. Poor inflation data — such as rising inflation — is also dangerous as it would put this rate-cut cycle at risk. Of course, anything related to economic growth would threaten valuations."

The total return of the S&P 500 index in 2024 has already exceeded 20%, indicating that much of the economic and policy tailwinds have already been absorbed by risk assets. Looking at the performance of major ETFs, both the US stock market and bonds are set to rise for the fifth consecutive month. This is the longest simultaneous rise since 2006.

The strong rally in US stocks this year has made many valuation indicators significantly overvalued. This includes the so-called Buffett indicator, which divides the total market value of US stocks by the total value of US GDP in dollars. As Yardeni pointed out, as Buffett himself recently reduced holdings of some high-profile stocks, the indicator is nearing historic highs.

The founder of Yardeni Research said, "Corporate earnings should continue to prove that rational exuberance is justified. The issue lies in valuation. In a melt-up scenario, the S&P 500 index could surge above 6,000 points by the end of this year. While this would be very bullish in the short term, it would increase the likelihood of a pullback early next year "

One reason why the high valuation has not hindered the rebound of US stocks is that, although the current valuation always seems expensive at any time, when profit growth remains in sync, the high valuation level is more easily proven to be reasonable. Garrett Melson, portfolio strategist at Natixis Investment Managers Solutions, said that this concept often appears as a reason to review market trends.

He explained, "Currently, valuation really doesn't matter because, ultimately, it just provides a perspective. That's how the market operates."

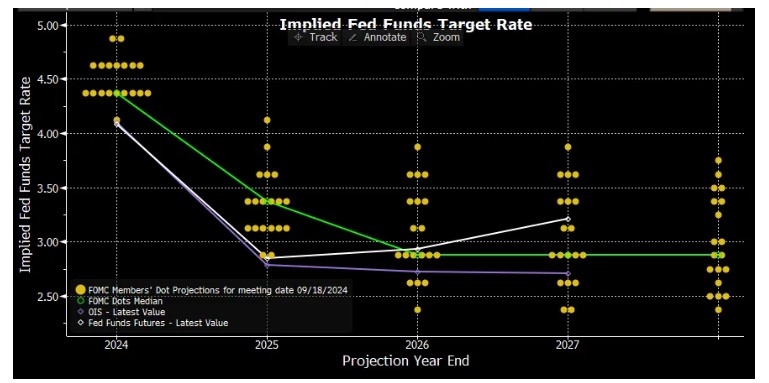

However, the possibility of disappointment in the US bond market is high, as bond traders continue to digest expectations for a more aggressive rate cut by the Fed next year than policymakers anticipate. They expect rates to be lowered to around 2.8% by 2025. In contrast, the median rate level is expected to be 3.4% by policymakers.

The market's implied rate cut path is more aggressive than the Fed's

The market's implied rate cut path is more aggressive than the Fed's

Just days after the Fed launched the highly anticipated easing cycle, the 10-year US Treasury yield rose to a two-week high.

One issue facing rate speculators is that, although the labor market shows intermittent weakness, most data remains robust. Deutsche Bank strategist Jim Reid used an artificial intelligence model to classify and rank 16 US economic and market variables (from consumer prices to retail sales) and found that only two variables currently imply an urgent need for economic stimulus measures.

When the Fed launched easing cycles of similar magnitude in 2001 and 2007, the number of indicators flashing "rate cut urgency" was 6 and 5, respectively.

Reid wrote, "Analysis shows that it is easier to prove that a 50 basis point rate cut in 2001 and 2007 was reasonable compared to 2024. Although this does not necessarily mean that last week's rate cut decision was wrong, it does mean that the Fed is more proactive this time and indicates that their decision-making is more subjective."

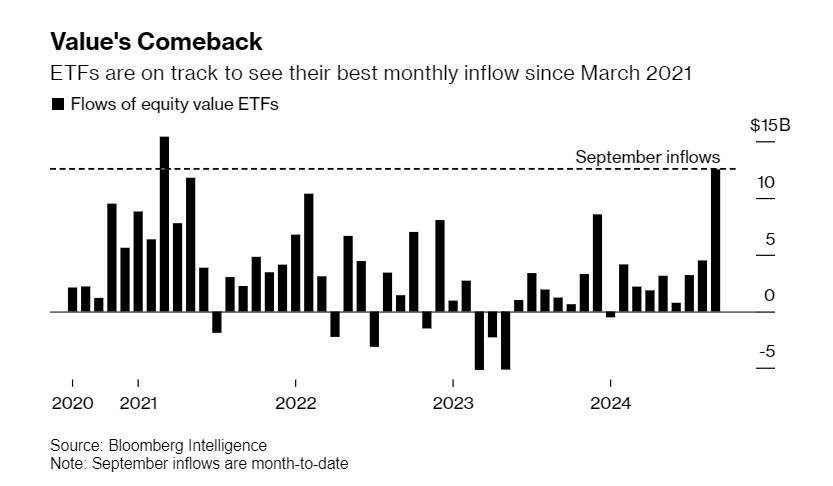

At least for now, market trends and fund flows have shown a clear belief in good economic prospects. Small-cap stocks, which are most sensitive to economic fluctuations, rose for seven consecutive trading days as of last Thursday, the longest streak since March 2021. ETFs focusing on value stocks attracted $13 billion in funds this month, the largest inflow in over three years. These value-oriented funds are mainly composed of cyclical stocks such as banks.

Stock ETF records the largest monthly inflow since March 2021

Stock ETF records the largest monthly inflow since March 2021

" In the fixed income space, concerns about inflation that have caused bonds to suffer in recent years have largely subsided. Earlier this month, the so-called 10-year breakeven rate (a measure of expected consumer price index growth) dropped to 2.03%, the lowest level since 2021.

However, anyone hoping for the S&P 500 index to easily continue its gains from the beginning of the year should consider that Wall Street strategists, not known for their caution, have already seen signs of exhaustion in the upside potential. The latest Bloomberg survey shows their consensus forecast at 5483 points, implying a 4% decline for the S&P 500 index for the remainder of this year.

Emily Roland, Co-Chief Investment Strategist at John Hancock Investment Management, has sensed this fear among clients.

She said, "When I go out every week and talk to investors, they tell me they are very afraid. I haven't seen a lot of bullish sentiment, but of course, this is not reflected in the cross-asset behavior we see as the stock market approaches historical highs."