Cash investment strategy remains favored after the Fed rate cut, but reinvestment risks are emerging

美聯儲降息後,現金投資策略仍受歡迎,貨幣市場基金資產超過 6.3 萬億美元。然而,富國銀行分析指出,投資者面臨再投資風險,難以找到不增加風險的 5% 收益機會。建議投資者減少現金配置,轉向中期固定收益投資,如住宅抵押貸款支持證券和市政債券,以鎖定票息收入並可能獲得資產價格上漲收益。研究顯示,投資高風險資產的回報遠超現金替代品。

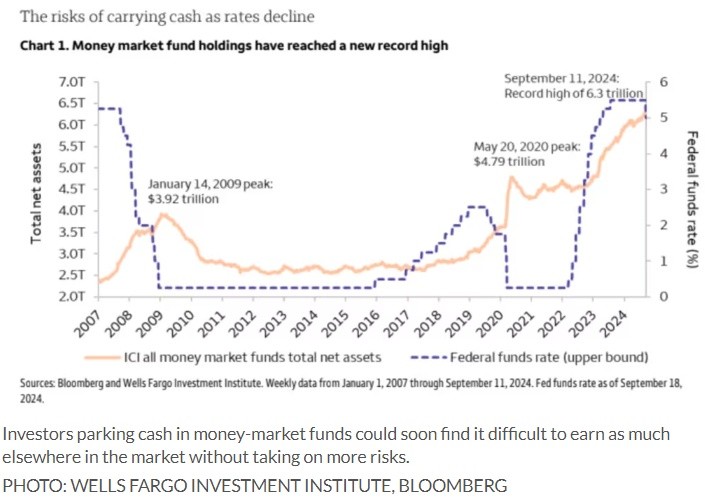

即使美聯儲開始降息,投資者在 “現金” 投資中賺取 5% 的收益且無需承擔太多風險的策略,依然頗受歡迎。智通財經 APP 獲悉,上週,貨幣市場基金——自 2022 年以來備受歡迎的現金投資工具——的資產總額超過了 6.3 萬億美元,即使美聯儲宣佈大幅降息 50 個基點。

然而,根據富國銀行投資研究所的分析,這種策略也帶來了 “再投資風險”。隨着債券市場對更低利率的重新調整,投資者將難以找到不增加風險卻能繼續獲得 5% 收益的機會。

富國銀行的全球投資策略師 Michelle Wan 認為,現在可能是時候,投資者應減少對現金替代品的配置,轉向 “中期” 固定收益投資,如住宅抵押貸款支持證券和美國市政債券。

Wan 在週一的一份客户報告中寫道,該策略可以 “幫助投資者鎖定票息收入,並有可能在市場利率下降期間獲得資產價格上漲的收益”。

此外,Wan 指出,另一個風險是 “現金拖累”。她與團隊研究了自 1926 年以來,投資 100 萬美元在更高風險資產中的表現,並將其與現金及現金替代品進行了比較。研究發現,小盤股的表現最為突出,100 萬美元的投資增值至 620 億美元;大盤股增至 210 億美元,而作為現金替代品的國庫券則增長至 2400 萬美元。

根據 FactSet 的數據,週一股票市場繼續刷新歷史高點,道瓊斯工業平均指數上漲 0.15%,標普 500 指數上漲 0.28%,而納斯達克綜合指數則上漲 0.14%。