Lalamove "Exposure": Continuous profitability in doubt, difficult to find new growth curve

Lalamove has updated its prospectus for the third time, continuing to target the Hong Kong Stock Exchange. Despite its total revenue of USD 709 million in the first half of 2024, an 18.2% year-on-year increase, and an adjusted net profit of USD 213 million, its profitability mainly relies on the support of its driver community, facing dual pressures from commissions and membership fees. Lalamove is eager to go public, but the sustainability of its business model is questionable, and it remains uncertain whether it can successfully list in the future

Editor | Yang Bocheng

Caption | IC Photo

On October 2, the same-city freight platform Lalamove updated its prospectus for the third time, continuing to target the Hong Kong Stock Exchange. Prior to this, Lalamove had applied to list on the Hong Kong Stock Exchange twice, but both attempts ended in failure.

In the updated prospectus, Lalamove disclosed its operational status and various information for the first half of 2024. For example, Lalamove is the world's largest same-city logistics transaction platform in terms of GTV, the logistics transaction platform with the highest average monthly active merchants globally, and the logistics transaction platform with the highest number of completed orders worldwide. Additionally, Lalamove's total revenue was $709 million, with a year-on-year growth of 18.2%, and the adjusted net profit was $213 million.

Despite Lalamove's impressive performance, beneath the surface, its profitability mainly relies on the "blood transfusion" from its driver community. Under Lalamove's business model structure, the driver community is facing dual pressures of commissions and membership fees.

Updating the prospectus three times in less than a year and a half, making three attempts to enter the capital market, all reveal Lalamove's urgent desire to go public. However, as a giant in the same-city freight platform industry, Lalamove not only lacks focus on long-termism but instead seeks short-term benefits through this desperate approach. Whether Lalamove can open the door to the capital market remains uncertain.

01.

Profitability May Be Difficult to Sustain

According to the prospectus, Lalamove's business model mainly involves connecting and serving merchants and drivers through a platform model, achieving a closed-loop transaction from online ordering to intelligent order matching, automatic dispatching, and after-sales service. The prices are mainly set by the platform, and due to adopting a light-asset business model, Lalamove does not own vehicles used by drivers to provide digital freight services.

Image Source: Lalamove Prospectus

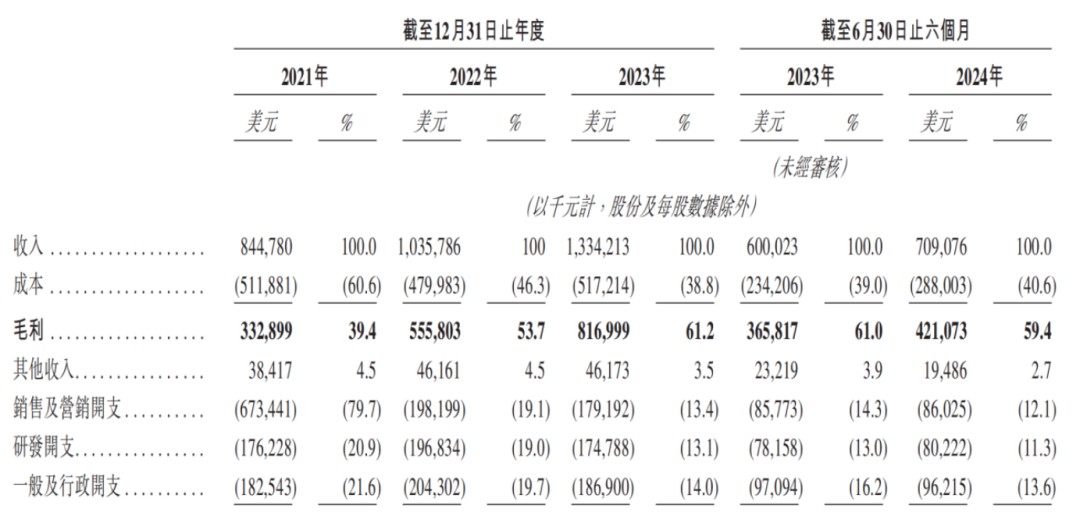

From 2020 to 2021, Lalamove's total revenue was $529 million and $845 million respectively, with adjusted net losses of $155 million and $631 million, accumulating a total loss of $786 million over two years. 2022 was a turning point for Lalamove, with total revenue reaching $1.036 billion and an adjusted net profit of $53 million, successfully turning losses into gains.

In 2023 and the first half of 2024, Lalamove's total revenue was $1.334 billion and $709 million respectively, with adjusted net profits of $391 million and $213 million, completely shedding the "loss-making" label.

Source: Lalamove Prospectus

Source: Lalamove Prospectus

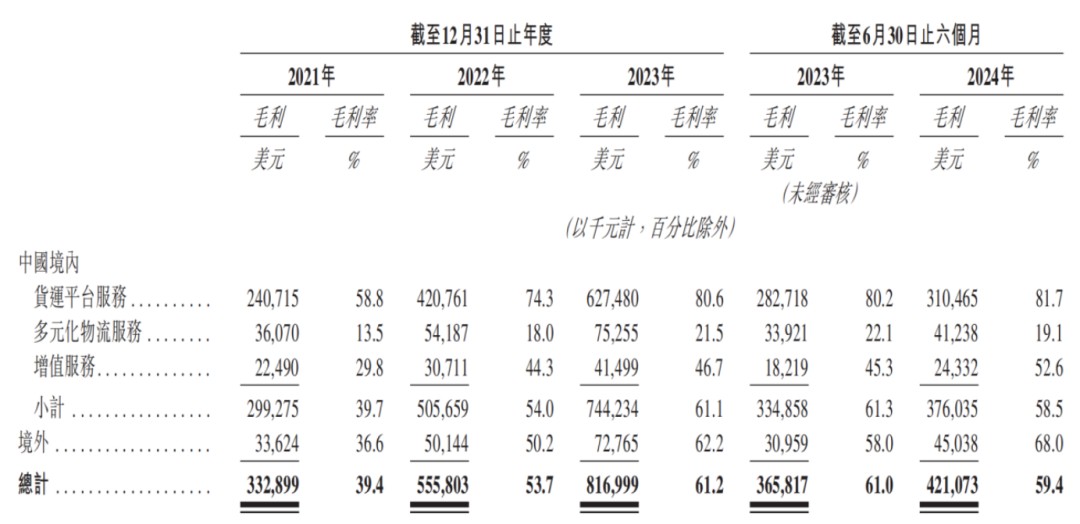

According to its business composition, Lalamove's revenue mainly comes from three parts: freight platform services, diversified logistics services, and value-added services. Among them, freight platform services are the largest revenue source, accounting for 53.7% in the first half of 2024. This business revenue can be further divided into membership fees paid by drivers and commissions earned by drivers upon completing freight orders.

In the other two major businesses, the growth of diversified logistics services was constrained from 2021 to 2023, showing signs of stagnation, but there was some recovery in the first half of 2024. The proportion of value-added services has been relatively small and has not shown significant improvement. Overall, these two major businesses have struggled to drive significant revenue growth, and the profitability of Lalamove is actually attributed to the large group of drivers.

From 2021 to the first half of 2024, the proportion of commission income to total revenue increased from 5.7% to 31.4%, while the proportion of membership fee income decreased from 42.1% to 22.0%. It can be seen that over half of Lalamove's revenue is contributed by the group of drivers, almost as if "the drivers are carrying Lalamove towards its IPO sprint." Additionally, commissions and membership fees are high-margin businesses, with gross profit margins of freight platform services being 58.8%, 74.3%, 80.6%, and 81.7% from 2021 to the first half of 2024, showing a continuous improvement trend.

Source: Lalamove Prospectus

It is also worth noting that from 2021 to 2023 and the first half of 2024, Lalamove's sales and marketing expenses were $673 million, $198 million, $179 million, and $86.025 million respectively. In 2022, Lalamove's sales and marketing expenses decreased by 70.57% year-on-year, significantly reducing costs, and in 2023, it decreased by 9.60% year-on-year, further reducing costs. This means that Lalamove's turnaround from loss to profit was not due to strong business growth, but rather by reducing sales and marketing expenses.

Source: Lalamove Prospectus

On one hand, continuously squeezing the profit margins of the driver group, and on the other hand, significantly reducing sales and marketing expenses. In this situation, how to balance the platform's profitability with the interests of drivers will directly impact whether Lalamove's profitability is sustainable.

02.

Diversified Business Hindered

Perhaps Lalamove also realizes that relying on the "blood transfusion" from the driver group cannot be sustained in the long run. In order to achieve diversified development and seek new growth curves, it has ventured into many areas For example, in March 2023, Lalamove announced the official launch of its errand service, covering a diverse range of delivery categories such as documents, electronics, clothing accessories, flowers and plants, gifts and cakes, electronic components, and fresh food.

Although the errand service can provide Lalamove with a high-frequency traffic entry point and help it further build a commercial closed loop, at present, Lalamove does not have a significant advantage in the errand service, especially with a group of same-city instant delivery platforms such as UU Errands, Flash Express, Dada Group, and SF Same City showing their strengths and accelerating the market "cake" division. The development of Lalamove will be full of uncertainties.

Building cars is also a new growth curve that Lalamove wants to explore. In its prospectus, Lalamove mentioned that the company is using its experience in existing vehicle leasing and sales services to explore new business opportunities, such as electric commercial vehicle research and development.

In July 2022, Lalamove plans to invest 10.5 billion yuan to establish the Chinese headquarters of its automotive business in the direct management park area of Chongqing High-tech Zone, layout and construction including the vehicle research institute, intelligent connected center, supply chain and large-scale manufacturing collaborative center; in April 2023, Tianyancha shows that Shenzhen Lalamove Technology Co., Ltd. underwent industrial and commercial changes, with the business scope adding intelligent in-car equipment manufacturing, intelligent in-car equipment sales, new energy vehicle sales, automobile parts and accessories manufacturing, and new energy vehicle electrical accessories sales; in October 2023, Xiamen Dora New Energy Automobile Technology Co., Ltd. was registered, with Lalamove Automobile Service Co., Ltd. holding 100% of the shares.

However, the road to building cars for Lalamove is not smooth. Financial issues remain a major challenge. Despite Lalamove's total revenue continuing to grow, its profitability still needs improvement.

In addition, Lalamove is also looking into internet credit business. In May 2024, Lalamove launched the borrowing product "Round Easy Borrow", with a maximum limit of 200,000 yuan, starting from an annual interest rate of 10.8%, and cooperated with licensed financial institutions such as Ma Shang Xiao Fei.

However, the good times did not last long. Less than half a month after the launch of Round Easy Borrow, Lalamove removed the borrowing entrance in the app. In response, Lalamove explained that "the system is undergoing maintenance and upgrades, and the specific online time is waiting for notification."

Although it is not clear whether the reason for Lalamove's removal of the borrowing entrance in the app is related to regulation, in September 2023, Lalamove was once questioned by the China Securities Regulatory Commission regarding its financial business. At that time, the CSRC requested Lalamove to supplement information on the compliance of its financial business during the process of sprinting for a listing on the Hong Kong Stock Exchange, especially regarding the operating entities in the mainland engaging in financing leasing, commercial factoring, small loans, private fund management, and other related businesses, compliance, the proportion of relevant data in the issuer's financial statements, and the regulatory opinions obtained from the financial regulatory department.

Due to the disorderly expansion of the internet credit industry in the past few years, regulatory authorities are gradually tightening the supervision of related businesses. The CSRC's scrutiny of internet companies engaging in internet credit business will inevitably be met with great vigilance. It can be seen that internet credit business is also difficult to become a lever for Lalamove's upward development 03.

The Accelerating Collapse of Reputation

Lalamove's business model determines that it only plays the role of an intermediary, serving to integrate and match information. Although it can quickly establish a large pool of transportation capacity to match goods and vehicles quickly, thereby increasing the volume of freight orders and reducing costs, Lalamove and drivers do not have a formal affiliation or employment relationship. This also means that Lalamove's constraints and management rights over freight drivers remain very limited, and it cannot fully control issues such as safety and compliance, leading Lalamove to be repeatedly embroiled in controversies.

On the consumer complaint website "Black Cat Complaints," many local freight platforms have a large number of complaint records. As of now, Lalamove has accumulated 68,466 complaints, with the main reasons for complaints focusing on drivers failing to fulfill orders after accepting them, raising prices during loading and unloading, and displaying a bad attitude in disputes.

Furthermore, Lalamove has been repeatedly named by regulatory authorities for its main issues, which include arbitrarily adjusting pricing rules, multiple charges, engaging in malicious price competition, and having excessively high commission rates or membership fees. Many of these issues have not been properly resolved.

For example, in July 2024, Lalamove was accused of tolerating overloading. Once a driver discovers that the customer's goods are overloaded and refuses to transport them after accepting the order, the platform may deduct points from the driver's behavior score. This could affect subsequent order-taking opportunities for the driver, and in severe cases, it may even affect cash withdrawals. Critics have questioned whether Lalamove is shifting the risk of overloading onto the drivers.

Tolerating overloading has always been a chronic issue for Lalamove. On the consumer complaint platform Black Cat Complaints, related complaints can be traced back to as early as 2022, with over 600 complaints. Many drivers have reported that after refusing to overload, Lalamove deducts behavior points from them.

Entering the sprint stage of going public while being repeatedly embroiled in controversies will undoubtedly have a huge negative impact on Lalamove. How to resolve conflicts with the driver community and how to present a new story that investors can look forward to will be challenging issues that Lalamove must consider