Nasdaq rises for the seventh consecutive week, the US dollar approaches a three-month high, and gold continues to rise | Overseas major asset weekly report

I'm PortAI, I can summarize articles.

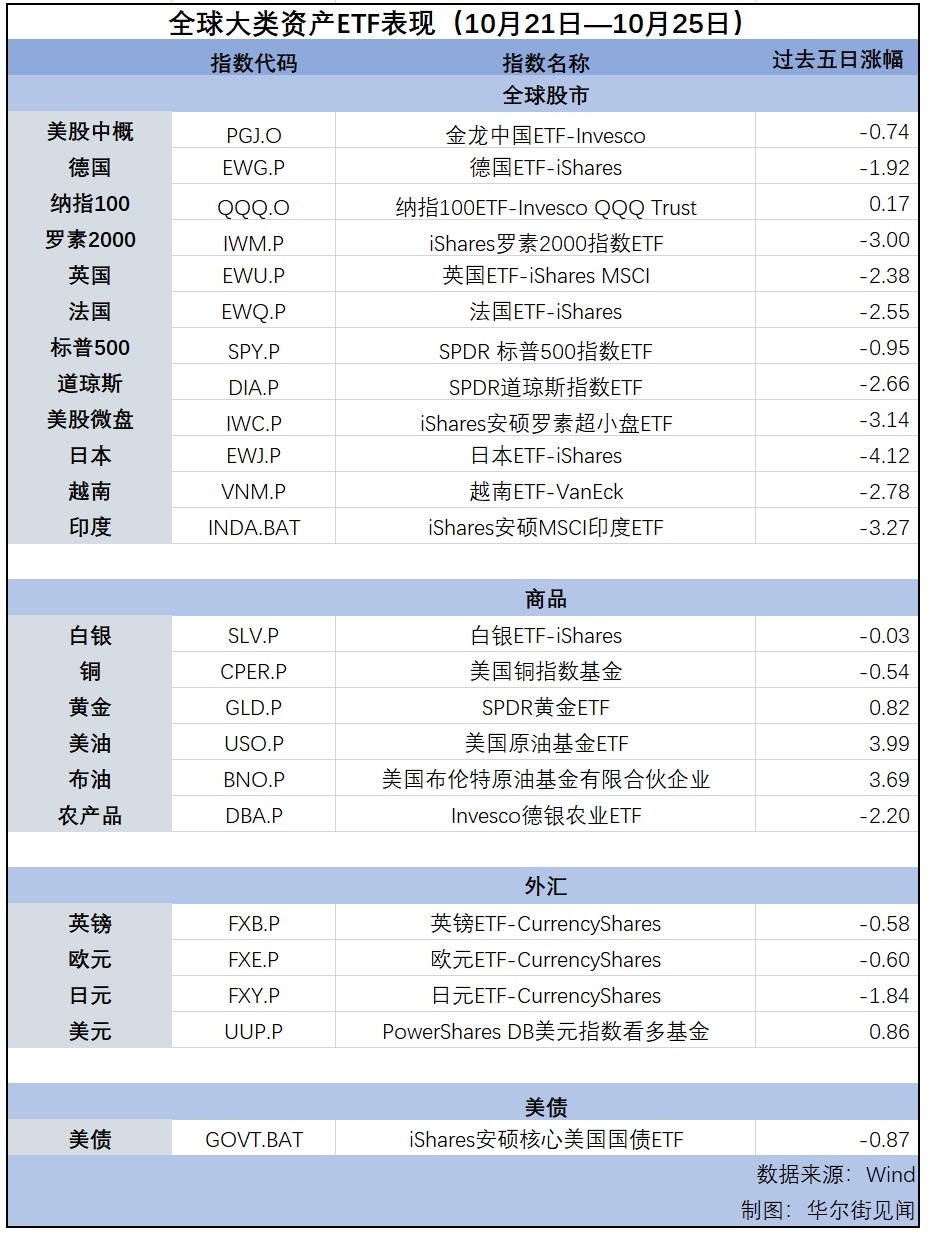

本週美股財報季繼續,納指連漲第七週,標普和道指回落。美債價格回落,10 年期美債收益率逼近三個月高點。美元指數連續第四周上漲,日元因政治不確定性下跌。現貨金創歷史新高,周內累漲超 0.9%。中東局勢緊張,助推美油和布油全周累漲超 4%。

本週美股財報季繼續,三大股指走勢不一,中概跑贏美股大盤,美債價格回落,黃金延續漲勢。

投資者紛紛買入科技股,納指連漲第七週,標普和道指回落告別六週連漲。標普 500 指數累跌 0.96%,道指累跌 2.68%,納指累漲 0.16%。

行業方面,光伏、芯片股領漲,醫藥、工業股領跌。中概反彈,中概本週收跌但跑贏美股大盤。

美債價格回落,美聯儲官員強調謹慎降息、“特朗普交易” 升温等多重壓力下,10 年期美債收益率重新上逼三個月高點。

美元指數週五重新上逼三個月高位,連續第四周上漲且本週累漲 0.8%。政治不確定性令日元本週累跌 1.9% 且一度跌穿 153 日元。

由於中東和美國大選局勢不穩,加之全球央行降息預期,現貨金本週連續三日創歷史新高,週三攀升至 2758.49 美元新高,隨後回吐部分漲幅,但本週仍累漲超 0.9%,過去 7 周內連續第 6 週上漲。

中東局勢依舊緊張,令週三 EIA 庫存和油需疲軟的利空作用曇花一現,助推美油和布油全周累漲超 4%