Wall Street's most accurate analyst: The plunge in U.S. bonds has ended because Trump cannot "tolerate debt and deficits"

Hartnett 認為,特朗普對 “小政府” 的追求意味着美債收益率將達到 “雙頂”,即 5% 的債券收益率不會進一步上升,建議投資者增加債券久期和利率敏感型資產的配置。

美債歷史性暴跌後,華爾街最準分析師預測,這波債券拋售潮可能即將結束,關鍵原因是特朗普政府"無法容忍更大的債務和赤字"。

自 9 月美聯儲宣佈 50 個基點的降息以來,美債收益率上漲超過 100 個基點,成為表現最差的資產之一,10 年期美債收益率飆升至接近 5% 的水平。這印證了美銀首席投資策略師 Michael Hartnett 長期以來的觀點:"賣出第一次降息"。

但 Hartnett 認為,特朗普對 “小政府” 的追求意味着美債收益率將達到 “雙頂”,即 5% 的債券收益率不會進一步上升。

90 年來首次,美債十年滾動回報陷入負值

Hartnett 在最新報告中指出,過去 90 年來,10 年期美國國債的 10 年滾動回報從未出現過負值,直到最近美國國債的十年回報率首次出現了-0.5% 的負值。

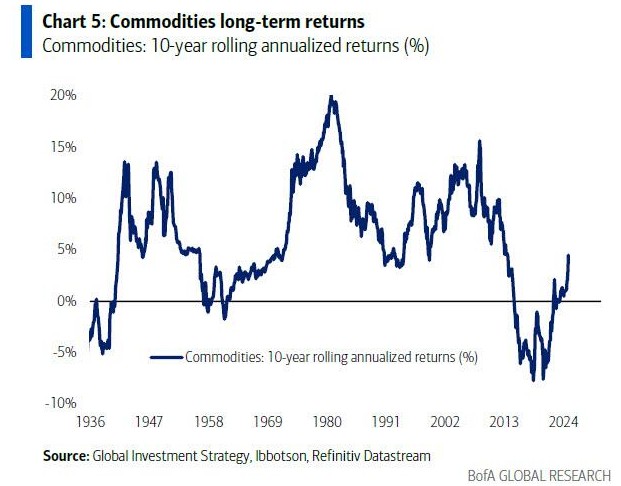

相比之下,同期美股長期回報率為 13.1%,大宗商品為 4.5%,投資級債券為 2.4%,國庫券為 1.8%。這意味着除了美國國債以外,其他主要資產類別仍保持正回報。

相比之下,同期美股長期回報率為 13.1%,大宗商品為 4.5%,投資級債券為 2.4%,國庫券為 1.8%。這意味着除了美國國債以外,其他主要資產類別仍保持正回報。

深跌後,美債或迎來 “特朗普拐點”

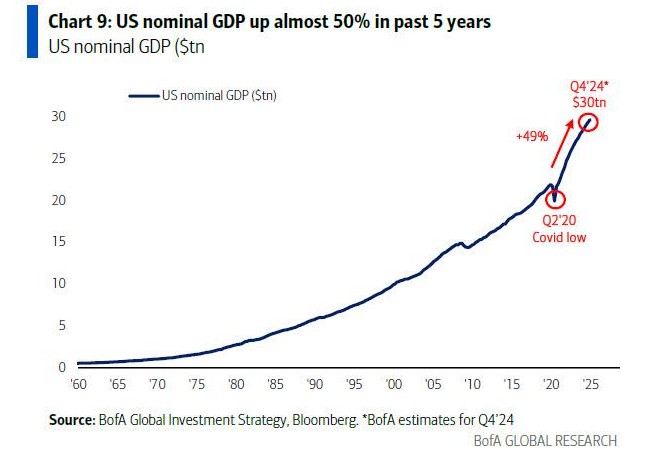

Hartnett 指出,特朗普政府"無法容忍更大的債務和赤字",這可能成為債券拋售結束的關鍵因素。美國政府目前規模達 7.3 萬億美元,相當於世界第三大經濟體。過去 5 年,美國名義 GDP 增長了 50%,其中很大一部分來自政府支出的擴張。然而,2025 年這一增長動力可能難以持續。

Hartnett 指出,特朗普對 “小政府” 的追求意味着美債收益率將達到 “雙頂”,即 5% 的債券收益率不會進一步上升。Hartnett 建議投資者增加債券久期和利率敏感型資產的配置,如 XHB(房屋建築)、UTIL(公用事業)、XLF(金融)和 XBI(生物科技)。

他還提出了債券投資組合的潛在回報:

如果收益率回落至 4%,一個 “低風險” 債券組合(20% T-bills、20% 30 年期美國國債、20% 投資級債券、20% 高收益債券、20% 新興市場債券)可能產生 11-12% 的回報;

一個 “高風險” 債券組合(25% 30 年期美國國債、25% 優先股、25% CCC 級債券、25% 新興市場高收益債券)可能產生 14-15% 的回報。

美債收益率見頂利好利率敏感型股票

對於股票市場,Hartnett 提出了四個關鍵觀察點:

a. 美國指數的下跌受到特朗普政策的保護,但上漲受到集中度、估值和持倉的限制。

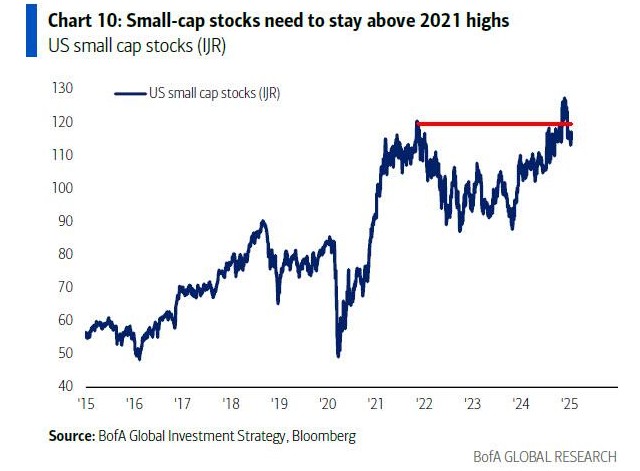

b. 如果收益率達到峯值且特朗普 2.0 無法推動小盤股(IJR)突破 2021 年的高點,資產配置者可能會減少股票的超配。

c. 他建議在收益率 “雙頂” 的情況下,購買利率敏感型股票(如 XHB、XLU、XLF、REIT)。

d. 對於 2025 年,他看好國際股票(歐盟、中國、新興市場),基於政策寬鬆、貨幣貶值和估值優勢,以及俄羅斯/烏克蘭和中東地區的和平局勢。