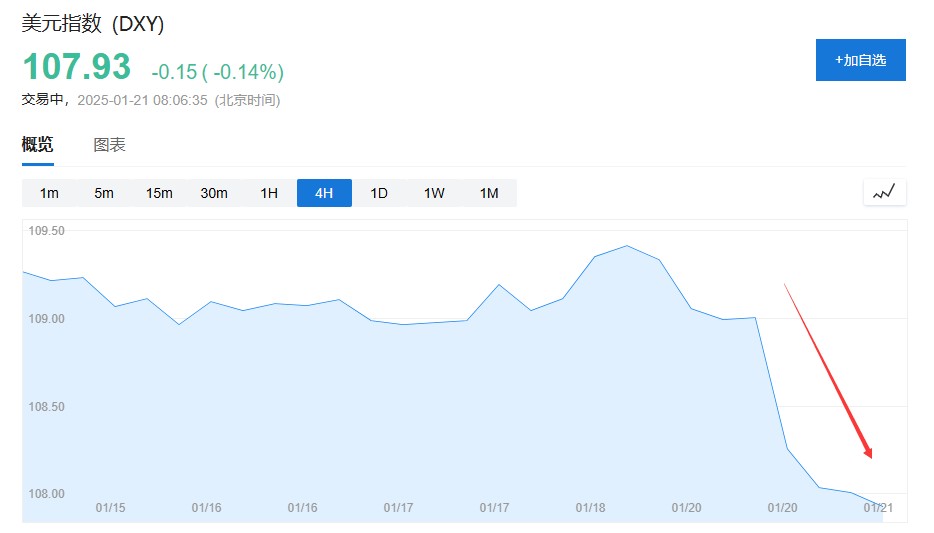

The biggest market surprise on Trump's first day: the dollar plummets

On the first day of Trump's inauguration, no specific tariff measures were announced. The Bloomberg Dollar Spot Index fell 1.1% on Monday, marking the largest single-day decline in 14 months. Currencies sensitive to U.S. tariff policies, such as the Canadian dollar and Mexican peso, rose by at least 1%. The emerging market currency index increased by 0.3%, achieving the best single-day performance since September of last year

On his first day in office, Trump did not announce specific tariff measures, leading to a sharp decline in the dollar and a rise in non-U.S. currencies.

On Monday local time, Trump stated in his inaugural speech, "We will impose tariffs and taxes on foreign countries to make our citizens wealthy," but he did not disclose further details of the plan. According to media reports, Trump administration officials indicated earlier on Monday that the president intends to assess trade relations with other countries but suggested that new tariffs would not be imposed quickly.

As a result, the dollar experienced a significant drop, with the Bloomberg Dollar Spot Index falling 1.1% on Monday, marking the largest single-day decline in 14 months.

The weakness of the dollar propelled other currencies higher. The euro rose as much as 1.6% against the dollar to 1.0434, while currencies sensitive to U.S. tariff policies, such as the Canadian dollar and Mexican peso, all rose by at least 1%. The emerging market currency index increased by 0.3%, achieving its best single-day performance since September of last year.

This surprised many market participants, as the market had generally expected Trump to implement aggressive tariff policies immediately upon taking office. According to the latest data from the Commodity Futures Trading Commission (CFTC), betting on a further strengthening of the dollar has become one of the most popular trades since Trump's election, with dollar long positions recently reaching their highest level since 2019.

Jane Foley, Rabobank's G10 foreign exchange strategy head, noted: "The dollar may have already priced in a lot of good news, so a pullback in the short term is not entirely unexpected. If there are one or two more triggering factors, the dollar could face a larger pullback."

However, most major Wall Street banks remain optimistic about the dollar's medium to long-term outlook. Currency strategists at large banks such as Goldman Sachs, TD Securities, and Deutsche Bank predict that, based on the relative strength of the U.S. economy and potential tariff policies, the dollar may strengthen further in the coming months.

Brad Bechtel, Jefferies' global head of foreign exchange, stated before Trump's inauguration: "Trump's policies are expected to be favorable for the dollar, but the implementation process may encounter noise. This could lead to volatility in the dollar and U.S. Treasury markets."