Why is the German economy so weak, yet the German stock market is so strong?

德銀認為,德國經濟和股市表現分化的原因主要在於,DAX 指數企業多為出口導向,本土需求貢獻不大,並且 DAX 指數和 GDP 的行業構成差異比較大,前者的漲幅主要是由龍頭股 “七巨頭” 推動的。

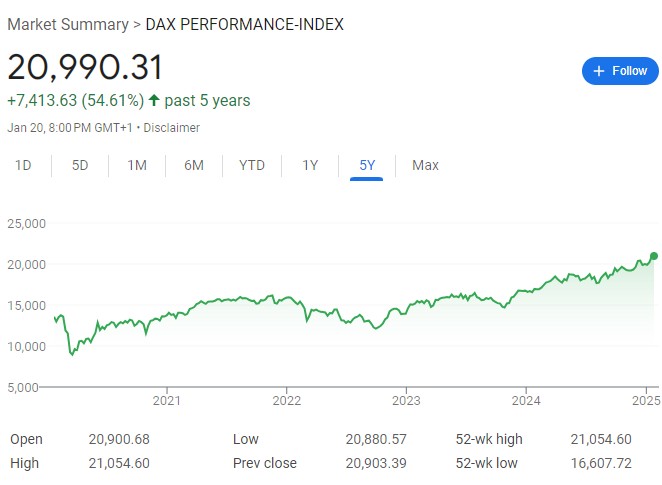

作為歐洲經濟的 “火車頭”,德國近年來經濟增長持續疲軟,但股市卻十分昂揚。數據顯示,自 2023 年以來,德國 DAX 股市已累計上漲 50%。

為什麼德國的經濟增長和股市表現之間存在較大差異?

在近日發佈的研報中,德銀分析認為,雙方之所以存在差異的主要原因在於,DAX 指數企業多為出口導向,本土需求貢獻不大,並且 DAX 指數和 GDP 的行業構成差異比較大,前者的漲幅主要是由龍頭股 “七巨頭” 推動的。

德國經濟和股市為何走向分化?

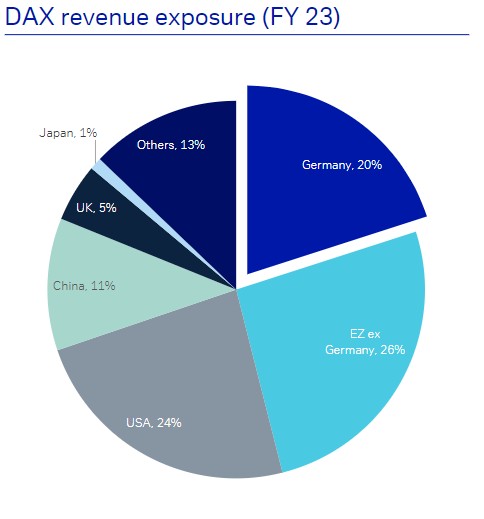

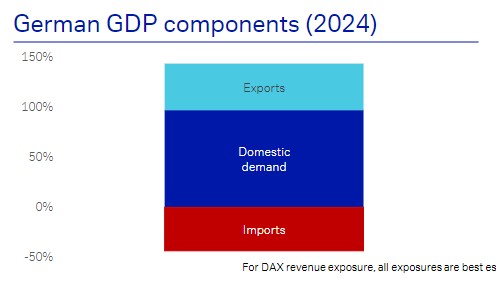

報告表示,DAX 成分股公司 80% 的收入來自德國以外地區,其中美國市場佔 24%,而德國本土公司只佔到 20%。相比之下,德國 GDP 主要依賴國內需求。

並且,由於較大的出口敞口,德國 DAX 指數與全球 GDP 增長的相關性 (0.41) 要高於其與德國 GDP 增長的相關性 (0.31) 。

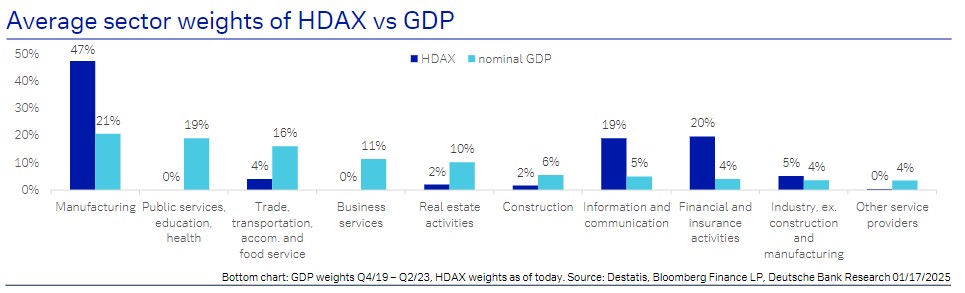

行業構成方面,報告認為,DAX 指數與德國 GDP 的行業構成差異較大。例如,對 GDP 貢獻較大的公共服務、交通運輸、房地產和建築業在 DAX 指數中佔比很小。

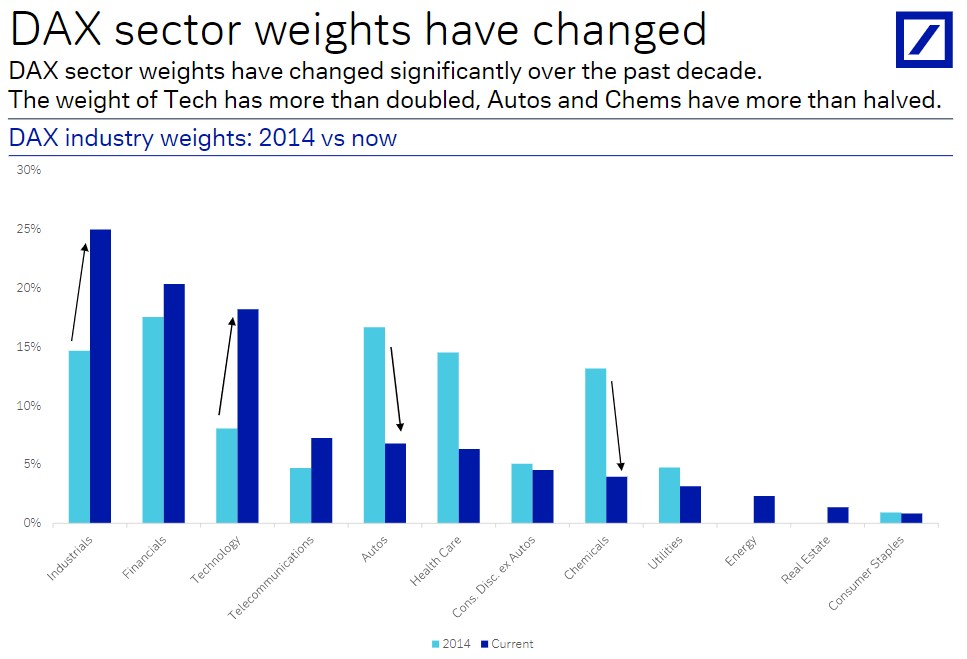

並且,過去 10 年來,DAX 行業的權重也發生了顯著變化,成長型公司和行業的份額有所上升,而化工和汽車等表現不佳的行業的權重被下調。

報告顯示,DAX 指數的汽車業權重從 17% 降至 7%,而科技行業從 8% 升至 18%。

在個股表現方面,DAX 指數的漲幅幾乎完全是由少數公司推動的。

報告數據顯示,2024 年內 DAX 漲幅的 98% 來自 “七巨頭”,其中光是 SAP 一家就貢獻了 7.8% 的漲幅——若剔除這 7 只股票,2024 年 DAX 指數自 2023 年底以來僅上漲 5%。

“七巨頭” 分別為 SAP、德國電信、安聯、西門子能源、慕尼黑再保險集團、西門子和德國萊茵金屬公司。