Will the European Central Bank cut interest rates next week "be set in stone"? Governing Council member Kazimir: There may be two to three more rate cuts in the future

歐洲央行管理委員會成員彼得·卡西米爾表示,歐洲央行下週降息幾乎已成定局,未來可能再降息兩到三次。他指出,近期數據支持連續降息 25 個基點的措施,但需保持政策靈活性以應對不確定性。儘管存在對歐元疲軟和通脹風險的擔憂,卡西米爾認為應在謹慎與激進之間取得平衡,預計未來幾個月歐元區通脹率將達到 2%。

智通財經 APP 獲悉,歐洲央行管理委員會成員兼斯洛伐克央行行長彼得·卡西米爾近日表示,歐洲央行下週降息幾乎已成定局,並且未來可能還會再降息兩到三次。他在週一晚間接受採訪時表示,近期數據表明,歐洲央行應繼續採取每次降息 25 個基點的連續降息措施。然而,鑑於不確定性加劇,歐洲央行必須保持靈活性,以便根據形勢變化及時調整政策。

這位斯洛伐克央行行長指出,連續三四次降息是可行的,但無法完全保證。他強調,對於下週的降息決定,“對我個人而言,協議已經達成。”

事實上,卡西米爾的大多數同事在歐洲央行 2025 年首次政策會議之前也發出了類似的信號,經濟學家和交易員也普遍認同這一舉措。不過,關於借貸成本應以多快的速度和多大的幅度進一步下降,爭論仍在持續升温。

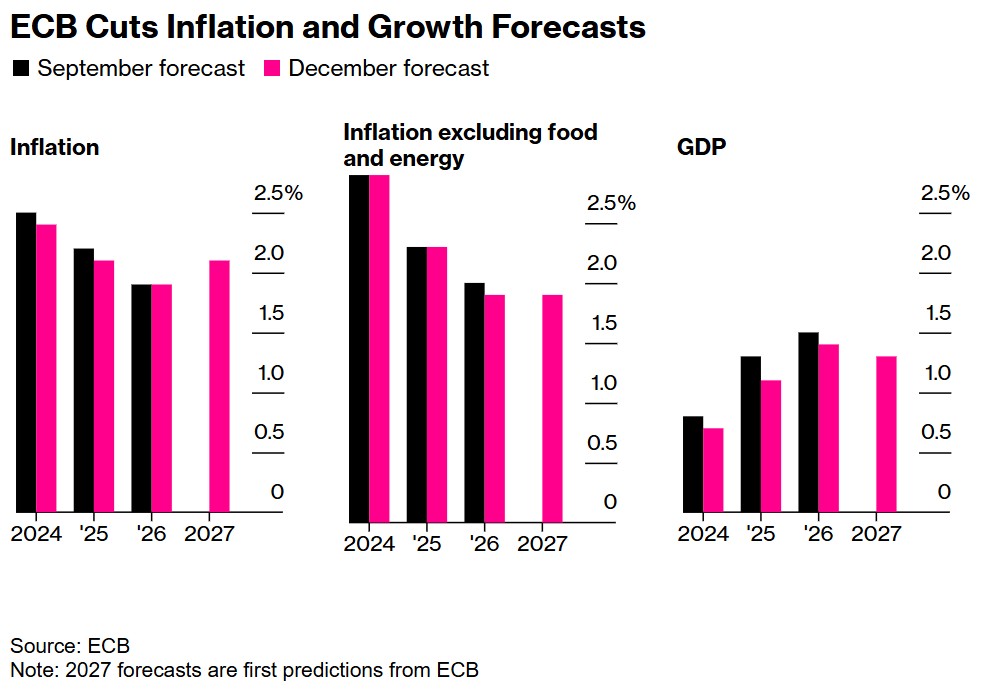

圖 1

一方面,一些人擔心歐元疲軟可能會增加通脹風險;另一方面,另一些人則擔心過於緊縮的政策立場可能會導致通縮過度。

卡西米爾表示:“我們最需要的是在過於謹慎和過於激進之間取得平衡。” 他指出,儘管歐洲央行的工作尚未完成,但在將通脹率恢復至 2% 目標方面,已經走在了 “正確的軌道上”。

儘管預計工資增長將進一步放緩,從而抑制服務業的價格壓力,但卡西米爾強調:“我們需要確鑿的證據證明這一渠道是有效的,而這需要一定的時間。”

此外,卡西米爾認為地緣政治帶來了額外的風險。他特別提到美國總統唐納德·特朗普的經濟政策可能帶來的價格壓力。

歐洲央行預計,未來幾個月歐元區通脹率將達到 2%,並至少在 2027 年左右在該水平附近波動。包括卡西米爾在內的官員認為,12 月份通脹率略有回升,並不會改變這一前景,也不令人意外。

圖 2

卡西米爾進一步表示:“最新數據顯示,我們將繼續維持目前的減產政策。我認為沒有理由暫停減產,也沒有理由討論不同幅度的減產。”

他指出,目前的減產幅度既能保持經濟增長勢頭,又能保留一定的靈活性,尤其是在不確定性沒有減弱跡象的情況下,這一點至關重要。

與此同時,特朗普威脅要關閉美國邊境並向全世界徵收貿易關税,這些政策可能會推高美國國內通脹,進而迫使美聯儲維持高利率。受此影響,美元最近在預期中走強,這也引發了人們對歐洲央行政策影響的猜測。

卡西米爾指出,歐洲央行管理委員會目前的意圖是消除經濟的所有束縛,同時不刺激需求。他認為,利率的中性水平應介於 2% 和 3% 之間,可能更接近 2% 而非 3%。

他強調:“我們依賴數據,而不是美聯儲。” 歐洲央行官員經常重複這一觀點。他還表示,歐洲央行正在監控匯率,因為它可能會通過進口價格影響通脹,但應避免根據短期發展得出結論。

卡西米爾還提到,特朗普政策可能帶來的負面經濟後果比其潛在的通脹影響更令人擔憂,尤其是考慮到歐洲已經 “非常緩慢的潛在增長”。

他指出:“歐洲的結構性問題更為嚴重和痛苦,隨着特朗普的經濟政策,歐洲的競爭力問題將變得更加突出。”