UK wage growth hits a six-month high, but expectations for a Bank of England rate cut rise

英國薪資增幅在截至 11 月的三個月中意外上升至 6 個月新高,達到 5.6%。儘管就業人數有所下降,分析師認為薪資上漲不會持續太久。英國央行關注的私營部門薪資增速也從 5.5% 上升至 6%。然而,勞動力市場出現寬鬆跡象,失業率微升至 4.4%。市場對英國央行降息的預期有所上調。

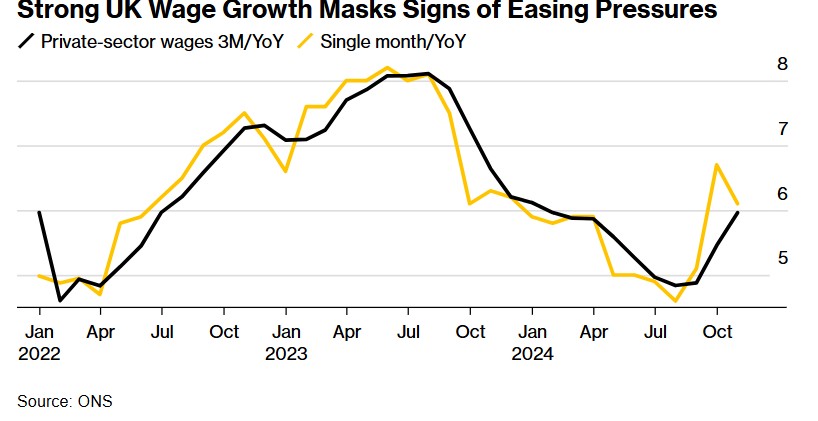

智通財經 APP 獲悉,儘管在工黨首次預算中增加薪資税後的幾周內英國就業人數有所下降,但英國薪資增幅卻意外升至六個月以來的最高點。英國國家統計局週二表示,截至 11 月的三個月裏,不包括獎金的薪資實現同比增長 5.6%,高於上月的 5.2%。這一數據略高於經濟學家們普遍預期的 5.5% 增幅,但有分析師指出,強勁的基礎數據效應推高了這一數字。

英國央行最密切關注的經濟指標——即私營部門的薪資增速,從 5.5% 加速擴張至 6%。然而,有顯著信號顯示,在英國財政大臣雷切爾·裏夫斯 (Rachel Reeves) 10 月份的最新預算案公佈後,英國勞動力市場出現了進一步寬鬆的跡象。

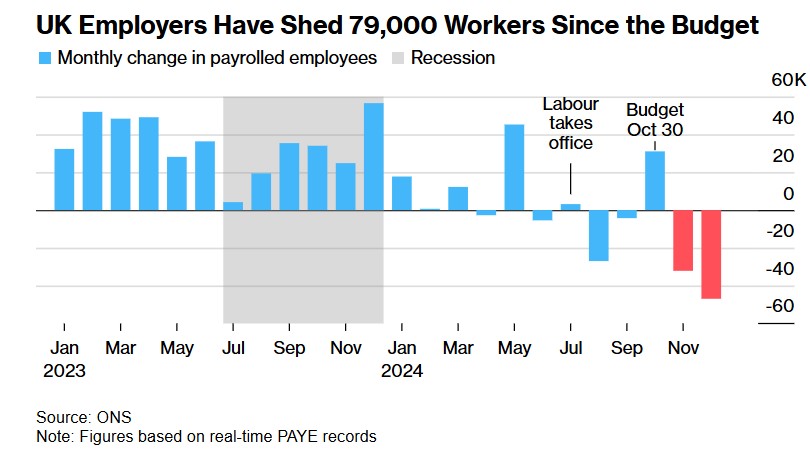

基於英國税務記錄的數據顯示,在 12 月減少 4.7 萬就業人數後,英國就業人數降至一年多來的最低水平。這是連續兩個月下降,這將加劇人們的擔憂情緒,即執政黨工黨所提出的 260 億英鎊 (大約 319 億美元) 的僱主國家保險上調正在導致企業大幅裁員。

自工黨薪預算案公佈以來,英國僱主已裁員 7.9 萬人

另一個經濟活動疲軟的跡象是,截至去年 12 月的三個月裏,英國職位空缺數量環比下降 2.4 萬個,至 81.2 萬個,這是連續 30 個月下降。在截至去年 11 月的三個月裏,失業率也從截至去年 10 月的三個月的 4.3% 微升至 4.4%,不過英國央行官員們對英國失業數據的準確性持謹慎態度。

最新的薪資數據公佈後,英鎊在美元整體走勢的影響下,兑美元匯率跌幅有所收窄,下跌 0.4%,至 1.2284 美元。與此同時,交易員們在薪資數據公佈後,反而略微上調了他們對英國央行今年降息次數的預期,這與利率期貨市場對美聯儲等其他主要央行的預期走勢一致。市場目前定價英國央行降息約 63 個基點,這意味着兩次降息 25 個基點,第三次降息的可能性則超過 50%。

這些數據發佈的時間距離英國央行決定是否繼續降息僅兩週有餘,而勞動力市場的狀況對英國央行的降息決定至關重要。自 8 月以來,對持續通脹壓力的擔憂已促使英國央行僅僅兩次放寬貨幣政策,使得該國央行落後於歐元區和美國中央銀行同行。

由於薪資上漲速度仍然遠快於物價上漲步伐,英國家庭在經通脹調整後的薪資增長達到了自 2021 年 8 月以來的最高水平。截至 11 月的三個月裏,實際薪資增長回升至 3.4%。

英國央行行長安德魯·貝利 (Andrew Bailey) 暗示將採取 “謹慎” 的進一步寬鬆措施。然而,央行的官員們對近期薪資增長的上升持低調態度,他們援引的調查顯示,由於經濟疲軟,英國勞動力市場正在降温。

英國薪資強勁增長,掩蓋了勞動力壓力大幅緩解的跡象

“由於勞動力市場面臨阻力,薪資增長的上升預計將是非常短暫的。” 來自畢馬威的英國市場首席經濟學家雅爾•塞爾芬表示。她指出失業率上升,並表示薪資增長上升 “主要受基數效應影響”。“在勞動力市場活動放緩的宏觀背景下,我們預計未來一年薪資增長將呈下降趨勢。”

在一些分析師看來,英國國內最新的薪資數據之所以被大幅推高,是因在去年的 9 月和 10 月薪資同比增長幅度相對強勁。僅 11 月單月的勞動力市場統計數據則明顯顯示出薪資增長放緩。

最新公佈的勞動力市場數據還顯示,非就業人口 (即失業且未尋找工作的人口) 數量下降了 5.4 萬人,至 930 萬人。然而,其中長期病患人數增加了 2.1 萬人,至 280 萬人。不過英國國家統計局表示,由於目前數據集不完全可靠,因此需謹慎對待這些數據。