The market calmly faces Trump's return to the White House as the Bank of Japan moves towards interest rate hikes

在全球金融市場對特朗普重返白宮反應平靜的背景下,日本央行預計將在本週五將利率提高至 2008 年以來的最高水平。這將是日本央行在不到 12 個月內的第三次加息,標誌着其貨幣政策正常化的進程。日本央行行長植田和男的進一步加息路徑將成為市場關注的焦點。

智通財經 APP 獲悉,在全球金融市場對特朗普重新入主白宮做出相對平靜的反應後,日本央行有望在本週五將利率提高至 2008 年以來的最高水平。

知情人士本月早些時候透露,在特朗普宣誓就職前,日本央行官員認為,除非特朗普入主白宮帶來太多負面的意外,否則加息的可能性很大。此外,知情人士在特朗普就職典禮後表示,日本政府官員也將支持日本央行本週的行動。

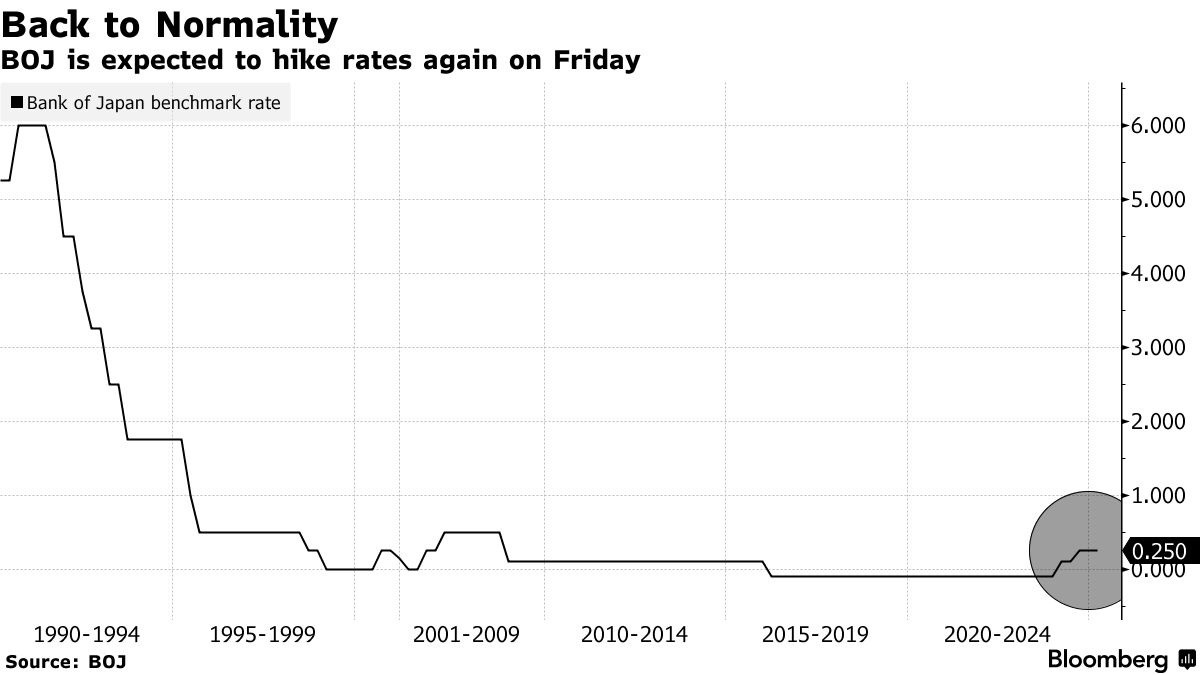

如果日本央行如市場預期的這樣在週五宣佈加息,這將是日本央行在不到 12 個月的時間內第三次加息。在去年 3 月之前,日本央行已有 17 年沒有加息。目前,日本央行正穩步邁向貨幣政策正常化,而美聯儲和歐洲央行正醖釀暫停寬鬆週期。

不過,即使在加息後,日本的借貸成本仍將是發達國家中最低的。日本央行行長植田和男對進一步加息路徑的設想可能是週五的一個關鍵焦點。考慮到日本央行在去年 7 月意外加息後引發的全球市場動盪,植田和男與市場的溝通方式將繼續受到密切關注。

週二早些時候,日元是十國集團 (G10) 貨幣中唯一兑美元上漲的貨幣,因為交易員押注特朗普的第一波關税攻勢不會阻止日本央行潛在的加息。All Nippon Asset Management Co.首席策略師 Chotaro Morita 表示:“日本央行將提高利率。在特朗普上任的第一天,沒有發生重大沖擊,股市也沒有暴跌。”

在本週的政策會議舉行之前,日本央行已然發出了不同尋常的明確信號,表明其可能會採取提高利率的行動。日本央行副行長冰見野良三在上週二對橫濱商界領袖的演講中明確表示,央行政策委員會將討論本週加息的可能性。日本央行行長植田和男上週三表示將在本週會議上考慮加息,並暗示對薪資上漲的信心增強,這強化了市場對日本央行將加息的預期。

隔夜指數掉期顯示,截至週三上午,日本央行在週五加息的可能性超過 90%,高於去年 12 月底的 41%。與此同時,上週公佈的一項調查顯示,在 53 位受訪經濟學家中,約有 74% 的人預測日本央行將在本週會議結束時加息。

在這種預期存在的情況下,如果日本央行最終不採取行動,其信號策略可能會面臨大量批評,並再度引發市場動盪。

與此同時,隨着政策利率逐漸接近日本央行政策制定者預期的最終利率 1%,日本央行觀察人士更有可能尋找該央行進一步加息的跡象。三井住友銀行首席外匯策略師 Hirofumi Suzuki 表示:“基準情況可能是每六個月加息一次。日本央行預計不會快速加息。”

據知情人士透露,日本央行還可能在本週的會議上上調季度通脹預期。這將表明,在過去三年生活成本一直保持在央行的目標水平附近後,未來兩年的生活成本將繼續保持在這一水平附近。在日本央行公佈利率決議前幾個小時,日本 12 月全國 CPI 將公佈。市場目前預計,日本 12 月全國 CPI 將同比上漲 3.4%,核心 CPI 將同比上漲 3%。

日本首相石破茂尚未完成其支出計劃。他的少數派政府需要獲得足夠的反對派支持,以確保 3 月通過年度預算。日本央行在本週的加息將從根本上消除貨幣政策在談判中的複雜性。

日本大企業的負責人也表示,他們不反對可能的加息。日本最大的商業遊説團體——經濟團體聯合會——會長 Masakazu Tokura 表示,鑑於通脹率已經在 2% 以上保持了一段時間,日本央行重新審視其利率政策是正常的。考慮到日本央行在本世紀頭十年加息時遭遇的強烈反對,這些進展可能會讓日本央行鬆一口氣。

在利率決議公佈後的新聞發佈會上,植田和男可能會嘗試保留自己的選擇餘地,同時謹慎地推進日本央行近 20 年來的首次貨幣政策正常化努力。植田和男承認,由於日本央行不知道其最終利率,與市場的溝通存在挑戰。

雖然 90% 的經濟學家認為日本的經濟狀況使得日本央行有理由在本月加息,但他們中的許多人也表示,日元疲軟可能是提高借貸成本的一個主要原因,未來加息時也將如此。

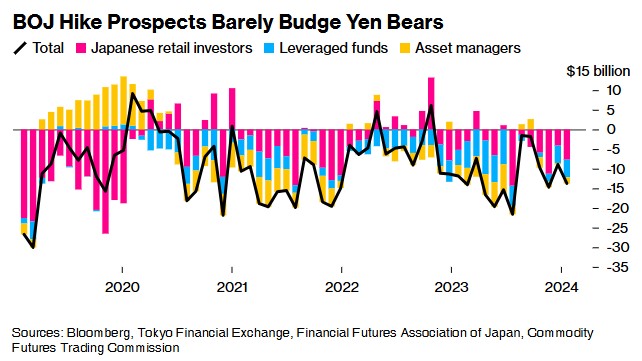

不過,對日本央行本週加息的預期幾乎沒有改變交易員對日元走弱的預期,原因是日本和美國之間的利率差距仍然很大。媒體對東京金融交易所、日本金融期貨協會和美國商品期貨交易委員會數據的分析顯示,日本本土散户投資者以及海外對沖基金和資產管理公司的日元空頭頭寸總額增加了 54%,達到 137 億美元。

瑞穗銀行首席市場經濟學家 Daisuke Karakama 表示:“即使日本央行加息,日元走強的勢頭也可能受限,因為結束降息正成為美聯儲關注的焦點。市場遲早會通過拋售日元來要求再次加息,這種可能性很大。”