The energy sector drives the simultaneous rise of US stocks, with Chinese concept stocks once again taking the lead. The US dollar hits a two-month low, while oil prices surge over 2%.

Key US CPI inflation data was released, and the Dow Jones Industrial Average rose more than 310 points. The Russell 2000 Index increased by about 1% to its highest level in over four months. The energy sector rose more than 2%, Activision Blizzard surged 10% to a two-year high, the Nasdaq Golden Dragon China Index rose 1.6% to a three-week high, and XPENG-W increased nearly 6%. Short-term US bond yields rose, while long-term bond yields fell, deepening the yield curve inversion. The British pound reached a 15-month high, and the offshore renminbi briefly rose above 7.20 yuan to a two-week high. Spot gold continued its three-day rally to a three-week high, and oil prices reached their highest level in over two months.

The market is awaiting the release of US CPI and PPI inflation data for June on Wednesday and Thursday, hoping to reveal a continued decline in inflation and lay the foundation for the direction of interest rates. "Systemically important financial institutions" such as JPMorgan Chase, Wells Fargo, and Citigroup will release their financial reports this week.

The ZEW Economic Sentiment Index for Germany further declined from -8.5 in June to -14.7 in July, significantly lower than the expected -10.5. The economic confidence in the Eurozone also dropped from -10 in June to -12.2 in July. In the three months ending in May, the UK's wage growth, excluding bonuses, reached a record high, with a year-on-year increase of 7.3%, intensifying pressure on the Bank of England to raise interest rates by 50 basis points next month.

In the US stock market, the closing session saw a two-day surge, with the Dow Jones Industrial Average rising more than 300 points. The NASDAQ Composite Index initially turned negative, but Chinese concept stocks once again led the way with strong performance.

On Tuesday, July 11th, the three major US stock indexes opened higher, with the Dow Jones Industrial Average jumping more than 100 points at the opening, and the NASDAQ Composite Index initially showing a slight decline. From midday to the closing bell, US stocks rapidly expanded their gains, ending the day at the highest point, with the Dow Jones and small-cap stocks leading the way with an approximately 1% increase.

At the close, US stocks rose for two consecutive days and approached recovering from the decline since last Wednesday. The S&P 500 Index stabilized above 4,400 points, and the Dow Jones Industrial Average rose above 34,000 points. The Russell 2000 small-cap stocks rose for three consecutive days and broke through 1,900 points, reaching the highest level in over four months since March 3rd:

The S&P 500 Index rose 29.73 points, or 0.67%, to 4,439.26 points. The Dow Jones Industrial Average rose 317.02 points, or 0.93%, to 34,261.42 points. The NASDAQ Composite Index rose 75.22 points, or 0.55%, to 13,760.70 points. The NASDAQ Composite Index 100 rose 0.5%, and the Russell 2000 small-cap stock index rose 0.96%.

US stocks rapidly expanded their gains after midday and rose for two consecutive days, with the NASDAQ Composite Index initially showing a slight decline.

All 11 sectors of the S&P rose, with the energy sector leading the way with a gain of over 2%. Utilities, industrials, finance, real estate, and telecommunications services rose by up to 1.2%, while the information technology/tech sector rose by 0.19%. The healthcare sector performed the worst, remaining flat.

Barclays raised its year-end target for the S&P 500 Index from 3,725 points to 4,150 points and raised its EPS earnings forecast for this year from $200 to $218. The bank believes that the stock market will maintain narrow fluctuations until the end of the year, and the upward trend centered on technology stocks will not expand to other sectors of the S&P. However, if technology stocks experience a short-term correction, it can be seen as a tactical entry point. Tech stocks rise and fall. "Metaverse" Meta rises 1.4%, hitting a 17-month high. Apple falls 0.3% to a two-week low, while Microsoft turns up 0.2%. Amazon rises 1.3% on Tuesday, breaking away from a three-week low. Google A rises 0.6%, reaching a two-month high. Netflix falls 0.3% to a monthly low, while Tesla falls over 1% and then rebounds slightly, ending a three-day decline.

Most chip stocks decline. The Philadelphia Semiconductor Index, which rose 2% yesterday, falls 1.4% and then slightly rebounds. Applied Materials falls over 2%, AMD falls 2% to a new monthly low, but Nvidia turns up nearly 2% and Intel rises 0.5%, both further distancing themselves from the monthly low.

AI concept stocks rise and fall. C3.ai rises another 1.6%, Palantir Technologies rises over 1%, both hitting a three-week high. SoundHound.ai falls over 6%, returning to a new low in over three weeks. BigBear.ai falls another 1% to a one-month low.

In terms of news, Microsoft has announced layoffs of 10,000 employees in January, and now it is laying off salespeople and customer service representatives. Reports indicate that Tesla has completed the design of the new generation of affordable electric car, Model 2.

Popular Chinese concept stocks show strength again, with ETF KWEB rising 1.3%, CQQQ reversing its decline and rising 0.4%, and the Nasdaq Golden Dragon China Index (HXC) rising 1.6%, breaking through 6800 points to reach a three-week high. Among the Nasdaq 100 constituents, JD.com turns up 0.2%, Pinduoduo rises over 1%, and Baidu rises 0.3%. Among other individual stocks, Alibaba rises 1.4%, Tencent ADR rises 1.6%, and Bilibili rises over 4%. NIO turns up 0.3%, XPeng rises nearly 6%, and Li Auto rises over 3%. Faraday Future rises over 12% to a monthly high.

Regional bank stocks reach a three-week high. The industry benchmark, the KBW Bank Index (BKX) on the Philadelphia Stock Exchange, rises 1.7% to a one-month high, having hit its lowest level since October 2020 on May 4. The KBW Nasdaq Regional Banking Index (KRX) rises over 1%, hitting its lowest level since November 2020 on May 11; the SPDR S&P Regional Banking ETF (KRE) rises over 1%, hitting its lowest level since October 2020 on May 4.

The "Big Four" U.S. banks all rise by about 1%, with Citigroup, which is about to release its earnings report, leading the way with a nearly 2% increase. Key regional banks rise together, with PacWest Bancorp rising 2.6%, Western Alliance Bancorp erasing most of its gains, Zions Bancorporation and U.S. Bancorp rising 3%, Keycorp rising 4%, and Truist turning up 1%. Jefferies upgraded JPMorgan Chase from hold to buy and dubbed it the "best in class" due to its strong balance sheet and higher fee income, but downgraded Zions Bancorp and Truist's buy ratings due to lowered profit expectations. Bank of America upgraded U.S. Bancorp from neutral to buy, citing its scale, profitability, and execution capabilities as among the highest in the U.S. banking industry.

Other notable stock changes include:

Despite opposition from the U.S. Federal Trade Commission (FTC), Microsoft's acquisition of Activision Blizzard received approval from a U.S. court, and the UK antitrust regulator also extended an olive branch, causing Activision Blizzard's stock to rise 10% to a two-year high.

Reports suggest that the European Union is likely to clear Broadcom's $69 billion acquisition of VMware on Wednesday, July 12. Broadcom initially fell 1.5% but later rose 0.5%, while VMware surged over 5% to its highest level in nearly two years.

Salesforce, a leading SaaS software giant providing cloud computing services, rose nearly 4% to a two-and-a-half-month high. Starting in August, it will raise prices for most cloud-based marketing tools by an average of 9%.

3M rose nearly 5% to a three-week high, leading the Dow Jones Industrial Average. Bank of America upgraded its rating from sell to neutral, optimistic about the potential in legal settlements, corporate restructuring, and plans to spin off its healthcare business. The SPDR Industrial Select ETF rose over 1% to a record high.

Leading U.S. online real estate company Zillow rose nearly 11% to a four-month high. Piper Sandler upgraded its rating from neutral to buy, raising the target price by over 30% from Monday's closing price, predicting that the U.S. housing macro environment has bottomed out and will continue to improve until the end of 2024.

The world's largest image trading website, Shutterstock, rose over 9% to its highest level in nearly two months. It expanded its partnership with OpenAI, with OpenAI gaining access to additional training data such as images, videos, and music libraries, while Shutterstock gains priority access to the latest OpenAI technologies.

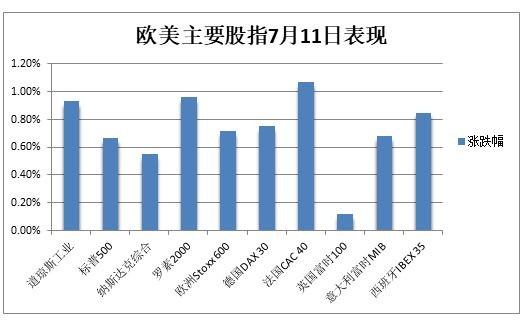

European stocks rose, with the French stock index leading the way with a gain of over 1%. The pan-European Stoxx 600 index closed up 0.72%, with almost all sectors ending higher. The construction and materials sector rose 1.8%, but the healthcare sector fell 0.12%.

Short-term U.S. Treasury yields rise, long-term yields fall, and the yield curve steepens ahead of key inflation data release

The two-year U.S. Treasury yield, which is more sensitive to monetary policy, rebounded during U.S. stock trading, rising as much as 4 basis points to 4.90%. It gave back most of its gains after midday but remained above the monthly low. The 10-year government bond yield fell more than 5 basis points, further distancing itself from 4%, giving back most of the gains since last Thursday. This may be related to investors' concerns that continued rate hikes will weigh on the economy, deepening the yield curve inversion.

Short-term US Treasury yields rose while long-term yields fell.

Eurozone bond yields remained steady at recent highs. The yield on 10-year German government bonds, the eurozone benchmark, rose 1 basis point to 2.64%, having reached a four-month high of 2.679% last week. The 2-year yield rose nearly 3 basis points to 3.35%, having hit a 15-year high of 3.393% last week, the highest since 2008. This indicates that investors increasingly believe that the European Central Bank will continue to raise interest rates and keep them at a high level for some time.

After wage growth reached a record high, the yield on 10-year UK government bonds rose more than 2 basis points to 4.66%. The 2-year yield, which is sensitive to monetary policy, rose nearly 6 basis points to 5.43% and remained near the daily high.

Oil prices rise more than 2%, hitting over two-month highs with US oil surpassing $74 and Brent crude above $79

The weakening of the US dollar, supply cuts, and prospects of increased demand in the second half of the year from developing countries have led to a simultaneous 2% increase in international oil prices.

WTI August crude oil futures closed up $1.84, or 2.52%, breaking through the $73 and $74 levels successively, and reaching $74.83 per barrel, the highest closing price since May 1. However, it is still down 6.7% for the year.

Brent September futures closed up $1.71, or 2.20%, at $79.40 per barrel, surpassing $79 and reaching the highest closing price since April 28. However, it is down 7.6% for the year.

Oil prices rise more than 2%, hitting over two-month highs

Oil prices rise more than 2%, hitting over two-month highs

Some analysts believe that oil prices have bottomed out, and the only thing that could break the situation is if US inflation becomes too high, forcing the Federal Reserve to tighten policy and causing the economy to enter a recession. The International Energy Agency (IEA) and OPEC continue to be optimistic about oil demand growth led by China.

TTF Dutch natural gas futures in Europe, the benchmark, turned slightly higher at the end of the session, still below 30 euros per megawatt-hour. Yesterday, it fell below this psychological level for the first time in a month since June 13. ICE UK natural gas, which fell more than 12% yesterday, fell more than 4% again.

US dollar at a two-month low, pound at a 15-month high, offshore yuan briefly surpasses 7.20 yuan to a two-week high

The US Dollar Index (DXY), which measures against six major currencies, fell by 0.3%, further distancing itself from the 102 level, reaching a two-month low since May 11. This is mainly due to the market's tendency to bet that the Federal Reserve's interest rate hike cycle is nearing its end.

The US Dollar Index falls to a two-month low.

The US Dollar Index falls to a two-month low.

The Euro rose against the US Dollar and broke through the 1.10 level, reaching the highest level in a month since May 8. The British Pound rose by 0.6% and broke through 1.29, reaching the highest level in 15 months since April 22 last year.

The Japanese Yen rose by 0.8% against the US Dollar, breaking through the 141 level for the first time in nearly a month. Since hitting a seven-month low and falling below 145 in June, it has risen by over 3%. Offshore Renminbi briefly rose above 7.20 yuan, an increase of nearly 350 points from the previous day's closing, reaching a two-week high.

Most mainstream cryptocurrencies have risen. The largest cryptocurrency, Bitcoin, rose by 1% and stabilized above $30,000, reaching a one-week high. The second-largest cryptocurrency, Ethereum, rose by 0.3% and broke through the $1,870 level.

Bitcoin briefly rose above $31,000, and US stocks returned to the $30,000 level during the trading session.

Bitcoin briefly rose above $31,000, and US stocks returned to the $30,000 level during the trading session.

Spot gold rises for three consecutive days to a three-week high, attempting to break through $1,940 per ounce, industrial metals fluctuate

Boosted by the decline in the US Dollar and the 10-year US Treasury yield, COMEX August gold futures rose by 0.31% to $1,937.10 per ounce. Spot gold rose by a maximum of 0.7% and stabilized above the $1,930 level, attempting to break through $1,940, reaching a three-week high for three consecutive days.

Some analysts believe that if US inflation data is weak this week, the gold price may rise to $1,950. And it is difficult for the gold price to fall below the $1,900 level, as concerns about the economic recession caused by the Federal Reserve's continued interest rate hikes will support the precious metal prices.

Spot gold rises for three consecutive days to a three-week high.

Spot gold rises for three consecutive days to a three-week high.

London industrial metals show mixed movements. London copper fell by 0.6% from a one-week high, while London aluminum rose by 1%, further distancing itself from the nearly one-year low since September last year. London nickel, which rose by 1% yesterday, fell by 1.5% and fell below $21,000 again, while London tin, which fell by 1.4% yesterday, rose slightly.