Posts

Posts Likes Received

Likes ReceivedShare surged 15%, Block (SQ.US) was saved by the US yield fall

After the US stock market closed on November 2nd, Beijing time, the US version of "Alipay" Block (SQ.US) released its third-quarter earnings report for 2023. Although the stock price rose significantly after hours, the performance was not impressive. Specifically:

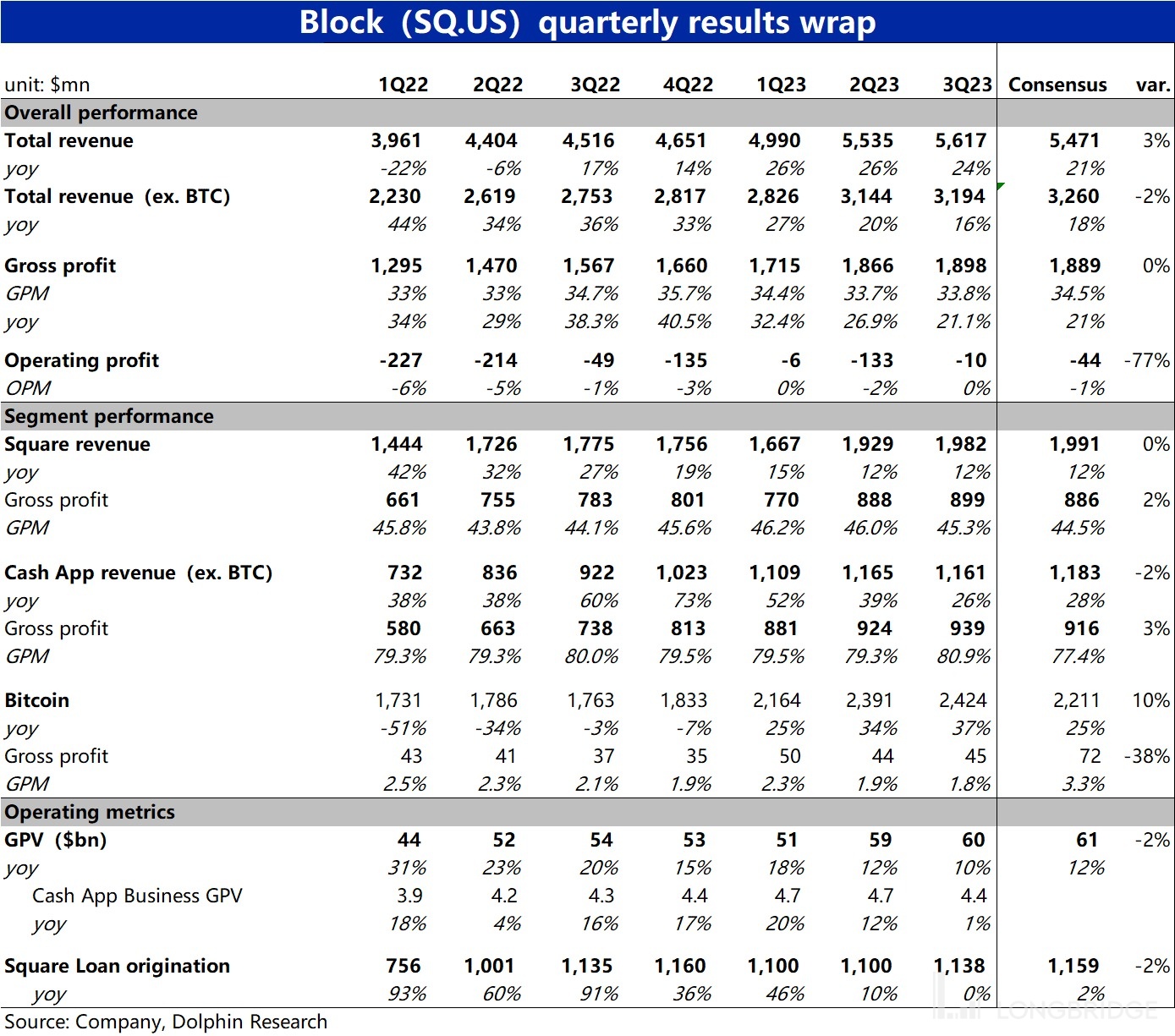

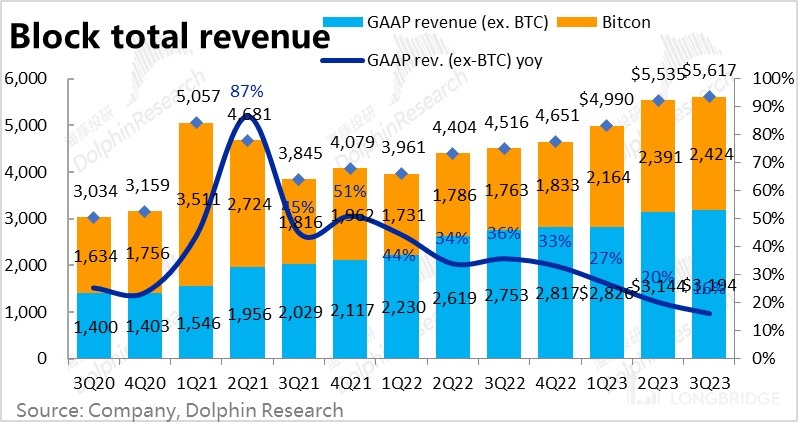

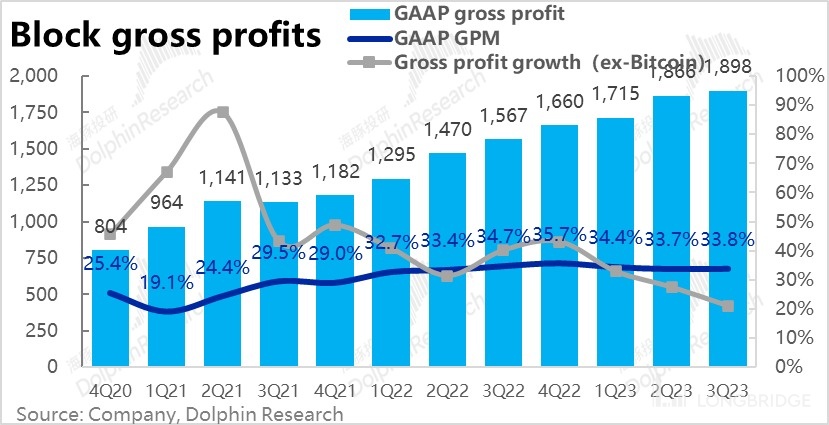

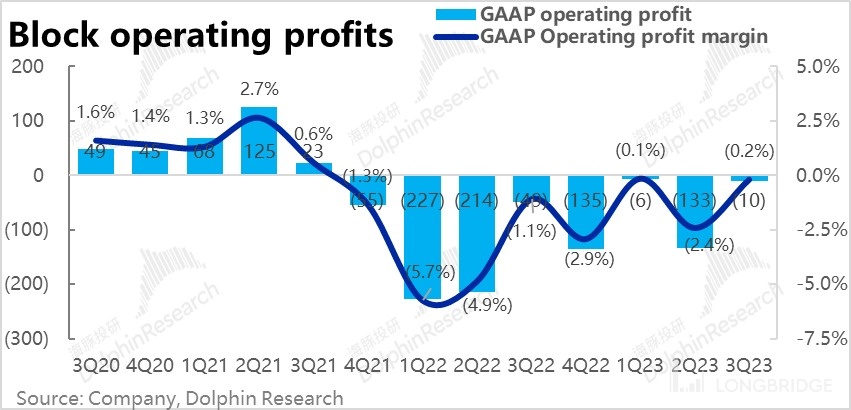

No outstanding performance in revenue and profit: In terms of overall performance, the company achieved a total revenue of $5.62 billion this quarter, which seems to be higher than the expected $5.47 billion. However, excluding the Bitcoin business, the core revenue was $3.19 billion, a year-on-year growth of 16%, which was lower than the expected $3 billion. In terms of profit, the company's most concerned gross profit this quarter was approximately $1.9 billion, which is consistent with expectations, but the year-on-year growth rate slowed to 21%, also without any outstanding performance. The only bright spot is that the operating loss narrowed from $130 million to $10 million, but this fluctuation of around $100 million does not have a significant meaning.

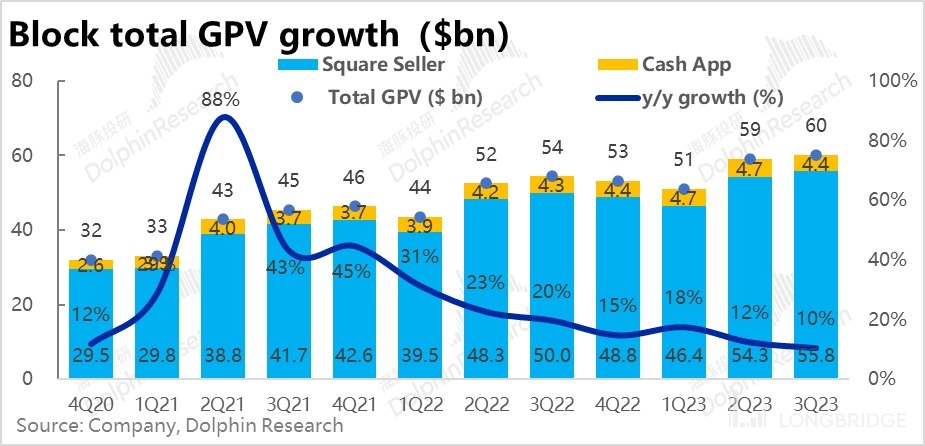

Continued weakness in the Square segment: The company's cornerstone segment, the Square segment, achieved a total revenue of $1.98 billion this quarter, with a year-on-year growth rate still at a historical low of 12%, showing no improvement and slightly lower than the market's expected $1.99 billion, indicating poor performance. Another key indicator, the Gross Payment Volume (GPV), was $55.7 billion, a year-on-year growth of 12%, which remained flat compared to the previous quarter. The C2B payment completed by Cash App was $4.4 billion, with a year-on-year growth rate of only 1%. The total of the two is approximately $60 billion, which is also lower than the expected $61 billion.

Signs of weakness in Cash App: Excluding the Bitcoin business, the Cash App segment achieved a revenue of $1.16 billion, with a continued decline in year-on-year growth rate, slightly lower than the market's expected $1.18 billion. In terms of details, both fee income and value-added service income growth rates have slowed down. The core operating indicator, the fund inflows of Cash App, was $62 billion, with a year-on-year growth rate of 21%. However, it has shown almost no growth for three consecutive quarters compared to the previous quarter, indicating a lack of growth momentum.

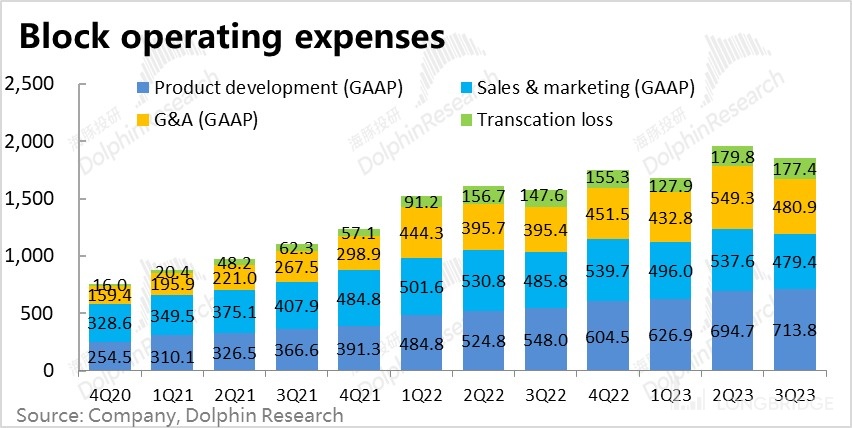

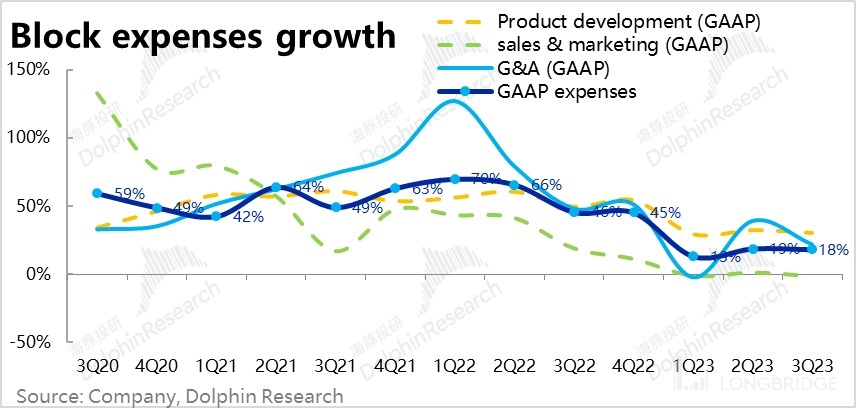

Cost control squeezes out a little profit: In terms of expenses, while the total gross profit increased by 21% year-on-year, the company's total operating expenses this quarter were nearly $2 billion, an 18% increase compared to the same period last year, which is higher than the revenue growth rate but lower than the gross profit. This contributed to the reduction of losses. In terms of details, except for the high growth rate of around 30% in product research and development expenses, marketing expenses have been declining year-on-year for multiple quarters, and the growth rate of management expenses has also slowed down. By saving approximately $90 million in expenses compared to the previous quarter, the company's operating loss narrowed from $130 million in the previous quarter to $10 million this quarter.

Longbridge Dolphin Research's viewpoint:

The US stock market saw a significant surge last night, with Block's stock price rising by as much as 15% after the release of its earnings report. However, the third-quarter performance does not justify such a sharp increase.

Firstly, both the overall revenue and gross profit indicators that the company focuses on failed to impress compared to expectations. The core business revenue and key operational indicators of Square and Cash App also continue to decline, showing overall weak growth without any signs of a turning point.

Looking at the guidance for the fourth quarter, the growth of gross profit continues to slow down, with only an approximately 11% higher adjusted EBITDA than expected, which cannot be considered a significant outperformance.

Therefore, the surge in stock price is primarily due to the overall bullish sentiment in the US stock market. Although the performance is not good, the previous price of less than $40 for the company's stock was indeed relatively low. Additionally, the company announced a $1 billion share repurchase program, which will also stimulate the stock price. Overall, this situation belongs to the category of small-cap growth stocks that experience significant fluctuations when market sentiment changes.

1. How should we interpret Block's earnings report?

Although Block is not a giant in terms of revenue scale, its business composition is quite complex. Readers can refer to the table below for a brief understanding of the company's business structure, which will help better comprehend Block's earnings report and our subsequent analysis. In summary, the company's core business consists of two major segments: the Square ecosystem for merchants and the Cash App ecosystem for individuals.

1. Square business: Provides merchants with POS hardware, payment settlement services, and extends to merchant business loan services (Square Loan), as well as management software services such as ERP/CRM for merchants.

2. Cash App business: Based on free P2P transfers between individuals, it extends to C2B payments (Cash for Business or Cash App Pay), co-branded bank card services, installment shopping services (Afterpay), commission-free stock investments, and Bitcoin transactions. The company records the total transaction volume of Bitcoin as revenue (rather than net price difference), so the revenue scale and volatility of the Bitcoin business are significant.

In addition, the company's acquisition of the installment shopping company Afterpay in the first quarter of 2022 is included in the performance of the Square and Cash App segments with a 50% weightage each. The company has also acquired or established emerging businesses such as the Tidal music streaming app, the Spiral cryptocurrency development platform, and the TBD decentralized technology development platform, which currently have a small proportion and do not require much attention.

2. Square's Merchant Segment Growth Remains Weak

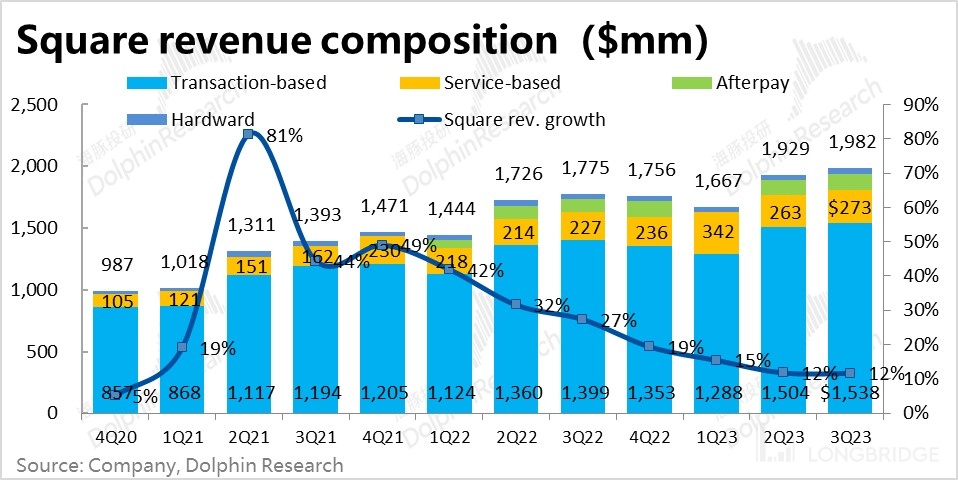

In the company's core segment, Square's B2B-focused Merchant segment achieved a total revenue of $1.98 billion this quarter, with a YoY growth rate of only 12%, which is still at a historical low and shows no improvement. It is also slightly lower than the market's expectation of $1.99 billion.

Breaking it down further:

Transaction fees generated approximately $1.54 billion in revenue this quarter, with a YoY growth rate of 10%. However, the MoM growth rate slowed down by 1%, indicating that the turning point in growth rate has not yet appeared.

Revenue from providing ERP/CRM services and funding loans to merchants reached $270 million this quarter, with a YoY growth rate of 20%. However, this growth rate also slowed down compared to the previous quarter's 23%.

Revenue from selling payment hardware, which serves as a means to attract merchants, amounted to $42 million, with a YoY decrease of 2%. This marks three consecutive quarters of zero/negative growth, suggesting that the number of new merchants is likely not significant.

As the main source of revenue, the leading indicator for Square's payment commission income is the Gross Payment Volume (GPV), which reached $55.7 billion this quarter, with a YoY growth rate of 12%. The growth rate remained stable compared to the previous quarter, further confirming the sluggish revenue growth.

In comparison, Cash App's C2B payment volume reached $4.4 billion, with a YoY growth rate of only single digits, also significantly slowing down.

The combined total payment volume of both Square and Cash App slightly exceeded $60 billion, which is lower than the market's expectation of $61 billion.

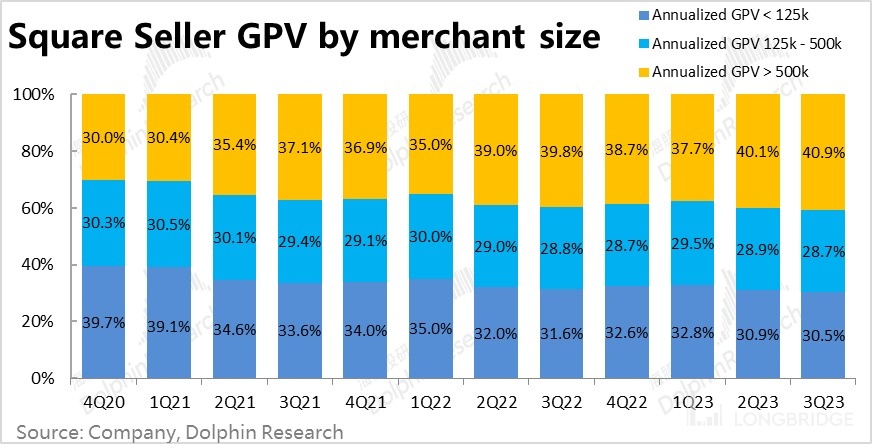

Another key indicator is the proportion of medium-sized and above merchants. This quarter, the proportion of merchants with an annual payment volume exceeding $500,000 further increased to 40.9%, continuing to rise slightly. The fastest decline in proportion is among the smallest merchants.

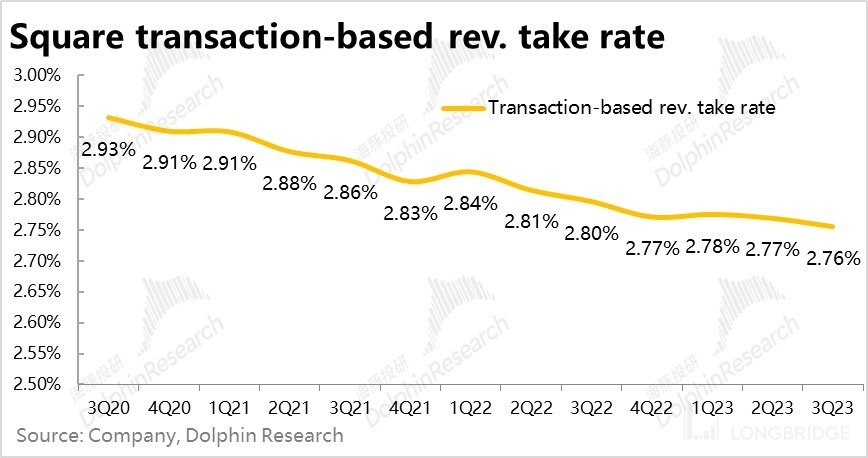

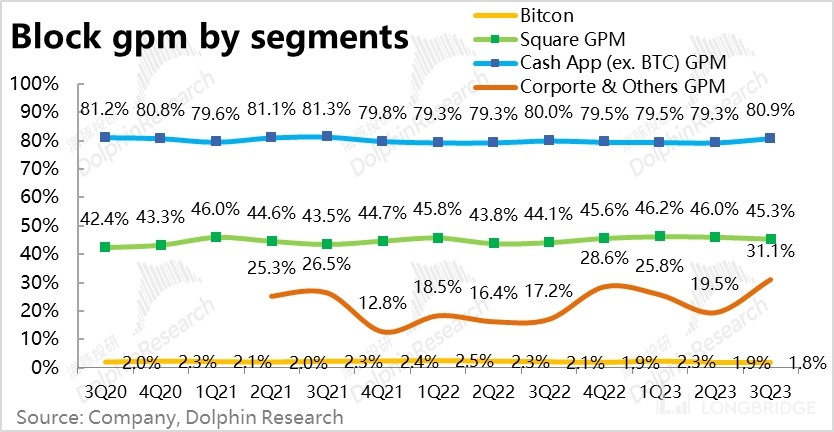

With the increase in the proportion of medium-sized and above merchants, the average payment fee rate calculated by dividing transaction fees by GPV is 2.76%, which continues to decline MoM. As merchant scale continues to grow, it is likely that the payment fee rate will continue to steadily decrease.

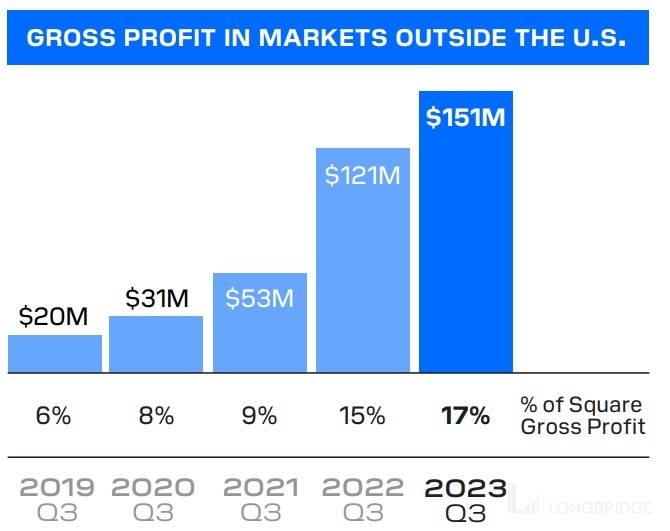

And another major strategy of Square is to increase the proportion of overseas business. In the first quarter of this year, the gross profit of overseas business reached 150 million, accounting for 17% of Square's overall gross profit, an increase of 1 percentage point compared to the previous quarter. The proportion of overseas business continues to increase.

Third, the growth of Cash App is also starting to slow down.

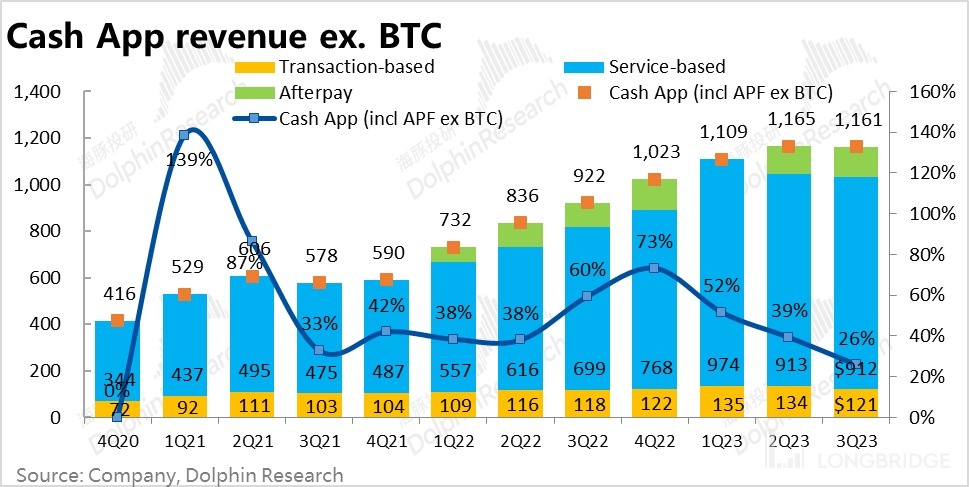

In this quarter, excluding the bitcoin business, the revenue of the Cash App segment reached 1.16 billion US dollars, a year-on-year growth rate that continues to decline and slightly lower than the market's expected 1.18 billion. It can be seen that Cash App also shows signs of weakness.

The fee income from C2B payments within Cash App was 121 million yuan, a decrease of about 13 million US dollars compared to the previous quarter, mainly due to the decrease in GPV realized by Cash App this quarter, which decreased by 300 million compared to the previous quarter.

The revenue from subscription services for co-branded bank card business and instant withdrawal business this quarter was 912 million yuan, also a decrease compared to the previous quarter.

In terms of key operating data, as of the end of this quarter, the monthly active transaction volume of Cash App was 55 million, a year-on-year increase of 11%. The average transaction amount per transaction was $1,132, an increase of 8%. The monetization rate calculated based on gross profit/transaction amount was 1.43%, an increase of about 8 bps compared to the same period last year.

Overall, the transaction amount on Cash App this quarter was 62 billion US dollars, although it still has a year-on-year growth rate of 21%, it has not grown for three consecutive quarters on a quarter-on-quarter basis, showing a lack of growth.

Fourth, the overall performance is mediocre and within expectations.

Adding up all the businesses, the company's total revenue this quarter was 5.62 billion US dollars, a year-on-year increase of 24%, better than the expected 5.47 billion. However, the source of revenue exceeding expectations is still the bitcoin business. Excluding the bitcoin business, the core revenue was 3.19 billion, a year-on-year increase of 16%, which is lower than the expected 3.3 billion.

From the perspective of gross profit that the company is more concerned about, this quarter, Block achieved a gross profit of nearly 1.9 billion US dollars, a year-on-year increase of 21%, which is basically in line with market expectations, and can be considered a moderate performance.

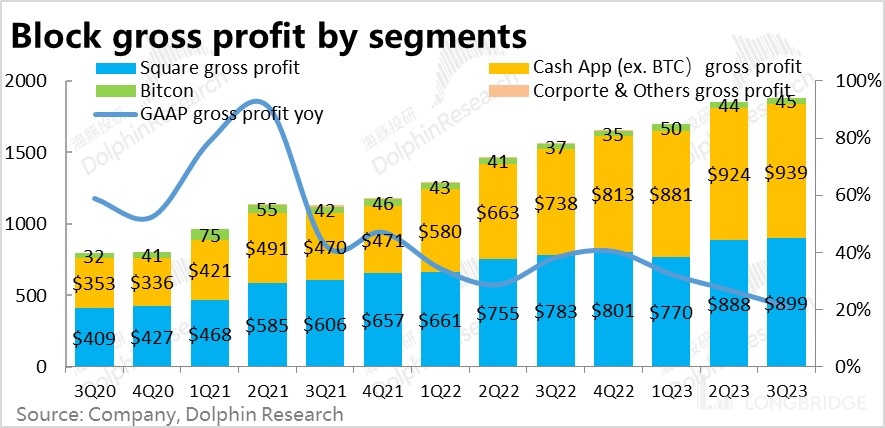

Looking at the specific segments:

The Square segment achieved a gross profit of 900 million yuan, slightly higher than the market expectation of 890 million. However, the gross profit margin dropped to 45.3%, and the gross profit margin has been declining for three consecutive quarters.

Excluding the Bitcoin business, the Cash App segment achieved a gross profit of 940 million US dollars, slightly higher than the market expectation of 920 million, and the gross profit margin slightly improved.

In addition to the core business, the gross profit of the Bitcoin business also increased slightly to 45 million.

Overall, although the gross profit margins of the two core segments, Square and Cash App, have declined, they are slightly better than market expectations. The performance is not good, but not as bad as worrying.

V. Reduced expenses, further narrowing the loss

Due to the large fluctuations in the company's total revenue caused by the Bitcoin business, the proportion of expenses to income is not of much reference significance. We mainly observe the year-on-year growth of expenses.

Overall, with a year-on-year growth of 16% in total revenue (ex. BTC) and a year-on-year growth of 21% in total gross profit, the company's total operating expenses this quarter were nearly 2 billion US dollars, an increase of 18% year-on-year, which is higher than the growth rate of income but lower than the gross profit. Therefore, it can be considered to have contributed to the reduction of losses.

In detail, the main reason is that the growth of product development expenses has been consistently around 30%, the marketing expenses have actually declined year-on-year for several consecutive quarters, and the growth rate of management expenses has also slowed down. These two aspects have saved some expenses.

Therefore, for Block, which has been hovering on the edge of profit and loss in the long term, although the total gross profit this quarter did not show a significant increase, the operating loss of the company was further narrowed from 130 million in the previous quarter to 10 million this quarter, thanks to the approximately 90 million US dollars saved in expenses compared to the previous quarter.However, although the reduction is significant in terms of proportion, it does not have a significant meaning in terms of absolute value.

Dolphin Research's Previous Studies:

Earnings Report Review

May 6, 2023 Conference Call: "Block: Focusing on Profit Growth and Risk Management"

May 5, 2023 Earnings Report Review: "Block: 'Alipay of the United States' Strong and Resilient in Adversity?"

February 25, 2023 Conference Call: "Block: Balanced Investment for Long-Term Growth"

February 24, 2023 Earnings Report Review: "Healed Scars, Learned Lessons: The 'Alipay of the United States'"

November 4, 2022 Conference Call: "Block: Increasing User Transaction Amount and Wallet Share is the Top Priority (3Q22 Conference Call Summary)"

November 4, 2022 Earnings Report Review: "Borrowing and Saving: Block's Generous Approach"

August 5, 2022 Conference Call: "Block: Slowing Down Investment Pace in the Near Term, but Firm Commitment to Diversified Long-Term Business (Conference Call Summary)"

August 5, 2022 Earnings Report Review: "Slow Cash Inflow, Aggressive Investment: Block's 'Awkward Situation'"

In-Depth Analysis

July 19, 2022: "Promises Unfulfilled, the Bubble of Square Needs to Be Squeezed"On June 21, 2022, "The Trillion-Dollar Choice of Payment: Square and PayPal, Who Will Come Out On Top" was published.

Risk Disclosure and Statement of this Article: Dolphin Research's Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.