Posts

Posts Likes Received

Likes ReceivedUber: flaws does not undermine pros, can Uber reach new heights?

On November 7th, before the US stock market opened, "Uber, the international version of Didi," released its third-quarter earnings report for 2023. Overall, the growth in gross bookings and operating profit margin at both ends of the spectrum exceeded expectations, indicating strong demand and profit release. However, the main issue is that the monetization rate of the food delivery business has declined, dragging down revenue and slightly falling short of expectations. The key points are as follows:

Increased order frequency drives resilient growth in order value: In the Mobility segment, Uber's core ride-hailing business achieved a gross booking of $17.9 billion this quarter, surpassing the market's expectation of $17.4 billion, with a year-on-year growth rate of over 30%.

Due to the permanent shift from public transportation to more private ride-hailing after the pandemic, as well as the ongoing trend of returning to the office, the demand for commuting rides is expected to continue to grow steadily for a long period of time.

Uber's food delivery business, which faced headwinds after the pandemic, achieved a gross booking of 16.1 billion yuan this quarter, slightly exceeding the market's expectation of 15.8 billion yuan. The year-on-year growth rate also rebounded to 17.6%, showing a marginal improvement trend.

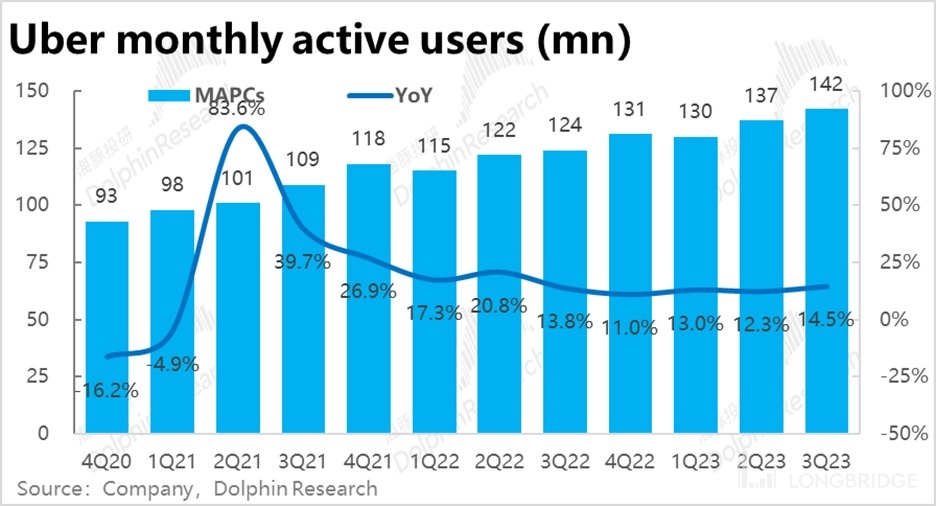

However, the average order value of core orders (including ride-hailing and food delivery) actually decreased by 1.9% to $13.8, lower than the market's expectation of $13.9. In terms of user numbers, Uber had 142 million monthly active users this quarter, slightly lower than the expected 144 million, and the growth in new users also slowed down.

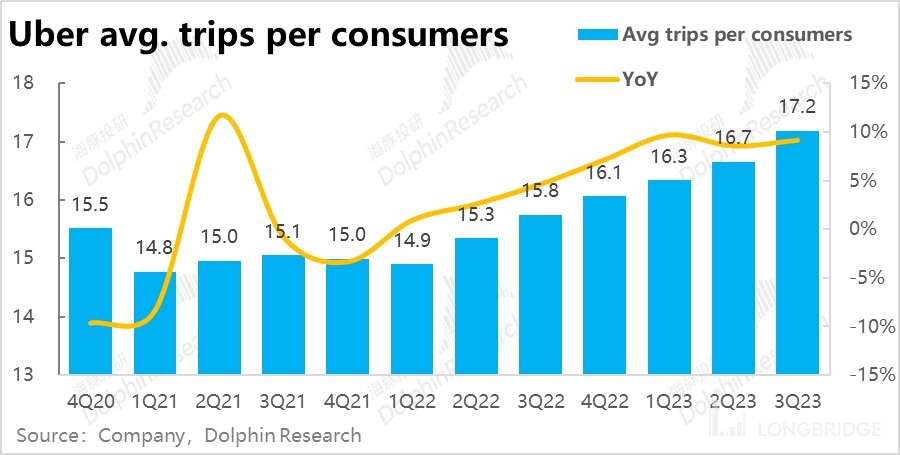

From the perspective of price and user performance, this quarter's results were not particularly good. However, the key improvement in Uber's business growth this quarter was the increase in user order frequency. The average number of orders per user reached 17.2 times, continuing to steadily increase from the previous quarter's 16.7 times. Dolphin Research believes that the integration of Uber One, the cross-membership program combining the two main businesses, as well as the new products and categories introduced by the company in the ride-hailing and food delivery sectors, have enhanced user stickiness and frequency, strengthening the company's long-term growth potential.

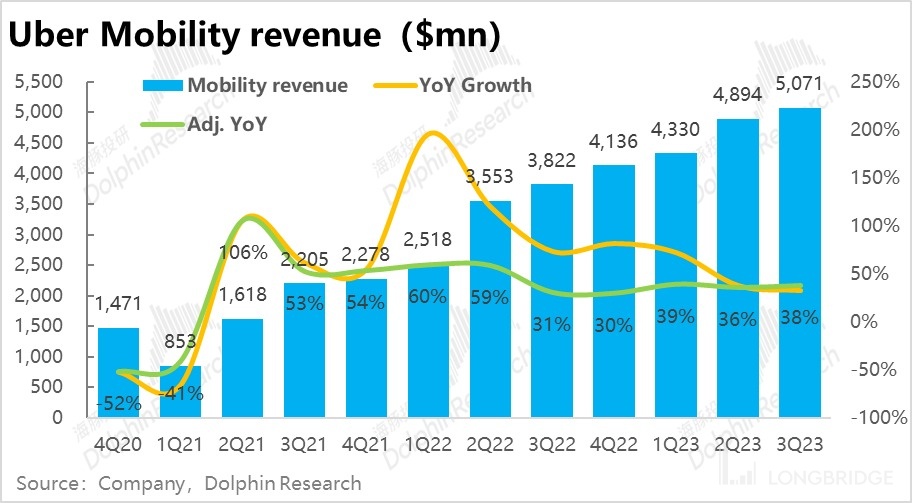

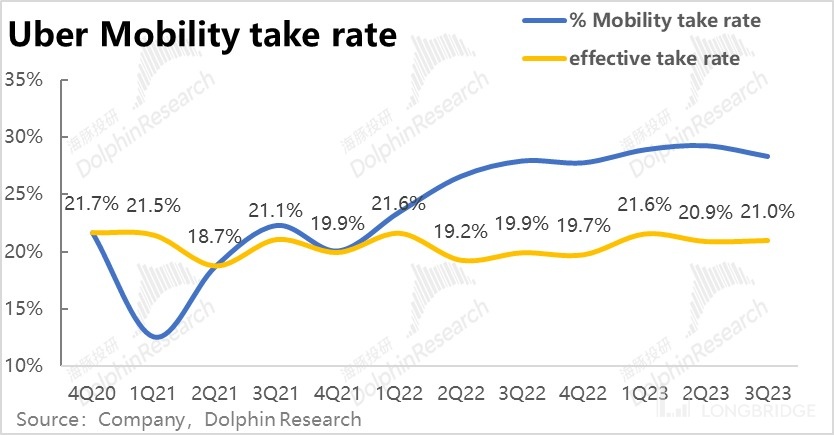

Declining monetization rate of food delivery business affects revenue: This quarter, the revenue from the ride-hailing business was $5.07 billion, slightly higher than the market's expectation of $4.96 billion, exceeding expectations in terms of magnitude and booking amount. After excluding the impact of changes in the business model, the comparable monetization rate of the ride-hailing business remained at 21%, basically unchanged from the previous quarter. Although the number of drivers on the Uber platform is still growing, theoretically contributing to a higher monetization rate for the company, the decline in oil prices and average order value may offset this positive effect.

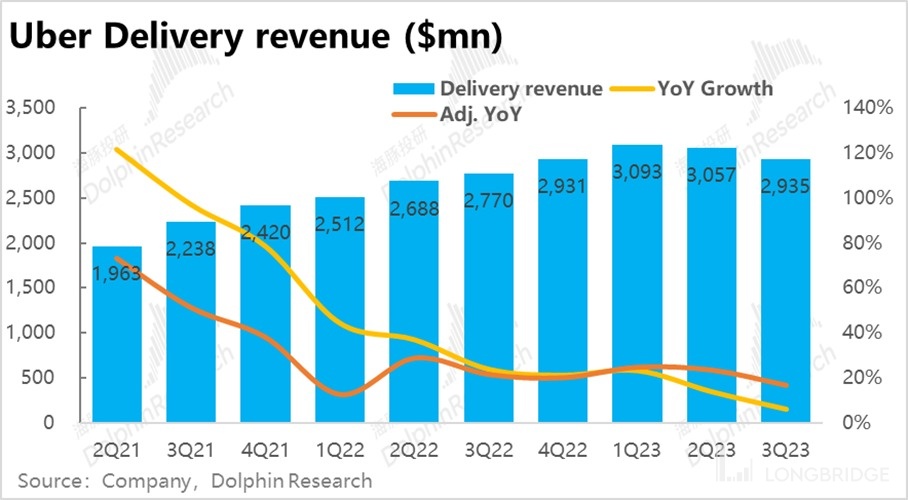

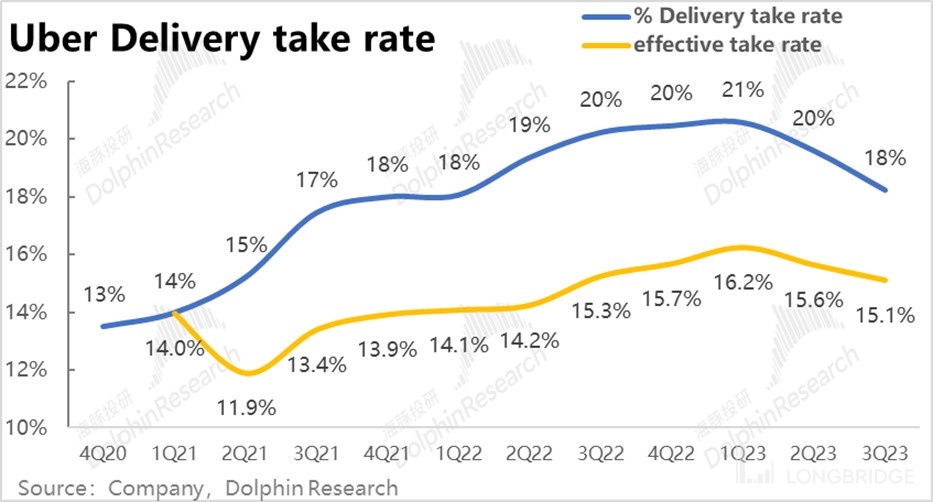

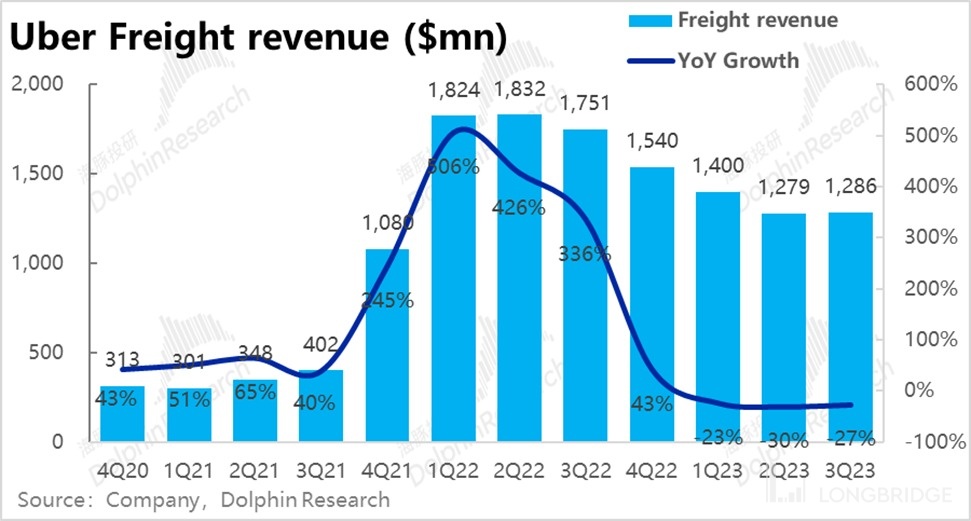

The biggest flaw in this earnings report is the continued decline in the monetization rate of the food delivery business. After excluding the impact of changes in revenue calculation, it decreased from 15.6% to 15.1%, resulting in a decrease in food delivery revenue to $3.94 billion, a decrease of nearly 7% compared to the previous quarter and lower than the market's expectation. It is worth paying attention to the management's explanation for this trend. Uber's freight business achieved revenue of 1.28 billion yuan this quarter, showing signs of stabilization after consecutive declines in previous quarters, but the impact is not significant.

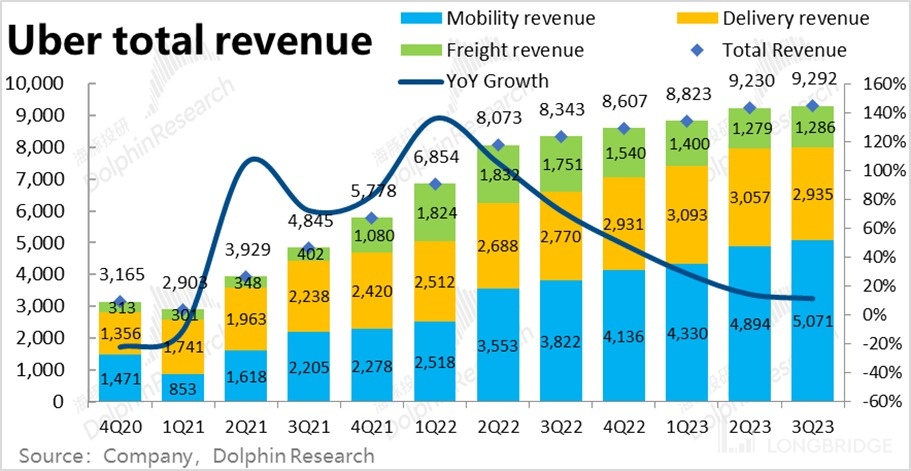

Taking into account all business segments, Uber's total revenue this quarter was 9.29 billion US dollars, which was 3% lower than expected due to underperformance in food delivery and freight forwarding businesses. However, the growth in underlying order value exceeded expectations, so it is not considered a significant flaw.

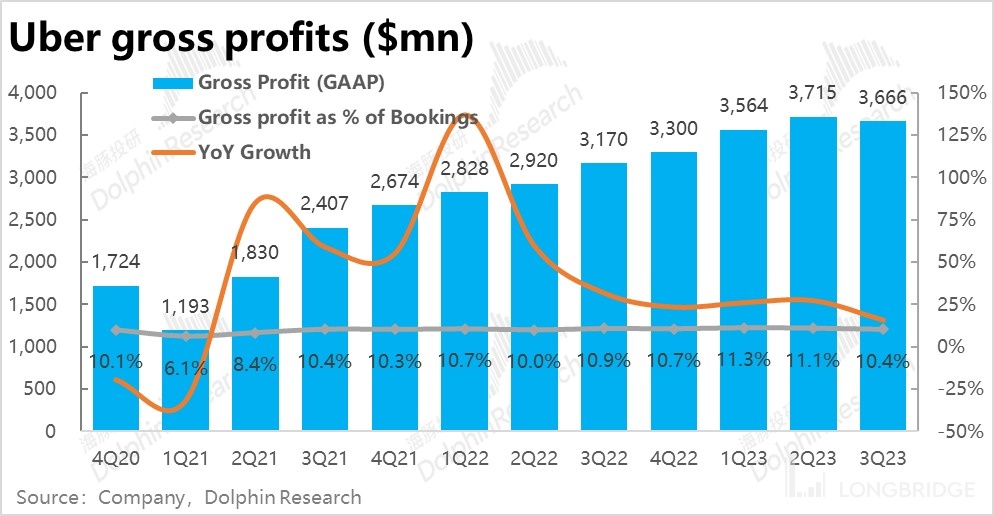

Cost reduction offsets gross profit decline, profit release continues to improve: Due to the decrease in monetization rate of food delivery, the gross profit margin declined from 11.1% to 10.4% as a percentage of order value. The absolute value of gross profit also decreased from 3.72 billion to 3.67 billion US dollars, slightly lower than the expected 3.81 billion.

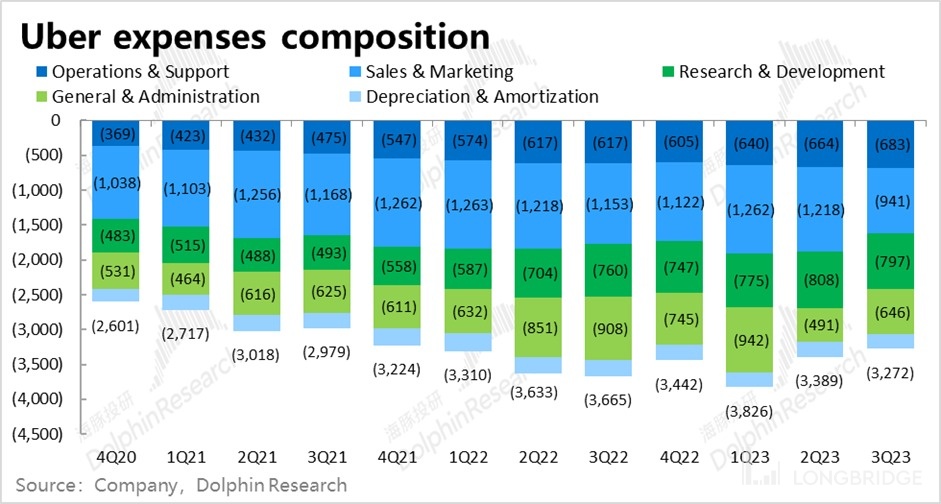

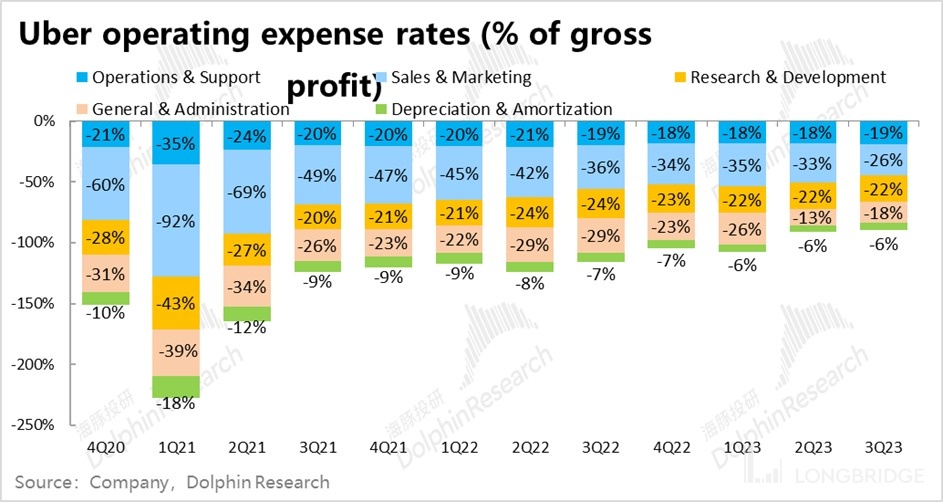

However, on the cost side, total operating expenses decreased from 3.39 billion to 3.27 billion compared to the previous quarter, indicating that the company is still steadily improving efficiency and reducing costs while continuing to grow at a rate of 20%.

Among them, the reduction in marketing expenses was most significant, decreasing from 1.22 billion to 940 million compared to the previous quarter, and administrative expenses also decreased slightly.

Although gross profit decreased, operating profit increased to 390 million, reaching a new high and exceeding the expected 310 million, indicating an improvement in profit release.

Revenue and profit continue to improve in the fourth quarter: For the performance of the fourth quarter, the company expects the total order value to be between 36.5 billion and 37.5 billion, once again exceeding the expected 36.3 billion. In terms of profit, the guidance for adjusted EBITDA is between 1.18 billion and 1.24 billion, also surpassing the expected 1.15 billion. Therefore, in the next quarter, the management has confidence in both revenue growth and profit release.

Dolphin Research's view: Overall, although the decline in the monetization rate of food delivery has affected revenue and gross profit, Uber's performance in the key areas of order value growth and profit release continues to exceed expectations. Therefore, overall, we believe that Uber's performance this quarter is still favorable.

Combined with the company's guidance for the next quarter, which indicates strong demand growth and continued improvement in profit margin, this investment logic remains valid. Therefore, Dolphin Research believes that if the management's explanation for the decline in the monetization rate of food delivery does not point to long-term or permanent deterioration, Uber's performance is likely to continue to improve in the future.

From a valuation perspective, we believe that the current price of around $50 per share in the US stock market is in a relatively reasonable range. Therefore, if the subsequent decline in US bond yields continues to drive overall market valuation improvement, Uber, with its supported performance, is expected to continue to break through. However, there is a risk of a pullback for Uber, which is not cheap in terms of valuation, if there are fluctuations in the macroeconomic environment or US bond interest rates.

Here is a detailed analysis of this quarter's earnings report:

1. Strong demand, Uber's growth remains robust

Firstly, Uber's ride-hailing (Mobility) business segment achieved a gross booking amount of $17.9 billion this quarter, exceeding market expectations of $17.4 billion, and the year-on-year growth rate has also rebounded to over 30% due to a low base. Although the market has long anticipated strong growth in the ride-hailing business, Uber's actual performance did not disappoint.

The reason behind this is that even though it has been two years since the lifting of pandemic restrictions in the United States, the public transportation ridership in major US cities is still far below pre-pandemic levels. The shift in residents' preference for more private commuting options such as ride-hailing services is likely to be permanent. In addition, the return to office work in major US cities has not fully recovered from the pandemic. Under the combined effect of these two factors, the demand for commuting rides is expected to remain strong for a considerable period of time.

At the same time, Uber's food delivery business, which has been struggling in the past few quarters, achieved a gross booking amount of 16.1 billion yuan this quarter, slightly exceeding market expectations of 15.8 billion yuan, and the year-on-year growth rate also rebounded to 17.6%. It shows a marginal improvement trend.

Combining the food delivery and ride-hailing businesses, the core gross booking amount for this quarter reached nearly $34 billion, with an overall growth rate of 24%.

Breaking down the factors driving price and volume, the average order value for core orders (including ride-hailing and food delivery) this quarter was $13.8, a year-on-year decrease of 1.9%, slightly lower than the market expectation of $13.8. We believe that the recent decline in oil prices and the increased proportion of lower-priced ride-hailing services may be the reasons for the overall decrease in order value.

Despite the decline in order value, the overall gross booking amount exceeded expectations, thanks to an increase in Uber's user order frequency. On the user front, this quarter Uber's monthly active users on the platform reached 142 million, slightly lower than the expected 144 million, with a MoM increase of 5 million, also lower than the 7 million increase in the previous quarter. It can be seen that the growth in new user numbers has also slowed down.

However, in terms of order frequency, the average number of orders per person this quarter reached 17.2, continuing to steadily increase from the previous quarter's 16.7. Dolphin Research believes that Uber's cross-membership program, as well as the new products the company has launched in the ride-hailing and food delivery sectors, have contributed to the increase in user stickiness and engagement. Despite the slowdown in new user growth, the company has still achieved impressive growth.

2. The monetization rate of the food delivery business has declined, dragging down revenue slightly below expectations.

Due to legal reasons, Uber has transitioned from a platform model to a self-operated model in some regions such as the UK and Canada. As a result, the confirmed revenue has changed from net commission to total payment amount, leading to an amplification of revenue. Therefore, Dolphin Research mainly focuses on the performance after excluding the impact of accounting changes.

Specifically, the revenue from the ride-hailing business this quarter was $5.07 billion, slightly higher than the market's expected $4.96 billion, exceeding expectations and in line with the booking amount. The YoY growth rate was 33%, and the revenue growth rate has stabilized after the adjustment for the change in business model.

Excluding the impact of the business model change, the comparable monetization rate of the ride-hailing business was 21%, which is basically in line with the previous quarter. It seems that the monetization rate has temporarily entered a plateau, which is also in line with market expectations.

Although according to research data, the number of drivers on the Uber platform is still growing, theoretically contributing to a further increase in the monetization rate, the decline in oil prices and average order value may offset this positive factor.

On the other hand, the monetization rate of the food delivery business continued to decline this quarter, dragging down the revenue growth. After excluding the impact of changes in revenue calculation, the monetization rate decreased from 15.6% to 15.1%.

Due to the decline in monetization rate, the revenue from the food delivery business decreased to $3.94 billion, a QoQ decrease of nearly 7% and lower than the market's expectations. The lower-than-expected revenue from the food delivery business is the biggest flaw in this earnings report, and it is worth paying attention to the management's explanation for this. As for Uber's freight business, it achieved a revenue of 1.28 billion yuan this quarter. After consecutive declines in the previous quarters, there are finally signs of stabilization. However, the freight business does not contribute significantly to the overall value of the company, so it can be overlooked.

Taking all business segments into account, Uber's total revenue this quarter was 9.29 billion US dollars. Due to lower-than-expected performance in the food delivery and freight forwarding businesses, the overall revenue fell 3% below expectations. However, the more crucial metric of order volume growth exceeded expectations, so it is not considered a major flaw. Additionally, the company did not disclose revenue breakdown by region this time, but according to third-party data, growth in the United States was relatively lower compared to other regions, with Europe and South America playing a more significant role in driving growth.

3. expenses continue to be reduced and profits continue to be released.

The decrease in monetization rate of the food delivery business not only resulted in lower-than-expected revenue, but also led to a slight decline in gross profit margin, with gross profit as a percentage of order amount decreasing from 11.1% to 10.4% MoM. The absolute value of gross profit also decreased from 3.72 billion to 3.67 billion US dollars, slightly below the expected 3.81 billion.

On the expense side, it can be seen that total operating expenses decreased from 3.39 billion to 3.27 billion MoM. Despite the continued 20% growth in business scale, the absolute value of expense decreased, indicating that the company is still steadily promoting efficiency and cost reduction.

Specifically, the reduction in marketing expenses is most significant, decreasing from 1.22 billion to 940 million MoM. Administrative expenses also slightly decreased MoM. As for other expense items, they remained relatively stable. Overall, although the gross profit decreased slightly on a MoM basis this quarter, the operating profit increased to 390 million, reaching a new high and exceeding the expected 310 million, thanks to the reduction in expenses. The released profit ultimately improved.

4. the EBITDA of each business has improved, and there may be an increase in capex investment.

The company's adjusted EBITDA for the quarter reached 1.09 billion, higher than the company's previous guidance and market expectations of 1.02 billion. Looking at the different departments:

The adjusted EBITDA of the ride-hailing business was 1.29 billion, with a slight increase in profit margin on a MoM basis, slightly higher than the expected 1.25 billion.

The adjusted EBITDA of the food delivery business reached 410 million, a significant improvement compared to the previous quarter's 330 million and the market's expected 340 million. From this perspective, the possible reason for the decline in GAAP profit in the food delivery business this quarter may be the company's increased capex investment.

As for the freight business, it incurred a loss of 13 million this quarter, which is not significantly different from the previous quarter and market expectations.

In addition, the loss at the group headquarters level increased from 570 million to 595 million, indicating that the company may have increased investment in some new businesses.

Dolphin Research's previous Uber research:

August 2, 2023 conference call "Uber: Confident in Continuous Revenue and Profit Growth"

August 2, 2023 earnings report review "Uber: Expensive but Flawless"

May 3, 2023 conference call "Uber: Will Business Growth Remain Strong?"

May 3, 2023 earnings report review "Uber: Is the Strong Quarterly Report the Last Highlight?" February 9, 2023 Conference Call: "Can Uber continue to grow while reducing costs?" Read more

February 8, 2023 Earnings Report Review: "Is the small and beautiful 'DiDi' outperforming the big and strong?" Read more

November 2, 2022 Conference Call: "Uber believes that travel demand remains strong, with a focus on improving user stickiness and habits (3Q22 conference call summary)" Read more

November 2, 2022 Earnings Report Review: "Can Uber make money without growth, and will the market buy it?" Read more

November 21, 2022: "After experiencing the 'bitter and sweet' of the pandemic, where is Uber's future headed?" Read more

October 14, 2022: "Navigating through the pandemic and inflation, the secret behind Uber's luck" Read more

Risk Disclosure and Statement in this article: Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.