Posts

Posts Likes Received

Likes ReceivedRoblox: Redeeming itself in the peak season and wiping away past shame

Hello everyone, I am Dolphin Research!

Roblox.US released its Q3 2023 earnings report before the US stock market opened on November 8th. Overall, the performance was good. With the boost from the "gaming peak season + Meta VR", Roblox's revenue accelerated faster than expected. At the same time, infrastructure costs contracted YoY, and the growth rate of employee compensation also declined, so the profitability was also decent.

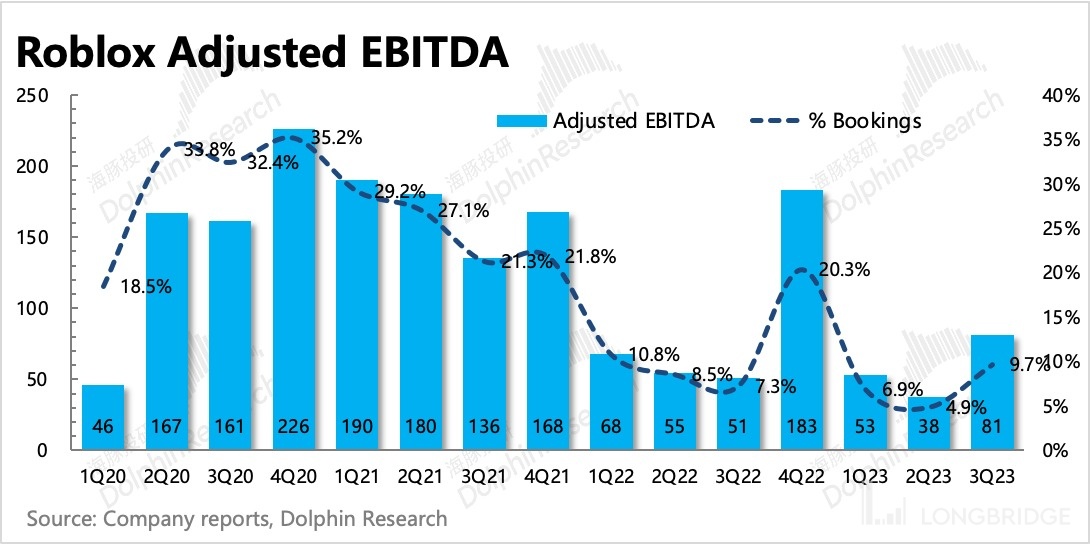

Adjusted EBITDA for the third quarter has recovered to nearly 10%, fulfilling the management's promise in the second quarter of "Adjusted RBITDA margin returning to double digits in the fourth quarter". Due to the strong growth in forward-looking indicators such as bookings and deferred revenue, and the management's guidance of "slowing growth in infrastructure costs", further improvement in profitability can be expected.

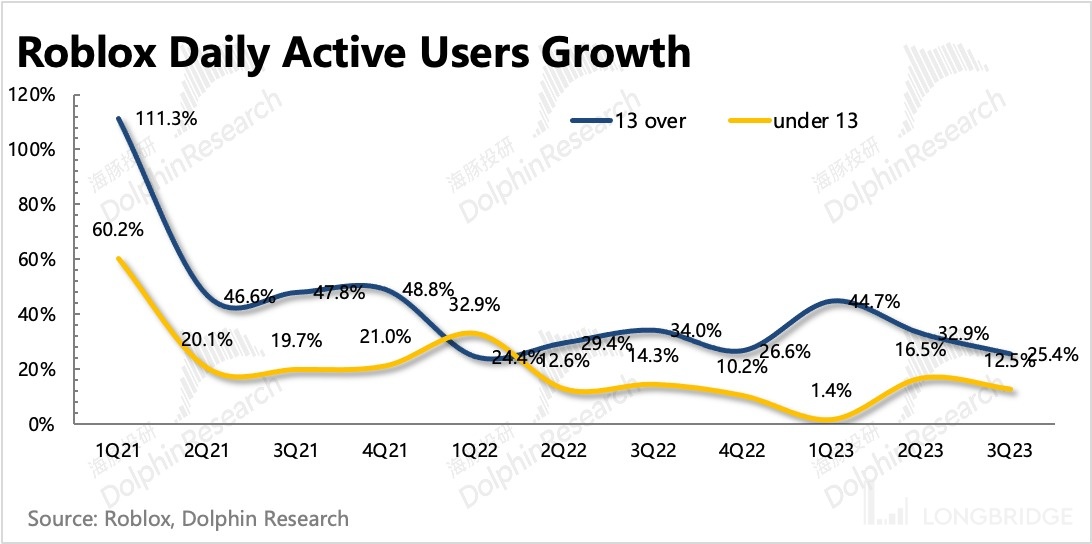

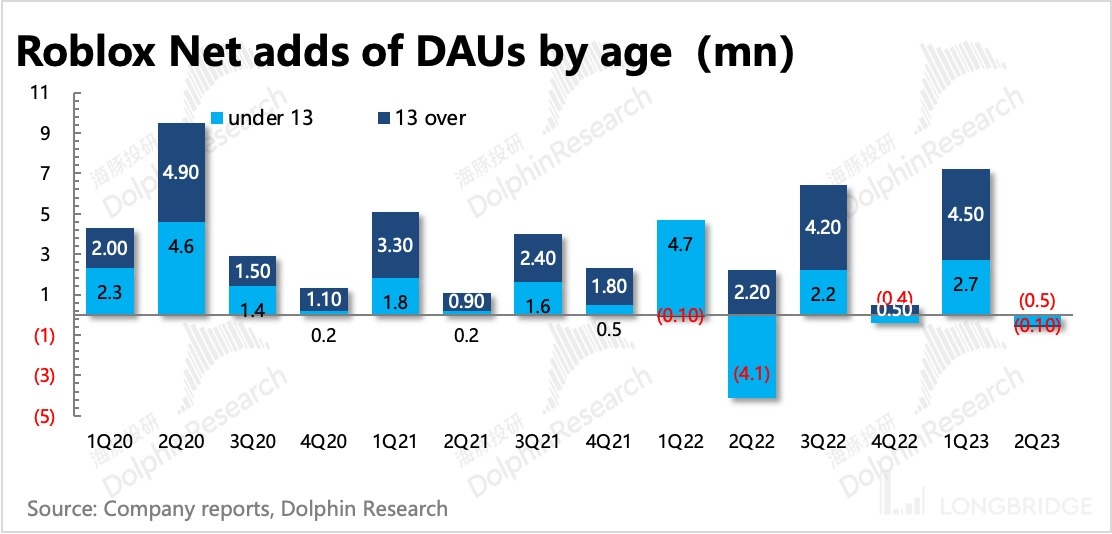

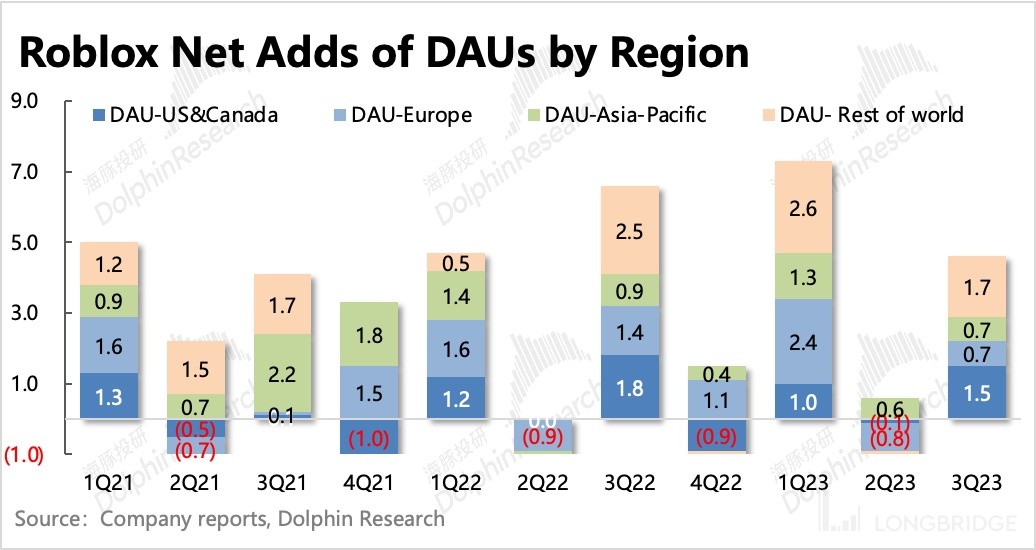

A significant part of the user growth is driven by Meta VR (bringing in 1 million new users in the first week). We are particularly concerned about DAU (daily active users) above the age of 13, which continued to grow steadily this quarter, reaching a total of 70 million daily active users, with a net increase of 4.7 million MoM. The main growth came from North America and other regions. However, some specific regions, such as Japan in the Asia-Pacific region and Germany in Europe, also showed impressive user data.

Overall, the core of this earnings report lies in the optimization of expense growth (infrastructure costs and total employee compensation) and the fact that subscription revenue growth exceeded expectations despite a high base.

In other words, in the two aspects that the market cares most about, namely reducing losses and future growth, the third quarter provided investors with relatively confident guidance and sustained expectations. Therefore, even though the valuation is not cheap at the moment, during the year-end window of easing liquidity and driven by market sentiment, Roblox's growth story (advertising, VR/console games) has already begun to unfold according to our previous neutral-to-optimistic scenario assumption ("Is it worth betting on the metaverse with Roblox?").

In addition, due to Roblox's strong seasonality, short-term performance fluctuations can be magnified. It is recommended that investors pay attention to the management's outlook for next year, especially regarding advertising progress and loss reduction targets.

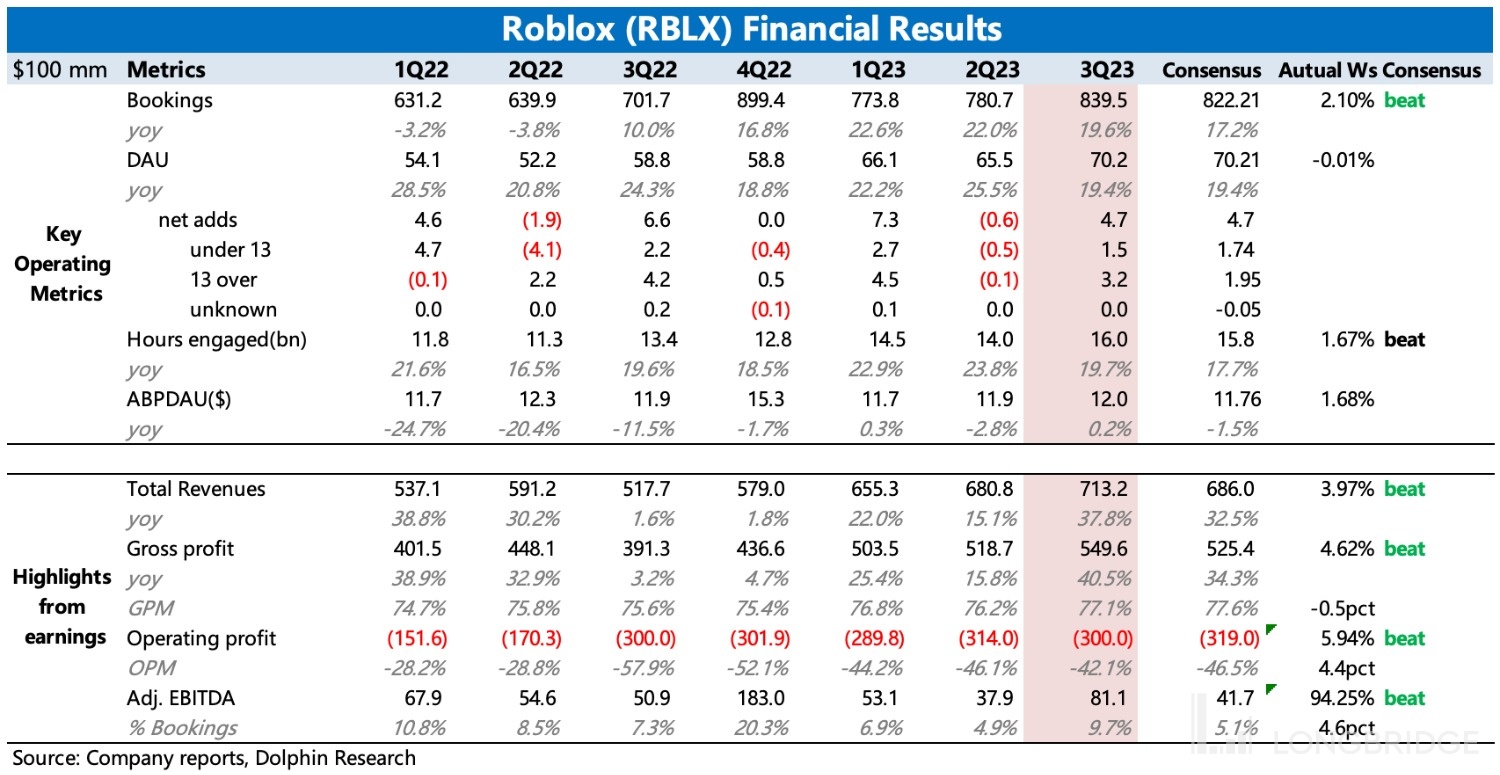

Performance indicators at a glance:

Earnings Report Analysis

1. Strong peak season, profits make a comeback

For Roblox, reducing losses is a big deal. After all, with the end of the pandemic dividend, the market's expectations for Roblox's growth are not as high as before, so naturally the focus shifts to the not-so-pretty bottom line.

In the third quarter, Roblox made a comeback, just as it stumbled in the second quarter. Adjusted EBITDA for the third quarter reached $81.1 million, far exceeding the market's expected $41.7 million. Adj. EBITDA/Bookings jumped from 5% in the second quarter to 9.7%, approaching double digits. The management had previously promised to return to double digits in the fourth quarter, and with the better-than-expected performance in the third quarter, the market will have even higher expectations for the fourth quarter.

So, how did Roblox turn things around in just one quarter?

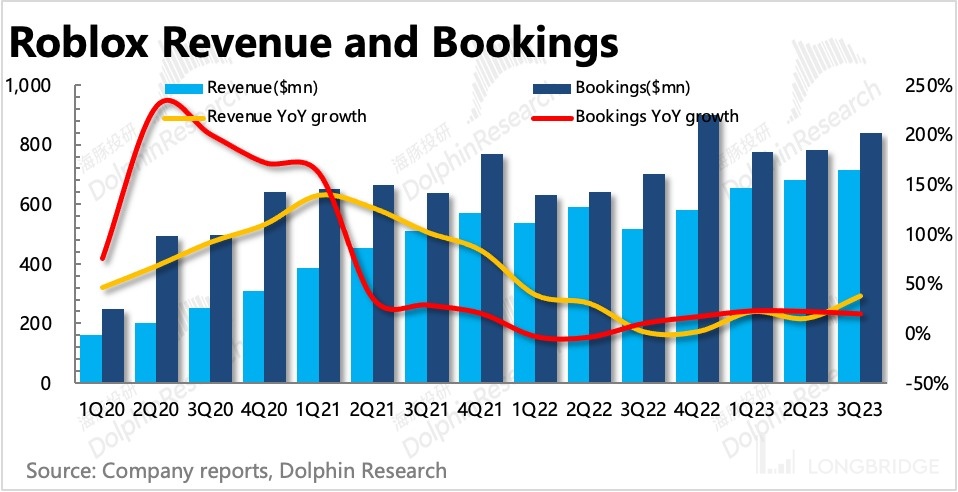

1. Revenue growth rebounds: Low base, new traffic brings new revenue, accelerated revenue recognition during peak season

In the third quarter, revenue increased by 37.8% YoY, with a significant acceleration on a MoM basis, mainly due to three factors:

(1) The low base in the third quarter of last year. The decline in revenue in the first half of last year (slower user growth, lower average user spending) affected revenue recognition in the third quarter.

(2) The dividend from joining Meta VR, with 4.7 million new users, comparable to the net increase during the pandemic.

(3) The third quarter is traditionally the peak season for global gaming due to summer vacation. Therefore, the consumption of virtual items purchased in the game or Robux recharge is accelerated and recognized as revenue, resulting in a revenue growth rate much higher than that of bookings.

However, this also leads to more pronounced seasonal fluctuations in revenue compared to bookings (Q3 +19.6%). But as investors, it is important to have a forward-looking perspective, so Dolphin Research suggests paying more attention to the growth of bookings when predicting short-term performance. Bookings in the third quarter increased by 19.6% YoY, slightly slower than the previous quarter, but the growth base and difficulty are obviously different.

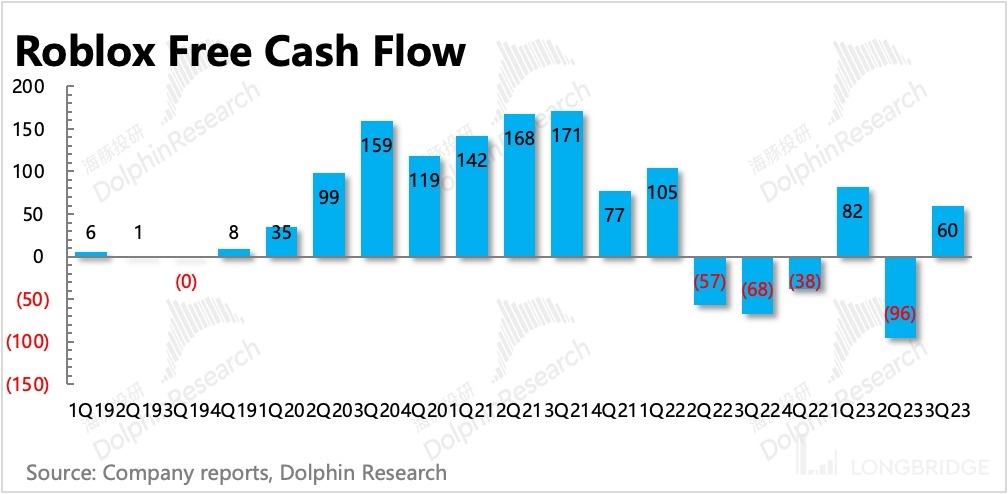

The steady growth of bookings naturally means that the probability of hidden risks on the revenue side of Roblox in the short term is low. Therefore, when there are no major issues with revenue, the management has presented a nearly transparent profit guidance - the growth rate of certain expenses will continue to be lower than the growth rate of revenue, and capital expenditures in the next two years will decrease. In this situation, it is not surprising that the market's expectations for reducing losses have naturally increased.

2. Cost Improvement and Expense Optimization

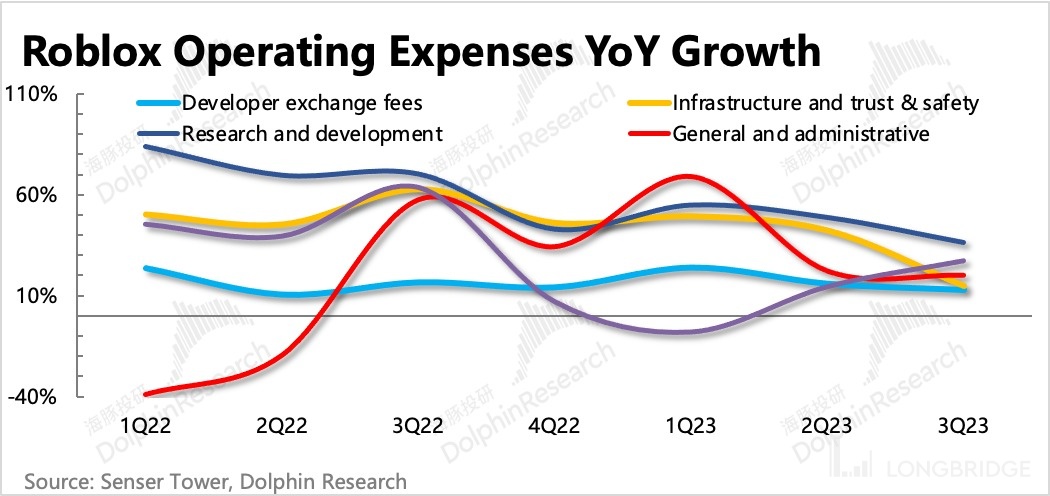

In terms of cost and expense in the third quarter, the main changes occurred in the growth rate of infrastructure and employee compensation expenditure, both of which showed a significant slowdown. Therefore, with the accelerated growth in revenue, the effect of reducing losses was immediately apparent.

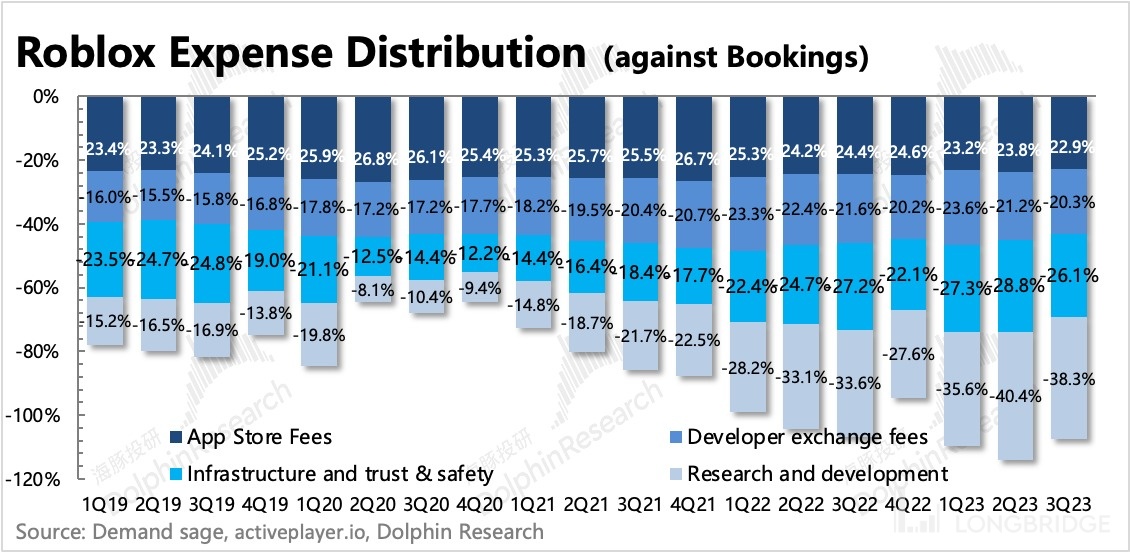

However, Dolphin Research has previously mentioned in the "Roblox: The Indigestible "Big Pie" of the Metaverse" that the way Roblox recognizes revenue and cost needs to be considered from the perspective of "Expense/Bookings" to better reflect the actual operating situation. From the chart below, it is clear that compared to the second quarter, the adjusted operating profit margin (against Bookings) increased by 4 percentage points in the third quarter, mainly due to the slowdown (optimization) in the growth rate of infrastructure and research and development expenses, i.e., the compensation expenditure for cloud and research and development personnel.

(1) A three-year cloud contract was renegotiated in the third quarter, resulting in some cost optimization.

(2) The growth in employee recruitment has slowed down, and excluding SBC, the year-on-year growth in employee compensation expenditure was 22%, which is a significant slowdown compared to the previous quarter's growth of 42%.

(3) Except for sales expenses, other expenses have been slightly optimized. Sales expenses generally fluctuate with the seasonality.

2. Peak Season + Meta, Roblox's Daily Active Users Exceed 70 Million

The expansion of Roblox's ecosystem traffic has been relatively stable, especially compared to the significant fluctuations in performance. This indicates that the Roblox platform itself has a high level of attractiveness, but there are still many problems that need to be solved and improved in terms of monetization.

Looking at different age groups, the growth of users aged 13 and above continues to slow down to 25%, but it has already accumulated 40 million users, accounting for more than half. The growth rate of users aged below 13 is only 12.5%. Therefore, the incremental growth in the third quarter still mainly comes from users aged 13 and above, which is good news for Roblox. With older youth users, they can continue to promote their advertising business.

From a regional perspective, the main growth contribution comes from the Americas and other regions, but Asia-Pacific and Europe are also performing well, especially in Japan and Germany, which have seen impressive user growth.

3. High Platform Stickiness

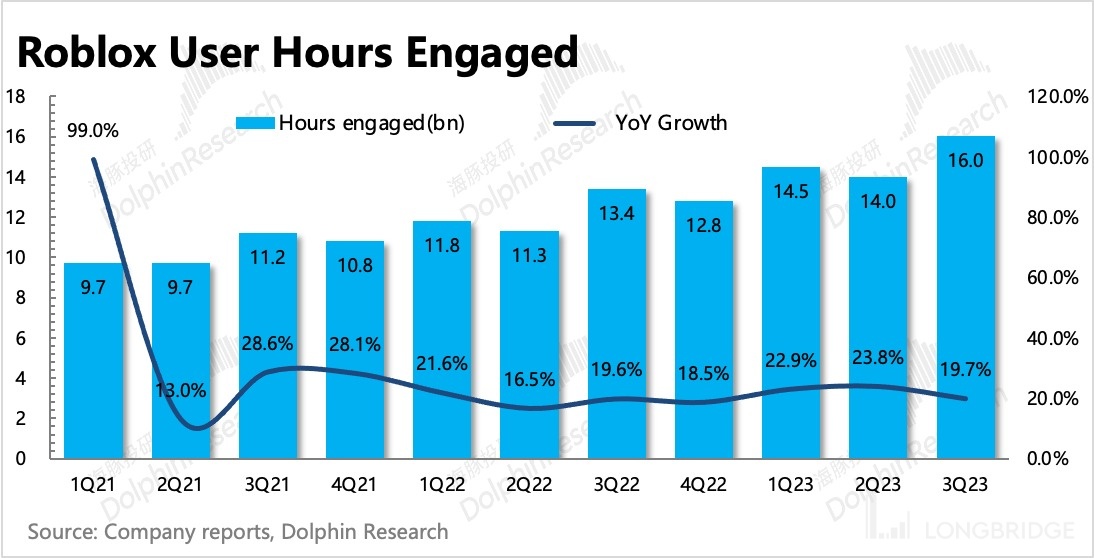

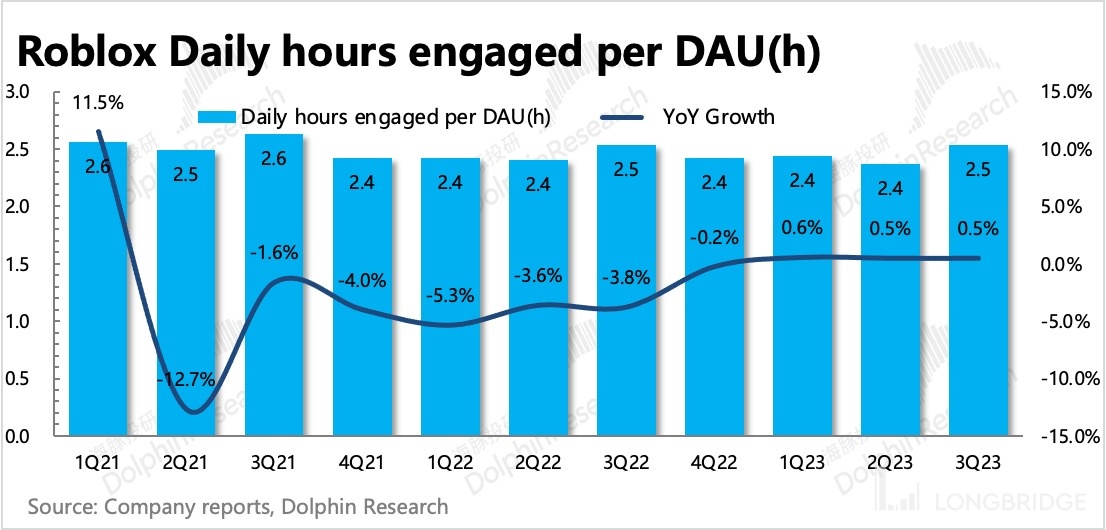

One good piece of data is that despite the influx of new users in the third quarter, the average usage time per user did not decrease due to the short usage time of new users. The total usage time in the third quarter was 16 billion hours, with an average usage time of 2.5 hours, which basically reflects the level of Roblox during the peak season.

It should be noted that the usage time of existing users may be higher in the third quarter, offsetting the low usage time of some new users. This naturally means that the stickiness of Roblox to its existing customers is quite high.

Although both platforms are labeled as Generation Z, they face the risk of long-term losses. However, Roblox is more likely to make money in the gaming track and overseas subscription service demand than Bilibili.

The only problem is that the platform's content is too dependent on games and game users, and it has not yet developed an advertising business to buffer the bottom of the game industry cycle. This may result in "unexpected" performance in the financial report. However, at the same time, we also hope that if Roblox becomes profitable one day, Bilibili can learn from Roblox and incubate a monetization path that suits itself.

Dolphin Research "Roblox" historical articles:

Earnings Report

August 9, 2023: "Roblox: Profit Warning, Breaking Through High Valuation"

In-depth Analysis

July 18, 2023: "Betting on the Metaverse with Roblox: Is It Worth It?"

July 13, 2023: "Roblox: Can't Swallow the 'Big Pie' of the Metaverse" This article's risk disclosure and statement: Dolphin Research's Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.