Good news for Vietnamese electric vehicle stocks $VinFast Auto(VFS.US), surged by 50%😂😂

The main markets for Chinese electric vehicles are, first, the domestic market, and second, the European and American markets. The European and American markets are the bigger playground because of their stronger purchasing power.

Africa and the Americas, along with smaller countries with good relations, have a combined GDP roughly equivalent to that of Japan and South Korea. What does this tell us? It tells us that these regions have very little purchasing power.

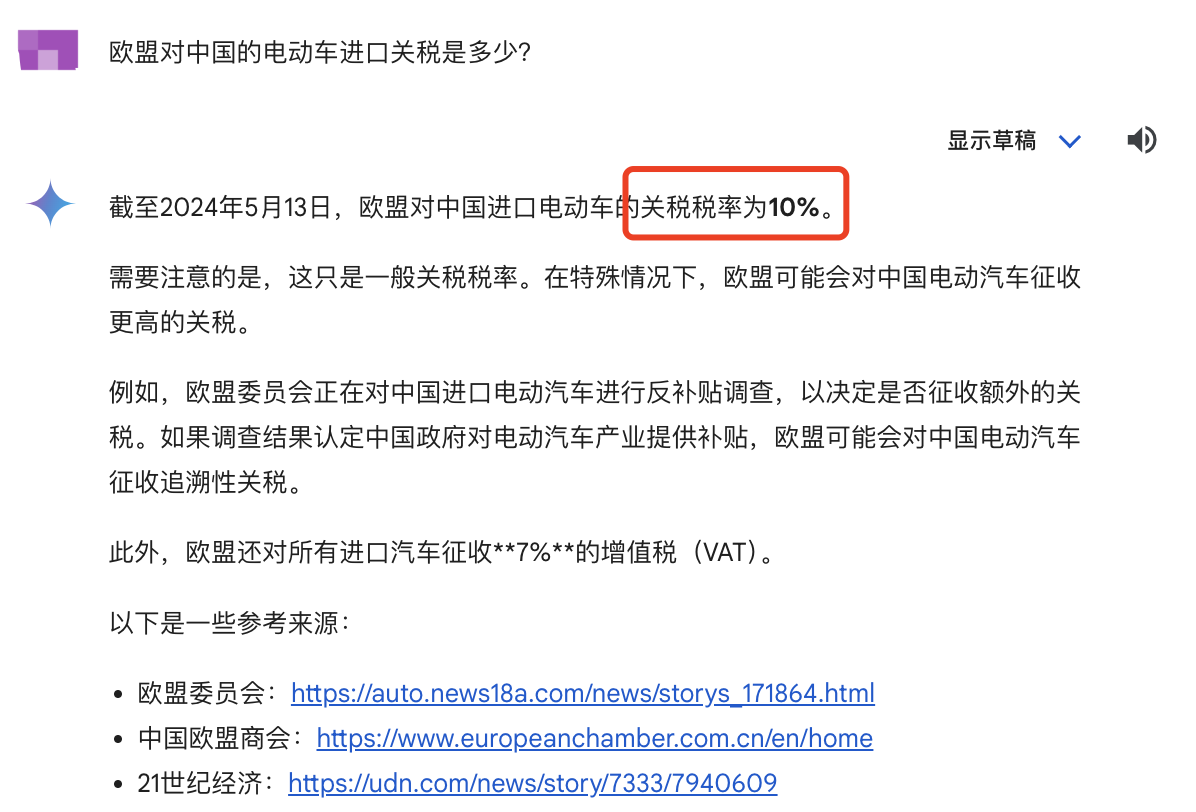

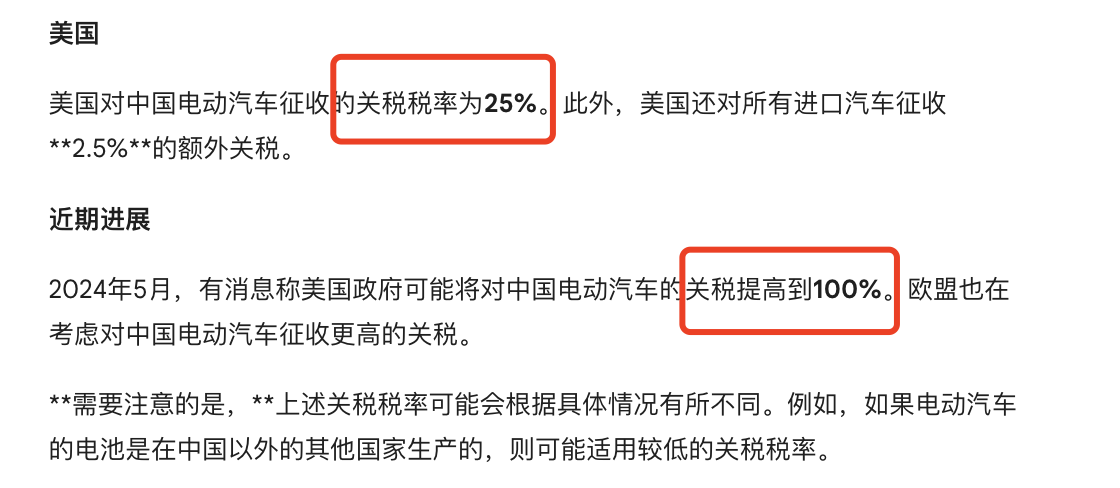

However, the prerequisite for trade is harmonious relations. Currently, the outlook isn’t very optimistic. Europe’s tariffs are around 10%, and the U.S. tariffs are around 25%, which is relatively low (compared to our tariffs on imported cars).

After following Pier Research for two years, here’s how developed systems view us—directly posting the chart (the data is from 2022, and there’s little difference now), no interpretation needed.

This also helps explain why there’s been talk recently about raising tariffs on the "new three" exports. This is the underlying logic, and it’s highly likely to continue.

This shift can be attributed to three key moments: first, the 2018 trade war; second, the pandemic; and third, the Russia-Ukraine conflict. Just look at the changes in the last chart (U.S.).

$ZEEKR Intelligent Tech(ZK.US)$NIO(NIO.US)$Li Auto(LI.US)$XPeng(XPEV.US)$LEAPMOTOR(09863.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.