Posts

Posts Likes Received

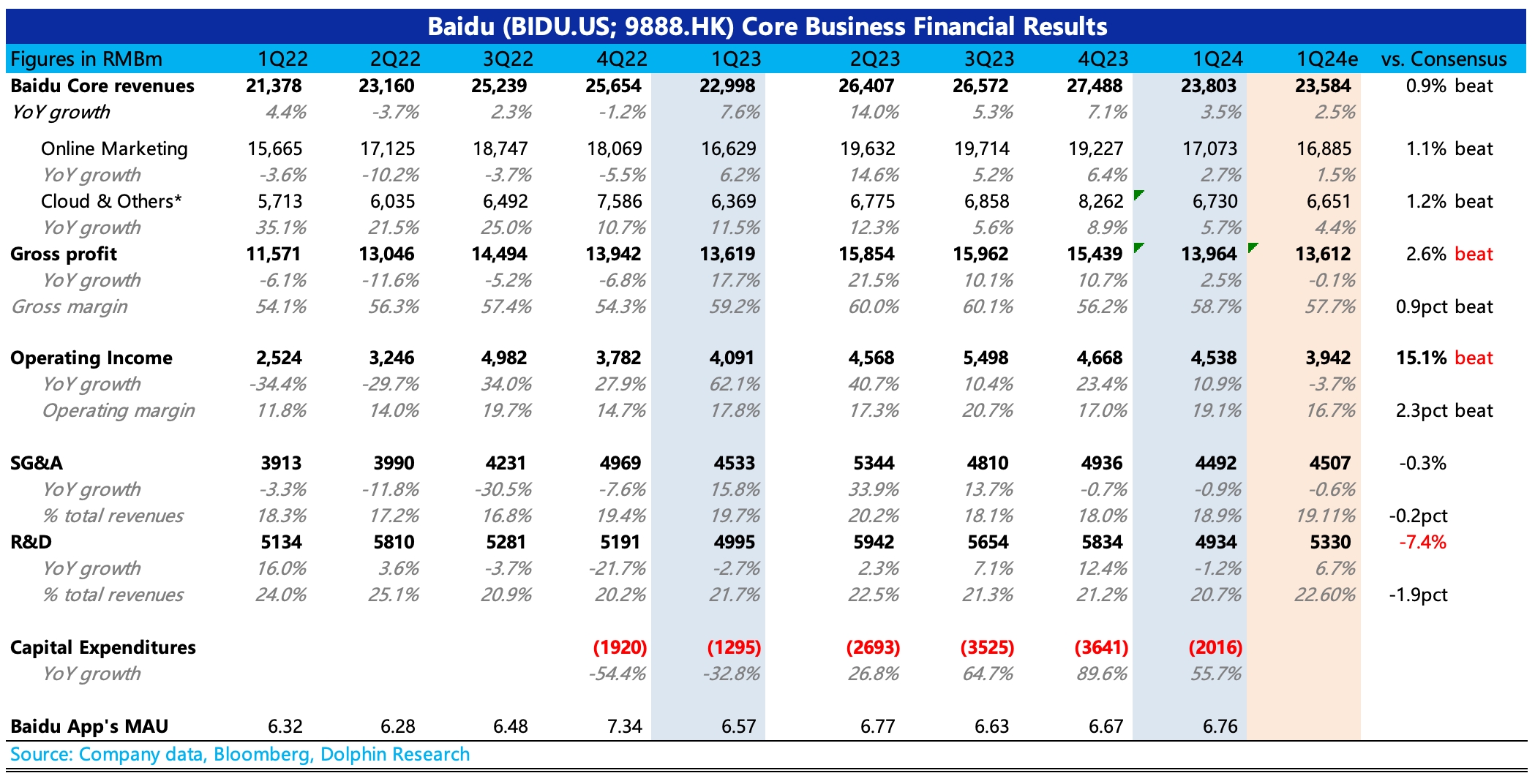

Likes Received$Baidu(BIDU.US) first take: Baidu's core performance slightly exceeded expectations in Q1, with the highlight being the profit side, while revenue was basically in line with expectations. The profit beat was mainly due to R&D cost compression. Despite increased AI expenses, the company was more aggressive in optimizing its R&D team (salaries). Judging from the stock incentive for R&D expenses, Q1 saw a direct year-on-year decline of 24%, reflecting the intensity of layoffs. Ultimately, Baidu's core R&D expenses fell by 1% year-on-year.

However, this earnings report also shows signs of expectation management. A month ago, during the preview, the company's guidance was more conservative, leading to downward revisions in institutional expectations. But if we look at advertising alone, the mere 2.7% year-on-year growth still reflects pressure. This includes a small boost from AI advertising, indicating that traditional advertising performance was even weaker after excluding AI. This is partly due to the weak macro environment in Q1 and the company's limited competitiveness. From a trend perspective, growth pressure will only ease in the second half of the year.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.