The dream that iQIYI can't catch? Netflix plays to "crazy flying"

$Netflix(NFLX.US) On January 21st, Eastern Time, Netflix released its financial report for the last quarter of 2024 after the market closed. The fourth quarter is traditionally a peak season, and Netflix has rolled out several blockbuster titles. Although there are some positive expectations in the market, the actual performance of subscriber growth has once again mirrored last year's "surprise," with the quarterly user additions even reaching a historical high.

One benefit of this booming growth is that cash flow will be more abundant. Although content investment in Q4 is proceeding at a normal pace, the favorable operating conditions have significantly exceeded previous expectations for free cash flow, achieving $7 billion in free cash flow for the entire year of 2024.

In addition, given the continued popularity of Q4's blockbuster releases and confidence in the rich reserves for 2025 (new seasons of several historically popular shows), management has raised its performance guidance—revenue (+1%) and profit margin (+100bps). Additionally, management has announced a $15 billion share buyback to maintain the current buyback momentum. The accumulation of positive factors has collectively boosted market investment confidence, leading to a 15% surge in Netflix's after-hours trading.

Key Highlights from the Financial Report:

1. User Growth Shines Again

In Q4, Netflix saw a net increase of 18.91 million users, significantly exceeding Bloomberg's consensus expectations and surpassing the latest forecasts from major investment banks. The pipeline for Q4 was rich, with titles like "Squid Game 2," "Fight Station," and the original suspense film "Carry-on" capturing massive attention, while the two NFL games aired during the Christmas season also achieved outstanding viewership.

Starting next quarter, Netflix will no longer disclose subscriber numbers and Average Revenue per Member (ARM), so there was no qualitative guidance on user numbers this time. However, the popularity of Q4's blockbuster releases continues to ferment, and there is also a substantial content reserve for Q1 2025. Combining this with the revenue guidance provided by the company, we expect around 6 million new subscriber additions in Q1.

2. Price Increases May Be Imminent This Year

With nearly 19 million user growth, all four major regions saw significant increases. Particularly in core regions like North America and Europe, approximately 5 million new users were added, effectively dispelling concerns about the diminishing effectiveness of the account-sharing strategy. It seems that as long as the content is strong enough, it can always stimulate users' willingness to pay.

In Q4, the average paid ARM across regions did not change much, mainly because, when the ad-supported user base has not yet achieved high ad fill rates and conversion rates, the average monetization value (subscription fees + ad revenue) tends to be lower compared to Premium users.

In Q4 and throughout 2024, Netflix only raised prices in a small number of countries (mainly in Europe), while most regions eliminated the Basic pricing tier to force low-paying users to become part of the ad-supported audience. In core countries like North America and the UK and France, the last price adjustment occurred at the end of 2023, and maintaining a rhythm of adjustments every 1-2 years, it is expected that core regions may see a new round of price increases in 2025

3. Advertising will gradually become a new growth driver

2024 is the year Netflix officially launches its advertising business line. As of the end of November, media reports indicated that Netflix's monthly active users for ads reached 70 million, with 50% of new users in regions promoting the ad-supported package choosing the Ad-support package.

However, the current issue with Netflix's advertising business is that ROI still needs improvement. In the second half of last year, the company launched its own 1P advertising platform in Canada and plans to accelerate the rollout in other regions this year, with the U.S. region set to launch the 1P advertising platform in April.

Although the company did not disclose detailed advertising revenue figures this time, market expectations suggest that the current proportion of advertising revenue is still below 10%, with a significant increase expected by 2025. Coupled with the company's upward revision of profit margins for 2025, advertising efficiency is expected to improve further.

4. Profit margins meet expectations

In the fourth quarter, the company's operating profit was $2.27 billion, a year-on-year increase of 52%. Compared to the third quarter, the same growth rate was achieved on a higher base. The main reason driving growth is that revenue steadily grew at a double-digit rate of 16%, while costs and expenses remained restrained.

5. Increased investment, but cash flow will also increase

In the fourth quarter, Netflix's content investment was on track, with an annual investment amount of $17 billion basically meeting targets. However, due to better operational performance, free cash flow in the fourth quarter significantly exceeded expectations, achieving $7 billion in cash flow for the year, higher than the previously guided $6-6.5 billion.

Starting this year, the impacts of the pandemic and strike waves have faded, and Netflix's content investment scale will further recover to $18 billion, a year-on-year increase of 6%. However, the company also mentioned that it would maintain high ROI in its investments, which past history can prove Netflix's investment discipline. Therefore, despite increased investment spending, management has raised its free cash flow expectation for this year to $8 billion.

6. Upgraded 2025 performance guidance

Given the continued popularity of Q4 blockbuster hits and confidence in the rich reserves for 2025 (new seasons of several historically popular shows), management has upgraded its performance guidance—revenue (+1%) and profit margin (+100bps). The revenue range is set at $43.5 billion to $44.5 billion, with a year-on-year growth rate of 12%-14%, while the profit margin is raised from 28% to 29%, with profit performance exceeding expectations.

7. An additional $15 billion buyback, average return but sufficient sincerity

At the end of the last quarter, Netflix had $3.1 billion remaining in its buyback quota. Based on last year's average buyback of $1.5-2 billion per quarter, the quota needed to be "recharged." Therefore, in this quarter, management authorized an additional $15 billion buyback quota to continue maintaining current shareholder returns.

Although a buyback of $5-10 billion a year is not considered "substantial" compared to Netflix's current market value (up 15% after hours to over $420 billion), Netflix's cash balance is not particularly high, and long video is essentially an investment-driven business. With idle funds (Q4 net cash of $7.8 billion, free cash flow of $1.4 billion, and after deducting content investment of $4.5 billion, only $4.7 billion remains),The repurchase amount of 1 billion accounted for 21%. From the perspective of proportion, Netflix's buyback can be considered very sincere.

8. Performance Indicators Overview

Dolphin Investment Research Perspective

Despite the prediction of at least a year of dividend period, Netflix's performance has significantly exceeded Dolphin's expectations. Looking at the current 2025 pipeline, with the presence of historical drama kings like "Squid Game 3," "Wednesday 2," "Stranger Things 5," and "You 5," even though peers are gradually overcoming the impact of the strike and intensifying competition with the launch of advertising packages, the explosive content reserve of Netflix this year makes it hard not to be optimistic.

In the short term, Netflix can tell two main stories:

1) Continue to increase investment in live sports programs, event content, and games. These not only broaden the existing user base but also help fill inventory slots for ads, which is expected to further expand advertising revenue and improve conversion efficiency.

2) In addition, the price increase cycle in core regions is quietly approaching, having maintained a rhythm of raising prices once every 1-2 years. Last year, when Disney, Paramount, MAX, and even Prime were raising prices, Netflix did not synchronize price increases in core regions like the U.S. and Canada, and the U.K. and France. Management believes that their price increase actions will not follow peers but will be based on their content costs and user feedback on content. Therefore, Dolphin believes that under the premise of a content explosion in 2025, core regions are likely to see a wave of price increases.

In the long term, management has begun to tell the story of expanding the entire entertainment business, including sports and IP game monetization. Specifically, this means raising the potential market size from 500 million streaming households outside of China and Russia to 750 million, as well as the overall $650 billion entertainment market, thereby illustrating Netflix's future potential.

However, the long-term story is more about emotional support. Currently, Netflix's logic still needs to follow the short-term content cycle. For Netflix in 2025, Dolphin believes that although the peak period for acquiring customers has passed, at the current high valuation (after a 15% surge post-market, the market cap of 420 billion implies a 25-year EV/NOPAT of 35x, but the profit growth rate CAGR over the next three years may only be 20%+), it is necessary to pay attention to some risks, but there is no need to be overly pessimistic.

After nearly five years of cycles, including the pandemic, Netflix's ability to create hit shows continues to be validated. More importantly, whether in describing development prospects or emphasizing shareholder returns, management's thinking is very clear. This will undoubtedly alleviate some investors' concerns about the slowing impact of account sharing, advertising effectiveness, and exchange rate effects, further boosting market investment confidence. There may still be some emotional premium in the short-term surge, but each round of valuation adjustment may be a good opportunity to re-bet and accompany growth.The following is the detailed content

1. User growth shines again

In the fourth quarter, the net increase in subscription users was 18.91 million, exceeding Bloomberg's consensus estimate of 9.2 million, and the expectations of leading institutions were just a little over 10 million. The user increase still stems from the crackdown on account password sharing and the launch of advertising packages.

From a regional perspective, all regions flourished. Especially in core areas like North America and Europe, approximately 5 million new users were gained, effectively dispelling concerns about the gradual slowdown of the account sharing crackdown strategy. As long as the content is strong enough, it can always stimulate users' willingness to pay.

For the first quarter of 2025, the company will no longer disclose user numbers and ARM. Dolphin believes that the popularity of Q4's blockbuster hits is still fermenting, and there is also a considerable amount of content reserves for Q1 2025. Combined with the revenue guidance provided by the company, it is expected that there will still be around 6 million new subscription users in Q1.

In the medium to long term, the main logic remains the replacement of cable television by streaming media, as well as Netflix maintaining its competitive advantage and industry leadership in streaming media. According to Nielsen data, although there were the Olympics and presidential debates in the U.S. in the third quarter (users generally watch on cable television), the share of streaming media viewership still increased by 1 percentage point, reaching 41%, breaking a new high.

2. Price increases may be imminent in core regions

In the fourth quarter, Netflix achieved revenue of $10.25 billion, a year-on-year increase of 16%, and a year-on-year increase of 19% at constant exchange rates. This year, it will also be affected by the high exchange rate of the dollar, which is expected to impact growth by 2-3 percentage points.

Revenue growth mainly relies on user scale. In Q4, the average paid ARM per region did not change much, mainly because, when the ad fill rate and conversion rate for Ad-supported users are still not high enough, the average monetization value (subscription fee + advertising revenue) will be relatively low compared to Premium users.

In Q4 and throughout 2024, Netflix only raised prices in a small number of countries and regions (mainly in Europe), while most regions forced low-paying users to become advertising customers by canceling the Basic price package. In core countries like North America, the UK, and France, the last price adjustment was at the end of 2023. Adhering to a rhythm of adjusting every 1-2 years, Dolphin expects that core regions may welcome a new round of price increases in 2025

2024 is the year Netflix officially launches its advertising business line. As of the end of November, media reports indicate that Netflix's monthly active users for ads reached 70 million, with 50% of new users in regions promoting the ad-supported plan opting for the Ad-support package.

However, the current issue with Netflix's advertising business is that ROI still needs improvement. In the second half of last year, the company launched its own 1P advertising platform in Canada and plans to accelerate the rollout in other regions this year, with the U.S. set to launch the 1P advertising platform in April.

Although the company did not disclose detailed advertising revenue figures this time, market expectations suggest that the current contribution from advertising revenue is still below 10%, with a significant increase expected by 2025. Coupled with the company's upward revision of profit margins for 2025, advertising efficiency is expected to improve further.

3. Competitive Environment: Focus on YouTube and Amazon's Competitive Threats

As the impact of the significant strike on peers gradually diminishes, changes in the industry competitive environment also need to be monitored. Although Netflix has released four to five sequel series this year, it cannot avoid the increased reserves of competitors, which may pose a risk in the competition for user viewing time.

According to Nielsen data, Netflix's viewership share began to rebound in November, but at the same time, YouTube and Amazon Prime Video continue to gain ground. Disney saw a short-term increase in share due to bundling Hulu with Disney+, but it also began to decline in November. Therefore, for Netflix, if it wants to focus on competition, YouTube should be the primary concern, followed by Prime Video.

4. Cash Flow: Continued Investment Cycle, Additional 15 Billion Buyback

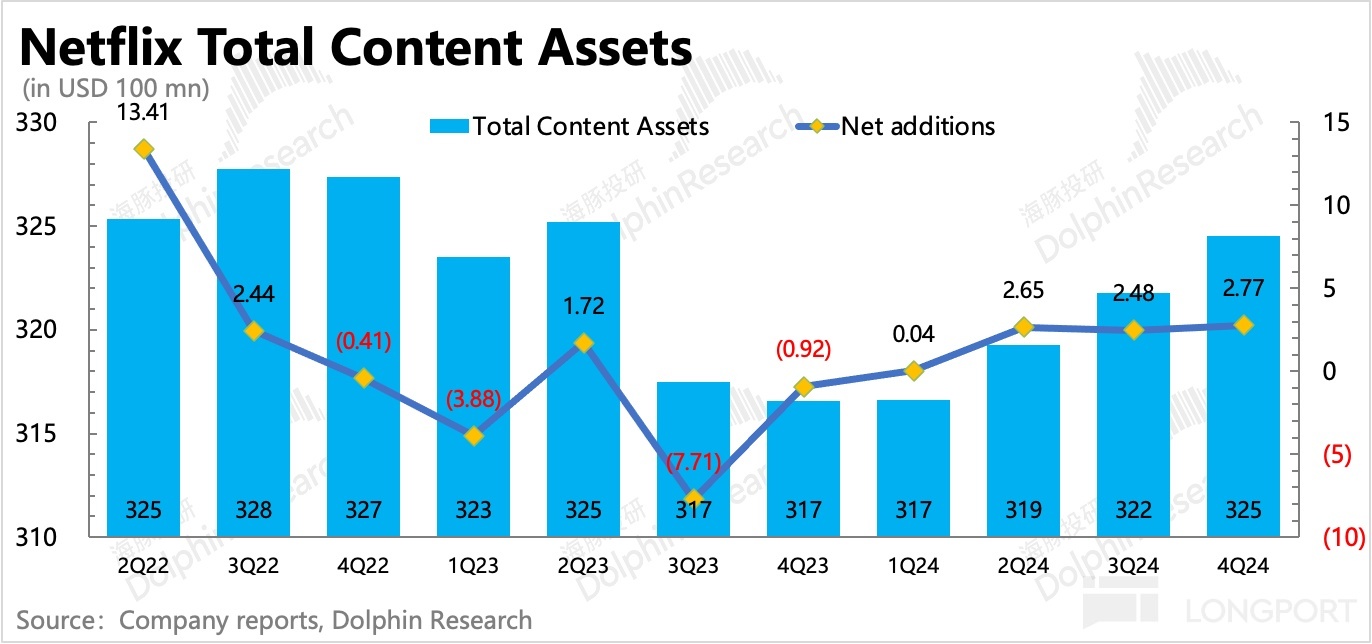

In the fourth quarter, content investment accelerated as expected, with an investment of 4.57 billion, bringing the total investment for 2024 to 17 billion, achieving the set target. This year's budget is set to increase to 18 billion. After distancing itself from the disruptions of the pandemic and the strike, Netflix's content investment has returned to normal expansion. From the end-of-period content asset scale, Netflix has achieved net growth for three consecutive quarters, especially in the content assets currently in production.

In the fourth quarter, free cash flow was 1.38 billion, and the annual total of 7 billion exceeded market expectations and previous guidance. In the fourth quarter, the company also spent 1 billion on share buybacks. Since the previous buyback authorization budget was nearly exhausted, an additional 15 billion was added for the ongoing buyback plan.

Although the annual buyback amount of 5-10 billion, compared to Netflix's current market value (which rose 15% after hours to over 420 billion), cannot be considered "substantial" shareholder returns. However, Netflix's cash balance is not particularly high, and long-form video is essentially an investment-driven business. From the perspective of idle funds (Q4 net cash 7.8 billion, free cash flow 1.4 billion, after deducting content investment of 4.5 billion, only 4.7 billion remains, with the buyback amount of 1 billion accounting for 21%), Netflix's buyback can be considered very sincere.

5. Profit margins still have room for improvement, but the pace will slow down

In the fourth quarter, Netflix achieved an operating profit of 2.27 billion, with a profit margin of 22% (+5pct), a significant year-on-year increase of 52%. Compared to the third quarter, this growth rate was achieved on a higher base. The main reason driving growth is that revenue steadily grew at a double-digit rate of 16%, while costs and expenses remained restrained (low growth), except for the accelerated growth in R&D expenses due to the establishment of its own advertising platform.

The operating profit margin for the entire year of 2024 is 27%, which basically meets expectations. However, the company's profit margin forecast for 2025 has been raised from the original 28% to 29%, reflecting management's confidence in operational growth and efficient operational capabilities.

However, it cannot be denied that starting next year, the pace of profit margin improvement will slow down. Therefore, if annual revenue growth remains at 10%-15%, and profit margins increase by 1-2 percentage points each year, then profit growth will be around 20%. This represents a certain healthy slowdown compared to the 40%-50% growth rates of the previous two years.

Dolphin Investment Research "Netflix" Historical Articles

Earnings Season (Past Year)

October 18, 2024 Conference Call: [Continue Efficient Investment, Netflix's Vision Goes Beyond Streaming (3Q24 Conference Call Summary)](https://longportapp.com/zh-CN/topics/24542403?invite-code=)》

October 18, 2024 Financial Report Review: "How High Can Netflix Still 'Fly'?"

July 19, 2024 Conference Call: "Netflix: Advertising Will Become the Main Driver of Growth by 2026 (2Q24 Conference Call)"

July 19, 2024 Financial Report Review: "The Results Are Good, But Expectations Are Higher. Will Netflix Be a Preview of the Seven Sisters?"

April 19, 2024 Conference Call: "Netflix: Focus on User Interaction Metrics Rather Than Just User Numbers (1Q24 Conference Call Summary)"

April 19, 2024 Financial Report Review: "Netflix: Currently Strong, But Will It Soon Become 'Weak'?"

January 24, 2024 Conference Call: "Netflix: Expand Content Investment and Use Quality Content to Drive Price Increases (Netflix 4Q23 Conference Call Summary)"

January 24, 2024 Financial Report Review: "Netflix: Content Dominance with Strong Foundations, True Gold Is Not Afraid of Fire Testing"

October 19, 2023 Conference Call: "Netflix: Hope to Restore Original Investment Levels to Drive Growth (3Q23 Earnings Call Summary)"

October 19, 2023 Financial Report Review: "Growth in Question? Netflix Raises Prices in Response"

July 20, 2023 Conference Call: "[The Effects of Cracking Down on Account Sharing Will Further Manifest (Netflix 3Q23 Earnings Conference Call Summary)](https://longportapp.com/zh-CN/topics/8342439?invite-code=032064)》

July 20, 2023 Financial Report Review: Netflix: Is the user growth squeezed out, but the market doesn't buy it?》

April 19, 2023 Conference Call: Key discussion on advertising and the prospects of account sharing (Netflix 1Q23 Conference Call Summary)》

April 19, 2023 Financial Report Review: Difficult to tackle freeloaders, mature Netflix can't "fly"》

January 20, 2023 Conference Call: Management changes do not hinder content strategy, advertising revenue target is over 10% (Netflix 4Q22 Conference Call Summary)》

January 20, 2023 Financial Report Review: Blockbuster dramas save advertising, Netflix perfectly interprets "content is king"》

October 19, 2022 Conference Call: Netflix: In addition to advertising, will focus on cracking down on account sharing next year (3Q22 Conference Call Summary)》

October 19, 2022 Financial Report Review: Netflix: Encountering a counter-trend surge again, good content is the real "cure"》

In-depth

February 16, 2022 In-depth: The "King of Competition" in Consumer Internet, Meta, Google, and Netflix are fighting fiercely》

November 23, 2021 In-depth: The long video mixed battle is coming, will Netflix and Disney suffer?》

Risk Disclosure and Statement of this Article: Dolphin Investment Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.