Posts

Posts Likes Received

Likes ReceivedShell's success comes from growth ================================= Yesterday, the Q3 2021 financial report of Shell Company was released. The report shows that Shell's net profit for the third quarter was US$5.53 billion, which is a substantial increase compared to the net profit of US$955 million in the same period last year. Shell's free cash flow also increased by 21% to US$12.4 billion. Shell's success is closely related to its business growth. Its upstream business has achieved considerable growth, and the market demand for its products has increased significantly. The report shows that the sales volume of Shell's LNG and natural gas in Q3 increased by 17% and 20% respectively year-on-year. In addition, the demand for petrochemical products has also increased significantly, and the sales volume of petrochemical products in Q3 increased by 23% year-on-year. The continuous growth of Shell's business has also brought confidence to investors. Shell's share price has risen by nearly 30% since the beginning of this year. In the past year, Shell has also invested heavily in renewable energy, such as wind power and hydrogen energy. The company has set a goal of net-zero emissions by 2050. Shell's success is also inseparable from the dedication of its employees. Dolphin Analyst believes that the reason why Shell can achieve such remarkable results is that its employees are always united, always innovative, and always strive to create value for the company. With the joint efforts of all employees, Shell's business will surely continue to grow steadily.

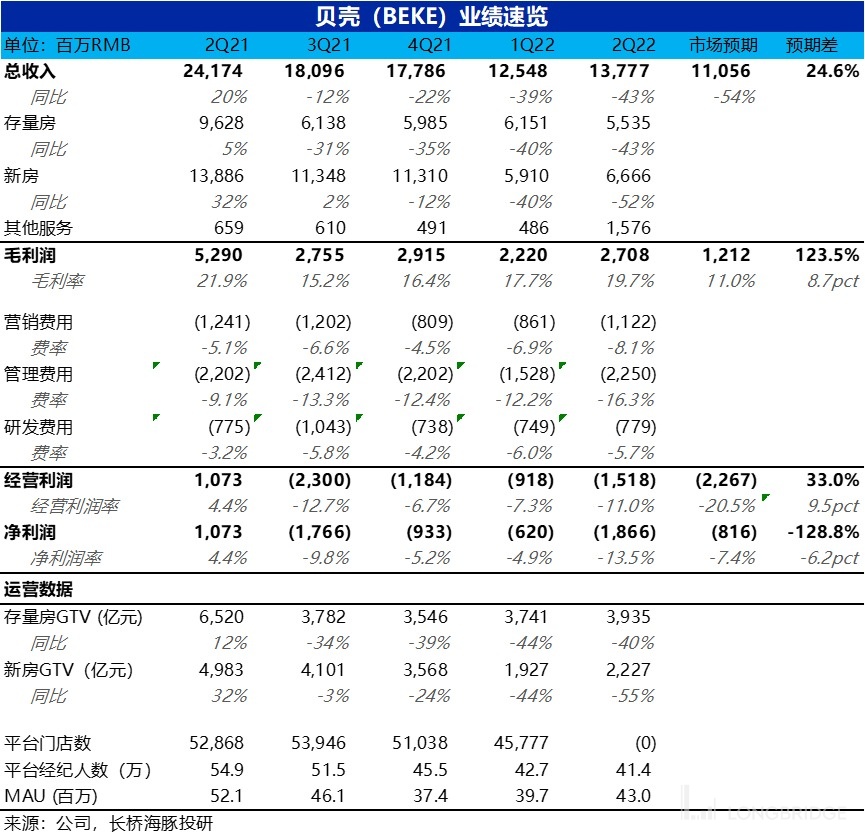

Before the market opened on the evening of August 23, Beijing time,$Kimball Electron(KE.US) announced its second-quarter financial report for 2022. Overall, compared to the company's previous guidance and the slow updates of the sell-side expectations,$Kimball Electron(KE.US) exceeded expectations in terms of revenue. Although the performance on the profit side was mediocre, it also greatly exceeded the overly pessimistic sell-side expectations. Specifically:

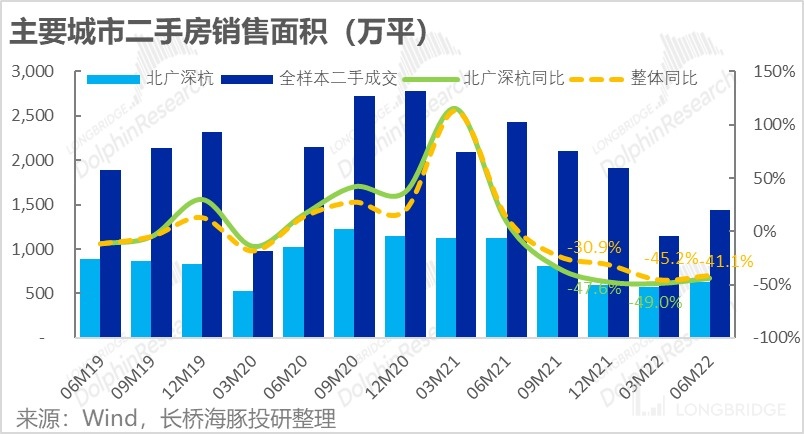

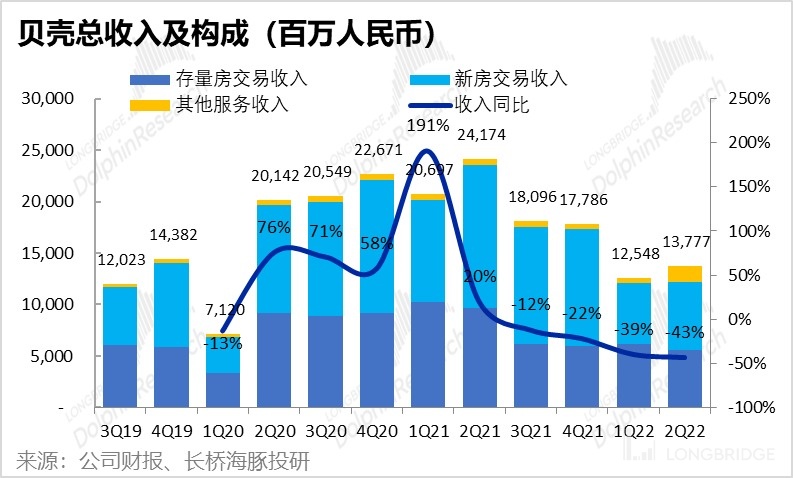

1. The existing home business led to total revenue greatly exceeding expectations: This quarter,$Kimball Electron(KE.US)'s total revenue was CNY 13.77 billion, greatly exceeding the company's previous guidance of CNY 10-10.5 billion and the sell-side's expected CNY 11 billion based on the guidance. The main reason for this significant outperformance is that the company's guidance and the market's previous expectations were that the existing home business would decline by more than 50% YoY under the impact of the epidemic. However, due to the violent rebound in the real estate market transaction in late June,$Kimball Electron(KE.US)'s GTV for second-hand houses actually only fell by 40%. Dolphin Analyst has tracked that the trading area of second-hand houses in core cities such as Beijing, Guangzhou, Shenzhen, and Hangzhou has decreased by 44%. Therefore, the sell-side's updated expectations were obviously not timely, but under the premise that its business is mainly concentrated in large cities such as Beijing and Shanghai,$Kimball Electron(KE.US)'s actual performance is still slightly stronger than the industry, and its ability to resist risks as a leader in the industry has been validated again.

2. Safety first for the new home business: After actively contracting the cooperative real estate developers of the new home business, the scale of the new home business continued to decline this quarter, with GTV down 55% YoY, even higher than the 50% decline of the top 100 real estate companies during the same period. And after focusing on the head cooperatives,$Kimball Electron(KE.US)'s bargaining power has also declined, with the realization rate decreasing by 10 bps for three consecutive quarters. However, under the strategy of safety first, the company's receivable account risk has indeed been significantly reduced. At the end of the second quarter,$Kimball Electron(KE.US)'s accounts receivable was CNY 5.69 billion, significantly lower than CNY 9.32 billion at the end of 2021.

3. Home decoration business finally booms:$Kimball Electron(KE.US) first disclosed its home decoration business separately this quarter, and its GTV was CNY 1.3 billion. According to previous communication, CNY 800 million of which were from the contribution of the consolidated main subsidiary, Shengdu. Compared with the same period last year, the GTV of home decoration was only CNY 50 million. The revenue of home decoration this quarter was CNY 1 billion, which is significantly growing and can also make certain contributions to total revenue. Its future growth should be watched.

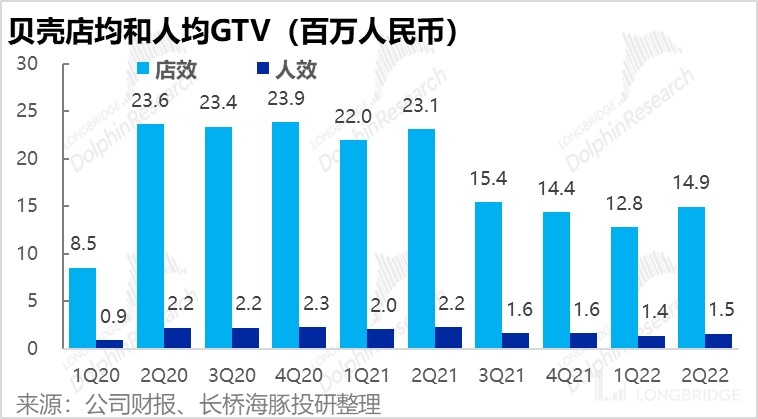

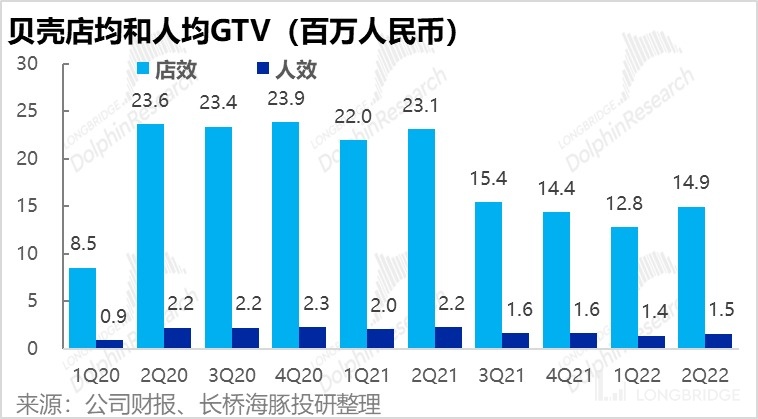

4. The efficiency of closing stores and reducing staff has improved: As previously communicated by the company,$Kimball Electron(KE.US) continued to streamline the number of its stores and brokers in the second quarter. Among them, the number of intermediary stores decreased by nearly 3,000 QoQ to 43,000, and the number of brokers also decreased by 20,000 QoQ to 410,000. However, with a reduction in staff, the GTVs contributed by a single store and a single broker improved significantly QoQ this quarter. As a result, the proportion of store expenses and other costs to revenue also decreased from 11.1% QoQ to 10.3%, reflecting the improvement of$Kimball Electron(KE.US)'s store operation efficiency.

5. The existing home business drove a significant improvement in gross profit:

From the perspective of the contribution of gross profit (revenue income - commission paid to brokers), it also improved significantly this quarter. In terms of different businesses, the main reason for the improvement is the significant increase in the gross profit margin contribution of the new home business, from 18% in the previous quarter to 24%. Since the realization rate of the new home business has decreased QoQ this quarter, the main reason for the improvement in the gross profit margin of the new home business should be due to a reduction in commission paid to brokers. The gross profit contribution of the inventory property business and others remains the same or decreased compared to the previous period. However, the main reason for the decrease in the profit margin contribution of other businesses is the increase in the proportion of decoration business. The gross profit margin contribution rate of the decoration business in this quarter, excluding material and labor costs, is 29%, while the gross profit margin contribution rate of other businesses excluding home decoration is around 41%.

Therefore, due to the improvement in store costs and revenue contribution margin, Ke Holdings' overall gross profit margin this quarter increased significantly from 17.7% to 19.7%.

6. Poor cost control and continued losses

Although revenue and gross profit performance are good, Ke Holdings performed poorly in cost control this quarter. Among the three expenses, only the marketing expenses with the greatest elasticity decreased by 10% year-on-year, but compared to the more than 40% decrease in revenue, the cost control performance is not good.

Moreover, management expenses and R&D expenses increased by 2% and 0% year-on-year respectively, and did not decrease, causing the proportion of revenue to expand rapidly.

Therefore, although the gross profit margin increased by 2 points, after the expense ratio increased significantly, the operating profit margin worsened from -7.3% to -11% quarter-on-quarter. The operating loss also expanded from 920 million to 1.52 billion. Even if the equity cost is excluded, the operating loss has also expanded from 570 million to 910 million.

7. 3Q22 Performance Guidance: For the third quarter, the company expects total revenue to fall between RMB 16.5 billion and RMB 17.0 billion, a year-on-year decrease of 6% to 8%, which is significantly lower than the expected revenue of RMB 18.2 billion by the market. However, the performance of second-hand housing transactions in August has been good in recent weeks, and Dolphin Analyst believes that management's guidance should be relatively conservative.

Dolphin Analyst Viewpoint:

Overall, although the degree of exceeding expectations of Ke Holdings' performance this quarter does not seem to be as great after excluding the impact of the delayed update of the seller's expectations, the core inventory property business still grew strongly, better than the industry growth rate and slightly higher than buyer expectations, which is still gratifying. In addition, Ke Holdings began to achieve results in streamlining its intermediary business, with gross profit improvement better than expected, and its second-tier home decoration business also recorded substantial growth, reflecting that Ke Holdings is steadily advancing its strategic direction in the market.

Although the performance of cost control and profit release this quarter was not outstanding, the market's focus on exceeding expected revenue growth is obviously higher than squeezing out profits through cost control. Therefore, overall, the sense of Ke Holdings' financial report this quarter is good, and the market has already made a response.

Dolphin Analyst believes that Ke Holdings' current valuation is also in a reasonable range, and its future performance mainly depends on the recovery of the real estate market (especially the second-hand housing market) in the second half of the year.

If you are interested in learning more about the company's earnings conference call, please add the WeChat ID "dolphinR123" to join the Dolphin research and investment exchange group and discuss investment ideas together.

Detailed Interpretation of This Quarter's Financial Report: 1. Existing Home Sales: Rebounded in Late June, Regaining Momentum

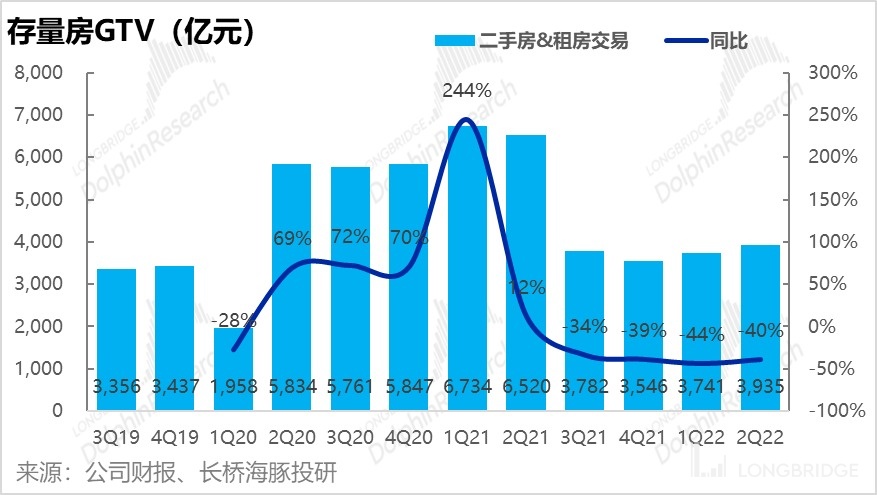

Due to stricter lockdown measures in Shanghai and other cities in the second quarter, real estate transactions were nearly suspended and the company originally guided that its revenue for 2Q would decrease by more than 55% YoY. The sellers' expectations were also quite pessimistic in line with the company's guidance. However, after the lockdown was lifted, the violent rebound in the property market in late June saved the second quarter. This season, Beike's existing home transaction volume (GTV) was 393.5 billion yuan, a year-on-year decrease of 40%, which far exceeded the (outdated) sellers' expectations.

According to Dolphin Analyst's tracking of second-hand housing transaction data in 18 cities, the transaction area in the second quarter decreased by 40% YoY, with core cities such as Beijing, Guangzhou, Shenzhen, and Hangzhou experiencing a decline of about 44% YoY, indicating that the impact on core cities during the epidemic was greater. Taking into account the impact of transaction prices, the performance of Beike's existing home sales, which fell by 40% in terms of transaction amount, still outperformed the industry as a whole. The leading player's risk resistance is still stronger.

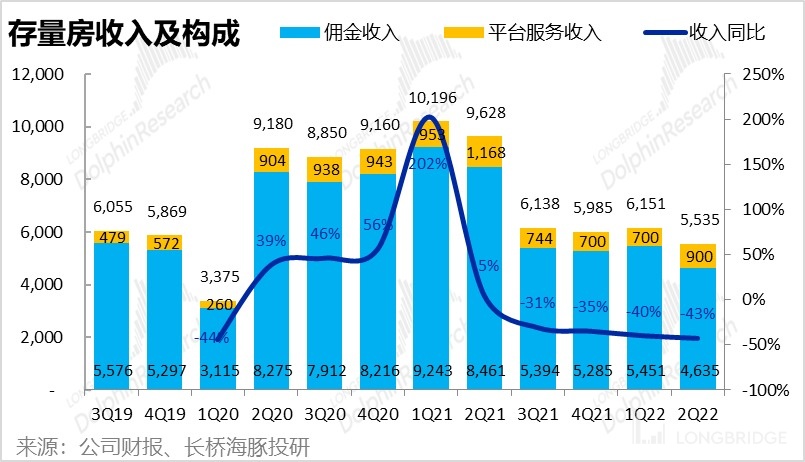

In terms of revenue realization, the revenue from existing home sales in this quarter was 5.54 billion yuan, a year-on-year decrease of 43%. Among them, platform service revenue was about 900 million yuan, a YoY decrease of only 23%, mitigating the risk of Lianjia's self-owned business relying on high-tier cities, showing a more resilient performance. However, the self-owned business of Lianjia, which is mainly concentrated in Northern and Eastern China, was hit harder, with commission income down by 45% YoY.

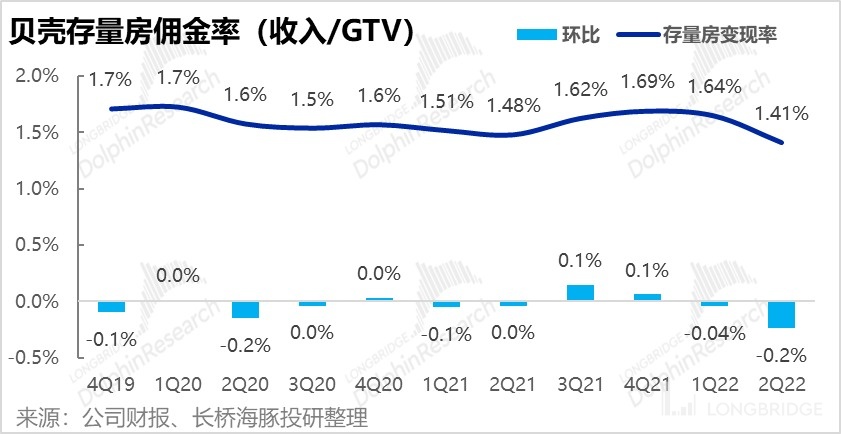

Due to the decline in revenue being higher than GTV, the rate of realization for Beike's existing home sales has decreased, with the overall commission rate for the quarter at 1.4%, a YoY/HoH decrease of 7bps and 23bps, respectively. Dolphin Analyst believes that due to the difficulties in selling homes during the epidemic, Beike has thus lowered its commission rate to promote home buyers to complete transactions.

Overall, similar to its performance in the previous quarter, Beike, although not immune to the industry's winter, has demonstrated greater resilience and has a more resilient performance due to its leading position and platform-oriented business model.

2. New Home Sales: Safety First, Continued Decline in Transaction Volume

Considering payment safety, Beike actively narrowed the scope of cooperation with real estate developers, resulting in a further decline in the scale of new home sales. GTV for new home sales in this quarter was 222.7 billion yuan, a YoY drop of 55%. Compared with second-hand homes, new home sales were obviously more miserable. According to Ke Research's data, the sales of the top 100 real estate companies in the second quarter decreased by about 50% year-on-year, and Beike's transaction volume decrease rate was higher than the industry average due to its initiative to stabilize.

This is just the cost paid for business and financial security. Reflected in the financial statements, the company's accounts receivable at the end of the second quarter was RMB 5.69 billion, a significant decrease from RMB 9.32 billion at the end of 2021, and the risk of bad debts has significantly reduced.

In addition, as Dolphin Analyst estimated, due to the following reasons: 1) structurally, Beike’s cooperation partners have become large real estate developers, reducing their bargaining power; 2) overall, after the transaction of real estate cooled down, the ability and incentive of real estate developers to pay channel fees declined. Therefore, the commission rate of new housing business continued to decline, and the cash ratio in this quarter once again decreased by 10bps to 3%.

However, compared with the period before the new house entered the ice period, the cash ratio has still slightly increased year-on-year. Therefore, the revenue of new housing business decreased by 52% year-on-year, which is lower than the decline in GTV.

Third, the home improvement business surged.

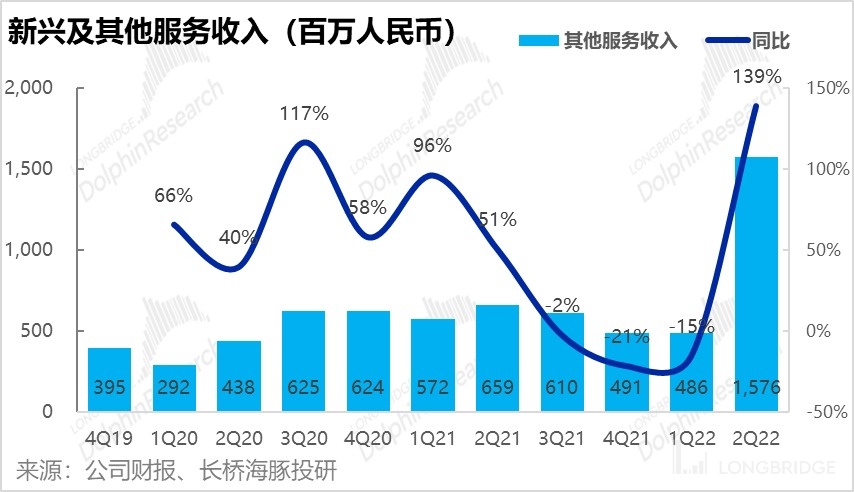

The GTV of other services consisting of financial services and home improvement maintenance in this quarter was RMB 23.3 billion, a sharp drop of 67% year-on-year, and the largest decrease among the three major business sectors.

Specifically, Beike for the first time separated the home improvement business and disclosed it separately this quarter. The GTV of home improvement in this quarter was RMB 1.3 billion, of which about RMB 800 million came from the contribution of San Francisco, which was consolidated. The GTV of home improvement in the same period last year was only RMB 50 million.

The GTV of other business after excluding home improvement was RMB 22 billion, a sharp drop of 69% compared with the same period last year. Dolphin believes that this is mainly due to the significant decrease in the scale of financial business such as purchase fund custody and bridge loans.

From the revenue perspective, due to the fact that Beike mainly adopts the self-operated model in the home improvement business, home improvement revenue accounts for about 78% of GTV, which is RMB 1.02 billion.

The revenue of other business excluding home improvement is RMB 560 million, a slight decrease of 10% compared with RMB 620 million in the same period last year. The sharp drop in GTV while only a slight decrease in revenue should also be due to the fact that the financial business involves a huge amount of money but a lower cash ratio, so the decrease in GTV and revenue is not proportional. In addition, the income from home services and other businesses that the company is promoting may make up for the decline in financial business income.

IV. Led by the stock housing market, total revenue greatly exceeded the seller's expectations

Due to the relative strong performance of the stock housing business and (the seller's expectations were not updated in a timely manner after the rebound of the property market at the end of June), this season Beike's actual total revenue was 13.77 billion yuan, greatly exceeding the company's guidance of 10-10.5 billion yuan in the first quarter, and the seller's expectations of 11.1 billion yuan.

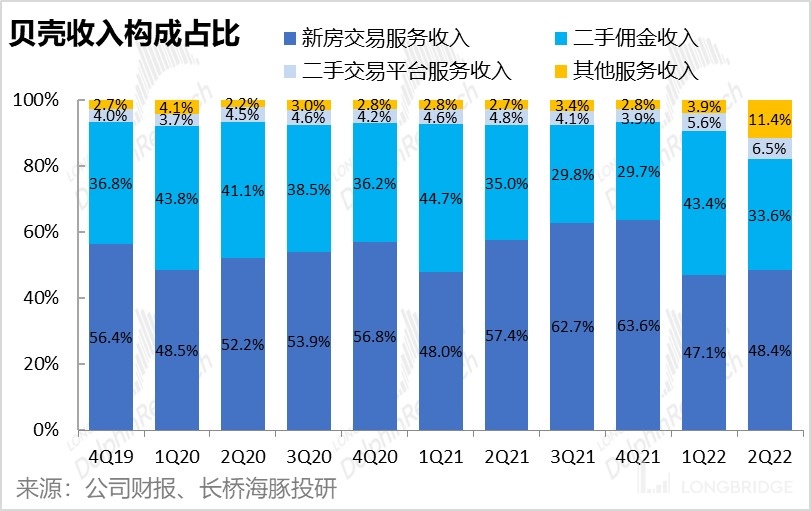

From the revenue structure, the proportion of the company's stock housing and new housing commission business is still declining, while the proportion of platform business and home decoration as the main business is continuing to increase, which shows that Beike's strategy of expanding from a simple agency business to a platform business and a comprehensive home business is steadily advancing.

V. The increase in the gross profit margin of new housing has driven the total gross profit of the company

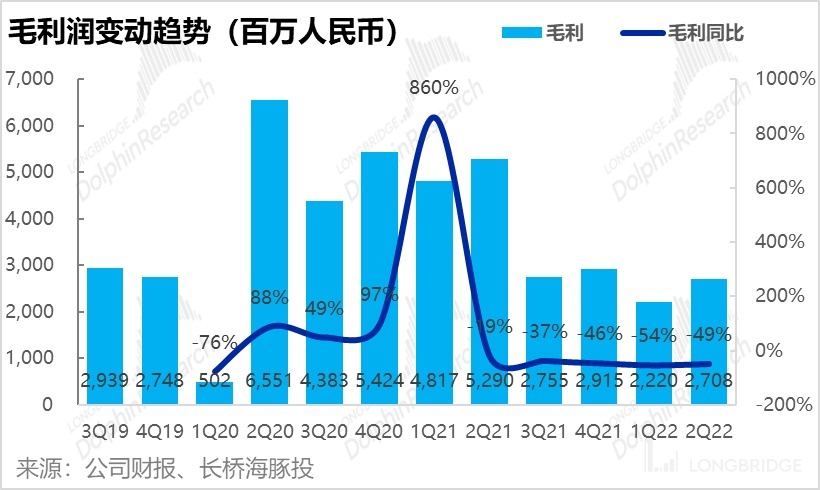

From the perspective of gross profit, Beike made a profit of 2.7 billion yuan this season, although it decreased by 49% year-on-year, it greatly exceeded the seller's pessimistic expectations of 1.21 billion yuan. The reason why the gross profit exceeded expectations by such a large extent is first of all that the company's actual revenue exceeded the expectation that was not updated in time by 2.7 billion yuan; secondly, Beike's actual gross profit margin of 19.7% this season also greatly exceeded the market's pessimistic expectation of 11%.

The reason why the gross profit margin of Beike exceeded expectations is still due to the company's excellent control of various fundamentals and the improvement of operational efficiency. Specifically, the proportion of Beike's store costs and other operating costs (business surcharges, etc.) to revenue have both declined this quarter (from 11.1% to 10.3% compared to the previous quarter). This is because even in the case of continuous reduction of stores and brokers, the actual decline in revenue was still lower than expected, and the per-store and per-broker GTV increased compared to the previous period, and operational efficiency improved.

Looking at the contribution of gross profit (revenue income - commission paid to brokers), the actual rate this season was 19.8%, a significant increase from the 17.7% in the previous quarter.

In terms of business segmentation, the main factor for the significant improvement in the contribution gross profit rate is the new housing business, which has increased significantly from 18% in the previous quarter to 24% this season. Due to the realization rate of the new housing business this season still declining by 3% as compared to the previous year, the main reason for the increase in the gross profit of the new housing business should be the decrease in the commissions paid to the new housing brokers. The contribution of stock property business and other business to gross profit remained stable or slightly decreased on a month-on-month basis. However, the main reason for the decrease in the contribution margin of other businesses was the increased proportion of decoration business. It was disclosed that the gross profit margin of the decoration business excluding material and labor costs in this quarter was 29%, while the gross profit margin of other business excluding home decoration was around 41%.

On the contrary to the common strategy of cost reduction and efficiency improvement adopted by internet companies, Beike's expenses did not significantly shrink this quarter, and some expenses even increased.

Specifically, among the three expenses, only the marketing expense with the greatest elasticity decreased by 10% YoY this quarter, but compared with the decline of more than 40% in revenue, the proportion of marketing expense to revenue continued to rise.

Moreover, the management expense and R&D expense increased by 2% and 0% YoY respectively, which did not decrease. Therefore, the proportion of these expenses to revenue expanded rapidly. However, management has previously stated that there would be an impact of severance pay in management expenses this quarter, and after excluding share-based compensation expenses, the management expenses decreased by 10% YoY.

However, even after excluding share-based compensation expenses, R&D expenses still increased by 8% YoY, indicating that internet companies were not sparing any effort in investment in R&D during the industry downturn.

Overall, against the background of a 40% plummet in revenue, the company's various expenses did not decrease accordingly, resulting in a sharp increase in the aggregate expense ratio from 25% to 30.7% this quarter.

Therefore, although the gross profit margin increased by 2 percentage points, the operating profit margin still deteriorated from -7.3% to -11% QoQ due to the sharp increase in the expense ratio. The operating loss also expanded from CNY 920 million to CNY 1.52 billion. Even after excluding share-based compensation expenses, the operating loss still expanded from CNY 570 million to CNY 910 million. 7. Operational data: Keeping the number of stores is key during the industry's winter

Overall, as previously communicated by the company, Beike continued to streamline its number of stores and brokers in Q2. The number of intermediary stores was reduced by nearly 3,000 on a month-on-month basis to 43,000. The number of brokers also decreased by 20,000 on a month-on-month basis to 410,000.

As mentioned above, however, with the streamlining of stores and personnel, Beike's personnel efficiency and store efficiency have improved significantly compared to the previous month, reflecting the improvement in operational efficiency.

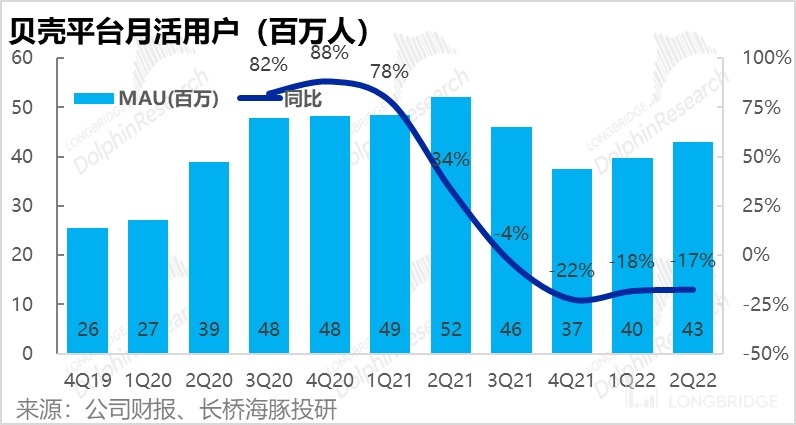

In addition, although the number of stores has decreased, the number of users who have a demand for purchasing properties has rebounded after the unblocking of the epidemic. Beike's monthly active users have increased by 3 million on a month-on-month basis, from 40 million in the first quarter, indicating that the demand for home purchases suppressed by the epidemic is still being released, which is also good news for Beike's future growth.

Dolphin's past Beike research:

Financial Report Season

May 31, 2022, conference call, "Housing transactions hit hard, emerging businesses steadily developing (1Q22 Beike conference call minutes)"

May 31, 2022, Financial Report Review - "The real estate market is deeply frozen, Beike can only hold on"

March 10, 2022, conference call, "One Body, Two Wings: In addition to brokerage business, Beike is poised to make a push into home decoration and home services (conference call minutes)"

March 10, 2022, Financial Report Review - "Escaping from real estate? Beike is bucking the trend"

In-depth

December 27, 2021, "Is the real estate market picking up? Should you invest in Beike? Wait a little longer"

On December 17, 2021, "Sohu shorting Beike? The short essay is too uninspired" (https://longbridgeapp.com/news/52268007)

On December 15, 2021, "From "revolutionizing lives" to "being revolutionized", can Beike withstand it?" (https://longbridgeapp.com/news/52080183)

On December 9, 2021, "The Rebel Beike: Whose life is being revolutionized and who is the savior?" (https://longbridgeapp.com/news/51728961)

**Risk Disclosure and Statement of this Article:** [Dolphin Analyst Disclaimer and General Disclosure](https://support.longbridge.global/topics/misc/dolphin-disclaimer)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.