Posts

Posts Likes Received

Likes ReceivedPhotovoltaic outbreak, major players end up? LONGi's self-directed "balance act"

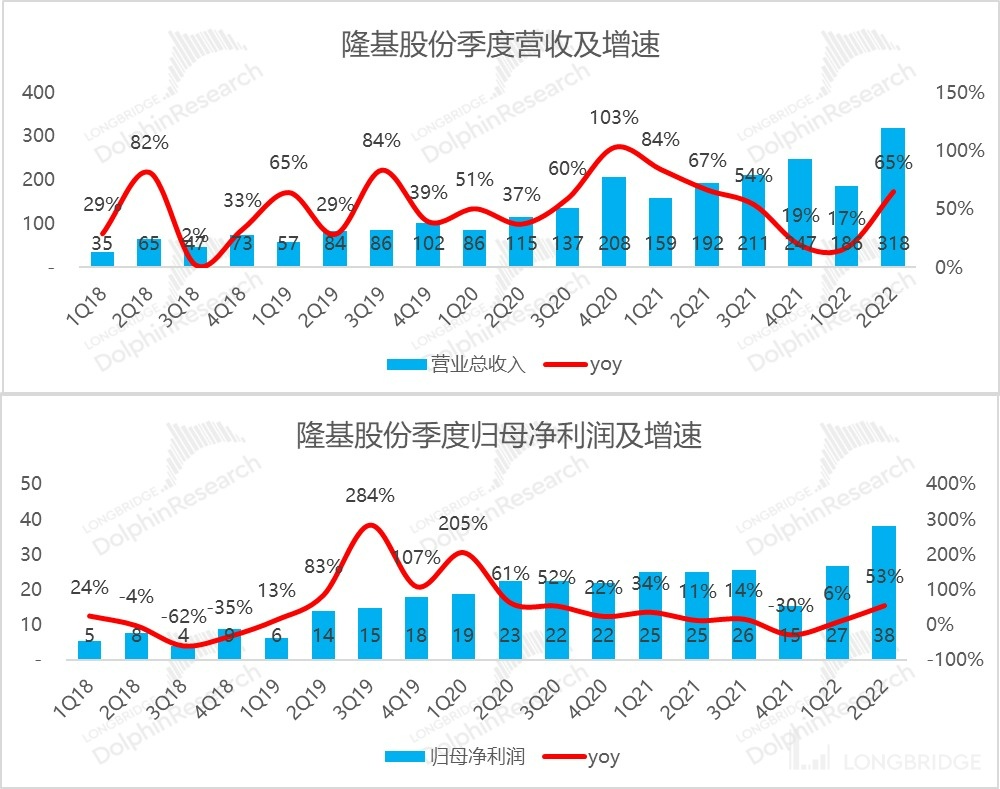

$ On the evening of August 24th, Longi Green Energy announced its first-half financial results for 2022. The company had already set its expectations for revenue and net profit. The actual results were in line with expectations, and the industry competition and game could be seen through the performance of shipments, costs and profits.

a. Due to strong demand and the increase in component and silicon wafer prices, the company's revenue in the second quarter reached 31.8 billion, with a year-on-year increase of 65% from the first quarter's 17%.

However, from the published component and silicon wafer shipments, the company did not outperform the industry in the first half of the year. This means that market share has declined. Although the company emphasized that its long-term goal of a 30% market share remains unchanged, the short-term rise in silicon materials forced the company to balance the trade-off between short-term market share (growth) and profit.

b. The balance resulted in significant revenue growth, but it was not the most outstanding in the industry. Profit growth was also considerable, but still not the most outstanding. However, the release of cost leverage and the translation gain/loss of overseas US dollar income partially offset the rapid decline in gross profit margins, and the company's profit showed a good positive growth in absolute value. In the context of the rapid growth of the industry, although not all of the benefits were fully enjoyed like Tongwei, Longi was still able to capitalize on the strong demand and maintain its profit level.

c. Pay attention to the US withholding order (WRO), which has a significant impact on the company's operations. The company originally planned to deliver 11GW to the United States, but after the WRO, this hope is slim. At the same time, due to this issue, the storage fees in Hong Kong surged from tens of millions in the same period last year to 450 million, which greatly dragged down the release of sales cost leverage.

Overall, this quarter's performance was somewhat comforting to the market through adequate communication between the company and the market. The previous market concerns about a price war in the component sector due to the increased competition in the industry as silicon wafer leader, Tongwei, entered the component business market, which would erode the profit margins of component leaders like Longi.

However, in the case of exploding demand, component manufacturers can screen customers, rather than grabbing customers, and Longi has the ability to select orders with certain profits. It will also balance the contradiction between market share and profit through production capacity and shipment adjustments. It is still necessary to pay attention to the trend of silicon material price changes, which will directly affect Longi's capacity utilization, revenue and profit release.

Dolphin Analyst will share the call summary with Dolphin users through the Longbridge app. Interested users are welcome to add WeChat "dolphinR123" to join the Dolphin research group to obtain the call summary in the first time.

For details of this financial report, please see the following:

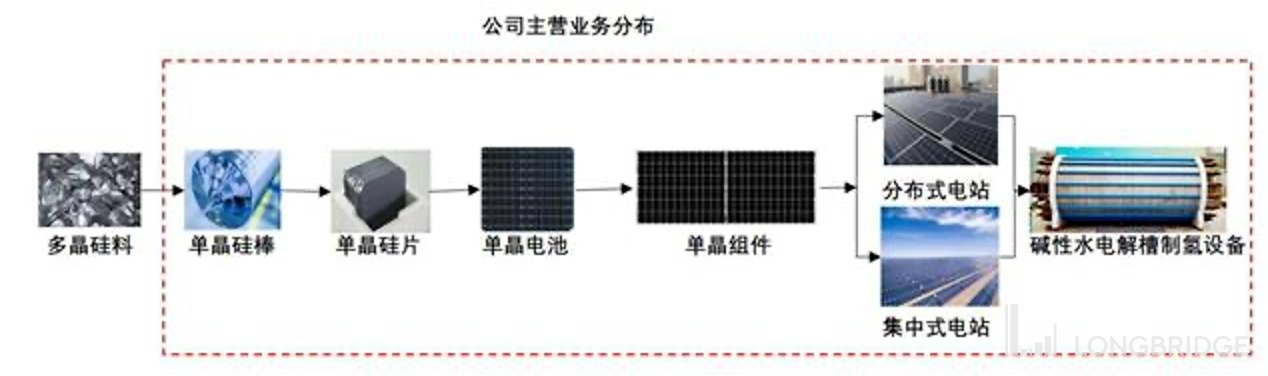

I. What should you know about Longi Green Energy?

Longi Green Energy is firmly established in the photovoltaic field and is a "photovoltaic giant." Starting with the silicon wafer business, the company has expanded its integrated layout along the photovoltaic industry chain. Its current business scope extends from smelting and refining silicon materials to research, development, production, and sales of silicon ingots, silicon wafers, solar cells and modules. The company has also laid out system solutions for centralized ground power stations and distributed photovoltaic rooftops (including BIPV) and other promising fields such as photovoltaic hydrogen production. However, the company's core businesses that everyone is familiar with are the silicon wafer and component sectors. The company has already become the global leader in monocrystalline silicon wafer and component production.

Data source: Company financial reports, Dolphin Research Institute

The silicon wafer and component sectors are the two core businesses that the market is paying attention to:

1. The component business is mainly sold externally. The company's component business began in 2014 and was developed based on its own leading monocrystalline silicon wafer technology. As one thing leads to another, the company's component business has grown to become the company's largest core business and has taken the top spot globally. At the same time, the company's component business has gone global, and overseas component revenue exceeds that of the domestic market, receiving recognition from overseas markets.

2. Some of the silicon wafer business is for self-use while some are for export. The company has banked on the monocrystalline silicon technology route and promoted the comprehensive replacement of polycrystalline silicon, making it the biggest winner in this replacement process. Due to the company's own start in the component business, part of the silicon wafers it produces are used for its own purposes, while the rest are sold externally, currently at an approximately 50:50 ratio.

3. The pricing game in the photovoltaic industry chain is intense, and changes in the company's profitability need to be closely monitored. The current photovoltaic industry chain is in a period of rising prices across the entire chain starting from silicon feedstock. The funding barrier in the silicon feedstock sector is high, and the production expansion cycle is long, becoming the bottleneck in this rapid development of the photovoltaic industry. The company's silicon wafer and component businesses are under pressure in terms of profits, and changes in the company's profitability indicators need to be closely monitored, as well as the trend and expected turning points of industry chain prices.

Second, here is Dolphin Analyst's detailed analysis:

1. The high cost of silicon feedstock and obstruction to US businesses only allow for sacrificing market shares to balance them.

In the first half of 2022, the company's revenue was 50.4 billion yuan, a year-on-year increase of 44%, which is basically consistent with the range of "50-51 billion yuan, a year-on-year increase of 42%-45%" announced in late July's performance forecast. Profit attributable to equity holders of the parent company was nearly 6.9 billion yuan, a year-on-year increase of 30%, slightly exceeding the guidance range of "6.3-6.6 billion yuan, a year-on-year increase of 26%-32%."

Overall, it is basically consistent with market expectations; as for the so-called slightly exceeding the guidance range for profit, it is mainly due to an extraordinary investment net income of 1.8 billion yuan. Excluding this factor, it should also be within expectations.

This performance corresponds to a significant acceleration in second-quarter revenue, driven by surging demand in overseas markets such as Europe, increasing from 17% quarter-on-quarter to 65% year-on-year, reaching RMB 31.8 billion. Profit attributable to equity holders of the parent company was 3.8 billion yuan, a year-on-year increase of 53%. Based on the current market expectations for full-year revenue of RMB 118.6 billion and for profit attributable to equity holders of the parent company of RMB 14.3 billion, the second quarter has approximately achieved 27%/27% of the expected figures, with a higher completion rate than in the past two years and more outstanding revenue performance.

Domestic vs overseas: In 2021, the company's overseas revenue accounted for 47% of the total, almost equal to the domestic market. However, in the first half of this year, this proportion fell back to 40%, which should be related to the poor shipment of components to the US market.

2. Slow component shipments: In the first quarter of 2022, component shipments were poor, and the overall shipments in the first half of the year were 18GW, corresponding to nearly 12GW in the second quarter. The company's current shipping goal is 50-60GW, which means that only 32% was completed in the first half of the year.

The main reason for the low shipment of components in the first half of the year is still the low shipment in the first quarter. Because the price of silicon materials is relatively high, some low-cost orders were abandoned. At the same time, due to policy issues, the originally planned 11GW shipment target in the US has been basically abandoned and new orders are being selected.

The company estimates that it will be able to ship 30GW in the second half of this year, which is almost the same as the full-year target. Whether the core can be accelerated still depends on whether the US shipment can smoothly pass through customs.

3. Silicon wafer shipments lower than the industry average: The silicon wafer shipments in the first half of the year were 40GW, which is only a slight increase compared to the 38GW in the first half of last year. The first quarter was over 18GW, and the second quarter was over 21GW. The new installed capacity of photovoltaics in China and the world is much higher than this number.

The company's shipments of components and silicon wafers are lower than the industry growth rate, and the main reason is that the cost of silicon materials is too high. If the capacity utilization rate is to be increased, it is necessary to find materials in the market, which will further increase the price imbalance in the upstream.

In terms of shipment structure, about half of the silicon wafers are self-used and half are supplied externally. According to the company, the current silicon wafer capacity is about 1.5 times that of component production capacity, and about 2 times that of battery production capacity. Dolphin Analyst estimates that the proportion of self-use and external sales actually depends more on Longbridge's own battery production capacity.

As many battery cells are used, as many self-supplied silicon wafers are used. Another part of the battery cells that are not enough is supplemented through external procurement. However, since the profit of component procurement of external battery cells is low, the amount of external procurement is not sufficient, and lower-priced components need to make up for the short board of self-produced battery cells.

In addition, from the company's explanation, Longbridge values the long-term market share goal and the balance between short-term shipments and profits. In the case of a surge in market demand and high upstream silicon material prices that are beyond control, Longbridge intentionally abandoned some low-cost orders, resulting in a decline in short-term market share.

Four, is the price of silicon materials too high? Striking market share while hitting gross profit margin

Gross profit margin continues to decline rapidly: In the case of the global photovoltaic demand boom, silicon materials, due to heavy asset capital barriers and long expansion cycles, is the most violent segment of the entire industry chain, while downstream power stations are extremely sensitive to component costs. The cost increase in the upstream cannot be fully transmitted downstream. The cost in the middle can only be borne by the intermediate link, and what Longbridge does, from silicon wafers to battery cells to modules, just happens to be in this intermediate link.

So the company's gross profit margin has recently collapsed very badly: The overall gross profit margin in the second quarter dropped by six percentage points directly on the basis of 21% in the first quarter, further declining to 15%, nearly a historical low.

This mainly applies to the component business. Although the second-quarter shipments were high in quantity, the deliveries were all from pre-signed contracts, and could not keep up with the pace of the current market raw material price increases. In addition, the gross profit margin in the third quarter will not be better than that in the second quarter.

If we look at the silicon material and silicon wafer separately:

-

In the first quarter, the gross profit margin of silicon wafers delivery was 24%, and the gross profit margin only slipped slightly. This was mainly because of the high price of silicon material, which was not 100% fully transmitted.

-

The component business has pre-signed projects. By the time of production and delivery, the upstream silicon material prices have risen too much, leading to a second-quarter gross profit margin of only 12% , a drop of about six percentage points from the first quarter.

V. Is the effect of the release of operating leverage not significant? It's all America's fault

In this quarter, the growth in scale can only be considered a slight release of operating leverage: From the performance of the four fees, the biggest change comes from financial expenses. The financial expenses are mainly due to the company's overseas business being settled in US dollars, so there are US dollar reserves, and the appreciation of the US dollar has brought in 450 million in exchange gains, which is quite substantial.

If we look at the second quarter alone, the financial expense (interest income/expenses + exchange gains/losses) was a positive income of 700 million yuan, not the previous 2-300 million yuan in financial expenses, which also had a very significant short-term effect on profit release.

For the other three fees, sales expenses were particularly high in the second quarter, and there was no situation where expenses decreased while income increased. However, this was also the result of American business disturbances, mainly because the US WRO caused leasing warehousing costs to increase six-fold from less than 70 million last year to 470 million, which means that in the US, because of the WRO, the goods were not delivered, the revenue was not confirmed, but the expenses were real.

Other expenses such as management and R&D expense ratios have a small downward trend as revenue increases rapidly.

(This is the end).

For Dolphin Analyst's historical articles, please refer to:

Summary of the April 28, 2022 earnings call, "Shortages Abroad are Common, Could First Quarter Shortages be Made Up in the Second Quarter?" (https://longbridgeapp.com/topics/2441774) On April 28, 2022, Financial Report Review of 'Photovoltaic cuts, how can Longi regain its honor';

December 2, 2021, Company Depth Analysis of 'Longi shares (1): approaching the turning point, can the "photovoltaic plantation" be more promising?';

December 10, 2021, Company Depth Analysis of 'Longi shares (2): the internal competition is too fierce, can the "photovoltaic plantation" hold on?';

November 16, 2021, Industry Depth Analysis of 'With equal emphasis on affordability and carbon neutrality, can photovoltaic be the hope of new energy for the whole village?'

Risk Disclosure and Disclaimer for this Article: Dolphin Analyst Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.