Posts

Posts Likes Received

Likes ReceivedEnjie: Even the Battery Supply Chain "Fresh" Can't Hold It Anymore

On the evening of October 24, 2022, Enjie Corporation (SZ) announced its Q3 financial report for 2022. Due to limited data, Dolphin Analyst will provide a simple analysis based on the available information:

(1) The company achieved a net profit of RMB 1.2 billion in Q3 2022, a year-on-year increase of 72%, which is consistent with the company's original forecast. However, the core issue can be identified from the Q3 financial report due to the disappointing original forecast.

(2) The Q3 revenue was RMB 3.5 billion, a year-on-year increase of 78%, which is in line with market expectations and poses no major problems. Considering the 25% increase in sales from the previous quarter and the structural improvement of unit prices, there should be no problems with meeting the market expectations for annual revenue. Therefore, the overall revenue is not a major issue.

(3) The short-term issue lies mainly in the gross profit margin: Dolphin Analyst originally estimated that the gross profit margin would continue to increase as the proportion of high-gross-margin overseas businesses and high-unit-price coating products increased. However, the actual situation in Q3 was that due to the high demand for products overseas and the high cost of high-priced products, the effect of improving the gross profit margin was not significant. Moreover, the overall gross profit margin decreased due to the increase in the proportion of coating products, which was mainly used to increase the per-unit income and profit rather than the per-unit profit margin, which was actually decreased.

(4) Can Q4 meet the market expectations? Considering that the proportion of coating products may continue to increase, the gross profit margin in Q4 may continue to decline structurally. In the case of relatively certain sales volume and income growth rate in Q4, the structural downward trend of the gross profit margin may mean that the market expectation of delivering the annual net profit of RMB 5 billion to shareholders is a certain difficulty.

Dolphin Analyst's overall view:

Last quarter, Dolphin Analyst said that the battery diaphragm was a small fresh track in the chaotic situation of profit distribution caused by the rapid rise in lithium battery prices: in the case of insufficient industry capacity, it could hold its own small space and gain stable growth and profit.

From the situation in Q3, it did indeed maintain a relatively stable revenue growth rate, and the full production and sales alleviated to some extent the expected worsening of industry capacity release competition.

However, its problem is that its gross profit margin did not hold up this quarter. The company's explanation is that the gross profit margin of high-priced coating films is low, which means that the market has lowered its expectations for the gross profit margin in Q4. This means that the current market expectations for Q4's net profit are too optimistic, and there is a certain risk.

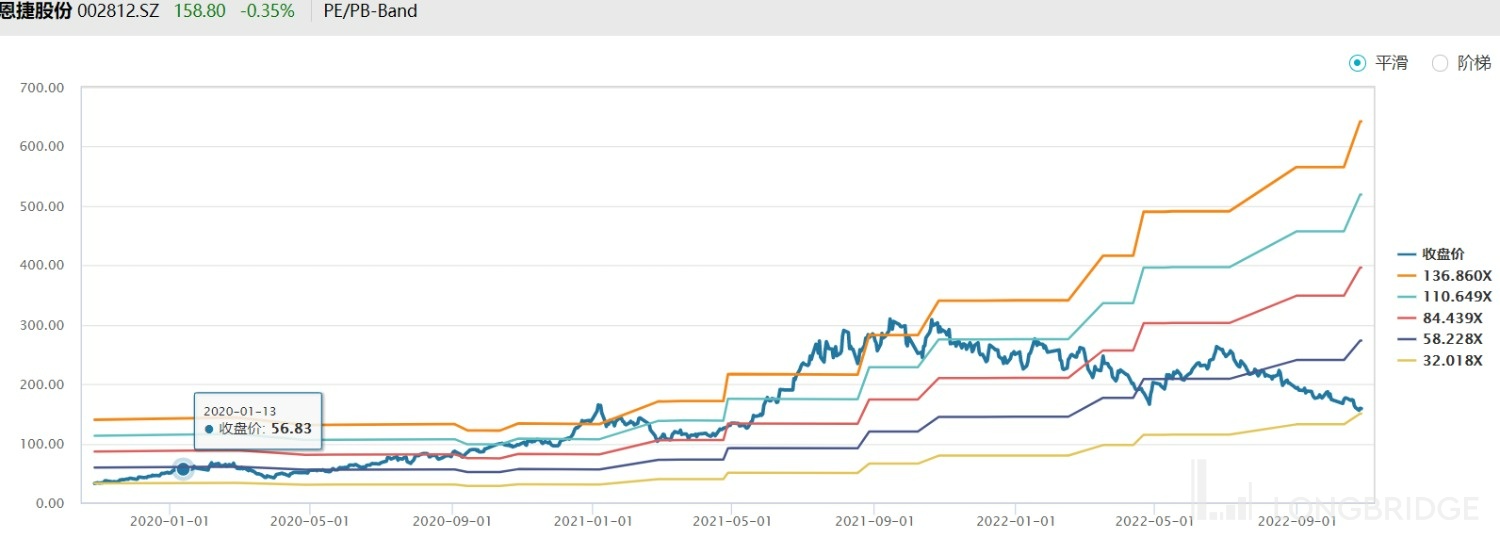

From the perspective of trading, Enjie's stock price seems to have dropped to a relatively low valuation position, with a PE ratio (TTM) of less than 35. If the company's output growth rate (from 5 billion to 7 billion) next year increases by 40% as expected, even if the net profit in the next year increases by 30% compared to this year's expected RMB 4.8 billion according to Dolphin Analyst's, the current stock price corresponds to only 23 times the PE ratio of next year's profit.

It seems that the current pricing in the market may have taken into account the pressure on profit growth caused by increased competition and declining gross profit margins, but the company emphasized in the conference call that "the company is operating at full production and sales, with no pressure on reducing prices this year and next year," indicating that there is no competitive pressure on the delivery end. Dolphin Analyst noticed that CATL expressed at a conference call that the supply shortage would see significant alleviation when the production capacity of every sector of the industry chain was freed up next year.

Therefore, the overall judgment on Enjie after this financial report is that its current valuation is indeed relatively low, but there is no clear inflection point from the short-term perspective on the performance fundamentals, coupled with uncertain changes in terminal demand or price transmission in 2023. While Enjie at this price point can be watched, it seems a bit early to try to buy low.

This article is an original by Dolphin Analyst, unauthorized reproduction is prohibited; interested users are recommended to add the WeChat account "DolphinR123" to join the Dolphin Analyst circle and discuss global asset investment views together!

The following are detailed points:

1. Steady Income

As the company has already pre-announced the third quarter's profits in advance after the National Day holiday, the actual result showed that the third quarter's net profit attributable to shareholders was RMB 1.2 billion, a year-on-year increase of 72%, which is basically consistent with the previous forecast (RMB 1.168-1.22 billion), but the company's profit forecast itself is slightly lower than expected.

After the company announced the profit forecast, the core of the third quarter's performance is actually to see the trend of revenue and gross profit margin and to observe where there is a problem. Let's first take a look at the revenue performance:

In the third quarter, Enjie's revenue was RMB 3.5 billion, a year-on-year increase of 78%. With the growth of battery shipments, Enjie's revenue growth will also quickly recover to the same level as in the first quarter.

Basically, the entire third quarter was in a state of full production and sales. According to the company's disclosure, the third quarter's shipments were over 1.2 billion square meters, an increase of more than 8% quarter-on-quarter, corresponding to a quarter-on-quarter growth rate of revenue of 11%, equivalent to a quarter-on-quarter growth rate of unit price of around 3%.

Moreover, if we look ahead to the fourth quarter, the company has already stated that its monthly production capacity is 500 million square meters, and the shipments for the fourth quarter can reach 1.5 billion square meters, with a quarter-on-quarter increase of 25%. If the corresponding unit price increase rate is also about 3%, then the fourth quarter should be around RMB 4.5 billion in revenue, a year-on-year increase of 71%, which is basically consistent with the expectation of nearly RMB 13.8 billion for the whole year on the Wind market.

In other words, Enjie's overall revenue is stable, and there is no problem.

2. Declining Gross Profit Margin: Where is the problem? Looking at the problem of the slower growth rate of the return to parent company than expected by the market, the main issue lies in the decline of gross profit margin. This quarter's gross profit margin was 49.1%, which is lower than the 50.7% of the same period last year and also lower than the 51.2% of the previous quarter.

The original expectations of Dolphin Analyst were: high gross profit for coated products and high gross profit for overseas markets. The increase in the proportion of these two parts can continuously boost the company's gross profit margin, drive revenue growth, and continuously increase gross profit margin through structural improvement of products, even in the industry's state of not having particularly relaxed production capacity.

However, from the situation in the third quarter, the proportion of overseas markets with higher pricing and coated products did increase according to the company's introduction.

-

The proportion of coated product revenue is expected to reach 40% by the end of 2022, and the target for 2023 and 2024 is to reach 50% and 70%. Long-term, online coating will be the main focus.

-

The proportion of overseas markets is also increasing. Only 10% of the revenue in the first half of this year came from overseas, but it has reached 20-30% now, and there is hope to exceed 30% by the end of 2022. The target for 2023 and 2024 is to increase the proportion to over 40%. Moreover, the US factory has already purchased land, and it will be built next year and put into operation at the end of 2024. Global market share is expected to reach 50% by 2025.

However, the actual situation in the third quarter is that the gross profit margin did not follow the expected scenario of Dolphin Analyst. In fact, as the proportion of coatings increased, the gross profit margin decreased instead.

The company's explanation is that the gross profit margin of coated products is low, and the high-priced coated products increase not the gross profit margin but the gross profit amount by increasing revenue and reducing gross profit margin.

Moreover, if explained this way, the trend of declining gross profit margin will continue in the fourth quarter. It is actually quite difficult for Q4 to achieve the target of RMB 1.7-1.8 billion in return to parent company profit and RMB 5 billion in return to parent company profit for the whole year. Currently, the market is uniformly expected to keep the profit expectation to RMB 5 billion.

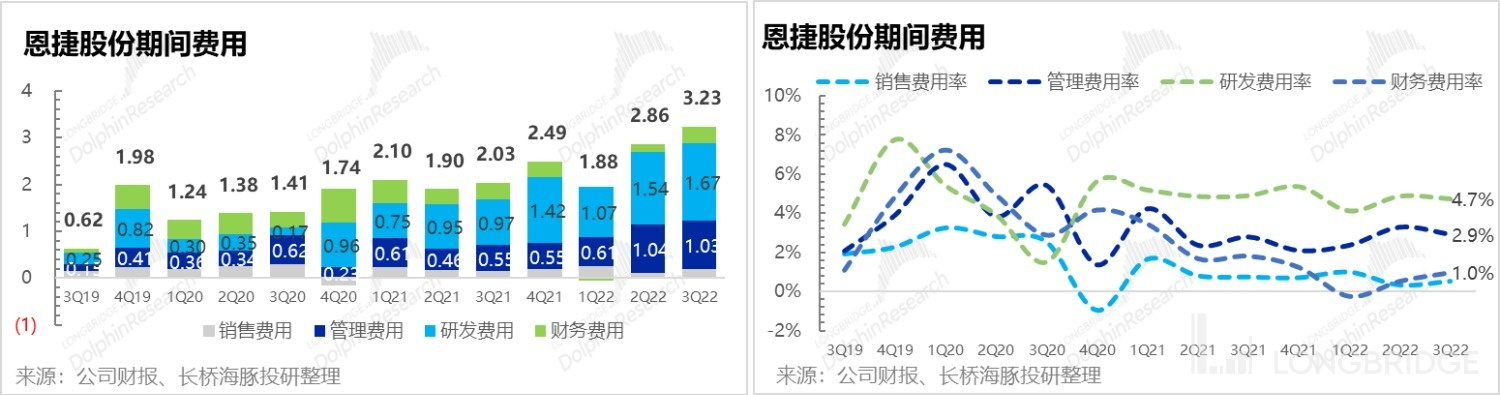

As the company's revenue growth is relatively fast, the release of operating leverage is very obvious. The amortization of sales and R&D expenses is relatively obvious, and the only problem is that the management expenses are still relatively high, and the reasons are the same as in the previous quarter, primarily due to a slightly higher share incentive.

Looking at the absolute values, the company's sales expenses in one quarter are only one or two hundred million, and the management expenses have recently only increased to the level of one hundred million per quarter due to the share incentive, with most of the investment in R&D. For this type of company, R&D is a rigid investment for maintaining technological leadership, and cannot be reduced. Therefore, the company's expense end actually does not have too much room, and more needs to be achieved through technology to both expand revenue and market share and increase product gross profit margin.

Data Source: Company announcement, Dolphin Analyst

Historical Articles of ENN Energy Holdings (002812.SZ) by Dolphin Analyst:

August 31, 2022 financial report review The Unique Style of the Battery Chain - ENN Energy Holding Faith

September 2, 2022 meeting minutes 50% Global Market Share in 2025

April 12, 2022 financial report review - ENN Energy Holdings: A "Double King" with Growth and Profits, Tastier After the Fall?

April 12, 2022 meeting minutes - Under the Equipment and Process Barriers, the Position of ENN Energy Holdings is Stable (Performance Presentation Notes)

December 29, 2021 Company in-depth report ENN Energy Holdings: Bursting the New Energy Bubble, Cost-effectiveness is Here?

October 18, 2021 Industry in-depth report Battery Materials (Part II): Short-Distance Running Champions Selection under Short Supply?

September 23, 2021 Industry in-depth report - Battery Materials (Part I): The Pattern is Open, How to Choose the Long-Distance Running King?

Risk Disclosure and Statement of this Article: Dolphin Investment Research Disclaimer and General Disclosures

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.