Posts

Posts Likes Received

Likes ReceivedHas Sunshine Power regained its dominance with a surge in profits?

On the evening of October 26, 2022, Sungrow Power Supply (300274.SZ) released its third-quarter report. Due to limited disclosure of information in A-share quarterly financial reports, Dolphin Analyst will provide a brief review based on the summary of the conference call and financial data as follows:

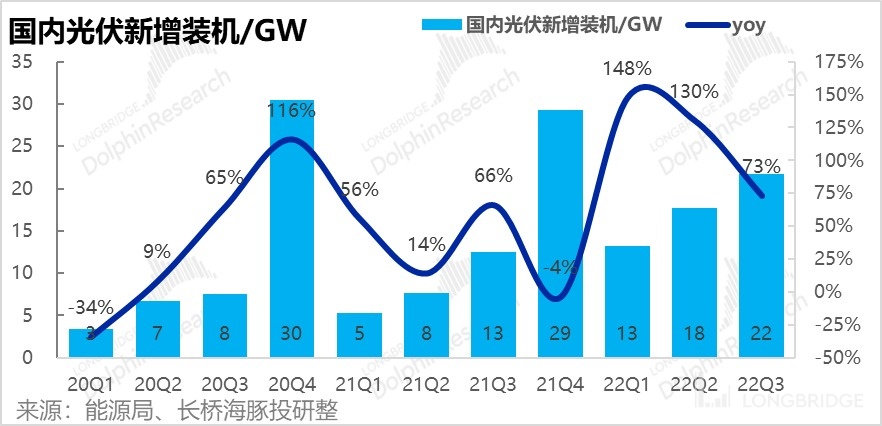

1. Record high revenue, bright prospects for inverter leader: In the third quarter, the company achieved revenue of RMB 9.9 billion. Although the growth rate slowed down to 39% YoY due to the high base last year, the absolute value of revenue actually hit a single-season historical high. As the leader in the inverter field of photovoltaic + wind power + energy storage, the growth of revenue is beyond doubt. Combining with industry data, after the photovoltaic installation rush in the first half of this year, the growth rate of new photovoltaic installations in China fell from over 100% to 73% this quarter, which is consistent with the company's revenue growth rate.

In addition, according to brokerage research, the company's inverter shipments in this quarter are about 20GW, which is basically the same as in the second quarter. The closeness of the inverter shipments and the record high revenue imply that the proportion of high-priced businesses in the company's revenue structure has increased (such as distributed photovoltaics), and the company's overseas revenue may also be one of the possible reasons.

2. Improved revenue structure and gross profit margin: As mentioned above, the company's revenue structure should have improved this quarter, and its gross profit margin for this quarter also improved by 1.9pct QoQ to 25.1%. According to the company's statement in the conference call, the reasons for the improvement of gross profit margin include the increase in the proportion of high-margin businesses (such as distributed photovoltaic and energy storage), the shortage of upstream raw materials such as IGBT, a significant decrease in export shipping fees, and the price increase of the company's energy storage business.

3. Improved gross profit and optimized expenses, the company escaped the trap of increasing revenue without increasing profit: Not only did the gross profit improve, but the major operating expenses of the company also narrowed QoQ in terms of their proportion to revenue this quarter. Specifically, the sales, management, and R&D expense ratios decreased by 2.9/0.4/1.1pct QoQ, respectively. Among them, marketing expenses, which are important for inverter companies that focus on branding and channel effects, decreased by RMB 70 million to RMB 670 million QoQ. In addition, with significant foreign exchange gains, the company achieved financial income of RMB 380 million. Under multiple favorable factors, the company's net profit in the third quarter increased by 55% YoY to a record high of RMB 1.16 billion in a single quarter. Finally, the profit growth rate surpassed the revenue growth rate, and the company finally escaped the trap of increasing revenue without increasing profit.

4. Significant improvement in business in the third quarter, is it possible to achieve the full-year target: Overall, Sungrow Power Supply's third-quarter performance is impressive. However, based on the consensus forecast on wind, which is for the full year 2022, it is believed that the company needs to achieve revenue of approximately RMB 17 billion or more in the fourth quarter, a YoY growth of about 95%, and Dolphin Analyst believes that the pressure is not small. However, in terms of profit, brokerage firms expect the company to achieve a net profit attributable to the parent of RMB 2.91 billion for the full year. This means that a quarterly profit of RMB 850 million needs to be achieved in the fourth quarter. If the company can maintain its profitability in this quarter, it will be easier to achieve the profit target. Dolphin Analyst's View:

Regarding this company, Dolphin Analyst believes that its biggest core advantage lies in its excellent position in the industry chain and competitive landscape. In the photovoltaic sector, the company does not participate in the price game within the long supply chain from silicon materials to components. In the energy storage sector, the company also does not need to worry about which storage technology paths, such as water storage, chemistry, and thermal energy, can be outstanding. The demand for inverters that convert electrical energy into usable AC power is the most certain. Therefore, holding the huge demand for inverters brought by the wind and light storage, the company's growth and certainty as the leader are quite outstanding, which is also the core reason why the company's valuation has always been high.

The company's investment logic depends more on the matching relationship between the company's higher valuation and predictable profits. The significant improvement in profits this season is likely to satisfy the market.

Dolphin Analyst will then share the minutes of the telephone conference with Dolphin users through the Longbridge App. Interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin Research Group and get the conference notes at the first time.

1. Holding the wind and light storage, the inverter leader has no worries about scale growth

In the third quarter of 2022, the company achieved a revenue of 9.9 billion yuan, with a year-on-year growth rate of 39%, which slowed down compared with the previous quarter. However, Suntech's revenue fluctuates seasonally, and the slower year-on-year growth is more due to the higher base of last year. Judging from the absolute value of revenue, this quarter has once again set the highest single-quarter revenue. It can be seen that as a leader in photovoltaics, wind power, and energy storage inverters, the company's performance growth is still undisputed. However, Wind currently displays that securities firms' revenue expectations for Suntech in 2022 are as high as 39.3 billion yuan, which means that the single-quarter revenue in the fourth quarter should be above 17 billion yuan, with a year-on-year growth rate of 95%, according to historical trends. It is not easy to achieve.

The company's quarter-by-quarter revenue breakdown by business is not disclosed, but combined with industry data, after experiencing the rush installation in the first and second quarters of 2022 (with year-on-year growth rates all above 100%), the new installed capacity of photovoltaics in China increased by 73% YoY in the third quarter, which corresponds to the situation of the company's revenue slowdown.

According to domestic securities firms' research, Suntech's inverter shipments in the third quarter were about 20GW, and the year-on-year growth rate also slowed down to 60% along with the new installed capacity of photovoltaics in China. It is worth noting that if the securities firms' research data is accurate, the inverter shipments in the third quarter and the second quarter are basically the same in terms of quantity, but the revenue realized by the company has increased significantly from 7.7 billion to 9.9 billion. This implies that the proportion of high-priced businesses in the company's revenue structure, such as distributed photovoltaics, has increased, and the company's overseas revenue has also increased, which is one of the possible reasons. ** 二、Revenue Structure Improvement, Gross Margin Improvement Follows**

As mentioned above, the company's revenue structure improved this quarter, with an average unit price increase. The company's gross margin for this quarter increased by 1.9pct QoQ to 25.1%. According to the communication during the company's conference call, the gross margin of the inverter, energy storage, and wind power inverter sectors have all improved. Among them, the energy storage business, which had a lower gross margin in the first half of the year, saw an increase in inverter prices, while shipping prices in the third quarter also fell by about 50%. Therefore, the gross margin of the energy storage business improved significantly.

Three, Gross Margin Improvement, Stacked Cost Margin Decline, Profit Improvement Finally

As can be seen from the chart below, while the absolute value of revenue has hit a new high, the gross margin has also improved QoQ, and the company's main operating costs have also improved QoQ. Specifically, the sales, management, and R&D expense ratios decreased by 2.9/0.4/1.1pct, respectively, compared to the previous quarter. Among them, marketing expenses, which are most important for inverter companies that focus on brand and channel effects, decreased by 70 million yuan to 670 million yuan QoQ.

Due to the fact that the company's overseas revenue accounts for more than half and the renminbi has depreciated significantly against the US dollar, the company confirmed a large amount of exchange gain in the third quarter, and the company realized financial income of 380 million yuan, a new high. Compared with the past, financial income alone has brought the company nearly 500 million yuan in profit.

Overall, due to the company's improved revenue structure, shortage of upstream raw materials such as IGBT, and significantly reduced export freight charges, the company's gross margin improved QoQ. At the same time, the proportion of main operating costs to revenue decreased QoQ, and exchange gains also hit a new high. With multiple benefits, the company's net profit in the third quarter rose sharply by 55% YoY to 1.16 billion yuan, also setting a new historical high in single-quarter profit. Moreover, the profit growth rate finally exceeded the revenue growth rate, and the company has finally broken free from the vicious circle of increasing revenue but not profit.

There is no content to translate as the input text is not in Chinese Mandarin.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.