Posts

Posts Likes Received

Likes Received"Virtual Fire" of Longi: The helplessness of the leading company hidden under the prosperity of photovoltaics

$On October 28, LONGi Green Energy announced its Q3 2022 results after the A-share market closed. As the most critical revenue and net profit had already been circled and specified by the company before, the results were not significantly different from expectations. The focus was on profitability quality from cost and expenditure, as well as progress on industry competition and games.

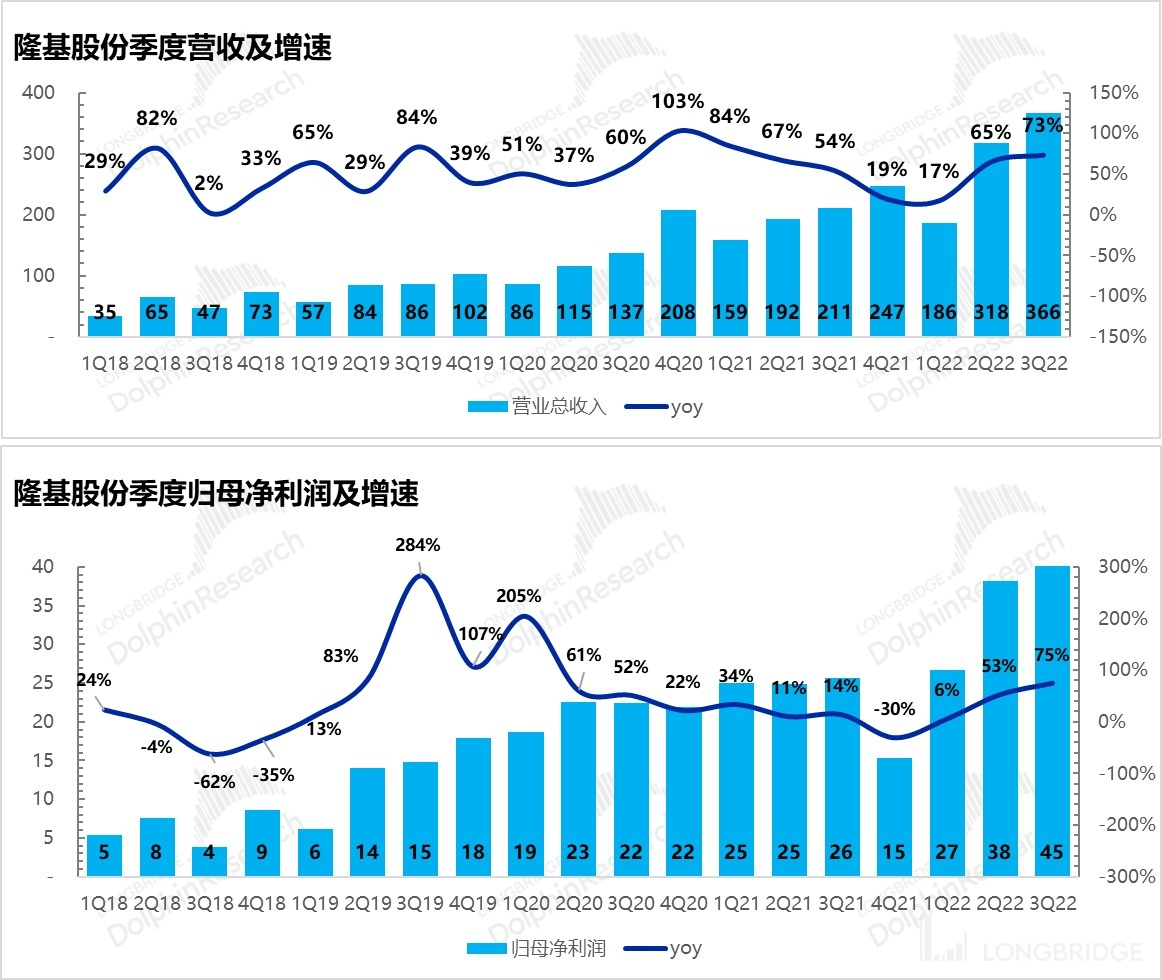

a. Driven by strong demand, the Q3 revenue of the company was CNY 36.6 billion, with a year-on-year increase from 65% in the previous quarter to 73%.

b. The net profit attributable to shareholders was CNY 4.5 billion, with a year-on-year increase of 75%. The profit margin was 12.3%, which was higher than the previous quarter. This is probably the core reason for LONGi's price increase after the Q3 revenue forecast was released. With the accelerating revenue, the performance of the profit margin is also continuing to recover.

c. The seemingly good performance of the net profit is mainly supported by the financial income from foreign exchange appreciation and silicon investment profits. Without considering these two aspects, the core operating profit of the main business evaluated by Dolphin Analyst is only CNY 3 billion, with a profit margin of only slightly over 8%, and a year-on-year growth of only 11%.

However, from the perspective of valuation, the exchange gains and losses come from external exchange rate changes, which are not a long-term consideration in valuation expectations. It is difficult for the financial rate to sustainably remain above -2% for a long time. Therefore, they are not considered.

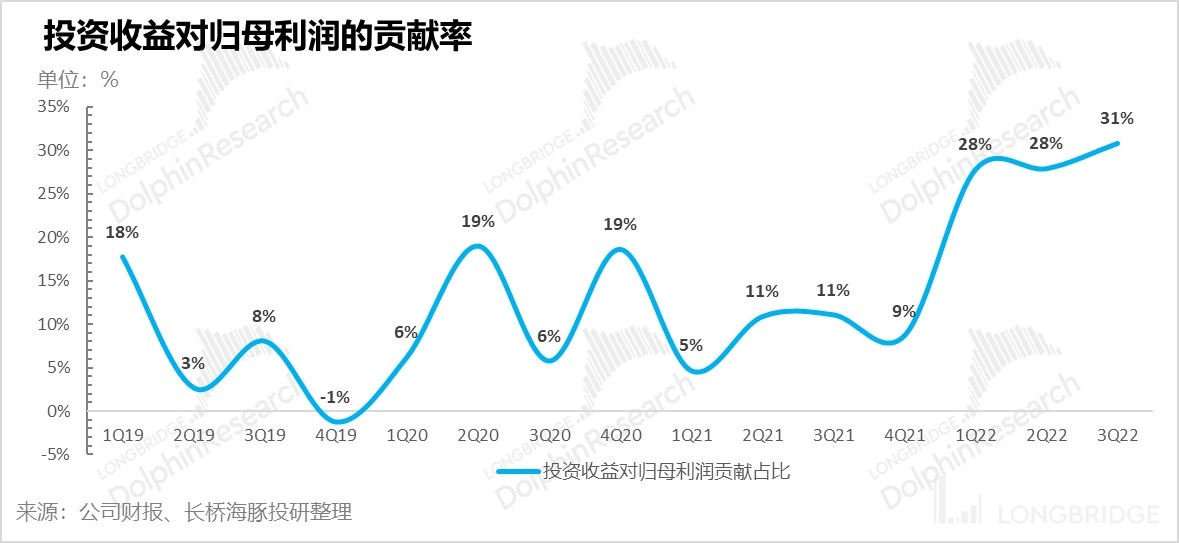

As for the contribution of investment income to valuation, it is generally handled in the following way: Since the company is not engaged in investment, such investment income is not part of its main business operations. Generally, the value is estimated separately by superimposing the target valuation of the company holding stakes (such as Tongwei) on the proportion of equity holding. It does not mix with the expected cash flow forecast of the main business.

After excluding these two factors, it mainly shows that LONGi is leading the industry's profits upstream in silicon materials and that the downstream component factory does not have the price transmission ability like Ningde Times. As the industry leader, the final way to balance the prices up and down the industry chain is to utilize the capacity utilization rate of its own components to avoid too much loss of profits, which will prevent it from being caught off guard when demand is booming and can only act as a gift to the upstream silicon materials.

As current photovoltaic equipment demand is still strong (reflected in the explosive growth of LONGi's contract liabilities in the third quarter, which increased by 67% compared to the previous period, while inventory increased only slightly by 4%, and order volume was large), LONGi's expected reversal still needs to wait for the release of silicon material production capacity. The trend of silicon material prices will directly affect LONGi's capacity utilization rate as a component industry leader, as well as the release of revenue and profits, which is still worth watching.

Dolphin Analyst will share the summary of the conference call with Dolphin users through the Longbridge App. Users who are interested can add WeChat ID "dolphinR123" to join the Dolphin Investment Research Group and get the conference call summary as soon as possible.

Dolphin Analyst will share the summary of the conference call with Dolphin users through the Longbridge App. Users who are interested can add WeChat ID "dolphinR123" to join the Dolphin Investment Research Group and get the conference call summary as soon as possible.

See below for details of this financial report:

1. What do you need to know about LONGi?

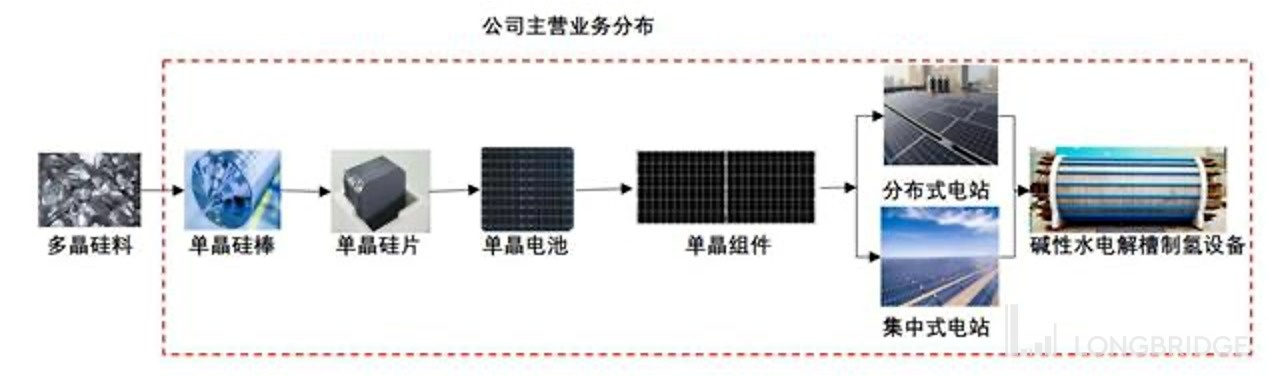

LONGi has made its mark in the photovoltaic track. Starting with silicon wafers, the company has developed an integrated layout along the photovoltaic industry chain. Except for the silicon material business of smelting and purification (only some equity investments), the basic downstream of the industry chain is covered: silicon rods - silicon wafers - cell slices - research and development, production, and sales of components. At the same time, it has also deployed system solutions for centralized ground power stations and distributed photovoltaic roofs (including BIPV) and sunrise fields such as photovoltaic hydrogen production. However, the pillars of the company's business are the two core links of silicon wafers and components that everyone is familiar with, and the company has already become a global leader in monocrystalline silicon wafers and components.

Data source: Company's financial report, Dolphin Investment Research arrangement

Silicon wafers and components are the two core businesses that the market pays attention to:

1. Component business is mainly sold externally. The company's component business started in 2014 and developed based on its own leading monocrystalline silicon wafer technology. The company's component business has grown into the company's first major pillar and occupies the world's leading position. At the same time, the company's component business is fully globalized, with overseas component revenue accounting for more than the domestic market and gaining recognition from overseas markets.

2. The silicon wafer business is partially for self-use and partially for export. The company bets on the monocrystalline silicon technology route and promotes the full replacement of multicrystalline silicon, thus becoming the biggest winner in this substitution process. As the company itself has started component business, a part of the silicon wafers produced by the company is for its own use, and a part is sold externally. Currently, it basically maintains a ratio of 2:1.

3. The fierce price game of the photovoltaic industry chain requires special attention to changes in the company's profitability. The current photovoltaic industry chain is in a period of rising prices throughout the industry chain with silicon materials as the source. The high capital barrier in the silicon material link and the long production cycle have become bottlenecks in the development of the photovoltaic industry. The profitability of the company's silicon wafer and component businesses is under pressure, and attention needs to be paid to changes in the company's profit indicators and the trend and expected turning point of the industry chain's prices.

The current situation of the company's production capacity structure is approximately as follows: the capacity of silicon wafers is 1.5 times that of components and 2 times that of cell slices. Therefore, currently, in terms of business structure, one-third of silicon wafer production is for external sales, two-thirds are for self-use for the next step of cell slice production, and when producing components, half of the self-produced cell slices are not enough, so there it needs to be externally sourced, and most of the components produced are sold externally, with only a small amount used for the photovoltaic power plant projects that the company has accepted.This is how the income side is reflected: module income accounts for about 75% of the income, while silicon wafers and rods account for about 20%, and the remaining 5% is miscellaneous items such as power station construction.

2. Detailed Analysis by Dolphin Analyst:

1. Accelerated Growth and Stable Profit

The company recently released a performance forecast for the period from January to September 2022, which also excited the market: "From January to September 2022, the company is expected to achieve operating income between RMB 86.4 billion and RMB 87.4 billion, a year-on-year increase of 54% to 56%; net profit attributable to the shareholders of the listed company is expected to be between RMB 10.6 billion and RMB 11.2 billion, a year-on-year increase of 40% to 48%."

This forecast implies that the revenue for the third quarter is between RMB 35.9 billion and RMB 36.9 billion, and the corresponding profit for the third quarter is between approximately RMB 4.1-4.7 billion. This implies a slight acceleration in revenue growth and a stable profit margin in the third quarter.

The actual results show that the revenue for the third quarter was RMB 36.6 billion, a year-on-year increase of 73%, which is not too different from the company's forecast. The net profit attributable to the shareholders of the listed company was RMB 4.5 billion, a year-on-year increase of 75%, also within the company's guidance range.

Looking at the trend, both the revenue and profit at the beginning and end of the company are accelerating steadily with relatively stable performance.

(2) High-priced silicon material further squeezes module profit

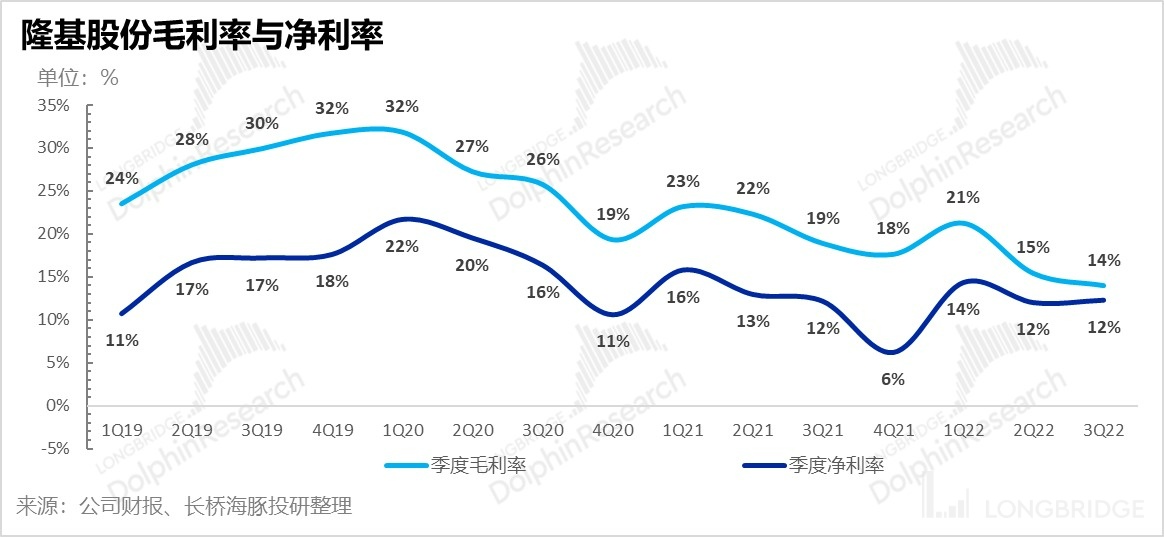

Continued rapid decline in gross profit margin: In the case of global photovoltaic demand soaring, silicon materials are the most fiercely rising link in the entire industry chain due to heavy asset and long expansion cycles. Downstream power stations are extremely sensitive to module costs, and the upstream cost increases cannot be fully transmitted downstream.

Only the intermediate link can bear the cost in the middle, and Longi's silicon wafer-cell-module just happens to be in this intermediate link.

The exploding demand in the industry has kept silicon prices hovering at high levels. Longi’s module orders, which were signed in advance, encountered continuously rising upstream raw material costs. The order prices could not keep up with the prices of raw materials, resulting in good revenue growth but continued erosion of gross profit margin. The gross profit margin of the company fell further from 15.5% in the second quarter to 14% in the third quarter of 2022, and the cost pressure of silicon materials remains high.

(3) The net profit attributable to shareholders is good? Not the credit of the core main business

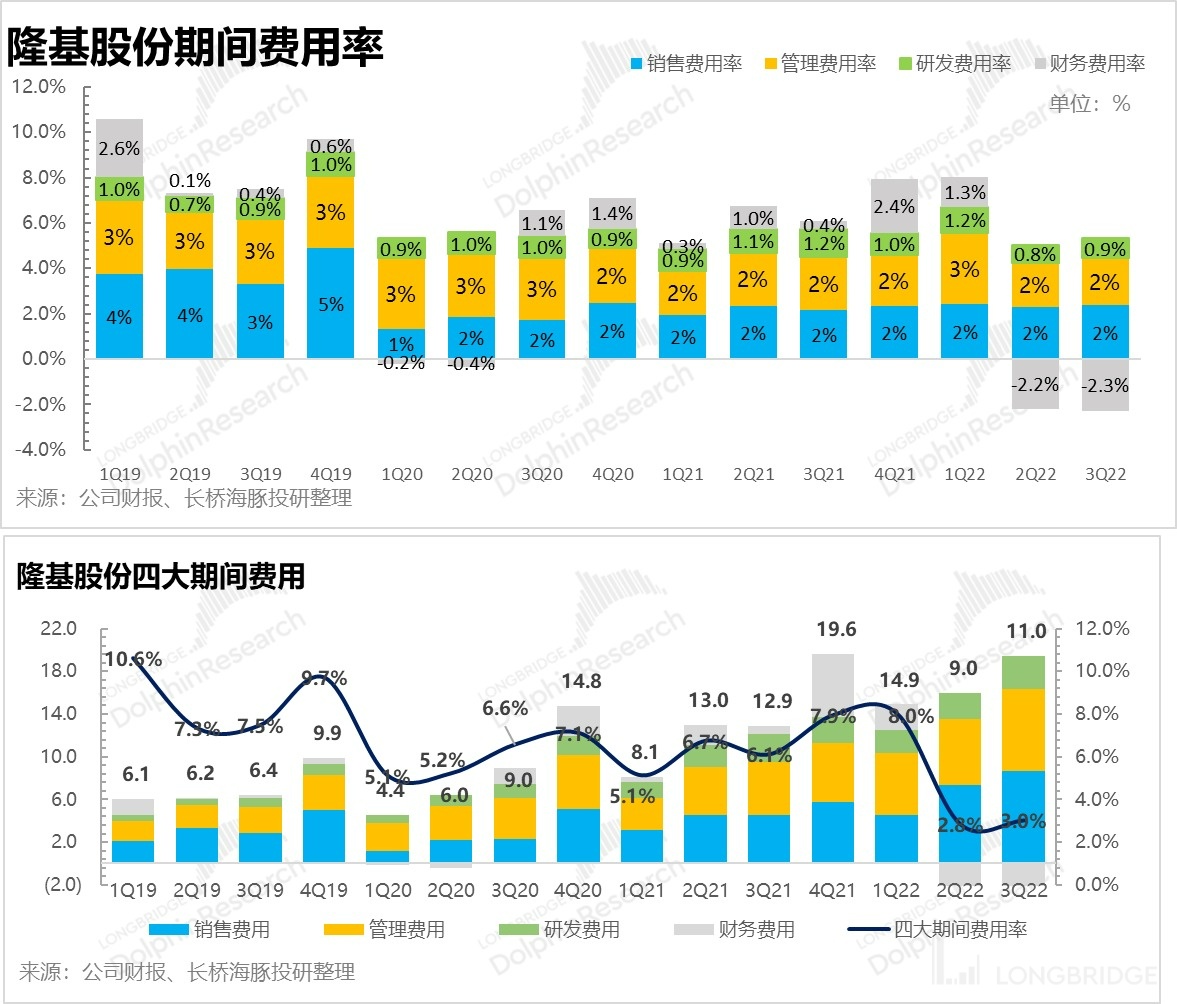

In the case of a significant decline in gross profit margin, the net profit attributable to shareholders was still good, reaching RMB 4.5 billion, a profit margin increase of 0.3 percentage points compared to the second quarter, reaching 12.3%, mainly due to two factors:

a. Financial expenses: In this quarter, financial income was higher than the previous quarter, resulting in a financial expense ratio of -2.3%. If it is for the same reason as the previous quarter, it may be that the company has more foreign exchange due to exports, and the appreciation of the US dollar may lead to a higher exchange gain or loss.b. Investment equity of Silicon material: The company does not engage in upstream Silicon material business in its operations, but through equity investment, it holds certain shares of Tongwei and other companies. In the third quarter, this equity investment distributed a profit of RMB 1.38 billion, which is more than RMB 1.1 billion in the previous quarter.

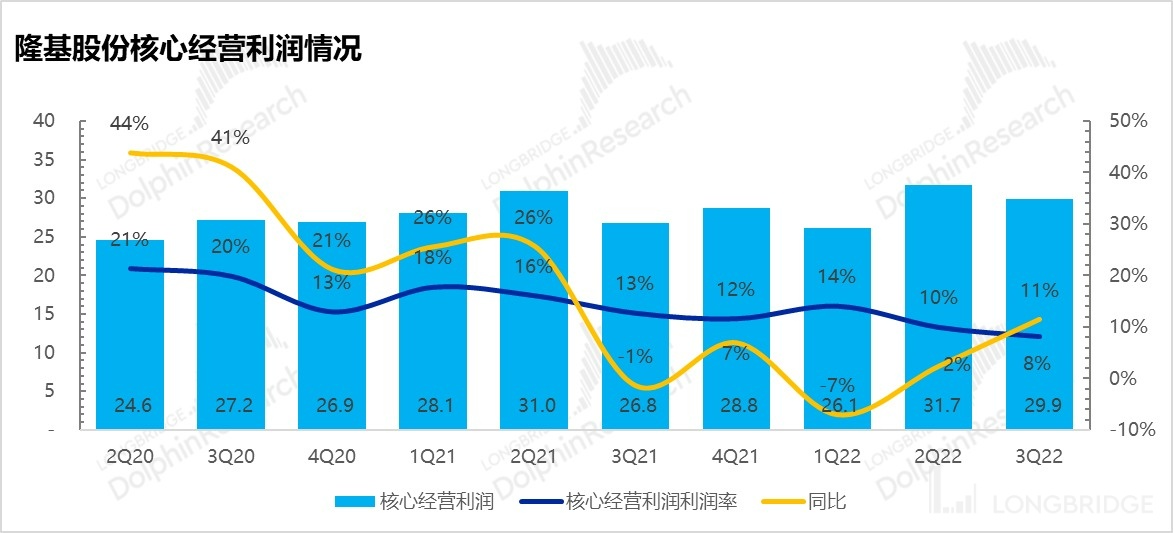

If these two sources of income are excluded, the company's core operating profit (revenue - cost - business tax - three expenses) is actually in a very unfavorable situation, with only RMB 3 billion in operating profit, a year-on-year increase of only 11%, and an operating profit margin of only 8%.

Looking at the company's cost structure, we can basically see that compared to the second quarter, the company's sales, management and research and development expense ratios have all increased, except for the financial income. The reason why the profit attributable to the parent can maintain the level of the second quarter is mainly supported by investment income. A single investment income of RMB 1.4 billion can already offset all operating expenses of RMB 1.1 billion.

From a valuation perspective, exchange gains and losses are caused by changes in external exchange rates and are not a long-term and sustained phenomenon. Therefore, it is not appropriate to assume that the company's financial expense ratio will remain above -2% for a long period of time and should not be considered.

As for investment income, since the company is not primarily engaged in investment and this investment income is not its main operating business, the value is generally calculated separately by adding the target market value of the holding company to its equity, and it is not mixed in the expected cash flow of the company's main business.

Therefore, in the view of Dolphin Analyst, the key profit indicator of the company is the profit after deducting revenue, cost, business tax and three expenses, which is calculated separately. As for this profit in the third quarter, the profit margin is only 8%, which is a decrease of nearly two percentage points compared to the previous quarter, and the profit growth rate is only 11% year-on-year, which slightly recovered from 2% in the previous quarter, when revenue accelerated.

In fact, although the photovoltaic demand is booming, excluding the equity investment in upstream silicon materials, as the leading company in the industry, Longi needs to carefully consider the balance between market share and profit creation in the component industry. The situation is not that easy.

Telephone Conference on April 28, 2022: "LONGi: Overseas Risks Persist, Can Q1 Gap be Made Up in Q2?" (Meeting Minutes)

Financial Report Review on April 28, 2022: "Photovoltaic Halved, How Can LONGi Regain its Face?"

Insight

December 10, 2021: "LONGi (Part II): Intense Competition, Can the Photovoltaic Industry Survive?"

December 2, 2021: "LONGi (Part I): The Turning Point is Near, Can the Photovoltaic Industry Get Even Stronger?"

Risk Disclosure and Statements in this Article: Dolphin Research and Analysis Disclaimer and General Disclosures

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.