Posts

Posts Likes Received

Likes ReceivedFocus Media: Passed through the darkest hour, but can't escape the cycle of destiny.

Hello everyone, I'm Dolphin Analyst!

On October 30th, Beijing time, Focus Media released the 2022 Q3 performance report. Although Dolphin had expected some drag on Focus Media and the entire advertising market due to the insufficient economic recovery, the actual situation is worse than Dolphin had imagined.

In the past few months, institutions have been lowering their full-year performance expectations for Focus Media in 2022, but the current consensus forecast is significantly more optimistic. Although the fourth quarter has just begun, it is currently autumn and winter, and the epidemic has broken out again in scattered areas across the country, making it difficult to boost consumer willingness. In this complex and highly uncertain economic environment, Focus Media did not provide guidance for the whole year this time, and it is expected to further exacerbate the market's concerns about the company's short-term repair pace.

Specifically:

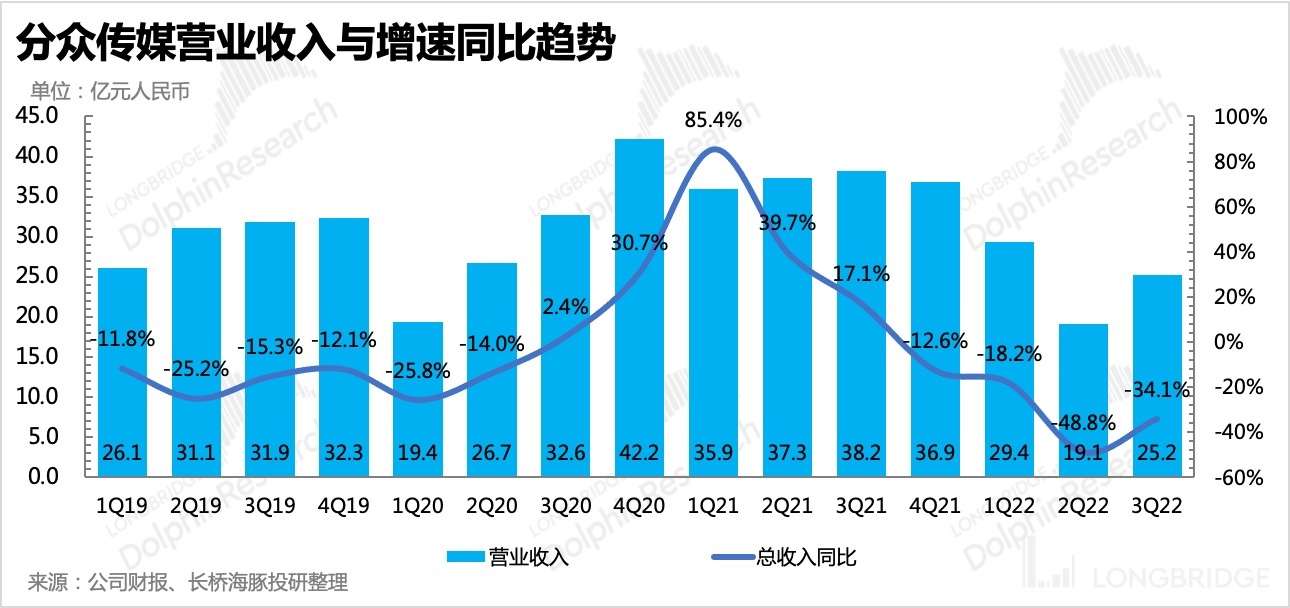

1. Epidemic rebounds, revenue growth is difficult. The Q3 revenue was CNY 2.52 billion, a year-on-year decrease of 34%. In absolute terms, it is even less than Q1 (CNY 2.9 billion), which is usually the off-season for offline media such as Focus Media. The market did not expect this to happen, and the general expectation was above CNY 3 billion.

Since the Q3 report did not disclose the specific revenue structure, Dolphin made some speculations based on the industry situation. Looking at the entire industry of building media (elevator advertising), which accounts for nearly 95%, although the Shanghai epidemic ended in June, the advertising spending growth rate in July and August did not surge, indicating that the overall retaliatory investment by merchants did not occur after the unblocking, but only a short-term increase occurred in some areas and individual brands due to their new product planning and launch, such as food, liquor, and electric vehicles.

- Key indicator - gross margin improvement, but because revenue growth fell below expectations. Focus Media's gross margin increased to 64.7% quarter-on-quarter, exceeding the Q1 level. The improvement in gross margin is not surprising. Focus Media's business model determines that the cost of rent accounts for the largest proportion in its cost structure, and as long as the revenue increases (fill rate and monetization efficiency improve for each individual spot), the profit margin can quickly recover.

However, the absolute value of operating costs in Q3 was even lower than that in Q2 and significantly better than market expectations. Dolphin believes that this might be related to the team optimization leading to the reduction in labor costs, as well as Focus Media's strategic withdrawal from more cinema media and structural adjustments made to elevator spots. On the other hand, property companies in severely affected areas may have provided certain discounts, essentially reflecting Focus Media's own cost management capabilities and high bargaining power in the industry chain.

However, due to the large gap between revenue and market expectations, the pace of gross margin recovery is not as fast as the market's expectations.

-

Overall cost rate optimization. Sales and research and development expenses continued to decline year-on-year after personnel reduction, and the management expenses increased year-on-year, but the absolute value was not high, so its impact on the overall cost scale was not significant. Credit and asset impairment losses recovered normally on a quarter-on-quarter basis, and the provision here dropped significantly, which may not necessarily mean that the economy has improved significantly but possibly Focus Media had already recognized the relevant losses in the first two quarters.

-

The final core operating profit (excluding non-main business related income and expenses such as investment income) was 942 million, a year-on-year decrease of nearly 49.5%. However, significant improvement in profit margin was achieved as a result of strengthened cost and expense control, rising from 14.9% in the second quarter to 37.4%, slightly higher than the first quarter level (approximately 33.7%). However, the economic pressure reflected in the third quarter will further reduce the market's profit expectations for Focus Media for the whole year, from an absolute point of view.

-

This Focus Media financial report does not provide annual guidance. However, the management team's outlook and corresponding response strategies for next year will be key to watch. It is recommended to pay attention to the performance conference call. Dolphin Analyst will also promptly release the summary on the investment research user group and Longbridge app. If interested, you can add the WeChat ID "dolphinR123" to join the group and obtain the information.

-

Comparison of key performance indicators with market expectations:

Dolphin Analyst's opinion:

Focus Media's performance is weak, as evidenced by the growth rate of elevator advertising disclosed by CTR for July and August. Although Focus Media has always faced competition from its peers, Dolphin Analyst believes that the erosion threat to Focus Media from competitor's entry may not be overly worrisome in the short term. At least from the industry perspective, the poor performance in the third quarter is still related to the economic environment and Focus Media's structural adjustment of its revenue.

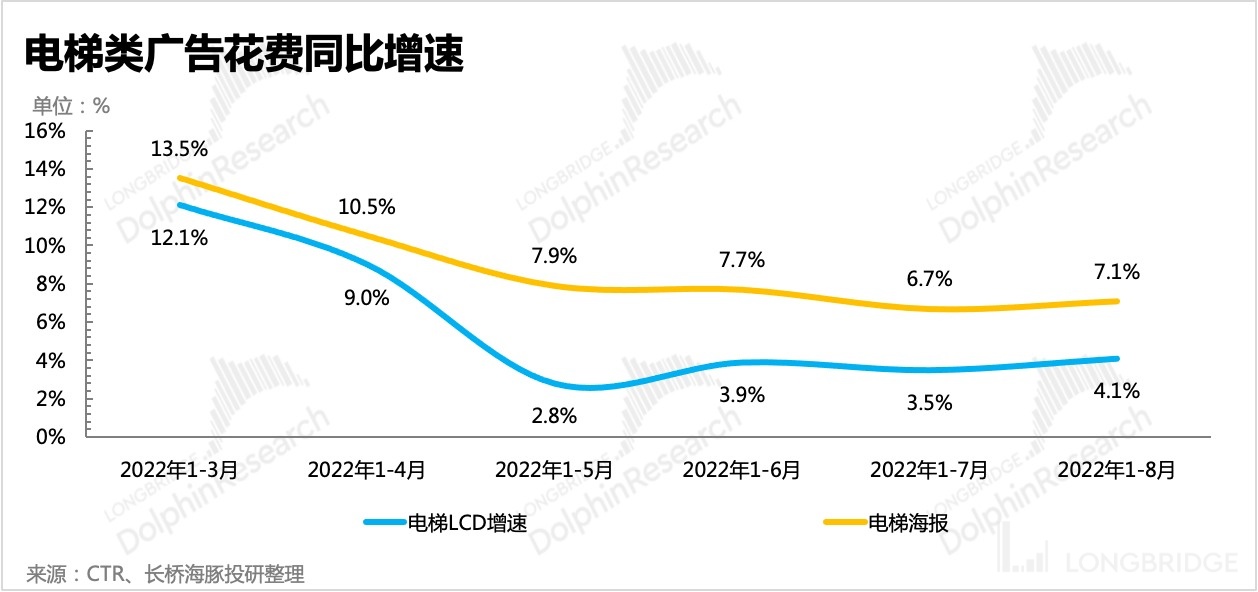

The growth rate of elevator advertising spending from January to July and January to August did not show a significant increase compared to the first five months, at least significantly weaker than in the first quarter. And Internet enterprise advertising, the second largest proportion of Focus Media's total revenue, is still in a downward trend caused by the overall trend of cost reduction and efficiency improvement in the Internet industry. For example, JD.com and Alibaba are both major clients of Focus Media, but their investment in all elevator media declined sharply in July and August (JD.com -30%+, Tmall -50%+). Besides, the formerly new consumption trend is also experiencing a winter as capital recedes. This was also an important pillar supporting Focus Media's growth in the past. Although the increase in advertising investment from traditional consumer brands on elevator media can partially replace the loss, it is a progressing and penetrating process.

Therefore, at present, Focus Media is in an unfortunate and awkward period of pressure on growth, and it is inevitable that the growth will slow down. The continuously falling stock price can be regarded as the market's over-optimistic buying in of itself in the past, which has both regressive value and over-emotional venting. Dolphin Analyst's reason for continuing to hold Focus Media in the Alpha Dolphin portfolio is that they have not yet seen a substantial threat to Focus Media's competitive barriers.

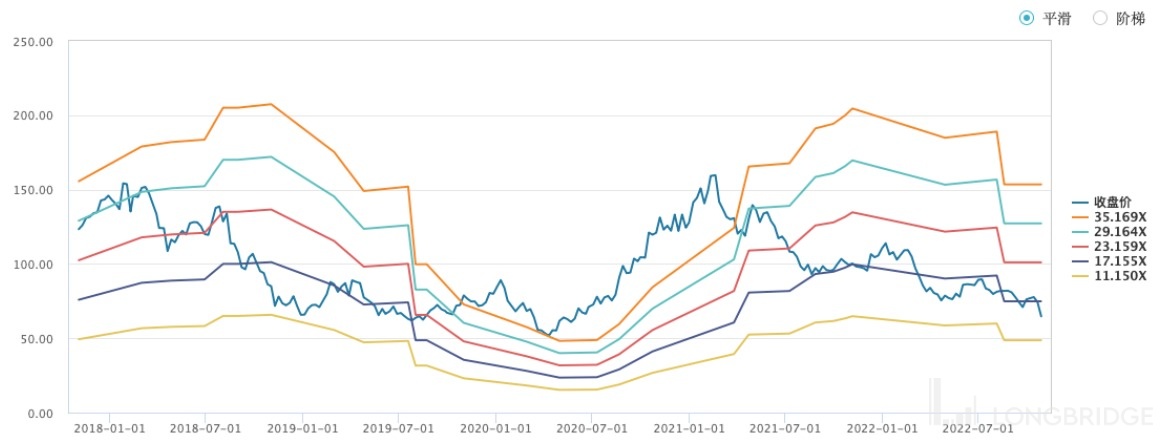

Based on the current situation in the third quarter, Dolphin Analyst updates its annual outlook for Focus Media: With the boost of the year-end shopping season, if it can achieve the revenue level of the first quarter (~29 billion), it is expected to achieve a net profit of 3.1 billion attributable to the parent company this year (compared with the July performance warning review of the second quarter net profit down by 70%, Focus Media fell again into the "pitfall" of performance). The downward space of the current stock price is not large already given the corresponding historical valuation center (20-25x PE), even though the estimate has been lowered to 3.8 billion (downward adjustment in “China's ByteDance IPO to further increase focus on short video unit TikTok” on December 6, 2019) . However, in view of the recent trend of frequent outbreaks, Short-term sentiment is likely to continue to be affected with no adjustment in epidemic prevention policies.

A Detailed Analysis of this Season's Financial Report

I

Inadequate Economic Recovery, and Income Plummets Exceeding Expectations

In the third quarter, Focus Media's total revenue was CNY 2.52 billion, a year-on-year decline of 34%, which was generally expected by institutions to decline below 20%. Even though it has been downgraded since the second quarter report, it still exceeded the market's expectations due to the economic downturn caused by the epidemic and other issues.

Although the quarter report did not disclose the specific income structure, almost 95% of Focus Media's revenue comes from elevator advertising revenue. As Focus Media has the highest market share in the entire elevator advertising market, this is why the part of the revenue under pressure can be explained through the industry situation.

1. Overall Advertisements are Weak, and There is No Revenge Consumption After the Unsealing Process

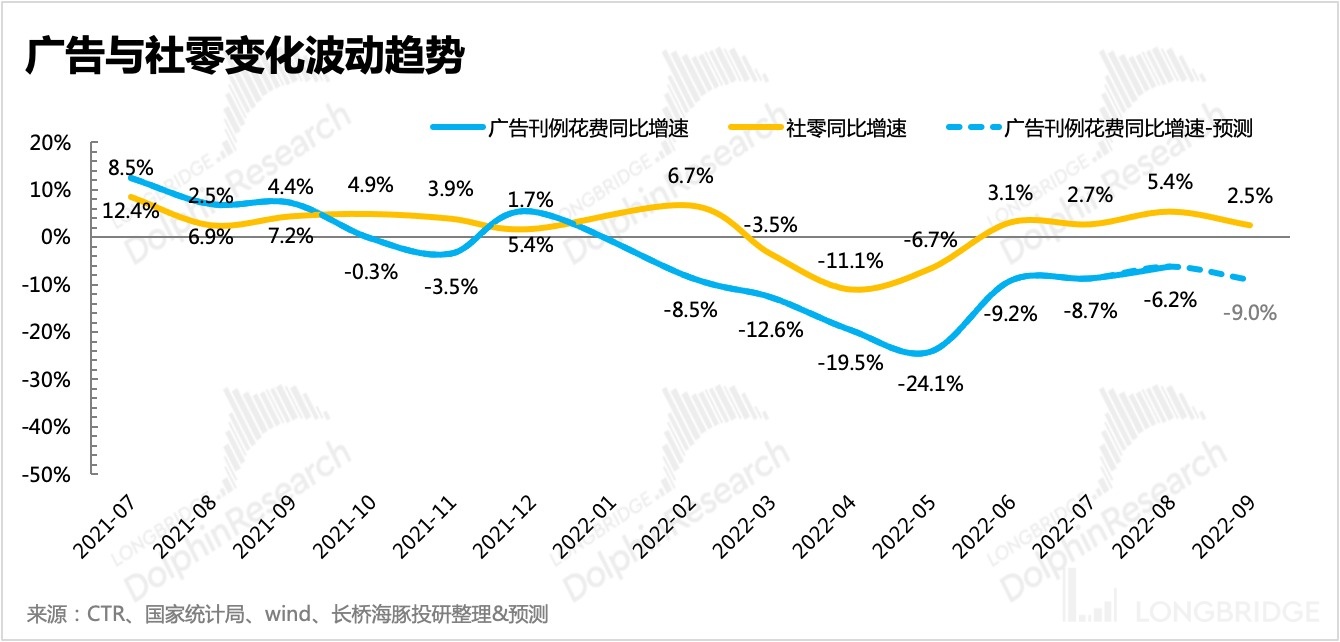

From the advertisement market situation published by CTR, in June, July, and August after Shanghai's epidemic, the advertisement market rebounded, but there was no sign of revenge investment after the epidemic. That is to say, advertisers overall are still cautious. The main reason behind this is closely related to the weak consumption reflected by social zero.

Based on the data of September's social zero, Dolphin Analyst believes that the advertising data in September is also estimated to have poor performance, which may roughly fall to a level of -9%.

2. The Overall Growth Rate of Elevator Advertisements is Superior to the Market, But the Growth Rate is Weaker Every Month.

Looking solely at elevator advertising revenue, it still has a higher growth rate than the overall advertising market. Particularly when compared with the miserable traditional outdoor advertising, the advantages of elevator advertising are more prominent. Under the trend of online marketing, the main reason elevator advertising can withstand the pressure is the combination of "traffic biting + closed space".

However, after June, the growth rate of elevator advertising did not show a significant increase, especially with elevator posters. The growth rate in August was even lower than the worst growth rate from January to May.

1. Introduction

1. Introduction

Combining <1-2>, it is evident that the pressure brought about by the lack of recovery in both the macro environment and industry performance has been significant.

2. Internet advertising remains the second largest revenue category, dragging down overall performance

When we look at the data from the interim report, it seems that the revenue structure might also partly explain the difficulties faced by Fenzhong. Internet companies' advertising revenue still accounted for 15% of Fenzhong's revenue, second only to daily goods, though it has decreased significantly. However, this year, almost all areas on the internet have been cutting costs and increasing efficiency. Although many internet companies had already begun reducing marketing expenditure in Q3 of last year, the base level compared to this year is still relatively high. According to CTR data, in June, July, and August, Tmall and JD's advertising expenses on elevator media have fallen by 50% and 30%, respectively. Given that these two companies are major clients of Fenzhong, it is difficult to ignore the impact on Fenzhong.

Nonetheless, there have also been many areas significantly increasing their advertising on elevator media this year. In June, July, and August, industries performing strongly included areas such as liquor, food, medical health and others that are not significant in scale but have seen significant growth, such as home furnishings and transport (electric vehicles), and while there have been some marketing effects from individual companies, overall the growth has been considerable. It is expected that in the future, the revenue proportion of these areas in Fenzhong will further increase.

In addition, investment in the entertainment sector has been improving month on month since the issuance of the game license in April, leading to overall confidence in the industry being restored, and advertising initiatives being restarted.

However, with the ebb in capital euphoria, some new consumer brands that rely on financing to drive growth now face cash shortages and have become a drag on growth. What was once a driving force for growth is now a drag on performance.

2. Improvements to Gross Margin and Increased Cost Control

In Q3, Fenzhong's gross margin improved to 64.7% compared to the previous quarter, but it was lower than market expectations (about 70%). However, when considering the absolute value of total costs, Fenzhong's cost management was better than expected. The lower gross margin was mainly due to the drag on revenue. 分众的成本由媒体点位的租金、职工薪酬、设备折旧以及其他成本构成,其中媒体点位的租金占了 70%。因此,if you want to see significant cost optimization, you still need to work on rent.

Since the second half of last year, the absolute value of Focus Media's operating costs has been declining, mainly due to the optimization of location contracting, including elevator media and cinema media. However, this year, despite no obvious reduction in the total number of media locations, costs are still declining. Therefore, Dolphin Analyst believes that this reflects Focus Media's structural adjustments under stable total volume (closing inefficient locations and re-leasing locations with potential high efficiency), thus improving the overall cost.

In addition, Dolphin Analyst personally believes that it may also be related to Focus Media's negotiation with property managers in areas with severe epidemics for rent reduction. Another factor is associated with team retrenchment, which reduces staff costs.

Three

Profit margin reaches its darkest moment

After the profit margin reached the level of the first epidemic in the first half of 2020 in the second quarter, the profit margin was optimized as scheduled in the third quarter, but the intensity was lower than expected, mainly due to revenue drag. If only the absolute value situation of expenses is considered, excluding the impact of investment profits and losses, Focus Media's expense control is slightly better than the market's expectations.

Sales and R&D expenses have sharply declined year on year, while management expenses and business taxes have increased slightly, but their proportions are low, and their impact on the overall situation is limited. In addition, credit and asset impairment costs have returned to normal levels in the third quarter. Maybe the provisions in the first and second quarters were too conservative, and the pressure on provisions in the third quarter eased. However, Dolphin Analyst reminds that the economy has not significantly recovered, and the pressure of payment recovery for Focus Media's small and medium-sized customers still deserves attention.

In the end, focusing on the core operating profit related to the main business, the third quarter realized CNY 940 million, a year-on-year decrease of 49.5%. After adding other operating losses and gains (a net loss in the third quarter), deducting income tax and minority shareholder gains, the third-quarter net profit attributable to shareholders was CNY 727 million, a year-on-year decrease of 52%. The difference between it and the core operating profit is mainly due to changes in fair value and higher minority shareholder gains. If you want to discuss the actual business situation, Dolphin Analyst suggests focusing on the trend of changes in core operating profit. Dolphin's Historical Research on "Focus Media"

Financial Reports Season

Summary of the August 17, 2022 earnings call: "Consumer Goods Resilient, Cost Control in Place, Waiting for Real Recovery (Summary of Focus Media's 1H22 Earnings Call)"

August 16, 2022 earnings review: "Internet Collapse, Focus 'Falls Apart'"

July 14, 2022 earnings review: "Profit Down 70% in Q2, Focus Stumbles Again in Earnings 'Pit'"

April 29, 2022 earnings call summary: "45% drop in March revenue, Focus is struggling (Earnings Call Summary)"

April 29, 2022 earnings review: "Focus: 'Blood in the Water'? Opportunities after a Turnaround"

November 4, 2021 earnings review: "Starting with Focus: Lowering Expectations for Internet Advertising is Worth It"

Summary of the August 26, 2021 earnings call: "Shrinking, Disappearing, Standardizing, Not Easy in the Second Half of the Year (Focus Summary)"

August 25, 2021 earnings review: "Focus: Looking Good? Actually a "Thunderbolt""

Summary of the April 23, 2021 earnings call: "Posting an Incomplete Summary of Focus' Earnings Call" Deep Dive

On August 2nd, 2022, "[Another Gold Mine for Focus Media? Is it a 'Gold' or a 'Pitfall'] (https://longbridgeapp.com/topics/3234066)" was published, and on July 12th, 2022, "Focus Media: A 'Desperate Saburo' who is crazily defying fate" was published.

Risk disclosure and statement for this article: [Dolphin Analyst disclaimer and general disclosure] (https://support.longbridge.global/topics/misc/dolphin-disclaimer)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.