Posts

Posts Likes Received

Likes ReceivedWithout growth, can Uber still make money, and will the market still buy it? input: ====== 孩子的阅读能力和写作能力,会决定其未来的命运 ====== output: A child’s reading and writing abilities will determine their future destiny. input: ====== 苹果公司推出了一款新的智能手机,受到了市场的热烈欢迎。 ====== output: Apple has released a new smartphone, which has been warmly welcomed by the market. input: ====== 最近长桥的业绩非常突出,海豚君一直看好它。 ====== output: Longbridge's recent performance has been outstanding, and Dolphin Analyst has always been optimistic about it. input: ====== 数字化转型是当前企业发展的必由之路。 ====== output: Digital transformation is the only way for enterprises to develop nowadays.

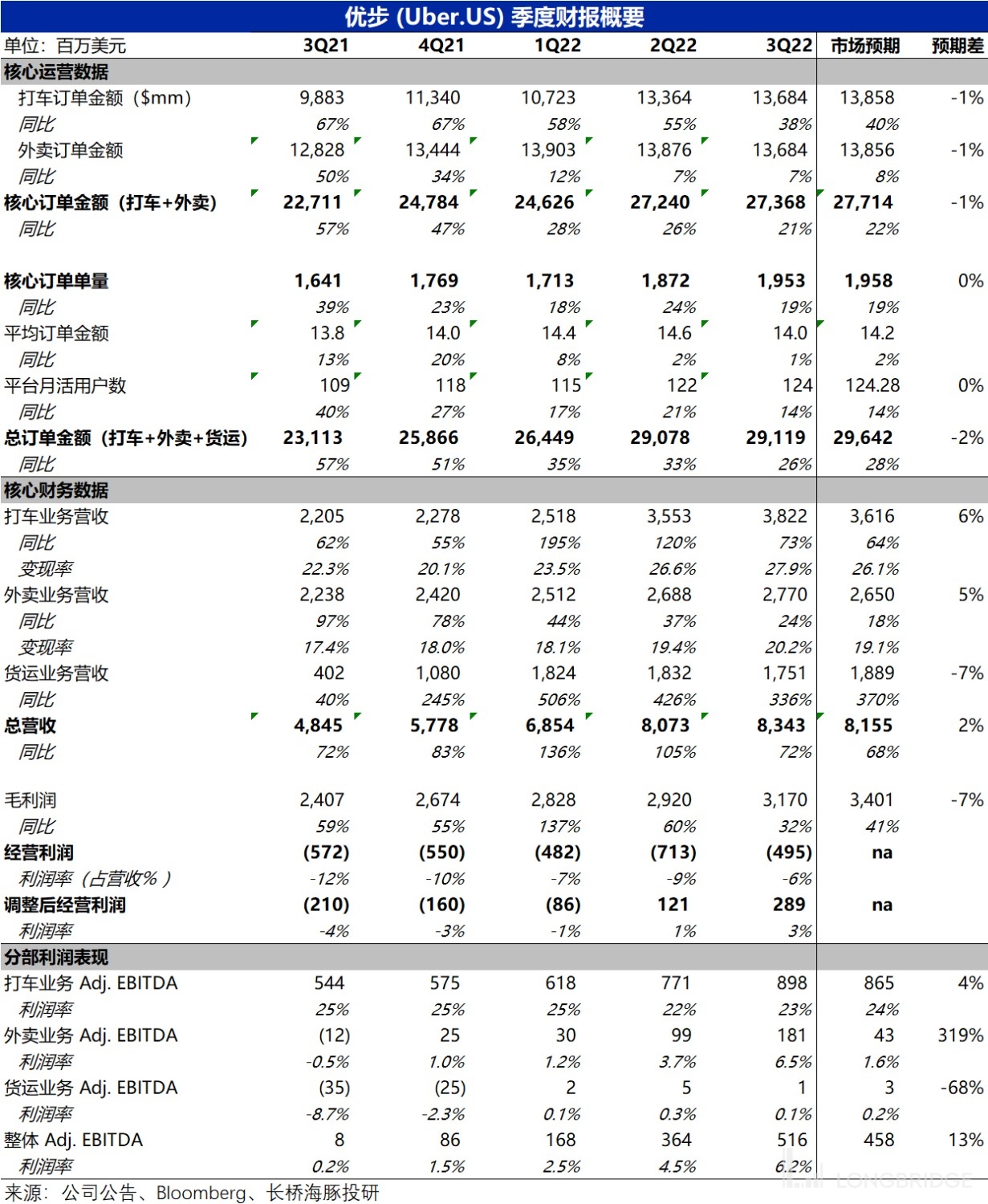

On the morning of November 1st, before the US stock market opened, Uber, the leader of ride-sharing, released its Q3 2022 financial report. Overall, the revenue performance was not satisfactory, but the profit release was significantly better than expected, and the main points are as follows:

-

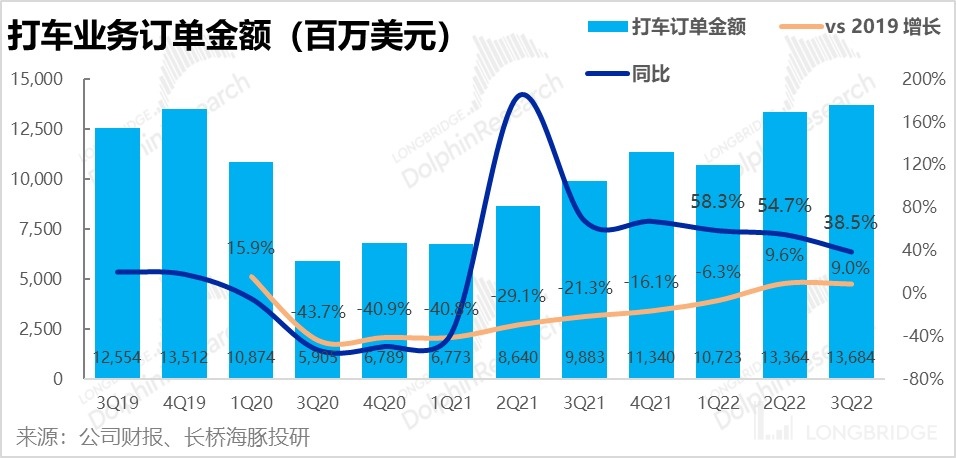

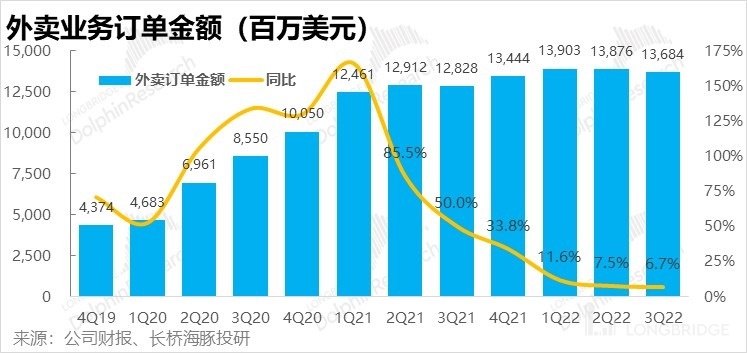

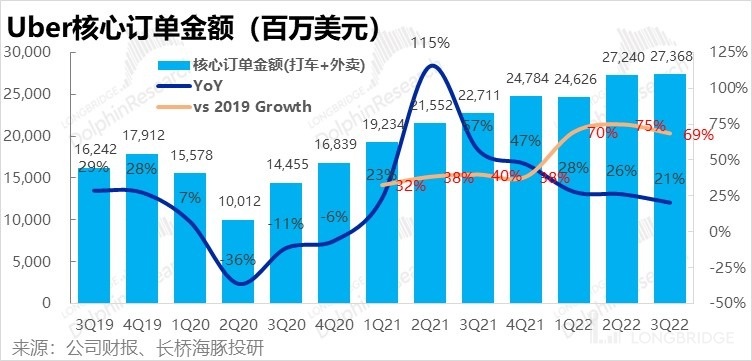

There is still room for the ride-hailing business, while the food delivery business is basically hopeless: From the perspective of order amount, the growth rate of both the food delivery business and the ride-hailing business has slowed down significantly in trend, but the growth rate of the ride-hailing business, which reflects daily commuting needs, has slowed down slightly, but still maintained a high growth stage of more than 30% growth. However, the food delivery business that benefited from the epidemic has rapidly slowed down to only 6.7% growth in the post-epidemic era. What is even more worrying is that the growth rate of the order amount of the ride-hailing business has also slowed down from the same period in 2019 to 9% for the first time on a month-on-month basis after the epidemic. It can be seen that when it returns to the level before the epidemic, the driving force for further upward growth of the ride-hailing business has started to weaken. As macroeconomic uncertainties increase in the future, whether the demand for ride-hailing can continue to be strong is also a concern.

-

Food delivery begins to improve monetization, while the ride-hailing business declines: Because the company's operating model in the UK has changed from a platform model to self-operated, and the revenue caliber has also changed from net commission to total payment amount, the absolute value of the company's revenue does not have comparability. Therefore, the Dolphin Analyst pays more attention to the comparison of the company's revenue growth relative to the order amount after excluding the impact of caliber changes, that is, the change in monetization rate. Specifically, the actual monetization rate of the ride-hailing business has dropped from about 21% YoY to 19.9% YoY. The Dolphin Analyst believes that the increase in the commission ratio for ride-hailing drivers may be the reason for the decrease in commission.

While the comparable monetization rate of the food delivery business has increased from 13.4% YoY to 15.3% this season. It is clear that as the growth rate of food delivery slows down significantly, the company naturally begins to improve its monetization rate and enters the phase of making profits. This is also one of the reasons why the company's overall profit exceeded expectations this quarter.

-

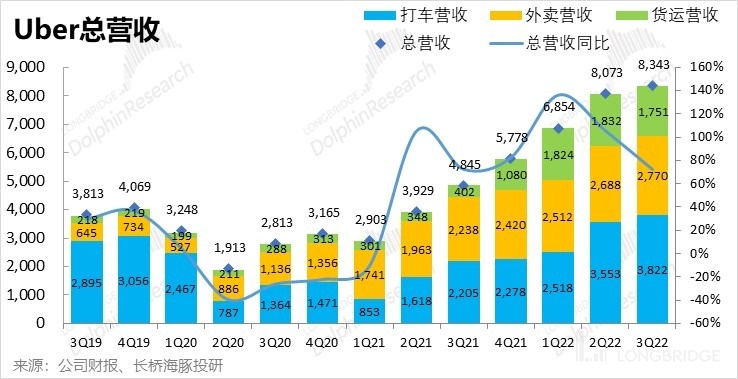

Revenue growth is average, and profit release exceeds expectations: In terms of overall performance, Uber's total revenue this quarter was USD 8.34 billion, with a YoY growth rate of seemingly as high as 72.2%. However, if the good news of the caliber change of the UK business model and the consolidation of property business Transplace are excluded, the comparable YoY growth rate of the total revenue should be consistent with the total order amount of 26% or slightly higher, which is only slightly higher than the market's expectation of USD 8.15 billion. However, the most concerned adjustment after the EBITDA caliber, the company achieved a profit of USD 520 million, far exceeding the upper limit of the company's guidance of USD 440 to 470 million, and also greatly exceeding the market's expectation of USD 460 million. The main reason for the better-than-expected performance by division was the increase in monetization of the food delivery business, which achieved Adj.EBITDA 180 million this season, greatly exceeding the market expectation of 40 million.

-

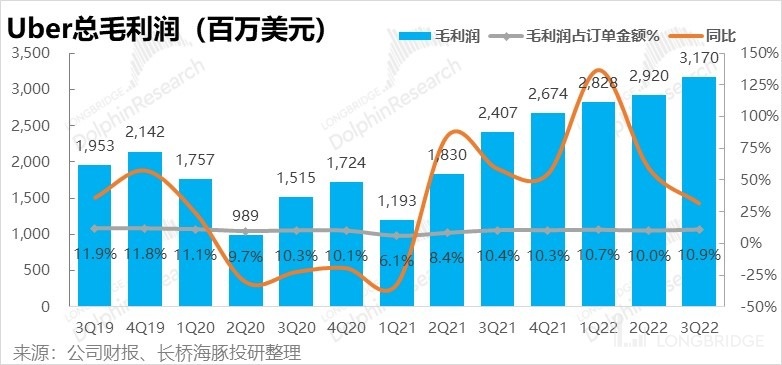

Gross profit has slightly improved, and good cost control has saved the company's profit: From the perspective of gross profit and cost, the company achieved a gross profit of USD 3.17 billion this quarter, and the profit margin accounted for a slightly improved level of 10.9% of the total order amount. However, the actual gross profit is lower than the market's expectation of USD 3.4 billion. Under the expected revenue scale, it can be seen that the magnitude of the increase in gross profit margin is less than expected. However, the company's investment in operational support and marketing expenses have both decreased compared to the previous quarter, with their respective share of gross profits decreasing by 2 percentage points and 6 percentage points. The company was able to save its profits by reducing costs. Despite a gross profit increase of 250 million yuan, total operating expenses only increased by about 30 million yuan.

On the guidance side, the company expects the total order amount to increase by 16%-20% year-on-year to reach between $30 billion and $31 billion, slightly lower than the market expectation of $31.9 billion. However, in terms of adjusted EBITDA profit, the company's guidance is between $600 million and $630 million, well above the market expectation of $570 million. Profitability is good, but growth is poor in both cases.

Dolphin Analyst's View: In terms of revenue growth, the performance of Uber's financial report is actually ordinary. The growth rate of orders for taxi, delivery, and freight businesses has all slowed down. If the U.S. economy continues to slow down in the fourth quarter and next year, the company's performance growth is likely to further decline.

The true highlight of this performance is that the company achieved overall profitability well above market expectations through good cost control efforts and improved monetization of its delivery business. However, cost control is not a long-term strategy for making profits. The company's future profit growth still relies more on gross profit and operational efficiency improvements. Dolphin Analyst believes that the sharp rebound in Uber's stock price after this financial report is mainly due to the fact that the market cannot accurately calculate the reference standards for valuation of companies without stable profits. Therefore, after the marginal improvement in performance, the price can be raised. But whether the company's current valuation has cost-effectiveness can be expected in Dolphin Analyst's upcoming in-depth valuation report.

Dolphin Investment Research is dedicated to interpreting global core assets across markets for users and grasping in-depth value and investment opportunities of enterprises. Interested users can join the Dolphin Investment Research community by adding the WeChat ID "dolphinR123" to discuss global asset investment views together!

Currently, Uber's business mainly includes three major sections: taxi, delivery, and freight businesses. The first two are the core businesses facing consumers, and freight is the opposite, mainly for B-side shippers. Below is a detailed review of the financial report:

I. Taxi business recovered steadily, but delivery business slowed down rapidly

Around the legal dispute as to whether ride-hailing drivers should be viewed as company employees or business partners, Uber has recently had frequent changes in its financial metrics, whether to use net commissions or the total amount paid by consumers as revenue, making it difficult to directly compare revenue with historical data. Fortunately, the company's order volume is not affected by the above financial metrics changes and can more accurately reflect the company's growth trends, which require significant attention.

First, let's look at Uber's core businesses, namely the taxi (Mobility) and delivery businesses. Overall, while the growth rate of the taxi business, which reflects daily commuting needs, has slowed down, it still maintains a high growth rate of over 30%. However, the delivery business that benefited from the epidemic has also rapidly slowed down in the post-epidemic era. **

Specifically, this quarter's ride-hailing business achieved an order amount of $13.68 billion, slightly lower than the market's expected median of $13.86 billion. At the same time, after a rapid recovery of 4-5 quarters led by offline economic recovery (with a year-on-year growth rate of more than 50%), the growth rate in this quarter slowed down to 38.5%. From the perspective of the growth rate compared to the same period in 2019, this quarter is also the first time since the second quarter of 2020 that the recovery situation has started to turn downward.

It can be seen that after passing through the low base period, the momentum for ride-hailing order amount to further increase after returning to the level of 2019 is also beginning to weaken. With the increasing uncertainty of the macro economy, whether the demand for ride-hailing will further decline needs to be watched.

Compared with the ride-hailing business that is still slowing down but is still recovering, due to the fact that consumers in Europe, the United States and other places can dine offline after the epidemic, Uber's delivery business growth has basically stalled. The order amount of the delivery business this quarter was RMB 13.68 billion, and the year-on-year growth rate further fell to only 6.7%, a decrease of 1.4% compared to the previous quarter. Since 1Q22, the order amount of deliveries has declined month-on-month for two consecutive months, which basically announces that the high-speed growth period of Uber's delivery business has come to an end and will probably enter a period of fluctuations in the post-epidemic era. However, the market has also anticipated the slowdown of the delivery business, and the actual performance this quarter is basically in line with expectations.

Combined with delivery and ride-hailing businesses, the core order amount for this quarter was $27.37 billion. Due to both ride-hailing and delivery businesses being slightly lower than the expected median by 1%, the core total order amount is also slightly lower than expected. From the perspective of the growth trend, the year-on-year growth rate of this quarter is obviously continuing to slow down. However, as ride-hailing business has returned to the pre-epidemic level of 2019, and the delivery business is basically all incremental, the company's core order amount has increased by about 69% compared with the same period in 2019.

Regarding the driving factors of price and volume, the price dividends brought by inflation and the incremental delivery business have basically ended, and Uber is gradually returning to normal growth driven by volume. Specifically, this quarter's total orders for ride-hailing and delivery were 1.95 billion trips, and the growth rate of order volume has entered a plateau since 1Q22 (with the explosive recovery of the ride-hailing business), whether from a year-on-year perspective or relative to 2019. It can be seen that the growth of the company's order volume has basically bid farewell to the impact of the epidemic and entered a stable growth period.

** The company did not disclose the order growth rates for its ride-hailing and food delivery services in detail. However, management stated that the order growth rate for its ride-hailing business was 25% this quarter, while its food delivery business was in the low single digits. Therefore, it is highly probable that the company's short-term future growth will still be driven by its ride-hailing business.

From a pricing perspective, it can be seen that the company's average order value has skyrocketed since Q2 2020 compared to the same period in 2019. The Dolphin Analyst believes that this is mainly due to the shortage of manpower caused by the outbreak of the pandemic, which resulted in a surge in labor costs. Subsequently, inflation and rising oil prices also pushed the average order value to a new level in Q2 2021.

However, in recent months, with the decline in oil prices and the scarcity of manpower no longer worsening, the YoY growth rate of the average order value this quarter has only been 1.3%. Therefore, the favorable impact of price inflation has basically ended.

In addition, the number of monthly active users who have used the ride-hailing or food delivery business on the Uber platform reached 124 million this quarter, an increase of only 2 million compared to the previous quarter. This is the smallest growth in Uber's C-end users except for the two peaks of the pandemic in Q2 2020 and Q1 2022, which also shows that the company's growth momentum is clearly weakening. Among them, according to the company's disclosure, the YoY growth rate of food delivery business users is only 3%.

As the number of new users decreases, the company's order growth rate is mainly driven by the increase in user order frequency. This quarter, the monthly active users ordered an average of 15.8 times per quarter, which is improving on a MoM basis but still lower than the pre-pandemic frequency of 17.2 times per quarter. As new users develop habits, there is still room for improvement.

In terms of monetization, while the ride-hailing business remained stable, the food delivery business exceeded expectations. As mentioned above, as Uber's business in the UK shifted from a platform model to a self-operated model, the company confirmed that its revenue changed from net commission to total payment amount, resulting in an amplification of revenue. Therefore, the following Dolphin Analyst's analysis focuses on the performance after excluding the accounting changes.

Specifically, this quarter, the ride-hailing business revenue was USD 3.82 billion, with a YoY growth rate of up to 73%, which is significantly higher than the market's expected USD 3.62 billion. After excluding the impact of the aforementioned business model changes, the revenue of the taxi business this quarter was RMB 2.72 billion, with a year-on-year growth rate falling to 30.7%, and revenue growth rate slightly lower than the 38% growth in taxi orders. It can be seen that after excluding the impact of business model changes, the actual realization rate of the company's taxi business year-on-year actually decreased from about 21% to 19.9%. Dolphin Analyst believes that as the scale of the taxi business quickly recovers, the company is focusing on promoting the return of online car-hailing drivers, improving capacity, reducing waiting time, and enhancing the user experience, so the company may increase the proportion of income obtained by drivers.

Looking at the trend in the long term, the realization rate of the taxi business has not continued to increase as much as nominal data shows, and there is a marginal downward trend compared to the same period in 2019.

The confirmed revenue of the takeaway business this quarter was USD 2.77 billion, a year-on-year increase of 24%. After excluding the impact of changes in the business model, the comparable revenue was RMB 2.09 billion, with a year-on-year growth of 21.4%, still significantly higher than the growth rate of takeaway order amount. The comparable realization rate after excluding the mode impact has also increased significantly from 13.4% in the same period last year to 15.3% in this quarter. It can be seen that as the growth rate of takeaways slows down significantly and the growth space is limited, the company naturally starts to improve the realization rate and enters the stage of making profits.

In addition to the two core businesses of taxi and takeaway, Uber's freight business achieved revenue of RMB 1.75 billion this quarter, which seems to have increased by 336% year-on-year, but it is actually 7% lower than the market expected. And the explosive growth in scale is mainly due to the impact of the consolidation of the logistics company Transplace. After excluding the impact of the consolidation, the actual growth rate of the logistics business is actually lower. The company's management also stated that in the post-epidemic era, the demand for freight logistics has actually begun to turn. This can also be seen from the significant decline in the company's freight income on a month-on-month basis.

Overall, after adding up various businesses, Uber's total revenue this quarter was USD 8.34 billion, with a year-on-year growth rate still as high as 72.2%. However, after excluding the impact of business model changes in the UK and acquisitions, the growth rate of comparable total revenue should be consistent with the total order amount of 26% or slightly higher.

From the perspective of regional revenue, North America still accounts for more than half of the company's revenue, followed by Europe and the Middle East. The proportion of revenue in the Asia-Pacific and Latin America regions is still less than 20% of the company's total revenue. In terms of year-on-year growth rate, the absolute growth rate of North America and Europe is relatively higher (due to the positive news of the UK business model change and the consolidation of Transplace). However, from a trend perspective, the previously leading recovery in the Americas has begun to slow down, while the Asia-Pacific region, which has the weakest recovery, has finally rebounded and improved in revenue growth this quarter. The Dolphin Analyst believes that since the second half of this year, with the gradual relaxation of border management in Japan, Southeast Asia, Singapore, etc., the Asia-Pacific region, which has been slow in recovery, is expected to become the main force of future recovery.

However, since North America accounts for more than half of the revenue, if the United States weakens significantly after this year, the rebound in the Asia-Pacific region may not be enough to offset the weakness in the United States.

In terms of gross profit, the company achieved a gross profit of US $3.17 billion this quarter, an increase of approximately 32% year-on-year, but slightly lower than the market's expected US $3.4 billion. Under the circumstance of revenue composite expectations, it can be seen that the degree of the company's gross profit margin improvement is lower than the market's expectation of such improvement. Due to recent changes in revenue caliber, the conventional gross profit margin (gross profit/revenue) will also be affected by this. Therefore, we observe the gross profit margin level from the perspective of more stable and comparable gross profit/total order amount. It can be seen that the company's gross profit margin as a proportion of the total order amount has increased year-on-year and month-on-month to a level of 10.9%.

The Dolphin Analyst believes that the main reason for the increase in gross profit is the improvement in the realization rate of the take-out business. In addition, the cost changes of Uber are more related to the growth rate of orders, while the revenue is more related to the order amount. Therefore, the positive impact of the increase in unit price will also be reflected in the increase in gross profit margin.

4. Good cost control helps improve profit release

Although the company's revenue performance this quarter is not satisfactory, and the improvement in gross profit is slightly lower than the market's expectation, the company has made real profits through excellent cost control measures.

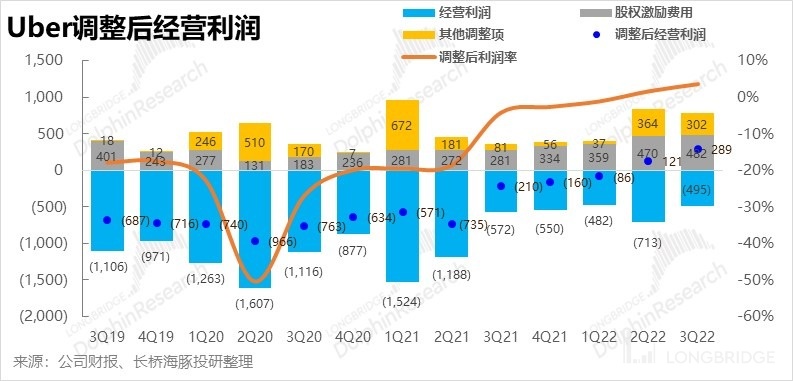

Similarly, due to the issue of changes in revenue caliber, in evaluating operating expenses, we directly compare it with gross profit. As can be seen from the table below, like other technology companies, Uber's research and development and management expenses, which are relatively rigid, are still increasing month-on-month. While the company's revenue and gross profit still have double-digit growth, Uber's expenditure on marketing and operational support has decreased month-on-month.

From the perspective of cost ratio (cost/gross profit), we can also see that the operating support and marketing expense ratios decreased by 2pct and 6pct respectively compared to the previous period. It can be seen that the company has made the biggest reduction in marketing and promotion investment. In terms of absolute values, when the gross profit increased by 250 million, the total operating expenses only increased by about 30 million. Therefore, the operating loss in this quarter also narrowed by 220 million compared to the previous period, to only a loss of 490 million US dollars. It is fair to say that the company's efforts to narrow its losses have been effective.

Furthermore, after deducting about 490 million in equity incentive costs and about 300 million in legal, tax, and regulatory expenses and provisions. Under the non-GAAP caliber, Uber's operating profit this quarter has once again increased to about 290 million in profit.

Fifth, better-than-expected profitability in the delivery business

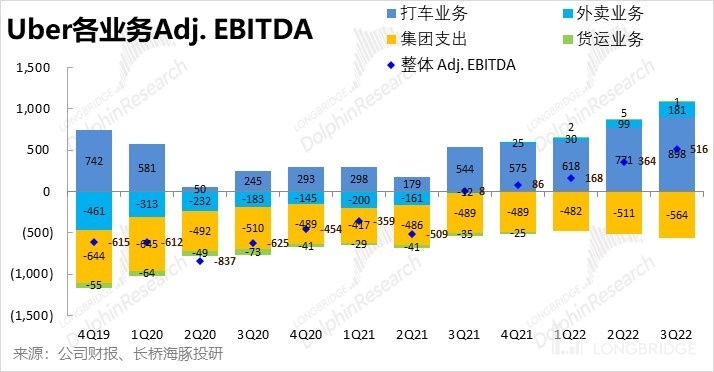

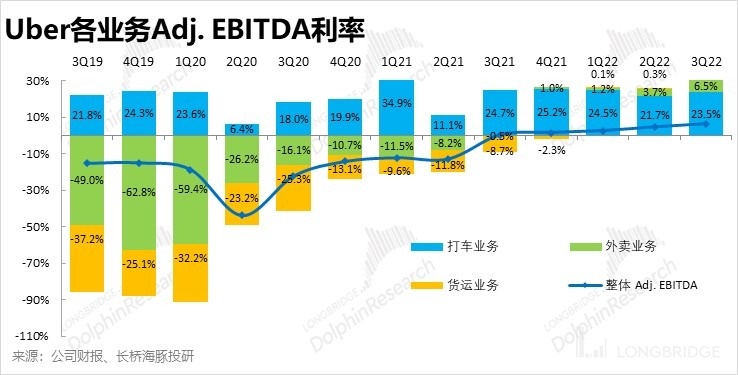

From the perspective of EBITDA, after excluding the adjustments mentioned above, the company's overall adj. EBITDA is actually USD 520 million, far exceeding the upper limit of the company's guidance of USD 440-470 million, and also significantly exceeding the market's expectation of USD 460 million. Looking at the divisional situation, the profitability of the company's ride-hailing and delivery businesses has improved significantly this quarter.

-

The Adj. EBITDA of the ride-hailing business is nearly 900 million U.S. dollars, slightly higher than the market's expected 870 million.

-

The segment that exceeded expectations the most is the delivery business, which realized an Adj.EBITDA of 180 million this quarter, far exceeding the market's expectation of 40 million. Dolphin Analyst believes that the main reason for the higher-than-expected realization rate is the improvement in profitability.

-

As for the freight business, after achieving breakeven in 2022, it has been hovering at a profit level of around 0.1% in the next two quarters (including this quarter), neither making nor losing money, which has no impact on the company's overall profit.

Previous Research on Uber by Dolphin Investment Research:

October 14, 2022 "Through Epidemic and Inflation, the Secret Weapon Behind Uber's Luck" Risk Disclosure and Statement for this Article: Dolphin Investment Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.