Posts

Posts Likes Received

Likes ReceivedNo matter how bad the news is, how much appeal does Airbnb have left?

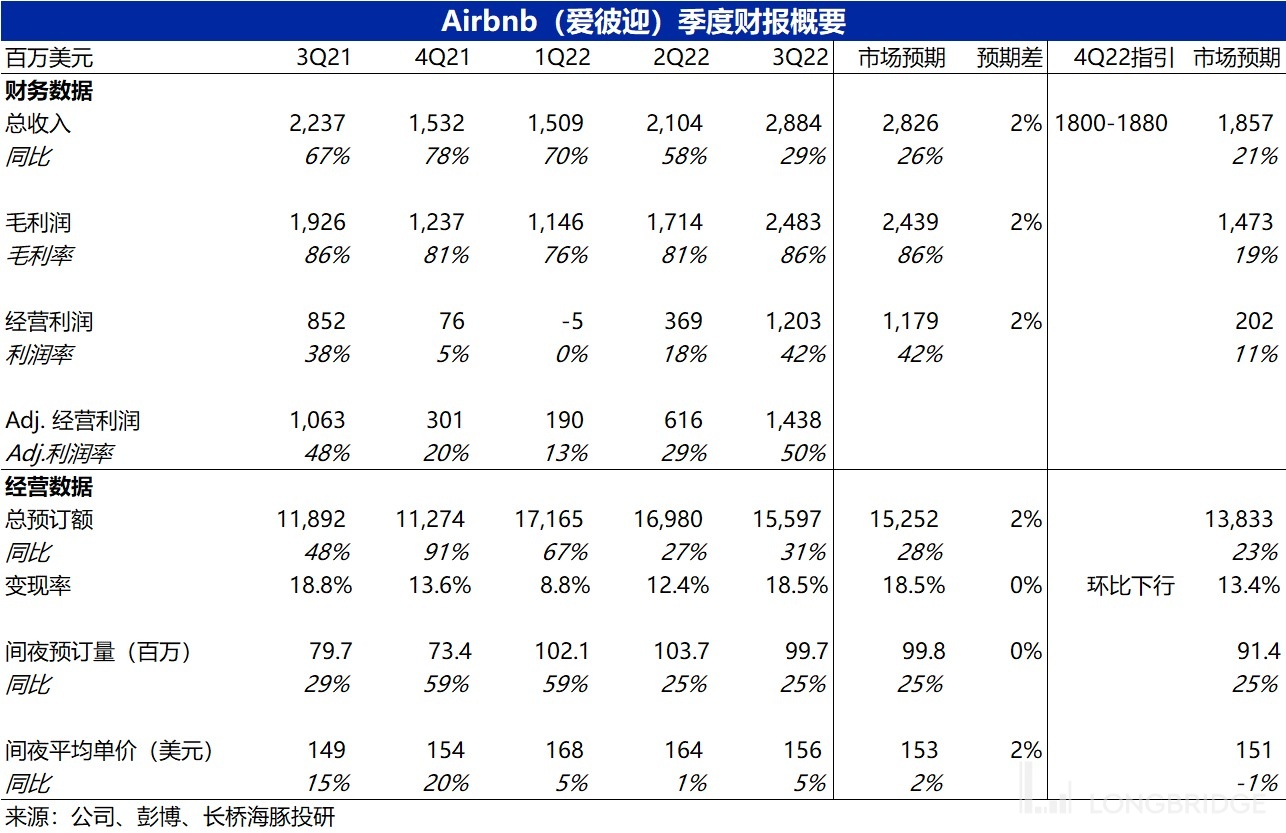

After the US stock market closed on November 2nd Beijing time, Airbnb released its third quarter financial report for 2022. Overall, the key indicators were basically in line with expectations, with a mediocre performance. The details are as follows:

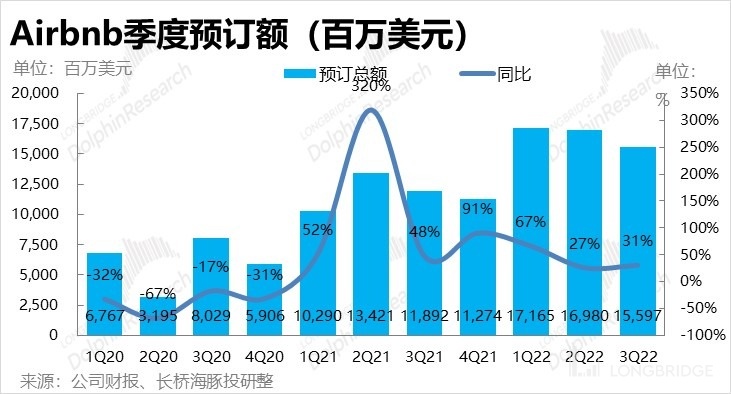

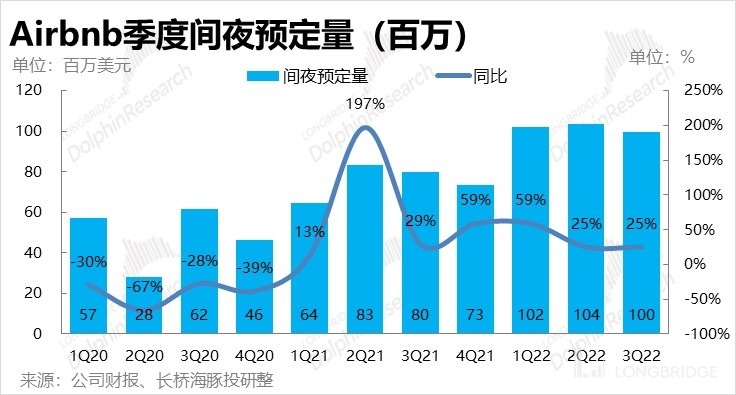

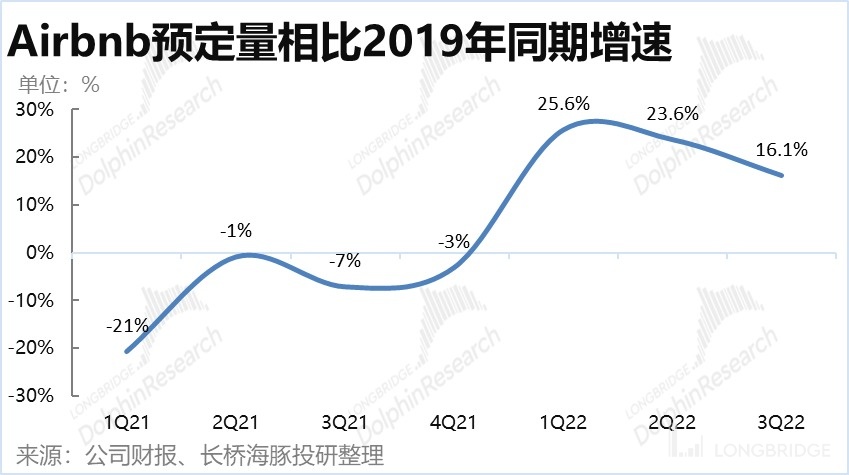

1. Weak Quantity, Strong Price, Sustainable, Normalized Growth after Reactive Rebound? In the quarter, Airbnb achieved a total amount of housing bookings (GBV) of 15.6 billion US dollars, slightly higher than the market's expected 15.25 billion. The year-on-year growth rate has also increased from 27% in the previous quarter to 31%, indicating that the growth in booking amount is still stronger than expected. In terms of price and quantity, the downside risk of strong price and weak quantity since the previous quarter has continued into this quarter. The total number of booked nights on the company's platform this quarter was 100 million, which is actually a rapidly decreasing growth rate of 16% compared to the same period in 2019. In terms of trends, the demand for travel surged from the first quarter of 2022, and after two quarters of digestion, the demand for travel has entered a normal growth range.

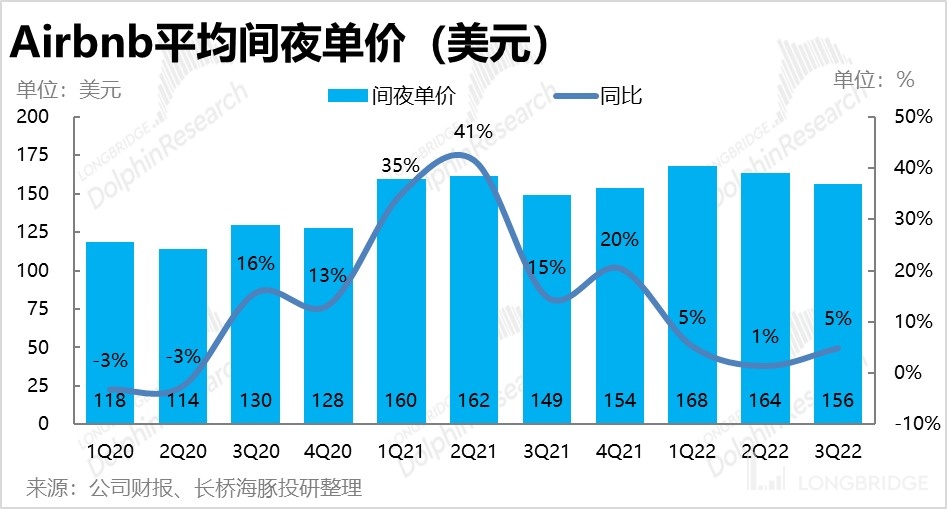

In terms of price, the average price per booked night this quarter was $156, a year-on-year increase of 5%, higher than the market's expected $153. The price increase is the main reason why the booking amount is stronger than expected, but the rise in the average price per booked night is completely caused by price inflation, and the impact of booking structure on the average price is actually negative.

2. Flat Monetization Rate, Revenue Growth No Longer Leveraging: The company's revenue this quarter reached 2.88 billion yuan, slightly higher than the expected 2.82 billion yuan, and the year-on-year growth rate slowed down to 29% under the high base, compared to no longer leveraging the growth rate of the booking amount. However, the absolute scale hit a historical high again, with an increase of nearly 600 million US dollars both year-on-year and quarter-on-quarter. From the perspective of monetization rate, it was 18.5% this quarter, a slight decrease of 0.3 pct compared to the same period last year, and the trend of improvement in the company's monetization rate since 1Q22 has stalled. There may be two possible reasons for this: the demand for travel is no longer too hot, and the competition between Booking and Expedia in the homestay rental track has put more pressure on the company, both of which may prompt the company to reduce commissions to landlords in order to maintain the attractiveness of the Airbnb platform.

3. Gross Margin Improvement Plateaued, but Cost Control Continued to be Outstanding: due to the year-on-year decrease in monetization rate, the company's gross margin this quarter did not continue to improve and remained at 18.5%. But the cost control effect of the company is still obvious. After excluding equity incentive expenses, this quarter's operating support expenses, marketing expenses, and management expenses as a percentage of the company's revenue are all reduced compared to the same period last year, and the absolute value of sales expenses has also decreased compared to the same period last year. R&D investment is the most rigid expenditure for technology companies, and this quarter's proportion of revenue has not decreased but instead increased to 12%.

Overall, while the company's revenue and gross margin scale have increased significantly to new highs, the company's total operating expenses (excluding equity incentives) have only increased slightly. Therefore, the company's operating profit (excluding equity incentives) this quarter was 1.44 billion US dollars, a year-on-year increase of 35%, higher than the revenue growth rate. It can be seen that the company's operating leverage is still being released, but the improvement in profitability is basically in line with market expectations. 4. Is the management team clueless about the cautious guidance for Q4?: Looking ahead to the fourth quarter, the company's guidance for revenue is between $1.8 billion and $1.88 billion, with a market expectation of $1.86 billion. Although the company's guidance range is slightly lower than the market's expectations, it is relatively in line with various indicators.

In addition, the company did not provide guidance on the number of room nights booked or the direction of average daily rates. Dolphin Analyst speculates that the "tight-lipped" guidance from the company may be due to the high macroeconomic uncertainty, making it difficult for the management team to judge whether travel and accommodation demand will slow down beyond expectations. We can pay attention to whether any additional information will be given in the following conference call.

Dolphin Analyst's point of view:

Overall, Airbnb's financial performance in this quarter is basically in line with expectations from various indicators, without any surprising performance to the market. In terms of the trend of company operations, after experiencing a violent rebound previously, both booking volume and revenue growth rates have shown signs of slowing down. From a profit perspective, after the logic of the increase in realization rate has stagnated, the increase in the company's gross profit margin has also begun to slow down. The improvement of the company's profitability is basically achieved by reducing expenses. Therefore, there is no outstanding profit performance.

Looking ahead to the fourth quarter, under the situation where the expected growth of various US stocks companies is still slowing down due to macroeconomic uncertainty, Airbnb is also very cautious about the guidance for the next quarter. As the demand behind Airbnb is optional travel and accommodation, if the macro economy really deteriorates, the impact on discretionary entertainment consumption will be even greater.

Therefore, in the absence of highlights in this quarter's financial report and the overall pessimism about economic prospects in the fourth quarter, the market also shows little interest in Airbnb. Continuing to pay attention to whether the macro-economy is really deteriorating and the travel demand of global residents can guide the tracking of Airbnb.

Dolphin Analyst will share the summary of the conference call with the users of Longbridge App and the Dolphin research group. Users who are interested can add the WeChat account "dolphinR123" to join the Dolphin investment research group and get conference call summaries in real time.

The details are as follows:

I. After the retaliatory travel, growth returns to normal

For Airbnb, the commission earned from renting houses on the platform constitutes almost all of the company's revenue, so the total booking amount of rental houses in the current period is the most important indicator that can reflect the company's operating trend and is the focus of investor attention.

Specifically, in this quarter, Airbnb achieved a total booking amount (GBV) of $15.6 billion, slightly higher than the market's expected $15.25 billion. The year-on-year growth rate also increased slightly from 27% in the previous quarter to 31%, showing that the company's booking amount realization this quarter was stronger than expected.

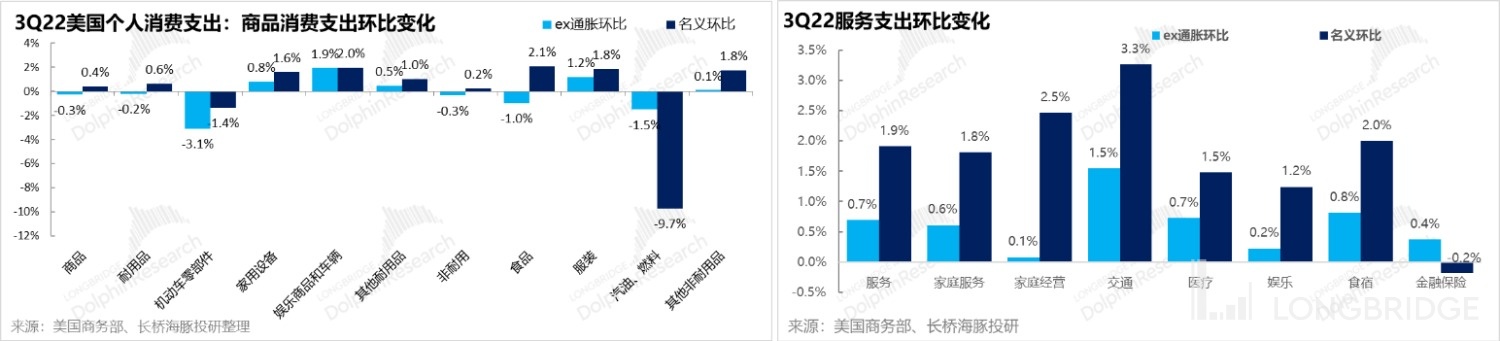

Combined with macroeconomic data from the third quarter of the United States, whether from the perspective of employment or resident consumption, offline activities (travel and entertainment) related industries are still in a stage of recovery and quite prosperous. Inflation-adjusted real growth in transportation and food and accommodation expenditures in the United States is the best performing among all items. Therefore, Airbnb still enjoys the industry's prosperity dividend.

Combined with macroeconomic data from the third quarter of the United States, whether from the perspective of employment or resident consumption, offline activities (travel and entertainment) related industries are still in a stage of recovery and quite prosperous. Inflation-adjusted real growth in transportation and food and accommodation expenditures in the United States is the best performing among all items. Therefore, Airbnb still enjoys the industry's prosperity dividend.

However, although the overall booking amount still exceeds expectations, the hidden worry of strong price and weak quantity since the previous quarter has continued into this quarter from the perspective of price quantity driving. Specifically:

The total number of booked room nights on the company's platform in this quarter was 100 million, with a year-on-year growth rate and the previous quarter remaining at 25%. However, after excluding the impact of the fluctuation in 2021's base figure, the actual growth rate of the company's bookings compared to the same period in 2019 is rapidly declining, at only about 16% this quarter. As can also be seen from the trend in the figure below, there was a surge in bookings in Europe and the United States in the first quarter of 2022 just as the pandemic was being lifted, but as retaliatory travel was digested, the growth rate of bookings compared to the pre-pandemic period continued to decrease, entering a normal growth trend.

Originally, both the company and the market believed that as the rental structure shifts from North America to the world and from vacation hotels to business travel, Airbnb’s average nightly price growth would slow down along with it as travel recovered. However, in reality, the average nightly price this quarter was $156, a year-on-year acceleration of 5%, and higher than the market's expected $153. According to management, the rise in the average nightly price was due to price inflation, and the impact of changes in the company's booking structure on unit pricing was downward.

Looking at different regions and types of bookings,

(1) The number of room nights booked in North America this quarter increased by about 20% year-on-year compared to the same period in 2021, and North American revenue accounted for 40% of the company's global revenue;

(2) Bookings in Europe, the Middle East, and Africa increased by 20% compared to the same period in 2021, with a slightly higher growth rate, and caught up with North America, and the previously lagging recovery in Europe has basically caught up with North America;

(3) The South American region achieved a 33% year-on-year growth rate, and the growth rate was slightly higher. Dolphin Analyst believes that in immature markets such as South America, travel recovery, increased penetration of the homestay industry, and Airbnb's increased market share have helped the company achieve growth rates higher than mature regions. (4) Currently the biggest drag on growth is the Asia-Pacific region, where order amounts continue to decrease year-on-year. However, since the lifting of restrictions in countries such as Japan, South Korea and Southeast Asia, the region has seen rapid recovery this quarter, with order amounts increasing by 65% compared to the same period last year. This is expected to be one of the main sources of growth.

(2) Looking ahead to Q4, the company has forecast revenue between $1.8 billion and $1.88 billion, compared to the market's median expectation of $1.86 billion. Thus, the company's guidance range is slightly lower than expected. In addition, the company has not provided guidance on occupancy rates or average daily rates, so management is unable to determine the growth of total bookings. The Dolphin Analyst speculates that the company is being cautious because of the increasing uncertainty in the macroeconomic environment, making it difficult to judge whether the demand for travel and accommodation will slow down unexpectedly. It is worth paying attention to whether additional information will be given in subsequent conference calls.

As for profitability, management has indicated that the adjusted EBITDA margin in Q4 will be equal to or slightly higher than the 22% level of the same period last year. Therefore, the company's profit margin improvement process may slow down in the next quarter.

(3) Since the monetization rate has remained flat this quarter, the company's revenue growth is no longer leveraging this factor. The quarterly revenue of the company was RMB 2.88 billion, which was 2% higher than the market's expectation. Although the year-on-year growth rate has fallen to 29% due to the high base period, the absolute scale of revenue has increased by nearly USD 600 million in both year-on-year and quarter-on-quarter comparisons.

From the perspective of monetization rate, travel demand has a strong seasonality, with Q3 being the peak season for travel and Q1 being the trough. Therefore, the monetization rate of the company also has similar seasonality, and when analyzing this factor, it should mainly be viewed from a year-on-year perspective.

The company's monetization rate this quarter was 18.5%, which was slightly lower than the same period last year, indicating that the trend of improving monetization rate since Q1 2022 has temporarily stagnated. There may be two possible reasons for this: first, after two quarters of recovery, travel demand is no longer excessively strong, and second, facing competition from Booking and Expedia in the homestay rental industry, the company has felt increased competitive pressure. These factors can prompt the company to reduce commissions to landlords to maintain the attractiveness of the Airbnb platform to them. From the perspective of expectation discrepancy, the monetization rate expected by the market this quarter was also 18.5%, so the actual performance was in line with expectations. IV. Ramp-up of Economies of Scale and Recovery of Profits, but Equity Incentives Remain a Significant Expense

As Airbnb has only recently gone public, the expense of equity incentives constitutes a significant and volatile part of its expenses. Therefore, when considering costs and expenses, we mainly eliminate the expense of equity incentives to better observe the trends in the company's expenses.

Overall, the growth in the company's revenue has slowed after a rapid rebound, but the company's measures for personnel streamlining and cost control are steadily progressing.

Specifically, due to a slight decrease in monetization rate, the proportion of operating costs to revenue in this quarter remained the same as last year. The gross profit margin was not able to continue to improve.

However, from the perspective of expenses, whether it's the proportion of operating support expenses, marketing expenses, or management expenses to the company's revenue, all of them have decreased year-on-year. Among them, sales expenses saw the largest reduction in terms of percentage and even absolute values year-on-year (indicating the enormous performance pressure on advertising companies).

In contrast, R&D spending is the most rigid expense for all technology companies. This quarter, Airbnb's R&D spending as a percentage of revenue increased to 12%, which shows that technology companies generally regard technology as an important productive force.

Therefore, overall, while the company's revenue and gross profit margin are still expanding significantly, the company's total operating expenses (excluding equity incentives) have barely increased from a MoM perspective. Therefore, excluding equity expense, the company's operating profit for the quarter was USD 1.44 billion, a YoY increase of 35%, which is significantly higher than the revenue growth rate of 29%. After deducting equity incentives, the company's GAAP-calibrated operating profit also reached USD 1.2 billion, which again set a new historical high. It is evident that the company's operating lever is still releasing, and the company's profit growth rate is still higher than the revenue growth rate.

However, from the perspective of deviation from expectations, the market's expected GAAP-calibrated operating profit was USD 1.18 billion, which is close to the actual performance. Hence, the degree of improvement in the company's profit base is mostly within market expectations.

Previous research:

2022 August 3rd Earnings Call: "How Does Airbnb Management View the Second Half of the Year? (2Q22 Earnings Call Summary)" On August 3, 2022, Analysis of Financial Statements: "High Valuation Guilty? Good Performance Can't Help Airbnb"

Telephone Meeting on May 4, 2022: "Shared Rides Industry Recovery (Summary of Airbnb's Telephone Meeting)"

Analysis of Financial Statements on May 4, 2022: "The Return of the Airbnb King as the Coronavirus Recedes"

Depth on June 1, 2022: "Airbnb: Growing Momentum, but Low Valuation for Price"

On June 1, 2022: "After the Epidemic, Airbnb and Disneyland Finally Made It"

On April 6, 2022: "Airbnb: A Different Type Under the Epidemic, Why Can Others Fall Behind While It Bounces Back?"

On April 7, 2022: "Airbnb: Crown Too Heavy, Valuation Runs Too Fast"

Risk Disclosure and Statement in this Article: Dolphin Analyst Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.