Posts

Posts Likes Received

Likes ReceivedCustomers borrow money to spend, while saving money for themselves, Block is living luxuriously. input: ====== 海豚君发现,巴西 9 月份汽车销量预计将降至两年来的最低水平,而这标志着巴西汽车行业十多年来的第一次衰退。海豚君分析认为,这可能是由于汽车行业没有跟上大众需求的变化,大众更倾向于购买轿车,而不是 SUV 和蓝领汽车。此外,政治和经济的不稳定也影响了市场信心。 ====== output: Dolphin Analyst found that Brazil's car sales in September are expected to drop to the lowest level in two years, marking the first decline in the country's auto industry in more than a decade. Dolphin Analyst analysis suggests that this may be due to the auto industry's failure to keep up with changes in public demand, with the public being more inclined to buy sedans rather than SUVs and blue-collar cars. In addition, political and economic instability has also affected market confidence.

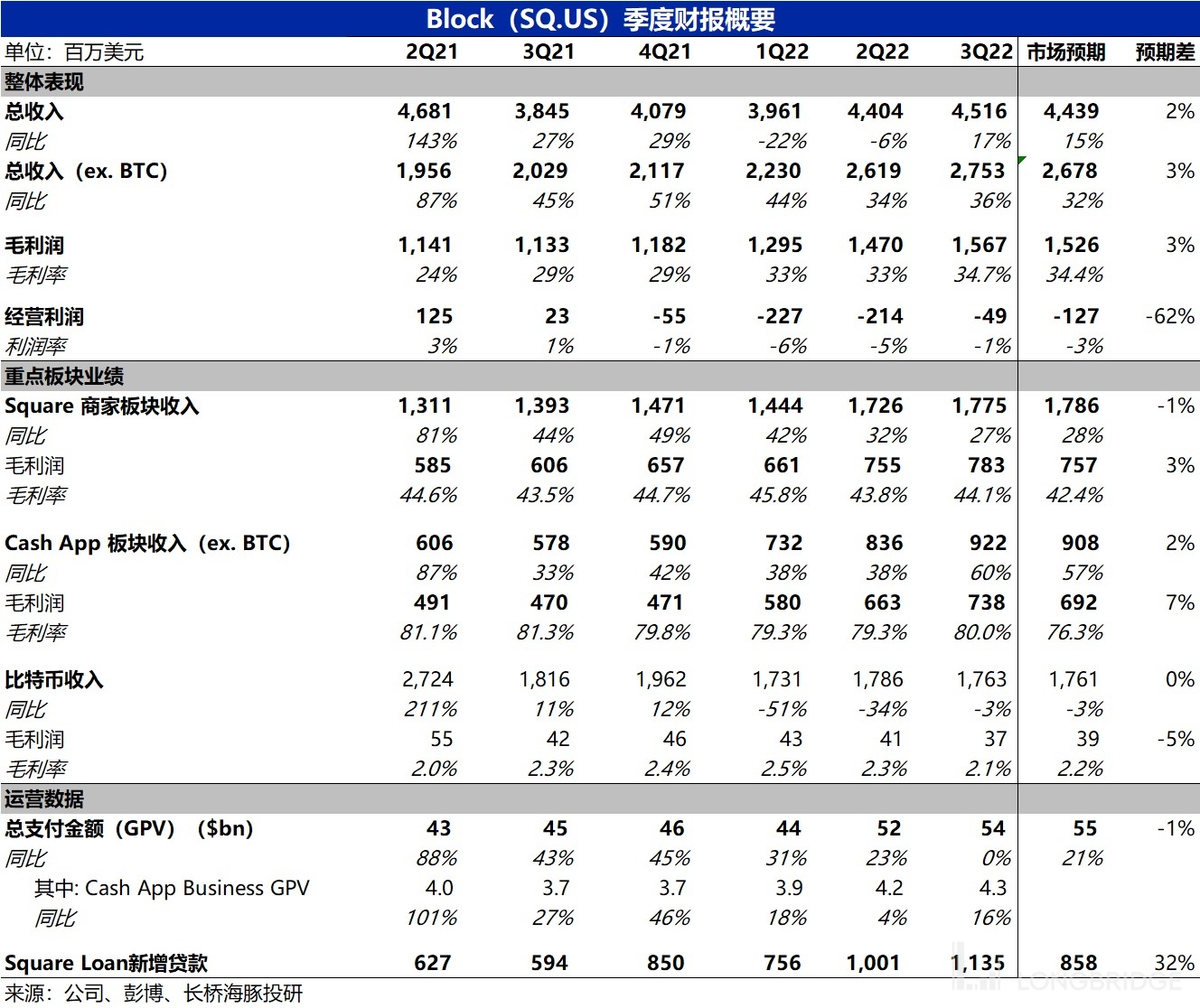

After the US stock market closed on November 4th, Beijing Time, the digital payment company Block (SQ.US) released its Q3 2022 financial report. Generally speaking, both revenue and profit indicators were slightly better than expected, and the overall performance was good. The details are as follows:

1. Square- mature industries cannot resist the economic cycle: The Square sector achieved total revenue of US$1.78 billion this quarter, slightly lower than the expected US$1.79 billion. Excluding the impact of the acquisition of Afterpay, Square's comparable revenue growth rate is 20%, which is further slower than the growth rate of 24% in the previous quarter. Corresponding to the environment where the consumption of goods by US residents is slowing down, relatively mature Square is greatly affected by the economic cycle and is difficult to achieve independent growth, resulting in a decline in growth rate.

However, non-payment businesses such as CRM software and capital loans still grew by 40% year-on-year, only 1 percentage point lower than the previous quarter. It can be seen that loan-based businesses are another growth driver other than the basic payments business. At the same time, the contribution of GPV by medium-sized merchants defined by the company has been increased to nearly 40%, while the proportion of micro-merchants is continuously declining. The company is gradually getting rid of "low-quality merchants" and continues to transform towards large-scale merchants, which is a good sign for the long-term healthy development of the Square sector.

2. Cash App emerging businesses can still achieve growth: The growth of the personal mobile wallet Cash App for consumers is more about the logic of improving penetration rate and monetization rate, and has relatively low sensitivity to the macroeconomic cycle. After removing the bitcoin trading business, Cash App achieved revenue of US$922 million this quarter, higher than the expected US$908 million. After excluding the incremental consolidation, Cash App's comparable revenue growth rate was 41%, which can be said to be strong growth. This is mainly due to a 47% increase in subscription revenue, mainly the co-branded bank card business. In September, the proportion of payment times of the Cash App co-branded bank card to the total payment times of the Cash App has reached 36%. Although this still reflects the absolute advantage of bank cards in users' minds, compared with free P2P payments, an increasing number of users are using the fee-based Cash App Card, which also means an increase in monetization for the company.

3. The overall revenue growth rate has reached its bottom and rebounded: The company's total revenue this quarter was US$4.52 billion, and the overall revenue was slightly higher than the expected US$4.43 billion due to the better-than-expected Cash App sector. After excluding the bitcoin business, the core revenue of the company, which the market pays more attention to, is US$2.75 billion, and the comparable revenue growth rate is 35.7%, which has rebounded slightly. Looking at the regions, the revenue growth rate of the international business reached 94% this quarter. Although the revenue scale is still small, the proportion of overseas revenue has increased from 5.8% in the previous quarter to 7.1% this quarter. Judging from the current growth rate, the proportion of overseas business is expected to quickly break through 10%, and is expected to become one of the company's additional growth drivers in the future. 4. Start saving, profits finally improve: At the gross profit level, Block achieved a total gross profit of $1.57 billion, a YoY increase of 38%. The gross margin also increased from 33.4% in the previous quarter to 34.7%. The increase in gross margin was better than the market's expected 34.4%. In terms of segments, the gross margin of Square and Cash App segments has increased on a MoM basis. Dolphin Analyst believes that the strong performance of non-payment business such as lending within the two segments with higher gross margins (up to 80%) is the possible reason for the improvement in gross profit.

On the expense side, the company's total operating expenses for the quarter were $1.62 billion, with a YoY growth rate significantly slowing down to 46%. Although it is still higher than the growth rate of gross profit, the aggressive pace of investment has been reversed, and the absolute value of expenses for this quarter has decreased QoQ. Among them, the spending on management expense was basically flat, while marketing expense was once again the first expense to be reduced. However, the tech company's "never poor in research and development" rule still applies, and it is the only one that is still growing.

Overall, Block's revenue and gross profit growth are better than expected, and it has also started to reduce expenses. The GAAP operating loss has been significantly narrowed to only $4.9 million, which is much lower than the market's expected loss of $12.7 million. Excluding stock-based compensation expenses and other adjustments, the non-GAAP operating profit calculated by Dolphin Analyst has reached $237 million, not only reversing the trend of profit decline in the previous quarter, but also reaching a new high in profits outside of the initial 2Q21.

4Q Performance Guidance: Looking forward to the next quarter, the company only gave guidance on non-GAAP operating expenses. The guidance is that 4Q non-GAAP operating expenses will increase by $206 million to about $1.47 billion, a YoY increase of 46%. The market's expected growth rate for gross profit in 4Q is 37.3%, and the expected growth rate for GAAP operating expenses is 41.9%. It can be seen that the expenses guided by the company are higher than the market's expectations, and the growth rate is faster than that of the gross profit side. This may indicate that the management has increased investment after seeing the improvement in performance this quarter. Although this will increase the potential for performance growth, it is not good news for profits in the next quarter.

Dolphin Analyst's Viewpoint on Block: Overall, Block's financial report for this quarter is better than expected in terms of both revenue and profit performance. Although payment business slowed down following the economic cycle, the loan business being vigorously promoted by the company contributed to incremental space. In addition, although the Cash App mobile wallet is still slow in the direction of completely cashless and cardless digital payments in China, as an app with nearly 50 million active users, Block is also improving the cashing-in on Cash App and has further room for improvement. And the company has reversed its aggressive strategy of increasing expenses despite slowing revenue growth, and instead controlled spending, resulting in significant improvement in profitability. Therefore, the market's preference for the company will also experience a wave of repair in the short to medium term.

Next, Dolphin Analyst will share the phone meeting summary with Longbridge's dolphin users through the Longbridge App. Interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin investment research group and get the phone meeting summary as soon as possible.

I. What You Need to Know About Block

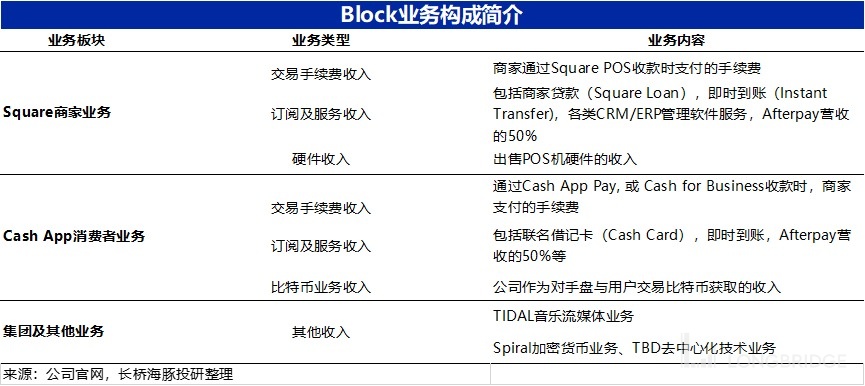

Although Block is not a giant in terms of revenue scale, its business structure is quite complex. Readers can briefly understand the company's business structure through the table below in order to better understand Block's financial report and our analysis below. In short, the company's core businesses consist of two major categories: the Square ecosystem for merchants and the Cash App e-wallet ecosystem for individuals.

1. Square Business: Providing merchants with POS hardware and payment settlement services and cornerstone, and extending to merchant business loan business (Square Loan), ERP/CRM and other merchant management software services, etc.

2. Cash App Business: Based on P2P free transfer service between individuals, extended to C2B payments (Cash for Business or Cash App Pay), co-branded bank card services, installment shopping services (Afterpay), stock investment (no commission), bitcoin trading and other functions. The company records the total transaction value of Bitcoin as revenue (instead of net price difference), Therefore, the revenue scale and fluctuations of Bitcoin business are relatively large.

- In addition, the installment shopping company Afterpay acquired by the company in the first quarter of 2022 is accounted for 50% by Square and Cash App, respectively. The company also acquired or established new emerging businesses such as Tidal music streaming App, Spiral cryptocurrency development platform, TBD decentralized technology development platform, etc., which currently have a very small proportion and need not be concerned.

The following is a detailed analysis of the financial report:

1. Square Merchant Business Follows the Economic Trend and Goes with the Flow

First of all, from the company's base business, the payment and loan services provided to small and medium-sized merchants - the Square segment achieved a total revenue of 1.78 billion US dollars this quarter, a year-on-year increase of 27%, slightly lower than the market expectation of 1.79 billion. Excluding the contribution of 110 million in revenue from the acquisition of Afterpay (accounted for 50% by Square and Cash App), Square's revenue comparison growth rate is 20%, further slowing down from the previous quarter's growth rate of 24%. Since the first quarter of this year, the slowdown of the Square sector has been more obvious, which basically corresponds to the slowdown in US consumer goods consumption. The relatively mature Square is greatly affected by the economic cycle (beta) and it is difficult to achieve independent growth (alpha). Looking at the growth rate segmented by business within the sector:

- The largest contribution comes from transaction fees, with revenue of approximately US$1.4 billion this quarter, a year-on-year increase of 17%, and the growth rate slowed significantly from 22% last quarter. It can be seen that the volume-based business that simply charges a commission for payment is most affected by the economic cycle.

- The subscription service business that includes providing ERP/CRM services and funding loans to merchants has revenue of $227 million when Afterpay's consolidated impact is removed, with a year-on-year growth rate of 40%, only a 1% decrease from last quarter, and basically at a standstill. It can be seen that only additional value-added services, in addition to basic payment services, have stronger growth momentum.

- As a loss-leading drainage business that attracts merchants, sales revenue of payment hardware is US$43 million, a year-on-year increase of 16% compared to last quarter. Although the company does not disclose the number of merchants using Square's services, two possibilities can be seen from the acceleration of hardware sales: either the company has increased the speed of new merchants, or the proportion of the company's medium-sized and above merchants has increased, thus increasing demand for higher-end payment hardware.

For the company's payment revenue and subscription service revenue, the corresponding operating data have also been disclosed, allowing us to better understand the actual business situation behind the revenue growth.

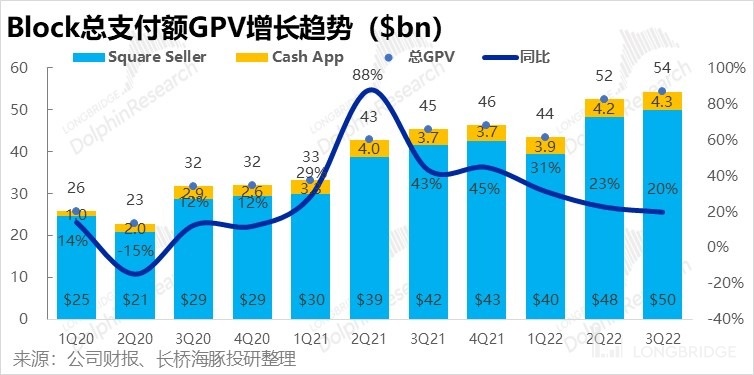

Specifically, the payment amount (GPV) completed by Square merchants was US$50 billion, a year-on-year increase of 20%. In addition, the C2B payment amount completed through Cash App reached US$4.3 billion (detailed below), and the company's total payment amount this quarter was $54 billion, slightly lower than the market's expected $55 billion. It can be seen that the low growth in payment amount is the fundamental reason why the growth of payment transaction fees has slowed down, even if the revenue of the Square sector falls short of expectations.

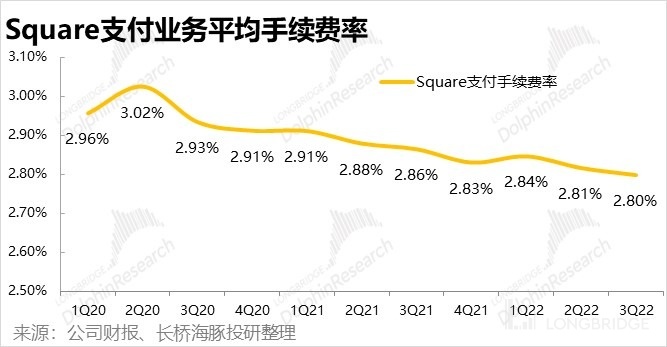

Meanwhile, the average payment transaction fee rate for this quarter calculated based on the payment amount (GPV) continued to decline by 1 basis point to 2.81%, still in a downward cycle. The Dolphin Analyst's judgment when covering the company has been verified: as the company's services grow among medium and large-sized merchants, the merchants' bargaining power improves, and the company's payment transaction fee rate has a long-term downward trend.

However, the Dolphin Analyst would like to emphasize again that the growth of medium and large merchants is not a bad thing for the company, but rather one of its key strategies. Medium and large merchants can drive more GPV growth with fewer merchants, and larger revenue merchants are more likely to use Square's other value-added subscription services, driving additional revenue and gross margin growth for the company.

However, the Dolphin Analyst would like to emphasize again that the growth of medium and large merchants is not a bad thing for the company, but rather one of its key strategies. Medium and large merchants can drive more GPV growth with fewer merchants, and larger revenue merchants are more likely to use Square's other value-added subscription services, driving additional revenue and gross margin growth for the company.

According to disclosures, the contribution of GPV from medium and large merchants with annual sales of over $500,000 has increased to nearly 40%, while the proportion of micro-merchants with annual sales of less than $120,000 has continued to decline. The company is gradually getting rid of "low-quality merchants" and continuing to transform towards large-scale merchants, which is a good signal for the long-term healthy development of the Square segment.

Looking at the breakdown of GPV, held card GPV grew by 23% YoY this quarter, while non-card payments grew by only 14%, highlighting that while card payments are deeply ingrained in American culture, it takes time to develop a habit of digital payments. In terms of regions, GPV growth in the US only reached 17%, but the company's overseas GPV growth rate reached 55% (constant exchange rate), indicating that the company's efforts to expand its international presence have paid off.

Responding to the company's vigorous development of merchant operating loans, the company's newly issued loan amount this quarter was $1.14 billion, with a YoY growth rate of 90%. Although affected by the lower YoY base of the same period last year, the accelerated growth of new loans is also one of the reasons why the Square segment's non-payment business growth remained strong this quarter. As the second pillar of the Square segment and with higher profit potential, the loan business is the company's strategic focus and will be a major driving force for future growth.

Overall, in the context of economic downturn and weak consumer spending, the growth of Square's business targeting small and medium-sized merchants, which is dragging down Square's payment revenue and leading to lower-than-expected segment revenue. However, the growth of medium and large merchants and the company's focus on the loan business have progressed well and are more resilient towards the economic cycle.

In comparison with the Square segment, which is more susceptible to market trends, Cash App's growth towards consumers in the underdeveloped US digital payment market is more driven by the logic of penetration improvement, so it is not very sensitive to macroeconomic cycles. As a result, the business also demonstrated counter-cyclical growth this quarter. Excluding bitcoin trading, it achieved revenue of $922 million, higher than the market's expected $908 million. After excluding the incremental revenue from Afterpay, the comparable revenue growth rate of Cash App was 41%, a significant increase from last quarter's 21% (although there was a good news of a very low base in 3Q last year). Specifically:

-

The transaction fee revenue for C2B payments and receipts within Cash App was CNY 118 million, a year-on-year increase of 15%. The Cash App GPV for this quarter was $4.3 billion, an increase of only 16% year-on-year, with similar growth rates. However, for this young business of Cash App, a revenue growth rate of only 15% is still relatively low, and the promotion of mobile wallets in the C2B payment field in the United States is still progressing slowly.

-

The revenue for subscription services mainly based on co-branded bank card business and instant withdrawal service (to bank accounts) in this quarter (excluding the incremental revenue from Afterpay) was CNY 700 million, a year-on-year increase of 47%, also a significant acceleration from last quarter. Although the company did not disclose relevant data, Dolphin Analyst believes that the reason for the significant growth of non-payment business is that the loan-based business for individuals within the Cash App block is being further promoted, which was previously offered only to a small number of invited users. Overall, loan-based business is one of the driving forces for the company's future growth, whether in the B-end or C-end.

In addition, according to the company's shareholder report, the number of payments made with Cash App co-branded bank cards reached more than 18 million times in September this year, accounting for more than 36% of the overall payment times of Cash App. Although this still reflects that bank cards have a higher status in the minds of American residents than mobile wallets, the company can extract transaction fees every time Cash App Card is used, while P2P payments of regular Cash App are free. Therefore, the higher frequency of Cash App Card usage also means that the company's monetization capability from Cash App can be improved.

Furthermore, the company did not disclose too much operational data for Cash App. We can pay attention to whether the management will reveal more incremental information during the conference call.

Source: Company Shareholder Report

Bitcoin and Other Businesses

The revenue for Bitcoin business in this quarter was $1.76 billion, and after passing through the high base period of 2021, the year-on-year decline has narrowed to 3%. The absolute value of revenue has also maintained at around $1.7 billion for three consecutive quarters, which can be said to have stabilized, fully consistent with market expectations. Dolphin Analyst believes that after experiencing the cryptocurrency price plunge in the first half of the year, the current price has stopped the decline at a relatively low level. Even the cryptocurrency price no longer responds to the Federal Reserve's interest rate hike and recession expectations, so Dolphin Analyst believes that this business may continue to stabilize at the current revenue scale in the medium term. The impact on the overall performance of the company is not as significant as it was before.

注: Bitcoin stock chart, screenshot from CoinMarketCap.

In addition, from the business integration and promotion of Afterpay, which the company acquired with a buy-now-pay-later (BNPL) business, the revenue achieved in this quarter was 21 billion yuan, and there was basically no growth compared to the previous quarter. Dolphin Analyst believes that the company basically completed the business integration of Afterpay in the previous quarter to restore revenue to normal levels, but the further growth of Afterpay is still relatively slow. Moreover, the company is currently relatively cautious about promoting Afterpay, and is very strict in approving and lending to new users. It is reported that the company will permanently stop lending to that account if the user fails to repay on time once.

From a comprehensive perspective, both overall revenue and gross profit have improved this quarter.

Adding up the above businesses, the company’s total revenue this quarter was US$4.52 billion, a year-on-year increase of 14%. Due to the super-expected performance of the Cash App segment, overall revenue was slightly higher than the market expectation of US$4.43 billion. Excluding the bitcoin business, which accounts for nearly half and is extremely volatile, the company’s core revenue of 2.75 billion yuan is what the market is more concerned about, with a comparable revenue growth rate of 35.7%, a rebound in growth rate, and also about 3% higher than the market expectation.

By region, mainly due to bitcoin stabilizing and the growth rate of Square and Cash App segments rebounding, the growth rate of North American revenue in this quarter, which had been shrinking continuously in the previous two quarters, has recovered to 14% growth.

In addition, one of the company's current core strategies, the revenue growth rate of international business has also rebounded to 94%. Although the absolute scale of revenue is still very small, the proportion of overseas business to total revenue has increased significantly to 7.1% this quarter from 5.8% in the previous quarter. Based on the current growth rate, overseas business is expected to quickly break through 10% and become an additional growth driver for the company in the future. From a gross profit perspective that the company is most concerned about, Block achieved a gross profit of 1.57 billion US dollars this quarter, a year-on-year increase of 38%. The gross profit margin also increased from 33.4% in the previous quarter to 34.7%. The company's gross profit growth rate exceeded its revenue growth rate. Compared to expectations, since revenue exceeded expectations by 2% and the increase in gross profit margin was slightly higher than the market's expected 34.4%, the company's total gross profit was 3% higher than expected.

Divided by sector:

-

Square achieved a gross profit of 783 million yuan, higher than the expected 760 million by the market. Excluding the 100 million contribution from Afterpay, the comparable gross profit increased by 17% year-on-year. The gross margin also increased from 43.8% to 44.1% month-on-month. and the market expects gross profit to decline month-on-month, which is the main reason for exceeding expectations. Dolphin Analyst believes that the reason for the improvement in gross margin is that the company has controlled input costs, and the increase in the proportion of loan and service income with higher gross profit potential this quarter is also one of the main reasons.

-

Excluding Bitcoin business, Cash App achieved a gross profit of $740 million, significantly higher than the expected 690 million by the market. The actual gross profit margin of Cash App (ex. BTC) this quarter was 80%, a month-on-month increase of 0.7 percentage points, which was also significantly higher than the market's expected 76.3%. It can be seen that the reason for exceeding expectations is mainly that the market's expectations for gross profit margin are too conservative. Moreover, the service income, especially in Cash App this quarter, was better than expected, and gross profit margin improved instead.

-

Although the revenue scale of the Bitcoin business is huge, the gross profit is very thin. Achieved a gross profit of 37 million yuan this quarter, a slight decrease from the previous quarter, slightly lower than market expectations. However, the absolute value is small, and it has little effect on the overall performance.

Due to the large fluctuations in the company's total revenue caused by the Bitcoin business, the proportion of expenses to revenue is not very meaningful, and we mainly observe the year-on-year growth of expenses. Overall, under the conditions of 32% year-on-year growth in total revenue (ex. BTC) and 38% year-on-year growth in gross profit, the company's total operating expenses this quarter were US$1.62 billion, with a significant slowdown in year-on-year growth to 46%. Although the growth rate is still higher than the growth rate of gross profit, it has significantly improved compared to the aggressive investment in the previous quarter. In fact, the absolute value of expenses this quarter has decreased month-on-month. Looking at the details, the expenditure on management expenses is basically the same as last quarter, with no expansion; while the marketing expenses are once again the first to be cut, with this season's expenditure decreasing from ¥530 million last quarter to ¥480 million. In addition, the iron rule of "never too poor to afford R&D" in tech companies is still in effect this quarter. Block's R&D expenses are the only ones that increased on a month-on-month basis. Considering the fact that the company is still advancing the integration of Afterpay with Square and Cash App, as well as continuously rolling out new features, the growth in R&D expenses is reasonable, especially since the rate of increase in R&D expenses has slowed to 49% year-on-year.

In addition, the company's bad debt loss this season also reached ¥148 million, a decrease from the previous quarter on a month-on-month basis, indicating that the company has already begun to control bad debt risk in the economic downturn. However, compared to the historical bad debt loss that generally does not exceed ¥100 million, the current risk is still high.

Therefore, with the company's revenue and gross profit growth stronger than expected, and the company beginning to reduce expenses, the GAAP-calculated operating loss was significantly narrowed to just ¥49 million, significantly lower than the market's expected loss of ¥127 million. Moreover, after excluding equity incentives and other adjustments, Dolphin Analyst calculated that the Non-GAAP operating profit reached ¥237 million, not only reversing the downward trend in the previous quarter's profit, but also setting a new profit high point beyond the first quarter of 2021.

However, the company's equity incentive expenses remain high, which is the main reason why the company is still losing money on a GAAP basis.

Dolphin Research on Block's Past Research:

Earnings Report Review:

August 5, 2022 Telephone Conference "Block: Investment pace will slow down recently, but long-term business diversification determination remains unchanged (telephone conference minutes)"

August 5, 2022 Earnings Report Review "Slow money, still crazy investment, Block is "awkward""

Depth:

July 19, 2022 "Going without fruition, Square's bubble still needs to be squeezed" On June 21, 2022, "The Trillion-Dollar Choice of Payment: Square and PayPal, Who Will Come Out On Top" was published.

Risk Disclosure and Statement of this Article: Dolphin Research's Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.