Posts

Posts Likes Received

Likes ReceivedDingdong Grocery: Pre-warehouse Seedling, Continuing to Survive

Last Friday evening (November 11th Beijing time), before the US stock market opened, Dingdong released its Q3 2022 financial report. The overall performance reflects the following operating status:

"After leaving the bonus of Shanghai's epidemic, the consumer purchasing power weakened and core members showed rapid loss after a short-term surge. This reflects the short-term (pursuing low prices) or long-term (competitive weakening) migration of consumer habits, which is a risk that needs special attention. In such an environment of hopeless expansion, the company continues to focus on contraction and efficiency improvement.

Under this strategy, the advantage is that Dingdong can gradually achieve self-generation of funds, which will make investors who care about losses more at ease. But the disadvantage is that short-term growth may be greatly discounted, thus affecting the market's higher imagination of Dingdong's valuation.

Due to the existence of offline vegetable markets, supermarkets, community group buying, and other peers, the long logic of the pre-warehouse model still needs to be based on the trend of consumption upgrading, but this is obviously not in line with the current economic environment. Therefore, it is wise for Dingdong to shrink and stockpile food, but at the same time, how much growth space it can still have in the future and when it can be reached, the overall uncertainty is also increasing.

Based on such considerations, the market may not blindly give growth valuation to Dingdong in the short term, at the same time, as China continues to gradually relax, offline consumption will accelerate to rebound short term, which will also partly affect the market's expectations of Dingdong's short-term growth. Therefore, in the short term, Dingdong mainly relies on the improvement of industry beta to obtain some valuation repair. For example, the Friday's soaring was more related to the expectation of slowing down of interest rate hikes and marginal changes in domestic epidemic prevention and control. The volatility of undervalued small-cap stocks was greater, and it was not closely related to the driving force of performance itself.

Detailed interpretation of this season's financial report:

- Reducing Epidemic Bonus, Core Members Surge and Fall

Dingdong's total revenue in Q3 was CNY 5.943 bn, down 4% YoY. Although the base of last year was high, under the decrease of subsidy proportion, the absolute value of revenue was reduced. It was mainly brought by the fact that the consumer purchasing power was weakened apart from Dingdong's contraction (exiting some cities, closing pre-warehouse locations with poor business results).

Sub-item revenue includes:

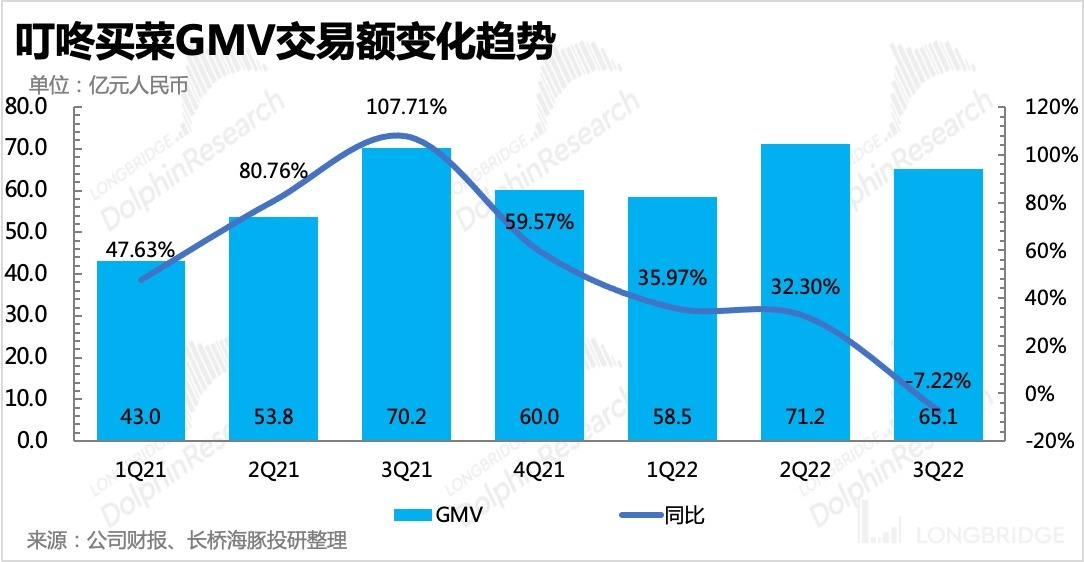

- Product sales revenue was CNY 5.872 bn, down 4% YoY. This quarter's GMV was CNY 6.5 billion, down QoQ. Although there was no epidemic bonus, Q3 is a high season (summer heat is not conducive to food preservation, generally speaking, the number of orders per user will increase). In fact, GMV did not reflect the effect of high season, which indirectly shows that after going out of the Shanghai epidemic, the consumer's actual purchasing power weakened, and they would pursue higher cost-effective offline vegetable markets or reduce the frequency of purchases on Dingdong.

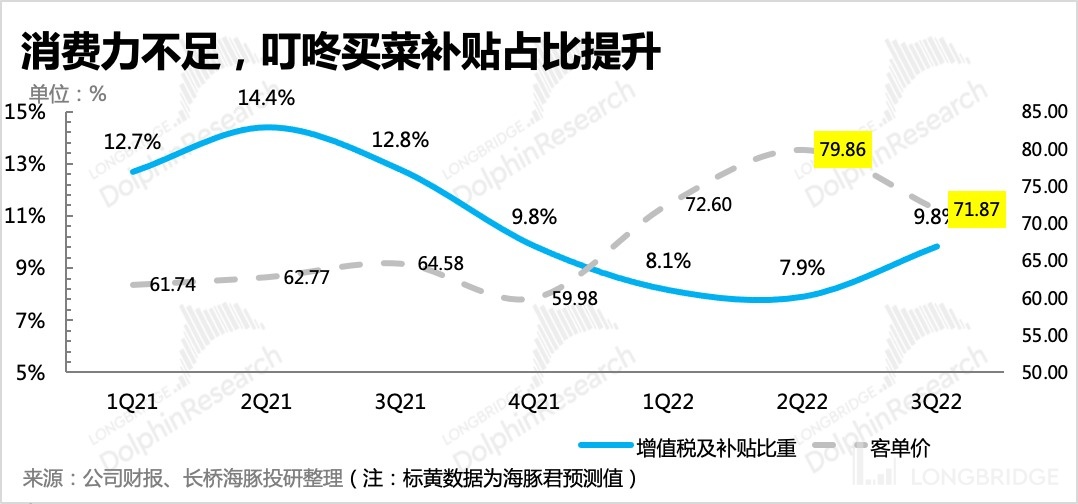

From the perspective of "GMV revenue", the proportion of value-added tax and subsidies in the third quarter has rebounded to 9.8%, indicating that the proportion of value-added tax and subsidies in the previous quarter was a relatively extreme situation under the epidemic situation (high prices, high unit price, fixed subsidy proportion). After the epidemic, the real purchasing power of consumers returned to the original level, but it is lower compared to the off-season in the first quarter, which indicates that user purchasing power may have been weakened.

From the perspective of "GMV revenue", the proportion of value-added tax and subsidies in the third quarter has rebounded to 9.8%, indicating that the proportion of value-added tax and subsidies in the previous quarter was a relatively extreme situation under the epidemic situation (high prices, high unit price, fixed subsidy proportion). After the epidemic, the real purchasing power of consumers returned to the original level, but it is lower compared to the off-season in the first quarter, which indicates that user purchasing power may have been weakened.

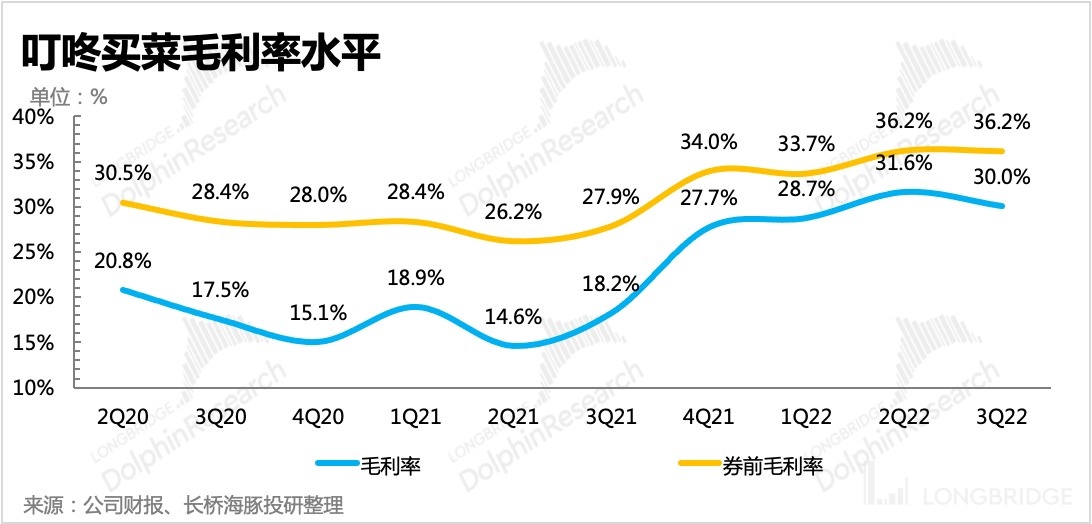

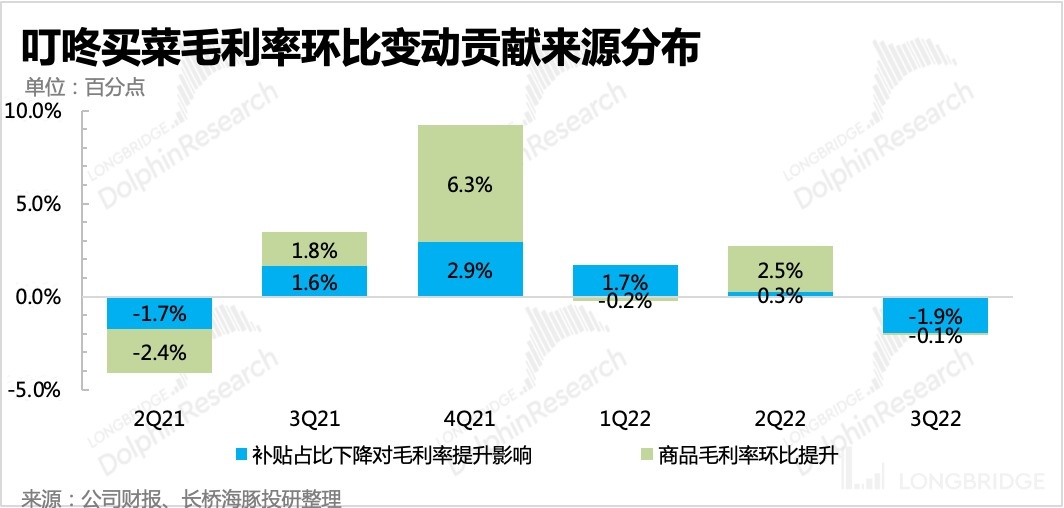

Therefore, the gross margin rate in the third quarter decreased by 2 percentage points compared to the previous period, mainly due to the lower unit price of a single transaction and the increase in the proportion of subsidies. The restored dish gross margin rate remained basically stable, partially reflecting the overall cost control of the Dingdong supply chain end is relatively good.

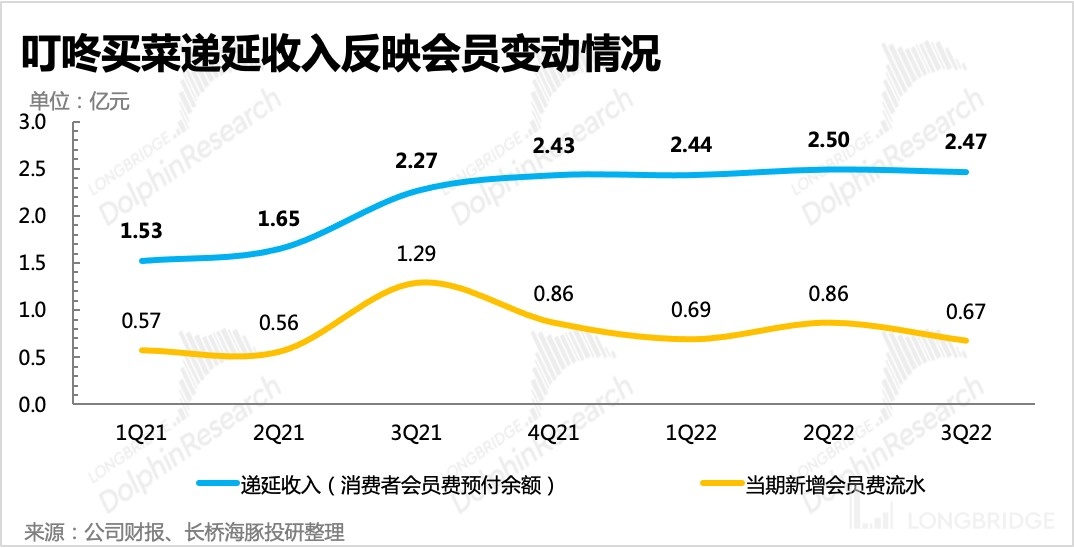

- Service revenue (mainly membership fees) grew rapidly YoY at 4.4%. The sharp drop in this number represents the monthly loss of core members, reflecting poor operating signals. It needs to be tracked continuously whether such a loss is due to short-term pursuit of low prices, or users opting to go to physical shops and markets after the unsealing, or Dingdong's competitive position declining, leading to the migration of long-term consumer habits.

II.

Cost optimization, warehouse closures continue.

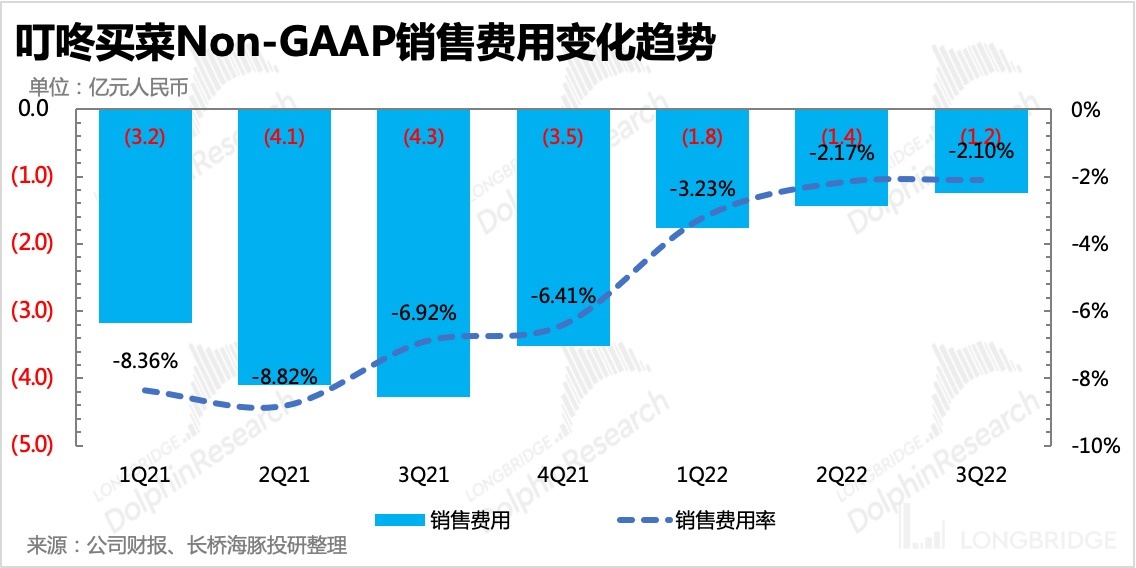

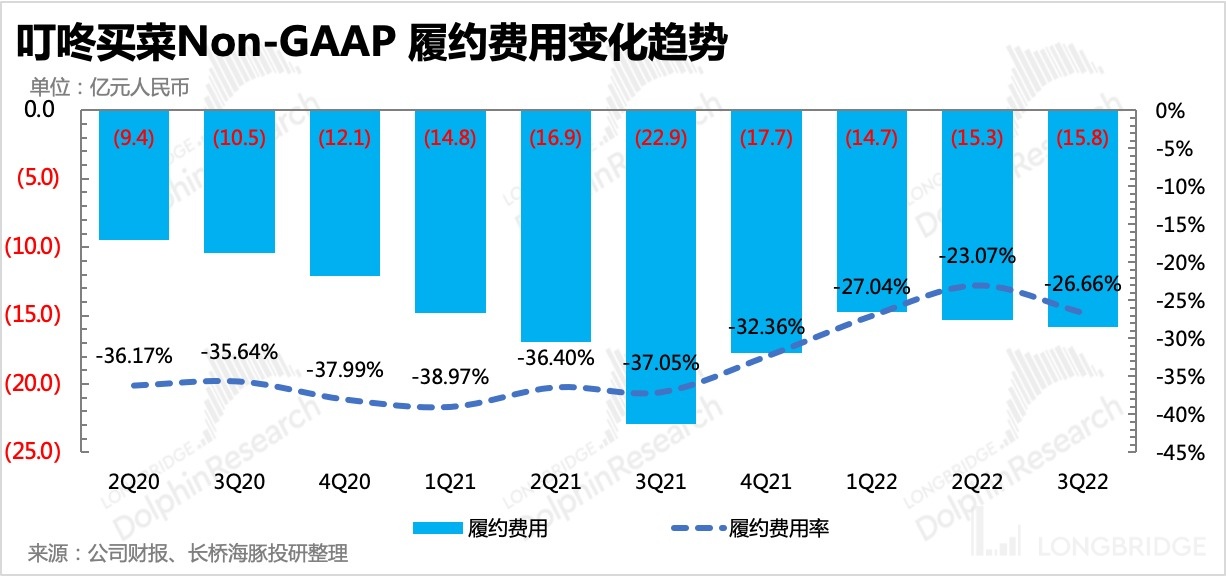

In the third quarter, the cost remained optimized, mainly in terms of sales costs. Apart from layoffs, the previous warehouse locations are still decreasing based on the fixed asset scale. Moreover, the short-term optimization of performance costs may have reached a certain stage, and the absolute value of the decline can only be achieved by closing more front warehouses, which seriously affects the growth of Dingdong. Therefore, there is more room for rate optimization, which can only be achieved by leading more GMV through the recovery of user consumption.

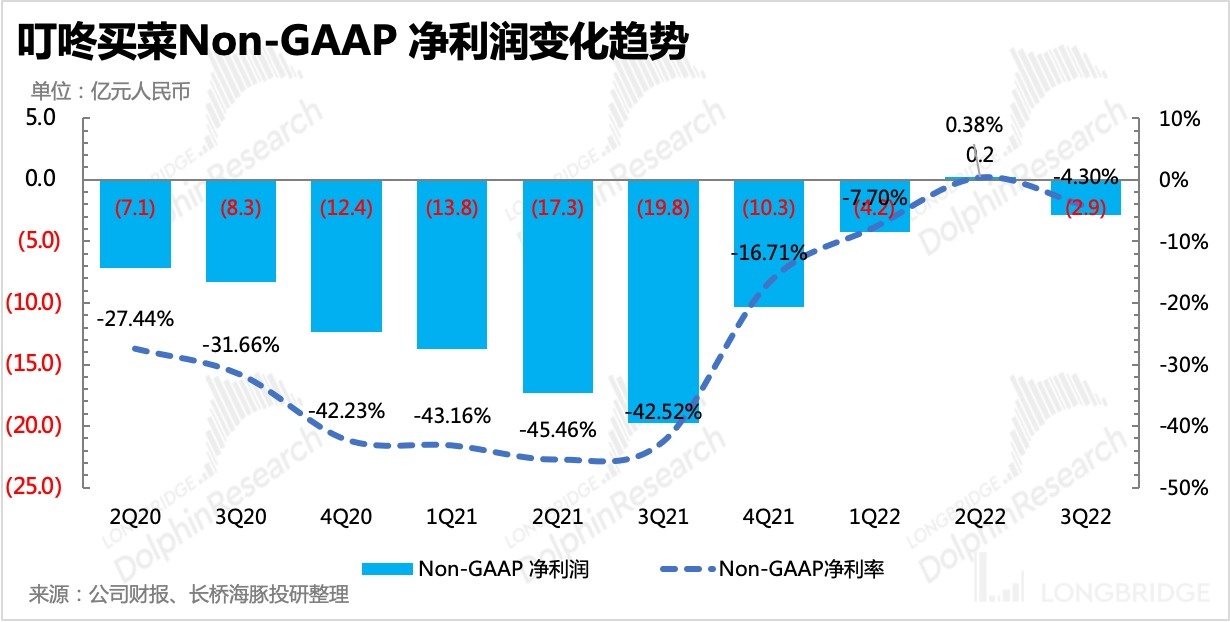

Final Non-GAAP net loss reached ¥290 million, with a loss rate of 4.3%. The pandemic dividend has receded, but the overall trend of optimization persists. The company's phone meeting anticipated Non-GAAP net loss rate to decrease to 1.9% in the fourth quarter, with Non-GAAP operating profit still expected to turn positive.

Final Non-GAAP net loss reached ¥290 million, with a loss rate of 4.3%. The pandemic dividend has receded, but the overall trend of optimization persists. The company's phone meeting anticipated Non-GAAP net loss rate to decrease to 1.9% in the fourth quarter, with Non-GAAP operating profit still expected to turn positive.

III

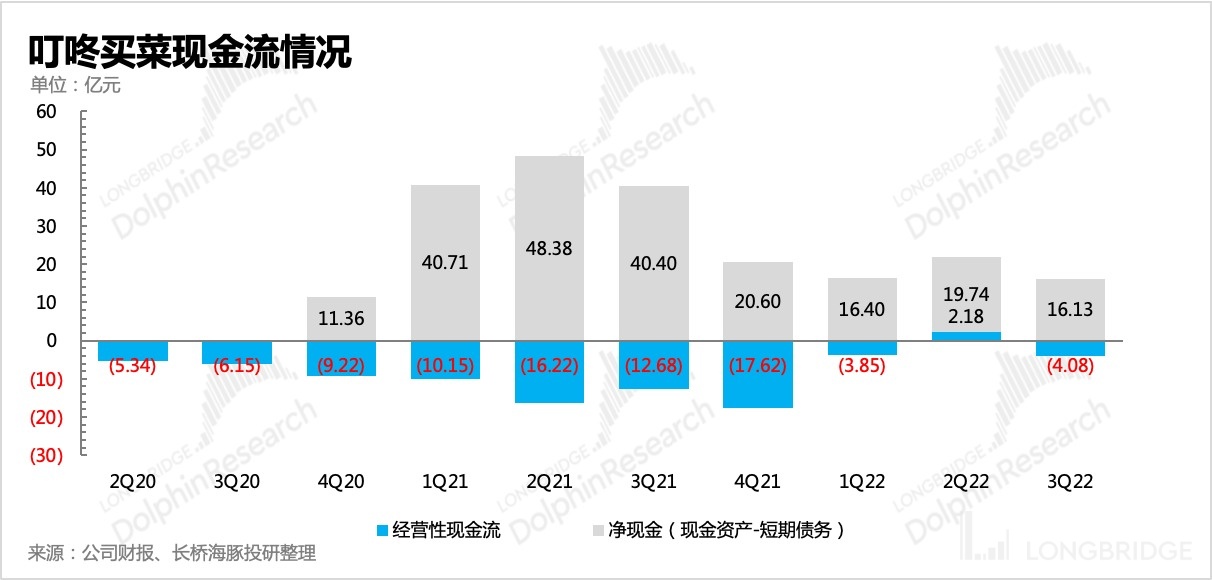

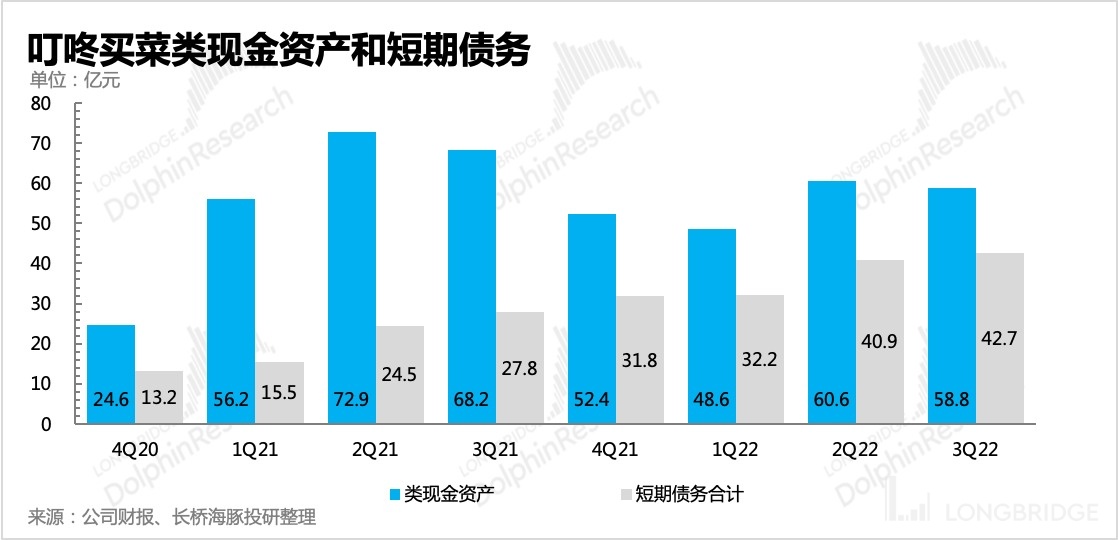

Further depletion of reserves, cash flow remains pressurized despite no crisis

As of the end of the third quarter, Dingdong's cash-like assets totaled ¥5.9 billion, with a net cash of ¥1.6 billion after deducting short-term liabilities, which decreased month-over-month. Despite the absence of a current cash flow crisis, the remaining reserves will continue to be depleted if the operating situation does not improve. Meanwhile, short-term debts are approaching ¥4.3 billion, which is higher MoM, and thus, these cash reserve shortcomings will become smaller, and the pressure will not be low.

Dolphin Research's "Dingdong Grocery Shopping" historical report:

Financial Report

August 12, 2022, "First Quarter Profit, Dingdong Grocery Shopping Becomes the"Last Hero of the Pre-storage""

Depth

June 22, 2022, "The Turning Point of Profitability is Near, Dingdong Grocery Shopping is Not So Desperate"

July 15, 2021, "Dingdong Grocery Shopping (2): Valuation is All About Imagination, It's Not a Good Time Now | Dolphin Research"

July 8, 2021, "Dingdong Grocery Shopping (1): The Overlooked Gem of Pre-Storage?"

Risk disclosure and statement for this article: Dolphin Research’s Disclaimer and General Disclosures

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.