Posts

Posts Likes Received

Likes ReceivedOnline shopping has become the only way out, and offline stores are struggling to survive.

The National Bureau of Statistics released its latest data on social consumption today: "From January to October, the total retail sales of consumer goods amounted to 36.0575 trillion yuan, a year-on-year increase of 0.6%. The retail sales of consumer goods excluding automobile sales were 32.3702 trillion yuan, a growth of 0.5%. Among them, the national online retail sales reached 10.9542 trillion yuan, a year-on-year increase of 4.9%. The online retail sales of physical goods reached 9.4506 trillion yuan, an increase of 7.2%, accounting for 26.2% of the total retail sales of consumer goods; among the online retail sales of physical goods, the sales of food, clothing, and daily supplies increased by 16.7%, 5.3%, and 6.5%, respectively."

Overall, "the consumer market weakened significantly again in October, and the pressure on domestic economic growth is indeed not small when combined with the published social financing data for October," said Dolphin Analyst. However, "I was somewhat surprised to see that the performance of online physical retail was exceptionally strong, with year-on-year growth accelerating for four consecutive months," he added. Specifically,

"1. The retail market turns weak again, Double Eleven advances, online consumption is‘strong’”

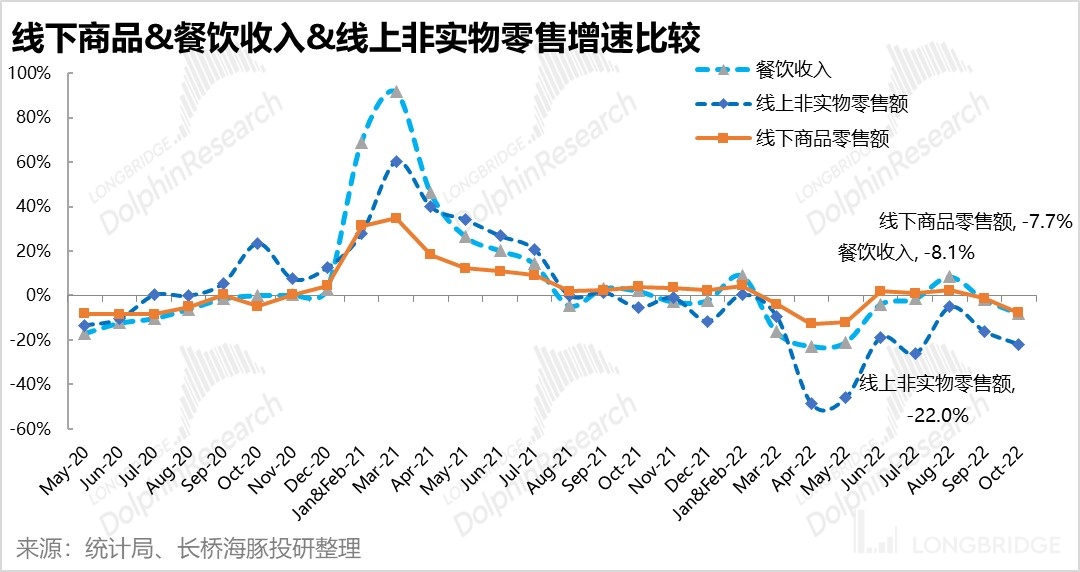

Possibly due to the recent resurgence of COVID-19 transmission in major cities such as Guangzhou and Zhengzhou, the momentum of the retail market has been reversed since June. The overall growth rate of the retail market in October dropped directly from 2.5% last month to a decline of 0.5%, indicating that domestic consumer sentiment is relatively fragile and has little resilience to macro factors. However, the performance of online physical retail was unexpectedly good, with a significant increase in year-on-year growth rate of nearly 8 percentage points to 22% this month, and the penetration rate of online retail in the overall market was as high as 30.1%.

Although online retail will relatively benefit from epidemics, the online penetration rate this month reached the level of the June 18th or Double Eleven period in the past, which is still surprising. Dolphin Analyst speculates that the major e-commerce platforms generally advanced the Double Eleven activities this year, and a large number of consumers had completed shopping before the first phase of Double Eleven on October 28, which may be the main reason for the exceptional strength of online physical consumption in October this year.

Combining with express delivery data, according to the preliminary statistics of the Postal Bureau, the total express volume in October was the same as last year, while the online retail sales growth rate was more than 20%, indicating that the average online transaction price has increased significantly this month. As can be seen from the figure below, the sudden increase in the average transaction price is also a typical feature of the two major promotion periods in June and November. This time, the increase occurred in October. 2. The performance of online physical goods is unique, while other sectors can only suffer

In addition to the "early fattening" of online physical goods, the performance of other retail channels continues to decline and can only suffer. Among them, the consumption of offline goods and catering is similar. In October, they both fell by 7.7% and 8.1% year-on-year, respectively. The growth rate curves of the two have basically overlapped in the past two months. The performance of online non-physical goods is even more miserable. It has dropped by 22% year-on-year in this month. Once the epidemic rebounds, non-physical consumption represented by tickets, admission tickets, and travel will always be more miserable.

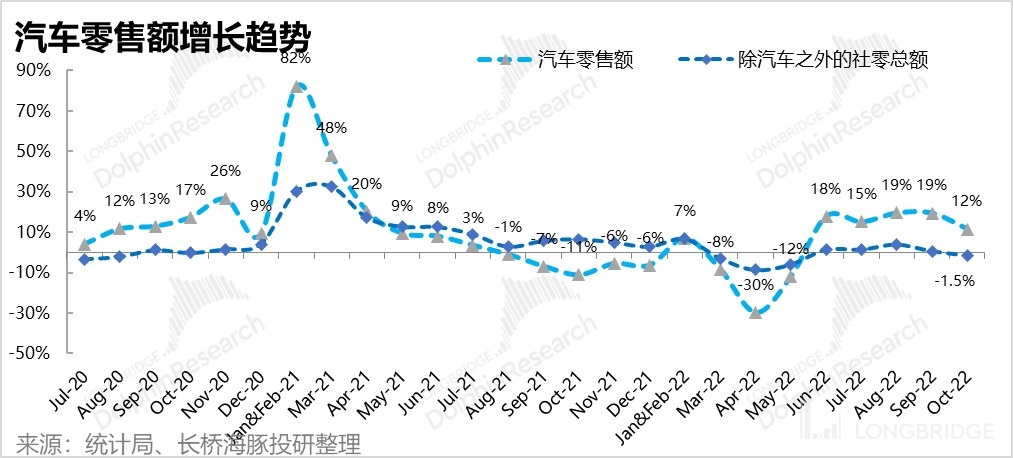

3. Auto consumption slows down, and the real estate completion chain begins to improve?

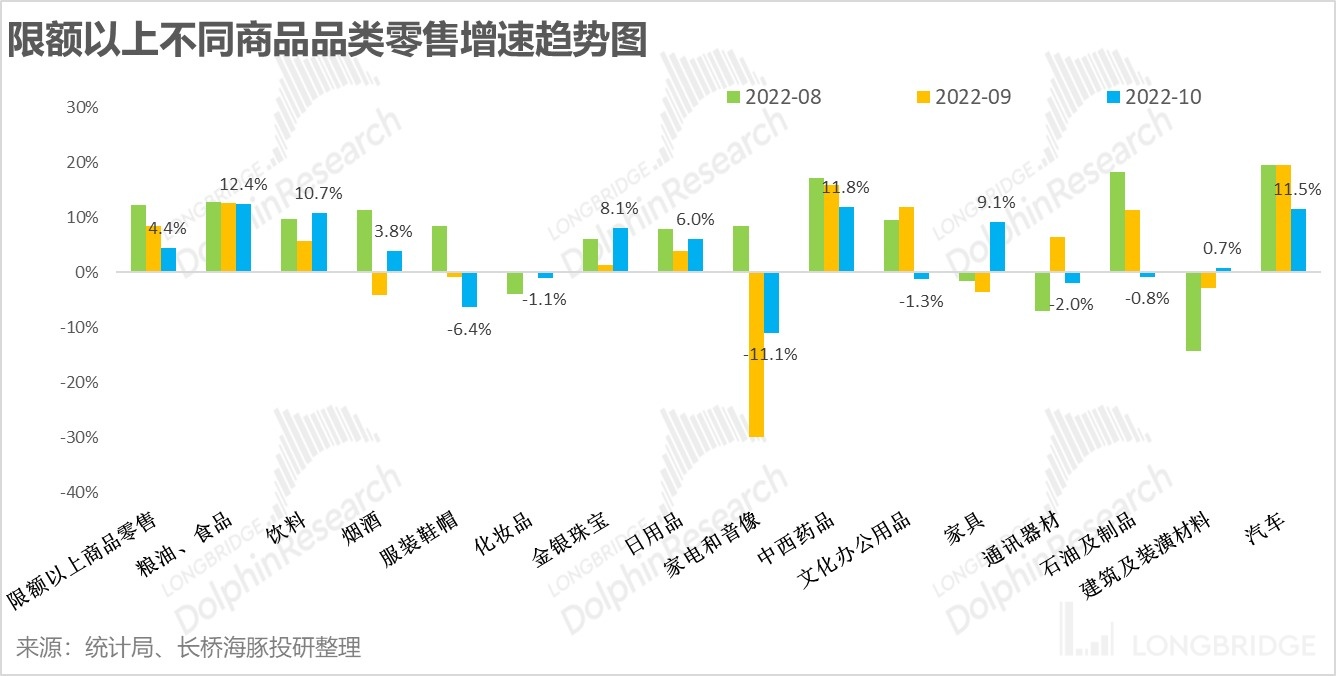

In terms of commodity categories, after strong growth under policy stimulation in the past few months, the retail sales growth of the largest single sector in social retail, the automotive sector, has also begun to slow down significantly. In October, it fell from 19% to 12%, and the demand for automotive consumption has been overdrawn. However, the growth rate of the automotive sector is still one of the highest among all sectors. If the contribution of automobiles is excluded, the social retail scale in this month has decreased by 1.5% year-on-year. In addition, with the decrease in oil prices, consumption of petroleum products has begun to fall year-on-year.

For other categories, it can be seen that the retail sales growth of grain and oil food, beverages, daily necessities, and Chinese and Western medicines still maintains a relatively high level. The consumption of other tobacco and alcohol, clothing and beauty, and home appliances is still weak. In addition, it is worth noting that the growth rates of two real estate delivery-related categories, furniture and building materials, have begun to rebound significantly this month. Dolphin Analyst speculates that with the help of government policies to ensure delivery and supportive loans for real estate companies, the completion of real estate projects has begun to improve significantly.

Risk disclosure and statement for this article: Dolphin Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.