Posts

Posts Likes Received

Likes ReceivedTo lose weight or gain some, they'd do anything. Even Beike risks its profits.

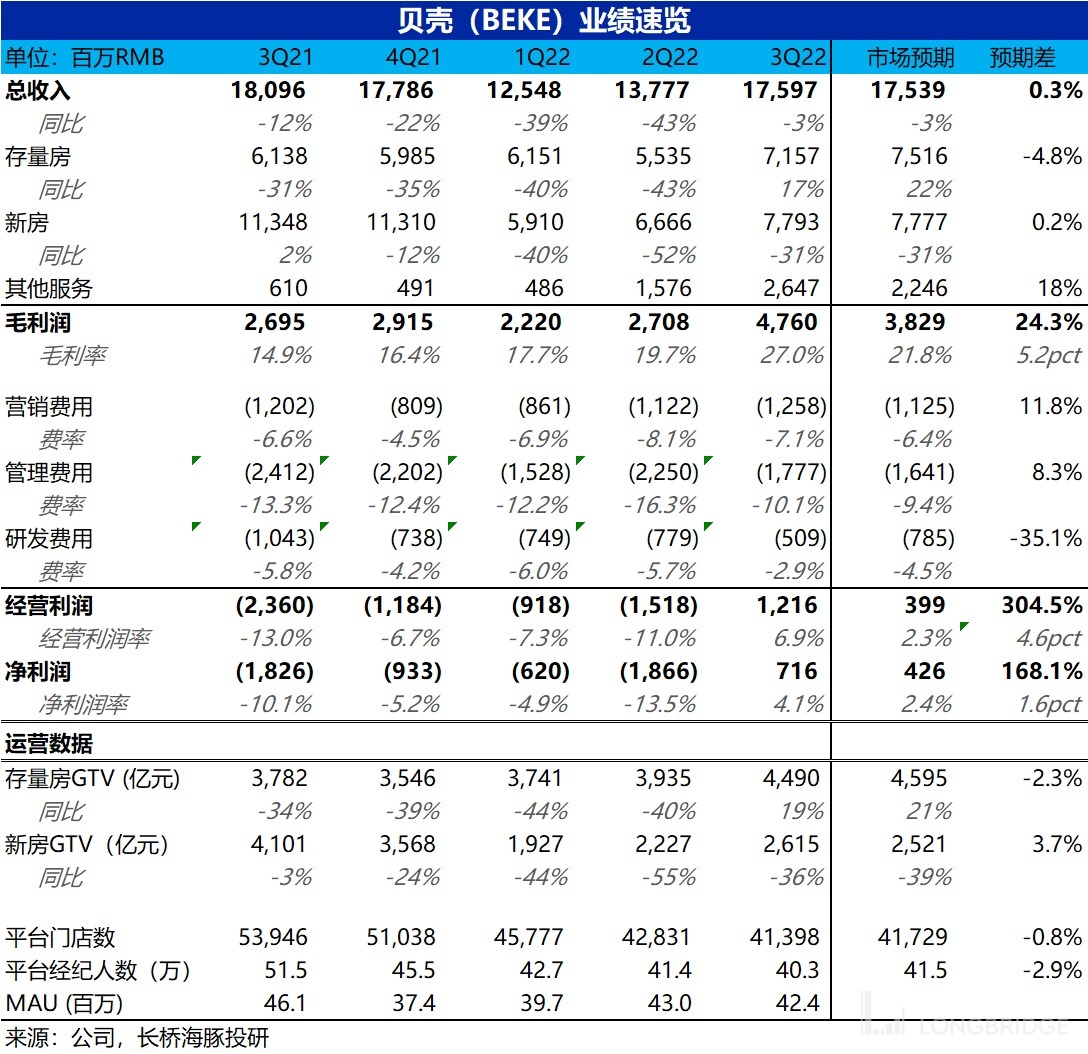

On the evening of November 30th Beijing time, before the US stock market, Ke.com (KE.US) announced its 2022 third-quarter financial report. Overall, the same "routine" of revenue growth and profits far exceeding expectations were achieved. The detailed points are as follows:

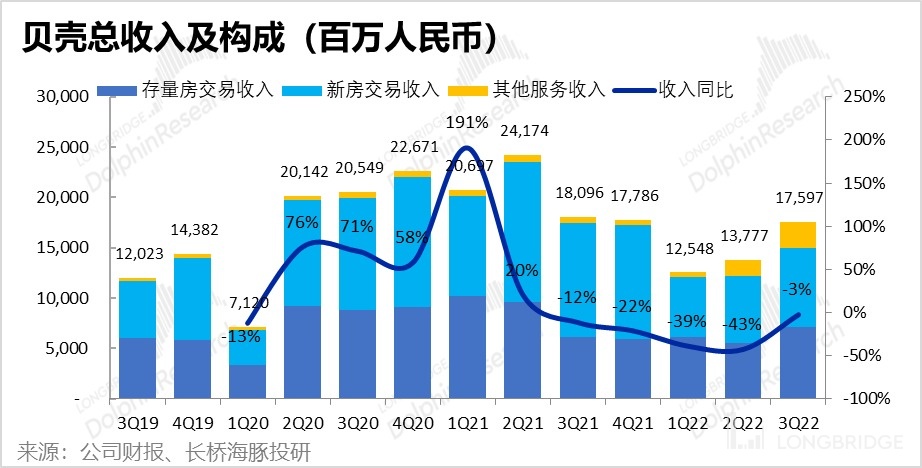

1. This quarter, Ke.com achieved a total revenue of RMB 17.6 billion, a year-on-year decrease of about 3%, which is completely in line with market expectations. By segment, the existing home business achieved a total GTV of RMB 449 billion, up 19% and 14% respectively, quarter-on-quarter and year-on-year.

Although the transaction volume began to rebound, the recovery was actually slightly lower than the company's guidance of 20% year-on-year growth and market expectations. It also did not perform as well as the Dolphin Analyst's tracked key city transaction area, which increased by 17% QoQ. But fortunately, after the second-hand housing transaction heat rebounded significantly, the company no longer needs to offer large commission discounts. The comprehensive commission rate (including platform-type business) also rebounded from a significantly lower 1.4% in the previous quarter to a normal 1.6%. Therefore, the revenue from existing homes actually increased by 17%, but it was still about 5% lower than expected.

The new home business continued to tighten cooperation objects, and the transaction scale shrank more than the industry trend. In this quarter, the transaction volume of new home sales was RMB 261.5 billion, a year-on-year decrease of 36%, which was higher than the 33% decrease in sales of the top 100 real estate companies during the same period. At the same time, the company's accounts receivable at the end of this quarter was RMB 4.89 billion, a further decrease from RMB 5.69 billion in the previous quarter, and the bad debt risk is also clearly decreasing. Fortunately, the market's new home transaction volume has basically stabilized (although it is at the bottom), and Ke.com's new home commission rate has also stopped falling this quarter. Finally, the revenue from new home business this quarter decreased by 31% year-on-year, consistent with market expectations.

The home renovation business continues to expand, and the GTV of home renovation this quarter reached RMB 2 billion, a QoQ increase of 54%, and generated revenue of RMB 1.85 billion, a QoQ increase of 81%. Currently, the proportion of new business revenue in the overall revenue has reached 15%, and this quarter's revenue from new business has far exceeded expectations, which compensated for the shortfall in existing home business, making the total revenue reach the expected target.

2. Closing stores and reducing staff, improving labor efficiency, and significantly increasing gross profit

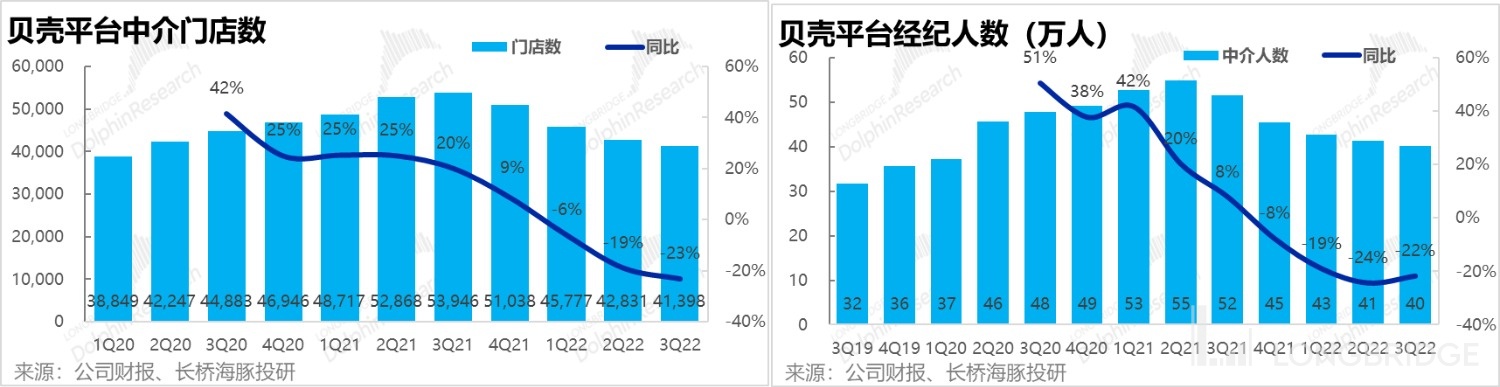

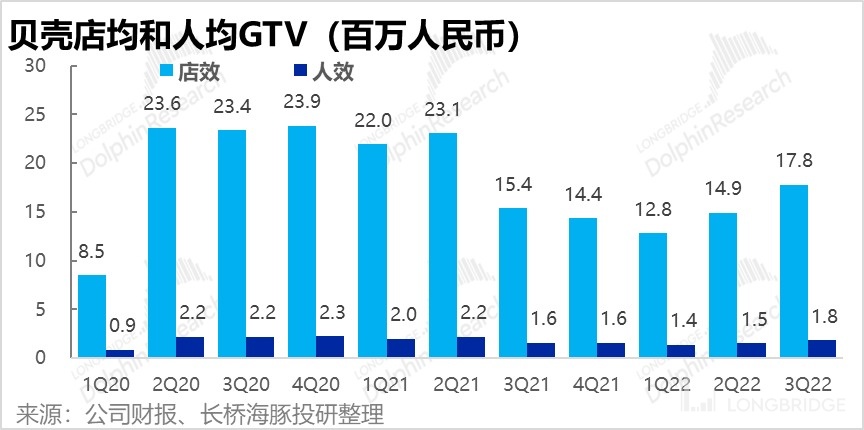

As previously guided by the management, in the third quarter, Ke.com continued to streamline the number of stores and brokers, with the number of stores and brokers decreasing by more than 1,400 and about 12,000, respectively, QoQ. With the reduction of personnel and obvious improvement in efficiency, the GTV contribution of average single store and single broker this quarter increased by 18%~19%.

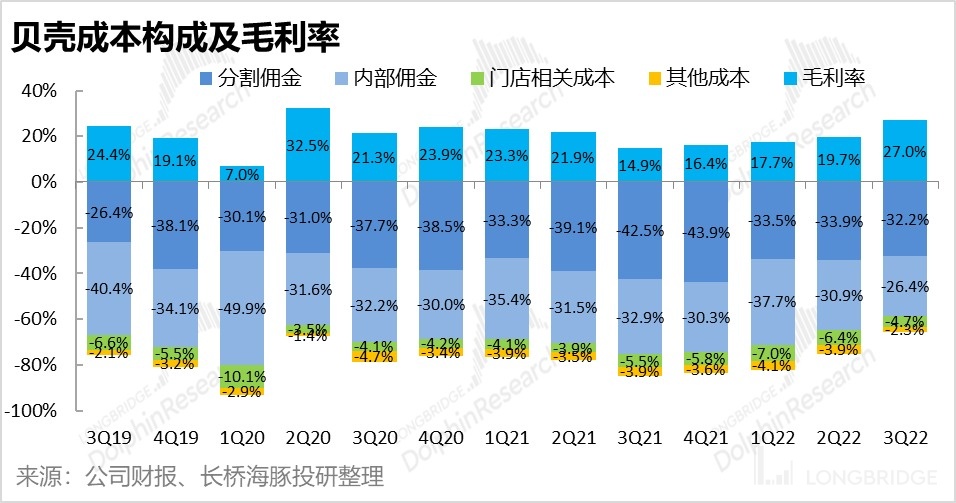

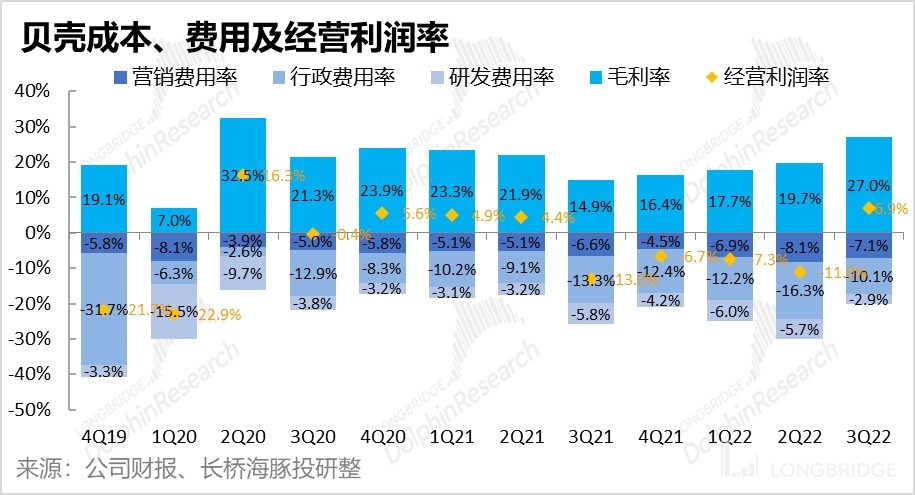

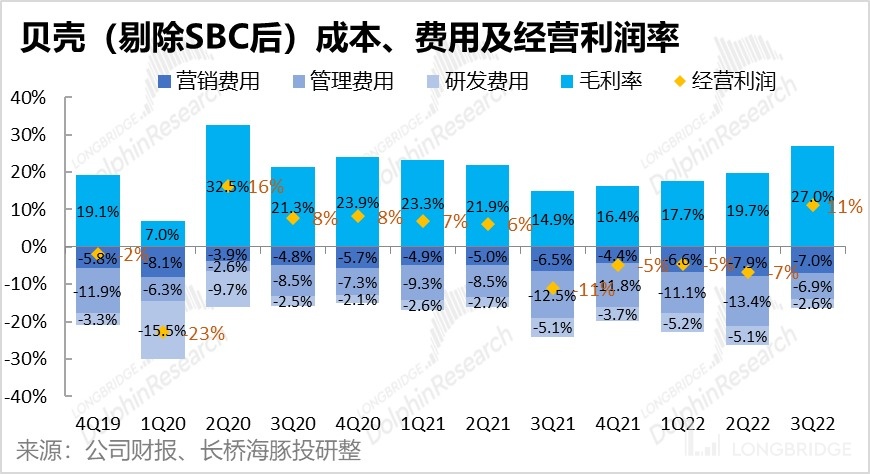

Dolphin Analyst believes that it is precisely because of the reduction in personnel and the improvement in efficiency that Ke.com's gross profit improved significantly this quarter. The gross profit margin increased by more than 7pct on a QoQ basis to 27%, realizing a gross profit of RMB 4.76 billion, a year-on-year increase of 77%, far exceeding the market's expected RMB 3.8 billion. The main reason behind this is that in this quarter, the commission split paid to internal employees by Ke.com decreased significantly from 30.9% in the previous quarter to 26.4%, and the cost of store rent and other expenses also continued to decrease after closing stores.

3. Improving Efficiency while Reducing Costs, Beike Turns Loss into Profit

Although the revenue growth of this quarter is not satisfactory, corresponding to the closure of stores and layoffs, the management and R&D costs have decreased by 26% and 51% respectively compared to the same period of last year. Only these two cost reductions have released about 10% of the profit margin for the company. As the stock-housing business has begun to recover and the home decoration business needs promotion, the marketing costs actually increased by 5% compared to the same period last year. However, under the dilution of revenue growth, the cost rate still decreased by 1%.

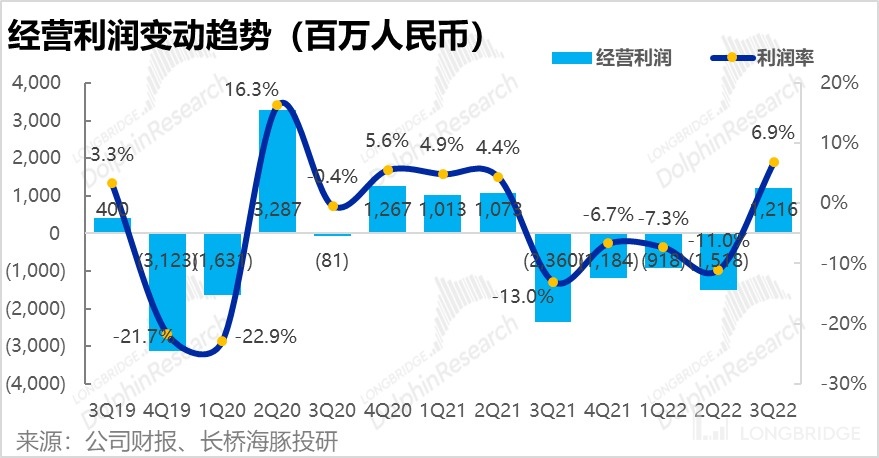

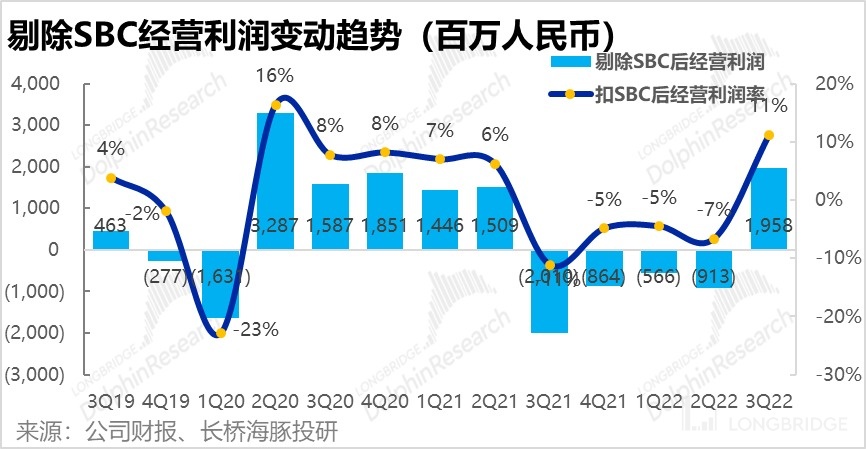

Therefore, under the measures of closing stores, reducing staff, and improving efficiency, Beike's costs and three fees have decreased significantly due to this logic, releasing about 18% of the profit margin for the company. Finally, Beike achieved an operating profit margin of about 7% this quarter, with actual profits exceeding 1.2 billion yuan, far exceeding the market's expectation of an operating profit of about 400 million yuan.

4. Fourth Quarter Performance Indicators, the company's total revenue is expected to fall between 14.5 billion yuan and 15 billion yuan, a year-on-year decrease of 16%-19%, and the scale and growth rate have worsened compared to this quarter. In contrast, the current market expectation for 4Q revenue is as high as 19.6 billion yuan. However, the impact of the domestic epidemic has become more apparent since September. After the real estate market revived for several months after the lifting of the Shanghai lockdown at the end of June, both the new and second-hand housing markets have started to weaken again since October. Therefore, the market's expectations have not been timely updated, and the decline in revenue guidance by the company is also reasonable. However, regardless of revenue degradation, it is bound to be bad news.

Dolphin Analyst's view:

Overall, although the company's overall revenues are only passable, the slow recovery of core inventory businesses makes Beike's revenue performance somewhat unsatisfactory. Fortunately, Beike has been continuously closing stores and reducing staff, and after the scale of revenue has started to recover and personnel efficiency has significantly improved, the company has made unprecedented reductions in commission expenditures and store costs, as well as the administrative and R&D expenditures on the cost side. Therefore, Beike finally turned its losses into profits and released a performance of over 1.2 billion yuan in operating profit, which proves Beike's execution efficiency and its good performance in reducing costs and increasing efficiency.

However, the weak revenue guidance for the company's fourth quarter also shows the severe weakness of the domestic real estate market. Although policies supporting real estate in China have been frequently announced, they are more for protecting the educational facilities and preventing risks rather than stimulating the real estate market. Beike's stock prices depend more on the beta factor of floor turnover. The key to whether it can continue to rebound depends on whether the domestic macroeconomic and buyer confidence can be substantially improved.

Users who are interested in acquiring the company's performance meeting minutes can add the WeChat number "dolphinR123" to join the Dolphin research and investment communication circle to discuss investment ideas together. Detailed Analysis of This Quarter's Financial Report:

I. Existing Housing Business: Expected Recovery with Slight Weakness

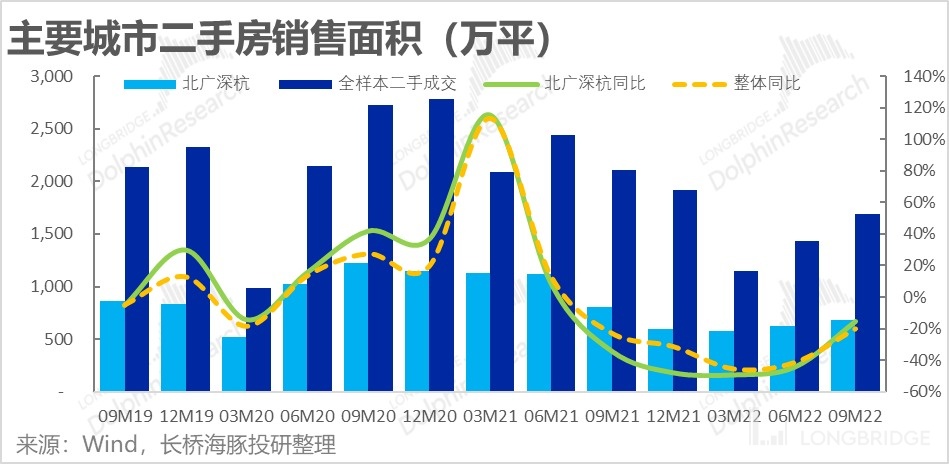

After the lifting of restrictions in Shanghai and other cities in the second quarter, with the continuous lowering of mortgage rates and the "retaliatory" or "hedging" mentality of home buyers, the second-hand housing transactions in major cities (especially first-tier cities) in China began to show obvious signs of recovery. With the improvement of the overall market, Beike achieved a scale of RMB 449 billion in existing housing transactions in the third quarter, up 19% and 14% respectively on a year-on-year and quarter-on-quarter basis.

However, although the transaction volume has bottomed out and rebounded, the actual degree of recovery is slightly lower than the 20% year-on-year growth previously indicated by the company and the expected trading volume of RMB 459.5 billion.

Compared with the industry average, the second-hand housing transaction area in major cities tracked by Dolphin Analyst increased by nearly 18% quarter-on-quarter in the third quarter, while Beike only increased by 14%, indicating that the rebound strength of Beike's existing housing business is even weaker than the industry average. (It should be noted that industry data is based on transaction area rather than transaction volume, and does not account for the impact of changes in housing prices). Therefore, overall, although Beike's existing housing GTV has already bottomed out and rebounded, the strength of the recovery is not as good as the industry average data and the market expectation.

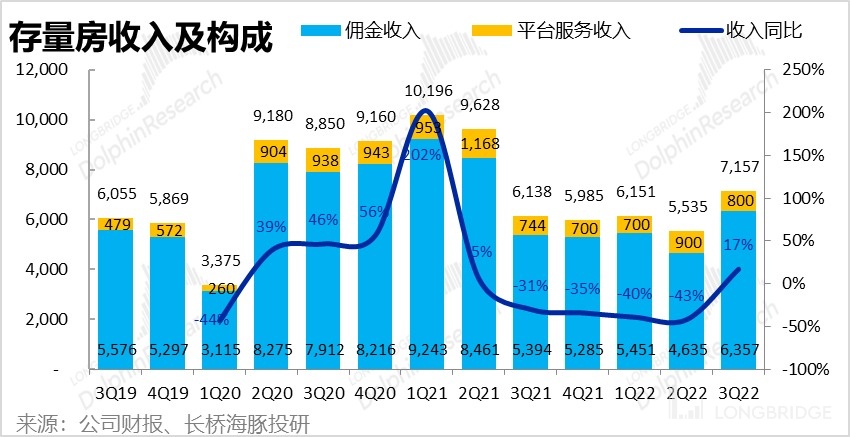

Due to the weaker-than-expected GTV recovery, the revenue of the existing housing business in this quarter of RMB 7.16 billion is also significantly lower than the market expectation of RMB 7.5 billion. Specifically, the platform service revenue collected from the platform-entered stores was about RMB 800 million, down 11% quarter-on-quarter, while the commission income reflecting self-operated business for this quarter was about RMB 6.4 billion, already back to a year-on-year growth rate (+17%). Combined with industry data, it can be seen that the recovery of the second-hand housing market in hot first- and second-tier cities such as Beijing, Guangzhou, Shenzhen and Hangzhou in the third quarter is clearly stronger than that in cities with lower levels. In the revenue structure of Beike, the platform-type revenue is weak, but the self-operated income is strong. Therefore, the lower-than-expected revenue of Beike's existing housing business is mainly due to the weaker-than-expected recovery of the second-hand housing market in non-head cities covered by joining stores.

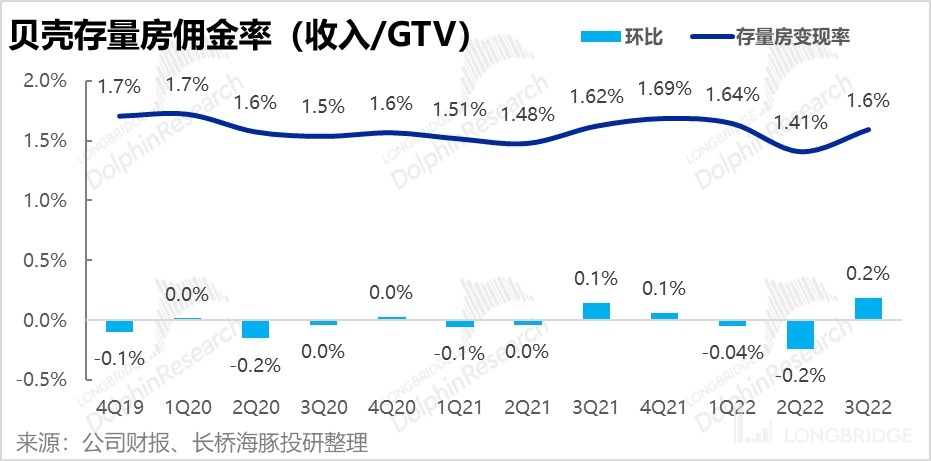

The comprehensive commission rate of the existing housing business (including platform-type business) also rebounded from a significantly low level of 1.4% in the previous quarter to nearly the previous normal level of 1.6% this quarter. Dolphin believes that the main reason for the rebound in commission rates is that in this quarter, the brokerage stores did not close in large numbers as they did in the second quarter, and the heat of second-hand housing transactions is also recovering, so there is no need to provide large commission discounts to stimulate customers to buy houses. However, it is worth noting that there have been rumors in the market recently that the government may take action to limit the upper limit of real estate agency commission rates. Although this has not been confirmed yet, as the small fluctuation in commission rates will have a significant impact on the company's profits, it is worth paying close attention to.

Overall, due to the drag from platform-based business (and its reflected lower-tier cities), Beike's existing home business rebounded as expected this quarter, but the strength was slightly below the market's expectations.

Secondly, for the new home business: safety continues to be the priority, and the transaction volume continues to decline.

Since 2022, in consideration of the security of the return of funds of real estate enterprises, Beike has raised the threshold for cooperation with real estate enterprises in new home sales business. The performance of the company's new home sales business transaction volume has always been weaker than the industry average, and this trend continued this quarter. This quarter, Beike achieved a new home transaction amount of 261.5 billion yuan, a year-on-year decrease of 36%. In comparison, the sales amount of the top 100 real estate enterprises in the third quarter decreased by 33% year-on-year. It can be seen that the degree of contraction of Beike's new home transaction volume is still slightly higher than the industry average.

However, at the same time, the company's accounts receivable at the end of the third quarter was 4.89 billion yuan, a decrease from the 5.69 billion yuan in the previous quarter, indicating that the risk of bad debts is also clearly continuing to decline.

Another good news is that due to Beike's choice to optimize cooperation with real estate enterprises, the overall commission rate for new home business has stabilized at 3% for two consecutive quarters after a downward trend. Therefore, Beike's new home business income did not drop significantly beyond expectations, and this quarter realized revenue of 7.79 billion yuan, which is basically in line with market expectations. Dolphin Analyst believes that with the absolute value of new home transaction volume basically stabilizing (although at the bottom), and real estate enterprises have also passed the most dangerous life and death phase of cash flow, the pattern of Beike's new home business will also become stable. This quarter's new home business of the company is also in line with market expectations and industry performance.

In addition, for the emerging business: home decoration continues to increase, and other sectors are steadily recovering.

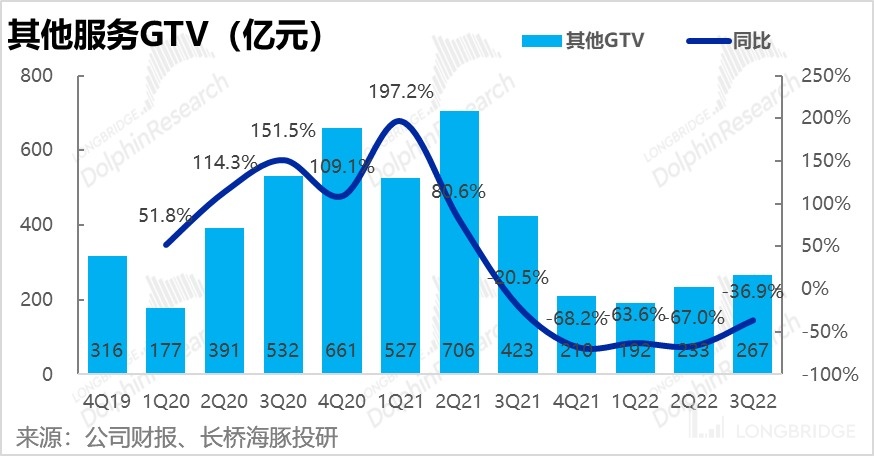

This quarter, the new business sectors including home decoration, financial services, and home services achieved a transaction amount of 26.7 billion yuan, a year-on-year decrease of 37%, but this is mainly due to the base effect caused by the significant contraction of the company's bridging loans and other financial services for home purchase. As a matter of fact, Beike's most valued home decoration segment has achieved a GTV of 2 billion yuan this season, representing a QoQ growth of 54%, and continues to gain traction. The GTV of other services, excluding this segment, is 24.7 billion yuan, showing a QoQ increase of 12%, which basically follows the trend of the stock housing business's recovery.

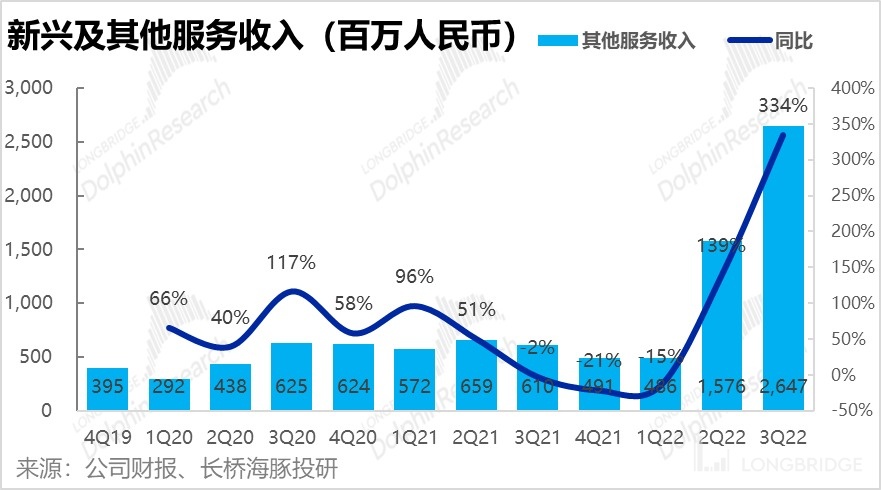

In terms of revenue, although the GTV scale has decreased YoY, the home decoration business generally regards GTV as revenue, while financial businesses, though having a huge GTV, contribute to a low single-digit percentage of the actual revenue. As a result, while the GTV of new businesses is rapidly shrinking, the actual income derived from the new-business block is rapidly growing due to a transition from financial businesses with high quantity and low added value to home decoration and home welfare ones with high added value. This season, the revenue of the home decoration business amounted to 1.85 billion yuan, representing an MoM increase of 81%, while that of other businesses was 800 million yuan, which also increased YoY by 44%. Hence, although the GTV of new businesses is contracting, the actual income generated from the new-business block is rapidly increasing, as the GTV structure shifts from financial businesses with high quantity but low added value to home decoration and home welfare ones with high added value.

IV. The surge of new businesses brings total revenue in line with expectations

Overall, the company's main revenue from the main channel business is somewhat lower than expected because the new housing business has continued to shrink as expected and stock-housing business has started to rebound, but to a lesser extent. On the other hand, due to the change of revenue structure for new businesses, whose degree of attention is relatively low, they have grown beyond expectations. As a result, the total revenue realized by the company has reached 17.6 billion yuan, which is basically in line with market expectations.

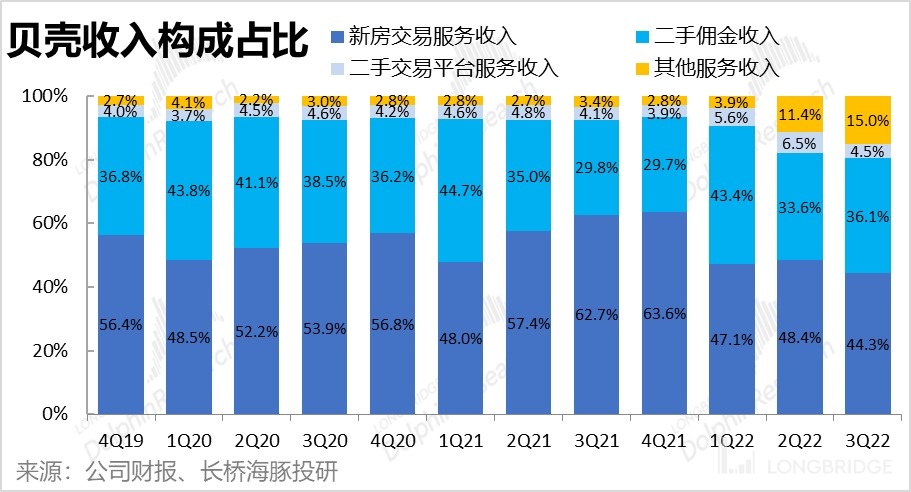

In terms of revenue structure, the proportion of new businesses and stock-housing business is continuously increasing, and the company's main growth and valuation potential in the future also come from these segments, which should be given high attention. Also, the proportion of revenue from platform-type businesses, which Beike has extensively publicized, is only in the single digits and has slightly decreased this season. Dolphin Analyst pointed out in a previous valuation report on Beike that the company is still fundamentally a company with self-owned businesses based on Lianjia and with platform businesses as a supplement, and that the company's performance and valuation mainly depend on the performance of the self-owned parent entity, rather than the transaction volume and scale on the Beike platform.

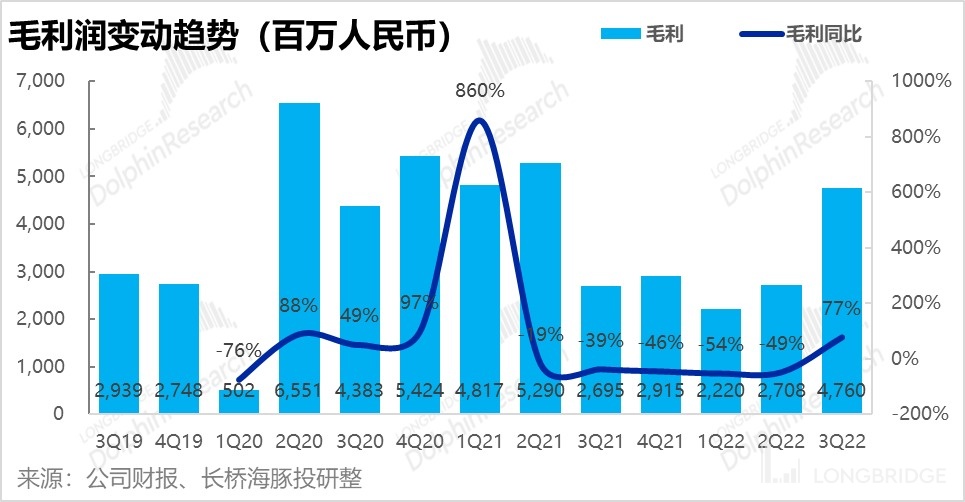

V. Increased efficiency and reduced commission? Significant increase in gross margin Although the company's revenue realization can only be said to have improved as expected, it is not surprising. But Beike's gross margin performance this quarter is quite impressive, showing a significant improvement. This quarter, the company realized a gross profit of RMB 4.76 billion, an increase of 77% year-on-year, far exceeding the market's expected RMB 3.8 billion. This is mainly because the gross margin rate increased by more than 7 percentage points to 27% on a month-on-month basis, and the company's gross margin rate has never exceeded 20% since last year's real estate winter. It can be seen that the improvement in gross margin rate this quarter is quite impressive.

From the composition of costs, it can be seen that the commission paid to external brokers is basically stable, but the commission paid to internal employees has dropped significantly from 30.9% last quarter to 26.4% this quarter. In addition, the historical data in the following figure shows that the commission rate for internal employees has never been lower than 30%. Therefore, Dolphin Analyst speculates that Beike has clearly compressed the commission paid to employees, which may be one of the main reasons for the significant improvement in gross margin rate this quarter. In addition, the company has also reduced the operating costs of stores and other expenses, saving a total of 3.3 percentage points of cost rate. This cost control effect is the second largest reason for the improvement in gross margin.

In fact, the reduction in costs can also be seen from other operating data disclosed by the company. Although the housing transaction volume has begun to marginally rebound this quarter, Longbridge's stores and brokers are still being streamlined and optimized. The number of stores and brokers decreased by more than 1,400 and about 12,000 respectively on a month-on-month basis this quarter. Therefore, it is reasonable for store costs and employee salaries to decrease.

At the same time, the rebound in transaction volume and the continued reduction of stores and brokers means that the average performance of a single store or broker is improving, with each respectively increasing by 18% to 19%. And if the average performance per person is significantly improved, but the salary and rewards paid to employees have not increased in the same proportion, then the company's retained earnings will naturally increase. Dolphin believes that Beike belongs to this kind of situation. (But from the perspective of the sustainable development of the enterprise, this measure is probably a last resort in the predicament.)

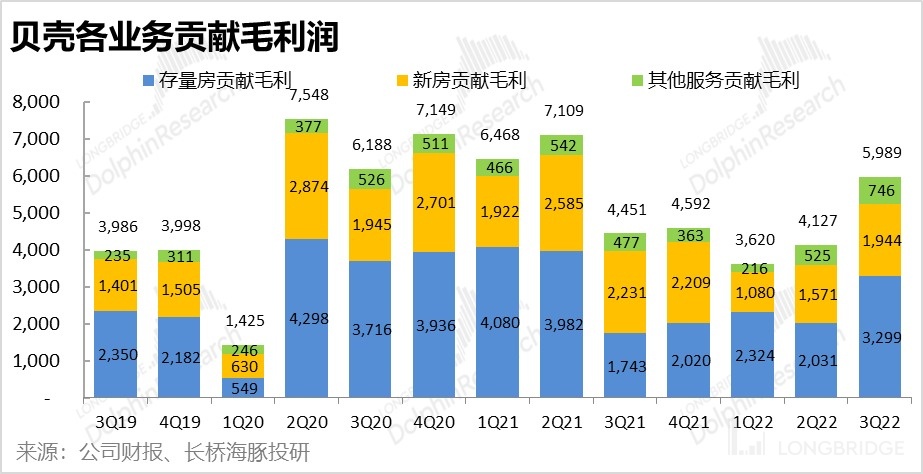

When viewed by segment, due to the aforementioned improvements in personnel and store efficiency, and the decrease in fixed costs based on the number of stores, the gross profit margin of both the stock and new property segments have increased this quarter. The commission rate for the new property segment's income stayed the same this quarter, so the contribution to the gross profit margin increase was limited. However, the commission rate for inventory housing business has also recovered significantly from the trough in the 2Q caused by the epidemic, increasing by 1.8pct this quarter; coupled with a decrease in cost-sharing, the contribution to the gross profit margin has increased sharply from 37% in the previous quarter to 46%.

When viewed by segment, due to the aforementioned improvements in personnel and store efficiency, and the decrease in fixed costs based on the number of stores, the gross profit margin of both the stock and new property segments have increased this quarter. The commission rate for the new property segment's income stayed the same this quarter, so the contribution to the gross profit margin increase was limited. However, the commission rate for inventory housing business has also recovered significantly from the trough in the 2Q caused by the epidemic, increasing by 1.8pct this quarter; coupled with a decrease in cost-sharing, the contribution to the gross profit margin has increased sharply from 37% in the previous quarter to 46%.

Although the gross profit margin of new business segments has decreased due to the increased proportion of heavy mode business like home decoration in the revenue structure, this segment only accounts for a relatively small proportion of 15% of the overall business, so the overall gross profit margin of Beike has finally increased by 4pct to 34%.

V. Increase lean and reduce fat, Beike directly turns loss into profit

Like other Chinese internet companies (except Pinduoduo), although Beike's revenue growth this quarter is not pleasing, under unprecedented cost-cutting measures, the company has turned losses into profits at one stroke this quarter, and the profit scale far exceeded market expectations. However, from the perspective of missed expectations, because Beike's gross profit margin has improved far beyond expectations this quarter, the company's actual investment in expenses is slightly higher than that expected by the market, but this does not change the fact that the profit significantly exceeded expectations.

Specifically, the proportion of the three expenses to income has all decreased this quarter, but the marketing expenses have actually increased by about 5% YoY, so the expense ratio has only decreased by about 1pct. The Dolphin Analyst believes that this is mainly because: 1) the company has turned losses into gains and has money to spend, 2) the core inventory housing business revenue has begun to rebound and return to YoY growth, so marketing investment needs to keep up, 3) Rapid scaling of home decoration business also leads to an increase in marketing expenses.

However, under the continuous measures of closing stores and downsizing staff, management and R&D expenses have quickly shrunk, and they have decreased by 26% and 51% YoY respectively. This is consistent with the trend of decreasing stores and reducing employee profit-sharing mentioned above. The significant reduction in just these two expenses has released a profit margin of 10pct of the income for the company.

Therefore, under the measures of closing stores and downsizing staff to increase personnel efficiency, Beike's costs and expenses have obviously decreased, releasing about 18pct of the profit margin for the company in one go, so Beike has achieved an operating profit margin of about 7% this quarter, with actual profits exceeding 1.2 billion and significantly better than the market's expectation of about 400 million operating profit. If stock-based compensation costs are excluded, the company's adjusted operating profit is close to 2 billion yuan.

Dolphin's Previous Shell Research:

Financial Report Season

August 24, 2022 Telephone Conference Call "How does Shell view the recovery of the real estate market in the second half of the year (meeting minutes)"

August 24, 2022 Financial Report Review "Shell is coming back from the decline, growth is the most important"

May 31, 2022 Telephone Conference Call "Housing transaction business is hit hard, emerging business is steadily developing (1Q22 Shell Telephone Conference record)"

May 31, 2022 Financial report review "Real estate market in deep freeze, Shell can only hold on"

March 10, 2022 Telephone Conference Call "Beyond brokerage business, Shell will focus on home decoration and home services (telephone conference call summary)"

March 10, 2022 Financial report review "Leaving real estate? Shell is going against the trend"

In-depth analysis

June 30, 2022 "Real estate market comes alive, will Shell step forward again?"

December 27, 2021 "Real estate market rebounds? Invest in Shell? Wait a little longer"

December 17, 2021 "Muddy Waters shorts Shell? The small essay is not heartfelt"

December 15, 2021 "From "revolutionizing the industry" to "being revolutionized", can Shell resist it?" 2021 December 9th, "Rebel" Shell: Who's life They Change and Who's Saviour?""

Risk Disclosure and Disclaimer of This Article: Dolphin Analyst Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.