Ideal profit flash crash? Not fatal, but quite "awkward"

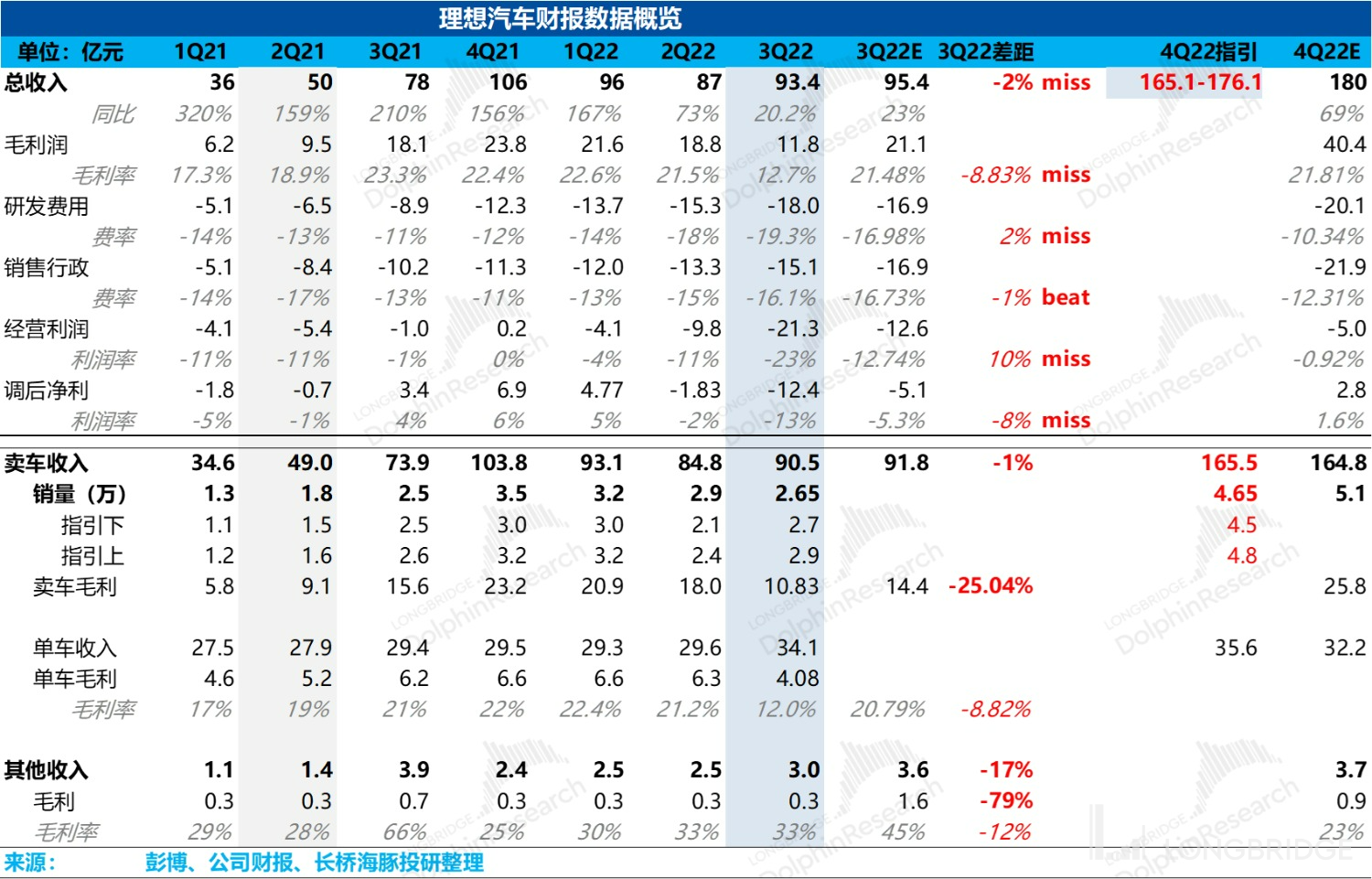

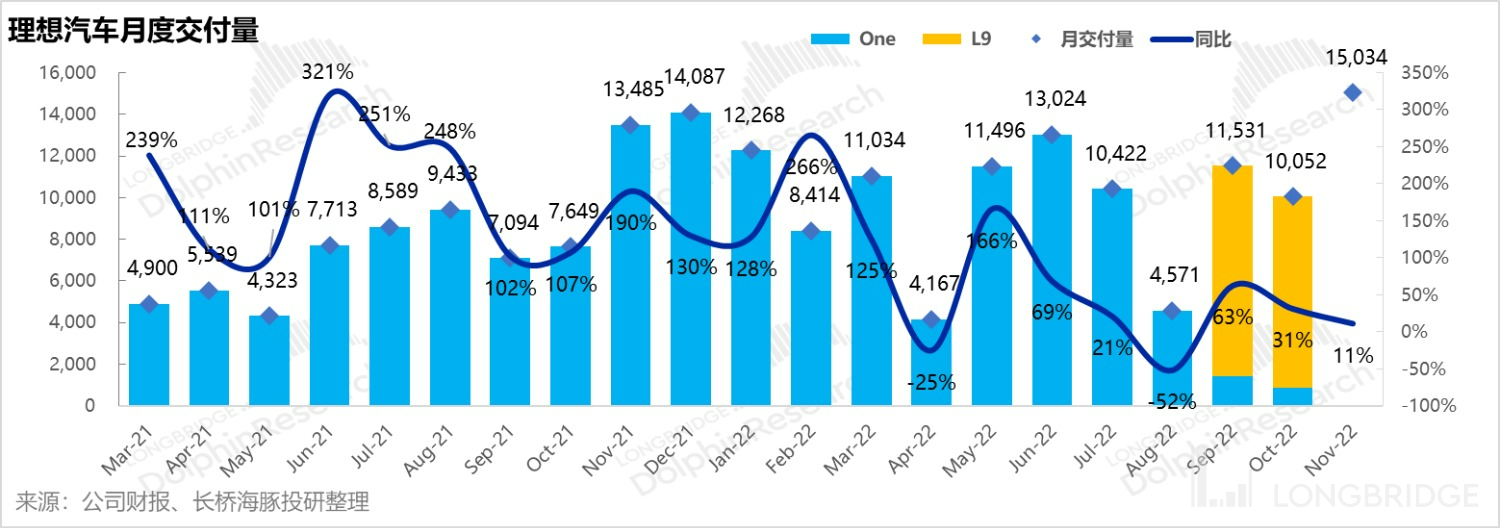

$ Ideal Car.US released its third-quarter financial report for 2022 after market close on Longbridge and before the US stock market on the evening of December 9th Beijing time. Although the sales volume of Ideal Car-W.HK slowly recovered in October and November, there were still problems in the third quarter:

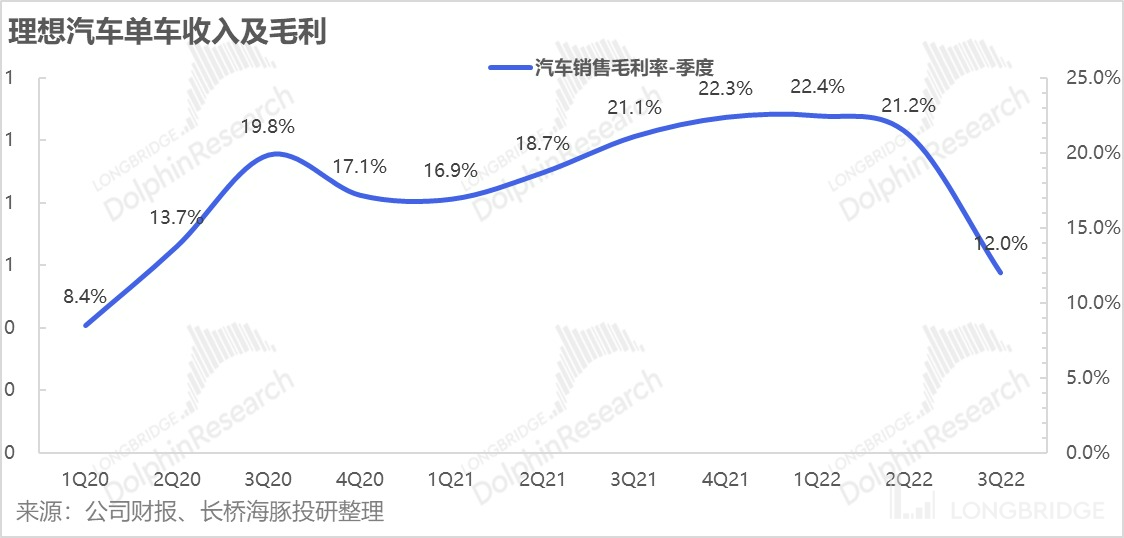

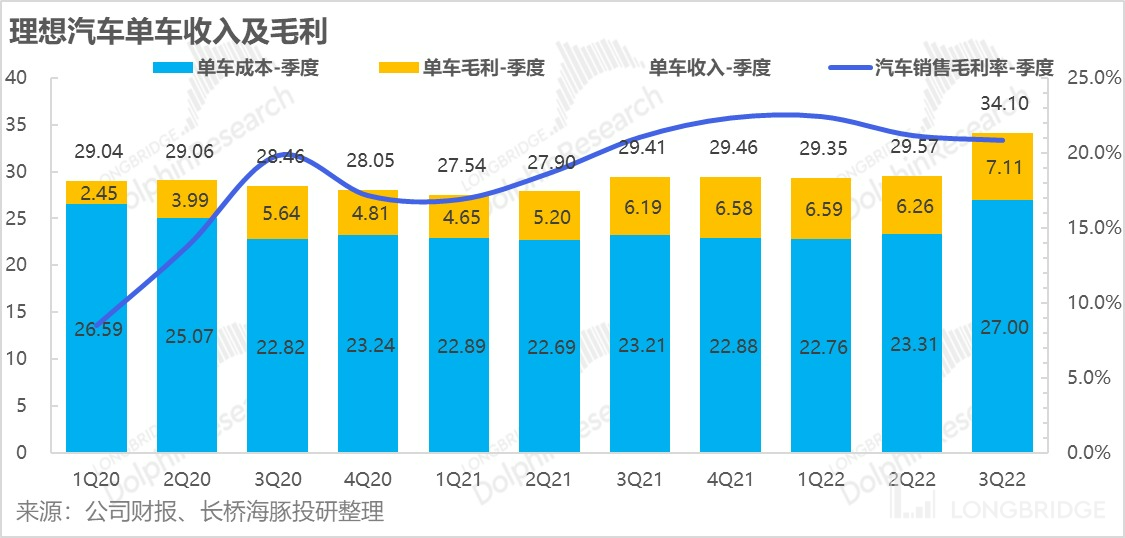

1. The aftermath of the sales volume failure of Ideal One, and the sharp decline in automobile sales gross profit margin: The gross profit margin of automobile sales in this quarter was only 12%, which is quite different from the profitability level of new forces in the industry, such as Xiaopeng and Leapmotor. However, from the reason point of view, this will not be included in the long-term expectation. The main reason for the decline is that the sales volume of Ideal One plummeted too fast during the vehicle model update. The company did not anticipate this, and the inventory and supplier contracts prepared for Ideal One both suffered losses. This quarter, Ideal One had to provide a provision of more than 800 million yuan for inventory impairment and contract losses.

What is the real gross profit margin for automobiles? Excluding this relatively unexpected one-time impairment loss, the gross profit margin of automobile sales is 20.8%, which is basically consistent with market expectations, but it is still in a downward trend. The main reason should be the poor sales volume. The new cars have not yet been released in large quantities, while the old cars are already outdated and with a large amount of inventory, which has affected the release of scale effects of the cost side.

Regarding the outlook of gross profit margin, even if the automobile sales volume rises in the fourth quarter, there is still a lot of uncertainty, mainly because the lithium price rose too much in the third quarter and is still hovering around 570,000 yuan, which will inevitably affect the gross profit margin. Under the severely deteriorating competition pattern of the automobile market next year, it is still uncertain whether Ideal can maintain its automobile gross profit margin.

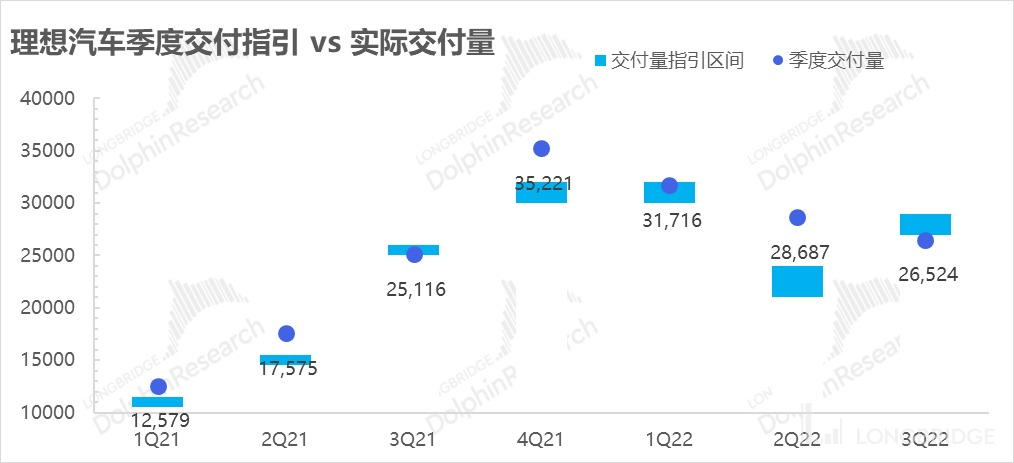

2. The sales volume guidance is just barely enough: The company's sales volume guidance for the fourth quarter is 45,000 to 48,000. Considering that the sales volume of October and November has been clarified, the implied average sales volume for December should be slightly more than 21,000, which is similar to the implied sales volume for December in NIO's guidance, but Ideal's sales in November actually exceeded those of NIO.

From the survey information, it seems that Ideal still has a considerable amount of booked orders, but the worse competitive situation next year is an indisputable fact, especially when the delivery volume of the Wishing M7 and M5 is also rapidly increasing.

3. Unit price: For example, the unit price of Ideal L9 was directly raised to 340,000 yuan because the sales proportion of L9 went from zero to 40%, but this data is also within market expectations and is even slightly lower than market expectations.

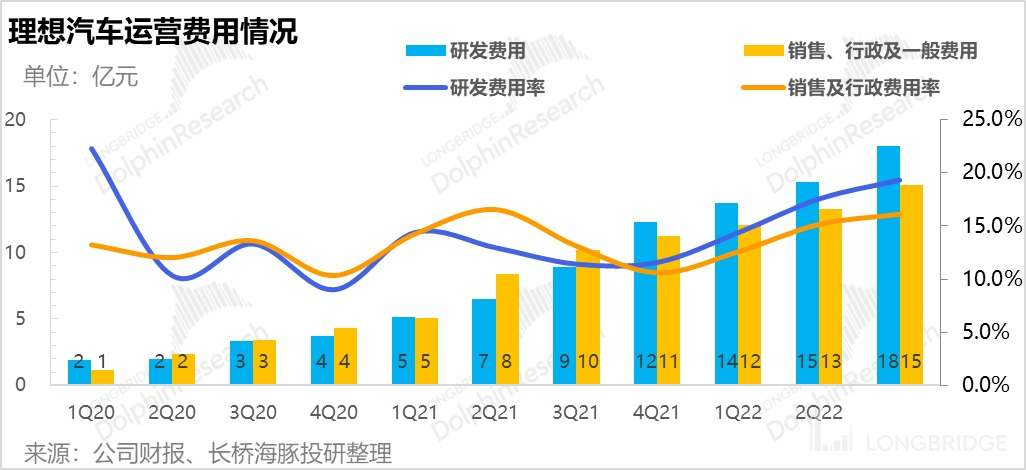

4. High R&D growth, unchanged expenses: For new forces in the industry like Ideal that still need to develop pure electric vehicles, the rigid growth of R&D investment is almost a certainty. This quarter, this trend was particularly visible with the increase in R&D investment. Only the sales expenses seemed to have restrained a little bit, but this restraint is also only relative. After all, new forces need to promote new vehicles and build a sales network. Overall, due to the poor automobile sales volume, the expense ratio has rebounded again.

Dolphin Analyst's Overall View:

Dolphin Analyst's Overall View:

Overall, although the gross profit margin has dropped significantly due to the Ideal One inventory issues, this is a one-time mistake and current sales are slowly recovering. This may have affected stock prices emotionally, but should not have a significant impact.

However, the main issue is that besides this relatively negative issue, Ideal's performance this quarter does not have very optimistic marginal information. Instead, indications are leaning towards falling within expectations, with revenue of 9.3 billion and a single vehicle price of 340,000, only barely meeting standards.

Looking forward, the gross profit margin in the fourth quarter is clearly not good, and competition in the overall vehicle market will intensify next year. The overall revenue and single vehicle gross profit margin are both very uncertain, and currently, Ideal's stock price has already returned to the level it was at during the National Day holiday in October this year.

Note that during the National Day holiday, Tesla announced disappointing sales in the second quarter, while production capacity was being released. Everyone began to realize that Tesla was going to reduce prices, and the domestic automotive competition landscape would undergo a major change, thus initiating a rapid drop in the stock prices of domestic new forces.

Clearly, Ideal's response this time does not have very attractive incremental information to significantly improve the market's judgment on Ideal's competition landscape next year. It can only be said that it is worth observing whether the company will release positive information about in-hand orders during the conference call or other occasions.

Dolphin Analyst will share the conference call summary with Longbridge App and Dolphin's user group, interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin Investment Research Group and receive the conference call summary as soon as possible.

The following is a detailed analysis:

1. Ideal's profits take a big hit, what's going on?

The most surprising part of this financial report for Dolphin Analyst was the "plummeting" gross profit margin of Ideal's automotive sales business. As the core indicator that the market most pays attention to besides sales guidance, this quarter's gross profit margin for the automotive sales business was only 12%, which instantly dropped to the level of Xiaopeng and Zeekr and fell far short of its own previous 20%+ margin and the market's expected 20.8% margin for this quarter.

However, the key issue is the rapid decline in Ideal One's sales that triggered the drop: in the process of product updating, Ideal One's monthly sales rapidly dropped from over 10,000 for two months to less than 2,000 vehicles in a single month.

Clearly, the speed of this decline was far beyond the company's expectations, resulting in excessive inventory and contract losses due to overestimating Ideal One's demand and signing contracts with suppliers too early. Ultimately, in the third quarter, the inventory impairment and contract losses related to Ideal One amounted to more than 800 million.If the 800 million loss is excluded, the actual gross profit margin of the automobile sales business is 20.8%, which is completely in line with market expectations.

So how should we view this eight hundred million loss? As an inexperienced new company that follows the strategy of selling big single products, we failed to fully realize the inventory risk of the old single products in the automobile replacement process and thus suffered a temporary decline in gross profit margin. If we can learn from this experience and better prepare for the next replacement, the market will not include such a one-time depreciated value in the long-term valuation. Therefore, this one-time depreciation, especially when L9 sales have begun to rise, should not have a punitive effect on the stock price in the market.

In the short term, the company has previously expressed its hope that profits will turn positive when L9 and L8 begin delivery. L8 is expected to start delivery in November, which means that Ideal's profit conversion should be imminent.

Second, the guidance for Q2 and Q4 is slightly weaker, but it does not prevent Ideal from becoming the leader of the new forces

After a sluggish period of vehicle model replacements, Ideal's sales guidance can now be seen to have been repaired significantly through the heavy volume of L9 and the advanced positioning of L7 and L8 in Q4. The company expects to deliver 45,000-48,000 cars per quarter, with implied deliveries of over 20,000 in December. Considering that Ideal's sales in November have already reached 15,000, the sales of around 21,000 in December are basically in line with expectations, without being significantly stronger than NIO.

Dolphin Analyst noted that Bloomberg's consensus expectation is over 50,000, which seems to be quite a difference. However, considering that the expectations for sales volume of automobiles are even adjusted in real-time with news such as insurance and delivery every week, this sales expectation is still relatively outdated.

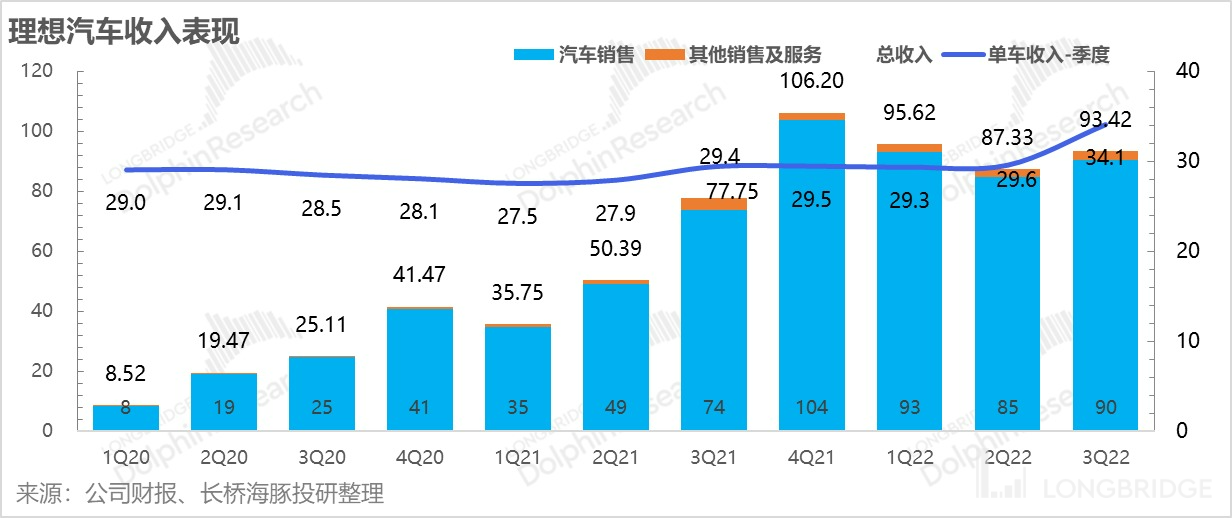

Under the prospect of high sales volume in Q4, Ideal's revenue guidance has reached 16.5-17.6 billion yuan, which is significantly higher than NIO and Xiaopeng, and the implied unit price of vehicles in the sales guidance is around 355,000 yuan, indicating a further increase in pricing for high-end customers.

Third, Q3: the embarrassment of being at a loss for words

However, the delivery of the third quarter of the company itself was relatively disappointing: Ideal sold 26,500 cars in Q3, and even failed to reach the original guidance range of 27,000-29,000 cars. The rapid decline of Ideal One is the core reason.

From the perspective of the new car release line:

After the release of L9 at the end of June, the sales of Idean One began to decline by around 5,000 units per month. The mutual erosion between L9 and One was obviously something Idean did not anticipate. This also corresponds to the inventory devaluation and contract losses of Idean One;

When the sales of One dropped rapidly to below 5,000 units in August, Idean quickly responded by introducing the six-seater SUV L8 and the five-seater SUV L7 at the end of September to take the place of Idean One. These two models are slightly different from L9.

The new flagship L9 of Idean is priced at 459,800 yuan, which is much higher than the previous Idean One (priced at 328,000-338,000 yuan, which was raised to 350,000 yuan).

The L8 with six seats, released at the end of September, is priced at 360,000-400,000 yuan, while the L7 with five seats is priced at 340,000-380,000 yuan, both higher than the previous price of One.

3. New vehicles can play a short-term role, but next year is still unknown

According to what the Dolphin Analyst has seen from research, the new L8 orders should have exceeded 10,000 in October, but they will erode some of the L9 orders. In response to this, Dolphin Analyst said that the corresponding competitors should be Qingjiejie M7, Tengshi D9, and Lingke 09. By the end of November, there should be 25,000 undelivered orders for L9, while L8 is about 20,000, and the order reserves are still relatively sufficient.

In addition, with the expiration of new energy vehicle subsidy policies at the end of the year, for companies like Weilai and Idean, which originally did not enjoy subsidy policies, this is a relative benefit. However, Tesla's price reduction has indeed cast a shadow over China's new car forces. After the big drop and REOPEN of Idean's valuation, due to the uncertain competition pattern next year, the pressure is still high, and we still need to walk and watch.

4. Revenue barely passed the passing line

From the perspective of overall revenue, it can only be said to have barely passed the passing line: the company's automotive revenue and other revenue, such as points and automotive services, were slightly lower than expected. The actual overall revenue was 9.34 billion yuan, slightly lower than the expected 9.54 billion yuan.

Average car price: In the third quarter, Idean's average car revenue was 341,000 yuan, an increase of 45,300 yuan from the previous quarter. With the high-priced new car L9 sales, its proportion in the third quarter has reached nearly 40%. From the company's guidance, the unit price in the fourth quarter is expected to further increase to around 356,000 yuan, an increase of 15,000 yuan.

4. Single car profitability: The price is higher, but the profit is still Alexander.As previously stated, we mainly focus on the actual unit profitability level after removing the one-time impact of significant devaluation and contract losses that severely affected automobile sales gross margins.

From the data perspective, the gross profit per unit has noticeably increased after the price hike. Previously, the gross profit of selling a car was basically over CNY 60,000, and the highest was not more than CNY 66,000. However, after the L9 launch, selling a car could earn a gross profit of CNY 71,100.

However, the gross profit margin has actually declined slightly, with only 20.8% in the third quarter, which is slightly lower than the gross profit margin of 21.2% in the previous quarter due to the impact of lithium battery price increases.

Moreover, in the short term, the gross profit margin in the fourth quarter may still face significant pressure: even though the lithium price has decreased in recent days, it is still hovering around the high level of CNY 560,000-570,000, and the increase is indeed too significant. Nevertheless, for Ideal, after the sales volume increases in the fourth quarter, the depreciation cost can have a certain dilution effect, which can help to mitigate the pressure to some extent.

Five, regardless of short-term sales, investment in costs is important

Ideal, as a new force in the industry that has fewer models and only transitional extended-range EV technology but no pure electric cars, has a key focus on research and development investment to enhance the certainty of future product lines.

As an emerging car manufacturer in the growth phase, expanding its sales network and increasing city coverage are also essential factors to continue to focus on in the short term, regardless of whether the sales volume is smooth.

1) The R&D expenses of Ideal in this quarter have surged dramatically, reaching an absolute value of CNY 1.8 billion, and the total R&D expenses of the three quarters have exceeded CNY 5 billion, which is very likely to exceed the company's annual R&D budget guidance of CNY 6-7 billion.

The company explained that the increase is for R&D preparation for the launch of next year’s new cars. Considering that the company will first release a pure electric platform car next year, the R&D investment will probably continue to rise successively. When revenue is low, the pressure on R&D expense ratio will be very high, and this quarter is such a scenario: the R&D expense ratio is 19.3%, which almost consumes the gross profit margin earned from selling cars.

2) The investment in sales and administrative expenses exceeded CNY 1.5 billion, which is relatively moderate. After all, two new cars were launched at the end of September, and the expansion of the sales network in the third quarter was not significantly lagging. The sales expense ratio has increased significantly both year-on-year and quarter-on-quarter, mainly because of the rigid growth of sales expenses unable to be diluted by the unimpressive sales volume in the third quarter.

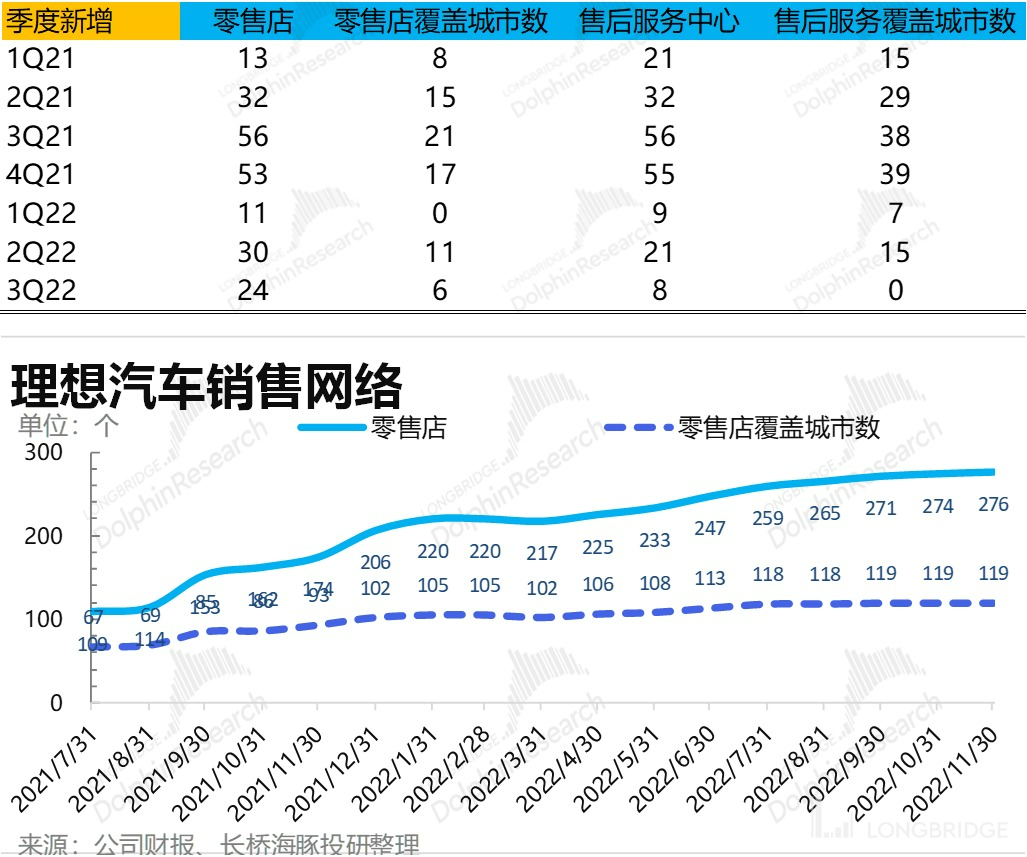

In terms of sales network expansion: 24 new retail stores were added during the entire third quarter, covering six new cities, which was basically normal. As of the end of November, two months have passed in the fourth quarter, and the city coverage is still 119 without adding new ones. The number of retail stores has only increased by five to 276.This also means that the goal of 400 retail stores set at the beginning of the year cannot be achieved due to the interference of the epidemic and the intensification of competition.

6. Although the loss has been made, it is still the "most family-style" new force

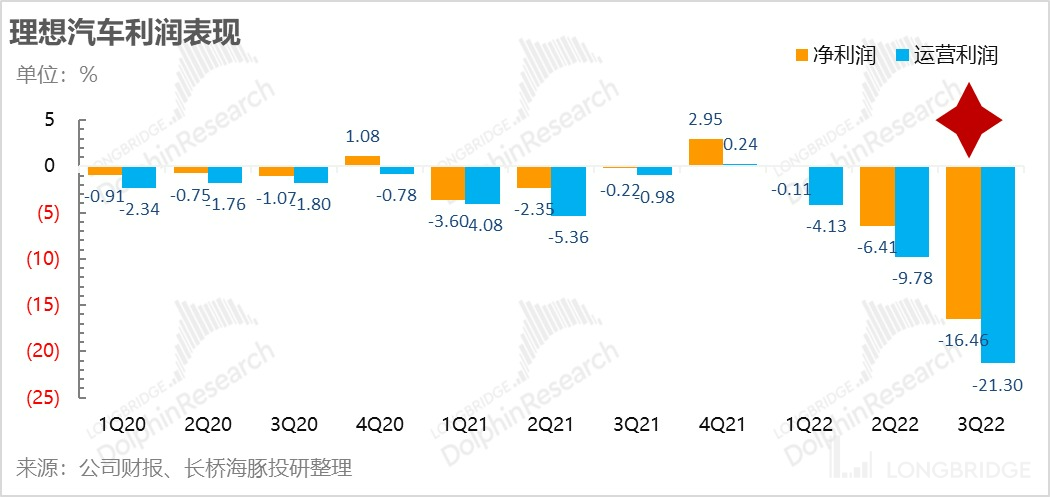

Ideal's operating loss in the third quarter reached 2.1 billion, significantly lower than the market expectation of 1.26 billion. This is mainly due to the inventory devaluation and contract losses of Ideal One. Excluding this impact, the actual loss is basically in line with market expectations.

The corresponding net profit also plummeted to 1.65 billion, far below past levels. If we exclude the impact of 800 million devaluation, the actual loss should be slightly over 800 million. This is mainly due to inadequate sales, which did not dilute the effect of fixed costs such as amortization and could not effectively utilize the scale effect of the cost side.

<Dolphin Analyst historical articles, please refer to:>

August 16, 2022 financial report comments, Ideal throws thunder and collapses, L9 can't support "collapsed ideal"

August 16, 2022 telephone conference summary, Ideal ONE was "eaten" by L9, and L8 will sell early (conference summary)

June 22, 2022, product release summary, L9, the new "ideal" for Ideal

May 10, 2022, conference summary, Ideal: Three new products will be launched in 2023, welcoming the peak of the product cycle

May 10, 2022, financial report comments, Ideal's Ideal, Everything Hopes to Be in the Second Half of the Year?

February 26, 2022, conference summary, Complete the verification period of 0-1, see how Ideal achieves growth from 1-10 (conference summary)

February 25, 2022, live broadcast of performance briefing, [Ideal Automobile (LI.US) Q4 2021 Earnings Conference Call](https://longbridgeapp.com/lives/7724?On February 25th, 2022, financial report review "With full financing capabilities, Li Xiang's ideal is now a reality".

On November 30th, 2021, meeting minutes "How does Ideal compete with Xiaomi in launching pure electric vehicles one after another? (Meeting Minutes)".

On November 29th, 2021, Q3 earnings conference call live broadcast "Ideal Automotive (LI.US) Q3 2021 Earnings Call".

On November 29th, 2021, financial report review "Is Ideal speculative or long-term in earnings compared to Xiaopeng and NIO".

On August 31st, 2021, meeting minutes "Ideal Motor: Q3 exceeded NIO and Xiaopeng, aiming at 150,000 vehicles next year (meeting minutes)".

On August 30th, 2021, Q2 earnings conference call live broadcast "Ideal Automotive (LI.US) Q2 2021 Earnings Call".

On August 30th, 2021, financial report review "Ideal Automotive: Steady performance, strong momentum?".

On June 30th, 2021, San Sha comparative study - part 2 "New forces in car manufacturing (part 2): Fifty days to double, can San Sha continue to surge?".

On June 23rd, 2021, San Sha comparative study - part 1 "New forces in car manufacturing (part 1): As market enthusiasm declines, what can San Sha do to consolidate its position?".

On June 9th, 2021, San Sha comparative study - part 1 "New forces in car manufacturing (part 1): Invest in the right people and do the right things, and take a look at the people and things of the new forces in car manufacturing".This article's risk disclosure and statement: Dolphin Research's Disclaimer and General Disclosure