2023, "One Billion" Target, A Pure Electric Vehicle (Minutes of Telephone Conference)

$ Ideal.us released its Q3 2022 earnings report after the Hong Kong market closed and before the U.S. market opened on December 9 Beijing time. The main points are as follows:

I. Quarterly key data vs. market expectations:

- Revenue end: Quarterly revenue is RMB9.34 billion, YoY+20.2%, lower than market expectations (-2% miss);

- Gross profit margin: Quarterly gross profit margin is 12.7%, YoY-10.6%, lower than market expectations (-8.83% miss);

- Delivery volume: Quarterly deliveries amounted to 26,500 vehicles, slightly below the company's guidance of 27,000-29,000 vehicles (about 500 vehicles short of the lower limit);

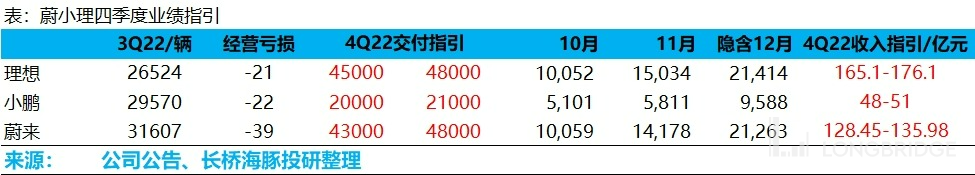

- 4Q22 guidance: Deliveries of 45,000-48,000 vehicles, implying December deliveries of 21,400 vehicles; revenue of RMB16.51-17.61 billion.

$ For more detailed financial information on Ideal-W.HK, please refer to Dolphin Analyst's comment "Ideal profit collapse? Not fatal but embarrassing".

II. Summary of phone conference incremental information

[1] L9 stable monthly sales volume is about 8,000-11,000, and L8 stable monthly sales volume is about 10,000-15,000.

[2] The first pure electric model will be launched in 2023.

[3] Since the price range of Ideal car models does not overlap with Tesla, the impact on the company is not significant.

[4] Factors contributing to the significant decrease in gross profit margin: inventory provision + procurement commitment losses (Ideal has procurement commitments with suppliers, and inaccurate production forecasts by ONE would cause such losses).

[5] L9: Benchmarking luxury brands of the same price or slightly higher; L8: Replacing Ideal one; L7: Targeting young users aged 25-35.

III. Phone Conference Original Text

1) Remarks by Management

[1] Delivery volume

【1】Historical delivery data

In Q3 2022, despite adverse macroeconomic conditions and supply chain disruptions, Ideal delivered 26,524 vehicles, up 5.6% YoY.

In October, a total of 10,052 new vehicles were delivered, up 31.4% YoY. In November, a record high monthly delivery of 15,034 new vehicles was achieved, up 11.5% YoY.

Among them, Ideal L9 reached more than 10,000 deliveries in its first full month of delivery, becoming the first Chinese-brand vehicle with monthly deliveries of more than 10,000 and a price above RMB400,000. Since its delivery began, Ideal L9 has been the best-selling large SUV in China for two consecutive months, becoming the preferred choice of Chinese families for a six-seat SUV. (2) 4Q22 Guidance

4Q22 is expected to deliver 45,000-48,000 vehicles.

【2】Models

On September 30th, the new-generation model of the Ideal ONE, the Ideal L8, a six-seater mid-to-large-size SUV, was launched, as well as the Ideal L7, a five-seater mid-to-large-size SUV. Both the Ideal L7 and L8 feature a brand-new four-wheel-drive extended-range electric system and an Ideal Magician Carpet air suspension. They have over 100 standard configurations and are available in Pro and Max models, which more widely cater to the needs of individual family users.

Specifically, both the Ideal L7/L8 Pro versions are equipped with the Ideal AD Pro intelligent driving assistance system. The standard configuration includes a high-speed NOA navigation assistance driving function, which is equipped with the Horizon journey 5 chip with a total computing power of up to 128 TOPS. The Max version is equipped with the AD Max intelligent driving assistance system, which is equipped with dual NVIDIA Orin-X computing chips with a total computing power of up to 508 TOPS, and will support intelligent driving assistance in all scenarios in the future. In terms of the cabin, both the Ideal L7 and L8 are equipped with the Intelligent Space SS Pro system, which supports four-screen interaction system in the front row, is equipped with 19 speakers, and features a Qualcomm Snapdragon 8155 car-grade chip; while the Max version is equipped with the Intelligent Space SS Max system, supports five-screen three-dimensional space interaction, adds a 15.7-inch LCD entertainment screen in the rear row, increases the number of speakers to 21, and adds an additional 8155 chip.

The combination of Ideal L9, L8, and L7 is beneficial to consolidate and expand the company's market share in the 300,000-500,000 price range. The Ideal L8's user satisfaction exceeded expectations after it began delivering in November, and it is believed to be the best choice for mid-to-large-size SUVs above 300,000 yuan. Since its launch, the Ideal L9 has been the sales champion in China's large SUV market for two consecutive months, becoming the first choice for China's large six-seater family SUVs. The Ideal L7 is also expected to become the preferred option for five-seater mid-to-large-size SUVs above 300,000 yuan.

【3】Vehicle Performance

(1) Safety

In the China Insurance Automobile Safety Index released in November, the Ideal L9 was the first large SUV in China to complete the driver-side and passenger-side frontal 25% offset collision tests and obtain the highest safety rating of G. Thanks to its ultra-high-strength body structure, the Ideal L9 can withstand a peak load of 116,475N in the roof strength test, with excellent results among the same level of models.

(2) OTA

In early November, the Ideal L9 ushered in the OTA 4.1.0 version, with 37 new features and 27 experience optimizations, comprehensively improving the product experience in areas such as Ideal AD, space interaction, space audio and video, application updates, and Ideal classmates. Especially, the newly added three-screen simultaneous screen projection function of the projection application turns the Ideal L9 into an excellent place for family users to watch videos, movies, and sports. [4] Two Big Goals: Business and R&D

IDEAL has always adhered to two goals: to exceed rather than just meet consumer demand, and to achieve healthy gross margin and cash flow, driving the company's continuous investment in the dual growth engine of business and R&D capabilities.

Business capabilities include commercial, supply, and organizational capabilities; R&D work will be more comprehensive across products, platforms, and systems, with the long-term goal of growing into a world-class technology company.

Supported by healthy gross margin continuous investment in business and R&D capabilities, the company will continue to pursue product and business success and cultivate a healthy long-term development model.

(1) Channel Layout

As of November 30, 2022, IDEAL has 276 retail centers covering 119 cities nationwide; 317 authorized after-sales maintenance and sheet metal spraying centers covering 226 cities.

In 3Q22, in addition to traditional retail centers located in shopping malls, IDEAL also began to open retail centers in places such as automobile parks, and diversified venues provide sales channels with opportunities to reach more potential users.

(2) Supply Chain & Self-developed Technology

In 3Q22, IDEAL officially started construction of the R&D and production base for its pure electric vehicle power semiconductor in Suzhou New District, Jiangsu Province. The base mainly focuses on the independent R&D and production of third-generation silicon carbide vehicle regulations power modules, which are core components of IDEAL's self-developed 800V high-voltage electric drive system.

IDEAL will continue to invest in the new generation of range-extenders, making every effort to maintain its leading position in the field of range-extenders.

At the same time, IDEAL is actively self-developing components of the 800V high-voltage pure electric platform, including power chips, power modules, power control, motors, and transmission systems, aiming to become one of the first automakers to launch high-voltage pure electric vehicles.

(3) Production and Manufacturing

Intelligent manufacturing is a core competitiveness for any successful car manufacturer and another area in which IDEAL excels. IDEAL's R&D work not only involves making a good car but also involves manufacturing.

IDEAL has industry-leading intelligent manufacturing equipment, and its self-developed management software, Li-MOS, can significantly improve the production efficiency and quality of the entire production process through precision control. This system will be applied to all of IDEAL's future factories, shortening the implementation cycle of new factories by more than three months.

IDEAL uses vision sensors and algorithms to precisely control the work process of hardware equipment, achieving flexible production and intelligent detection.

(4) Intelligent Cockpit

IDEAL self-developed the Li Ai intelligent space system, which uses the MIMO-Net six-audio zone voice enhancement network and the MVS-Net multi-perspective visual fusion network to help accurately perceive in complex acoustic environments, recognize complex gestures, and achieve unparalleled in-car entertainment and interactive experience.

(5) Intelligent Driving

In terms of autonomous driving, as of November 30, more than 170,000 household users have experienced IDEAL's high-speed NOA function. High-speed NOA further enhances the perception of dynamic obstacles and complex environments and improves the ability to predict the behavior of traffic participants. Ideal has led the industry by proposing a multimodal sensor system with the "3D hypothesis and 2D confirmation" concept.

The Ideal L9 is also the first model to achieve high-speed NOA based on the NVIDIA Orin SoC chipset.

Meanwhile, Ideal Motors has collaborated with Tsinghua University and the Massachusetts Institute of Technology to complete the world's first open project for the real-time construction of high-precision maps.

【5】Management Adjustment

-

Chief Engineer Ma Donghui will serve as President of Ideal Motors and join the board of directors, overseeing research and development and the supply group as a whole.

-

Senior Vice President Xie Yan will serve as CTO of Ideal Motors, fully responsible for the system and computing group.

-

Executive Director and President Shen Yanan will leave the board of directors and join the Ideal Motors Process Reform Committee.

- The supply team (including supply chain, manufacturing, and quality) managed by Shen Yanan will be transferred to President Ma Donghui, and the business team (including sales, service, and charging network) will be directly managed by CEO Li Xiang.

The personnel adjustment aims to upgrade the matrix organization mode. Since last year, Ideal Motors has been observing and studying those top-level enterprises with trillion-level revenue scales. The company has found that when the revenue scale of these enterprises reaches the level of tens of billions of yuan, they often upgrade to a matrix organizational model. Next, Ideal Motors will also move towards the goal of a hundred-billion-yuan revenue scale.

2) Analyst Q&A

【1】Delivery Volume

Q: What is the expected steady-state sales volume of the new model in 2023?

A: Specific sales volume needs to be judged based on product competitiveness and market size.

The L9 steady-state monthly sales are about 8,000 to 11,000 units, while the L8 steady-state monthly sales are about 10,000 to 15,000 units. It is too early to forecast the L7 outlook.

Backlogged orders will drive delivery data growth.

【2】Business Aspects

Q: What is the progress of the development and launch of pure electric vehicle models in 2023? Will two pure electric vehicle models be launched on schedule?

A: In 2023, Ideal will release its first pure electric vehicle model.

Next year, the most important task is the official delivery of L7 and the release of the first pure electric vehicle model.

Q: What is the impact of maintaining a stable supply chain bottleneck and adjustments to domestic epidemic prevention and control policies on the company's production in the coming months?

A: The supply chain will gradually return to normal with adjustments to epidemic prevention and control policies, but there may be a shortage of manpower at that time, which has already had some impact on production.

Currently, the company is working with partners to solve the shortage of manpower, and is also preparing its own workforce. If there is a shortage, employees will be dispatched to help the supply chain.

Q: What is the impact of Shanghai's cancellation of plug-in hybrid car green license plates starting in 2023?

A: Sales in the Shanghai region account for 5% to 6% of total revenue, and the policy will have a certain impact on sales in Shanghai.

However, in reality, Ideal's user demand is mainly for vehicle upgrades, and the first vehicle accounts for a small percentage.

Currently, the company is actively cooperating with the Shanghai team to formulate new sales strategies for next year to alleviate the impact of this policy change. Q: Reason for the devaluation of Li ONE which eventually resulted in a cost impact of 800 million, would it create a potential cost for future Li ONE production?

A: This devaluation came from parts and purchase contracts signed with suppliers. This devaluation occurred due to the non-conversion of some parts to automotive products in the future. The 800 million devaluation is based on the principle of confirming the lower value between cost and current estimated net realizable value.

Q: Methods for achieving greater differentiation and distinction on the product side and what will be the greater differentiation for different models and different numbers of seats?

A: Price and seat differentiation are the best way to segment user groups.

In practice, L8 and L9 have already begun delivering with L7 beginning to pick up small orders. The three groups of users have significant differences:

L9: The user group is basically luxurious brands of the same price range and more expensive luxurious brands.

L8: Has completed a good replacement of Li ONE, with its user group being almost identical.

L7: Captured many young family user groups aged 25-35.

【3】Research and Development Capabilities

Q: Decision factors for choosing discrete battery chips or designing chips?

A: The company is not self-developing chips, but is self-developing power drive modules with chips.

The reason why the company chose to design its own power drive module is that the efficiency of the module integrated into the company's 5 in 1 motor and 3 in 1 motor is crucial to the company's competitiveness and cost-effectiveness.

Q: R&D expense guidelines?

A: The company's full-year R&D expenses for 2022 are 1 billion US dollars (about 7 billion yuan), and the final budget for 2023 is not yet complete, estimated at about 10-12 billion yuan.

Q: Future company self-research direction

A: Since 2020, overall research and development has been divided into the following 3 parts:

(1) Product development, same as all other car manufacturers.

(2) Technology platform development, including newly built extended-range electric platform, high-voltage pure electric platform, intelligent cockpit platform, and intelligent driving platform. The benefit is that all models can share the same platform, which increases development efficiency and reduces costs, maintaining consistency of user experience.

(3) Development of underlying system, including operating systems, AI supercomputing platforms, cloud services, IT systems, and all subsequent internal computing platforms.

Ma Donghui is responsible for product and technology platform development, and Xie Yan is responsible for underlying system development.

The most investment is in the development of technology platforms, followed by product models and underlying system development.

In the long run, underlying system development may surpass that of model R&D investment, but the largest investment is still in technology platform R&D, which is crucial for product development and user experience.

【4】Organizational Structure

Q: Li ONE 's matrix-type organization

A: Next year Li ONE will enter the scale of hundreds of billions of revenue. Since 2019, we have been studying the management styles of trillion-dollar companies. We discovered that when these companies reach a revenue scale of hundreds of billions, they upgrade to a matrix management system.

The key characteristic of the 0-1 stage is efficiency. As we move from the 1-10 stage, quality becomes more crucial. Internally, we focus on high-quality cognition, planning, execution, and review. Externally, we prioritize high-quality research and development, manufacturing, products, and services.

Matrix organizational management is the only way to achieve success in this regard. We need a robust planning sense and execution process internally, and we need powerful product research and sales capabilities externally.

Our current management model aims to ensure all process management indicators. We plan, construct, and operate the roads horizontally, while vertically, we design, produce, and operate the cars.

Over the past two years, the company has successfully verified the matrix management through pilot projects. The success of L8 and L9 was not accidental but came from our hard work. We are currently expanding the scope of our pilot projects to provide successful products and services.

【5】Industry Competition

Q: What is the ideal price for Tesla's price reduction strategy, and will there be intense price competition in the future?

A: Our overall vehicle models are not in the same price range as Tesla. The impact is relatively small, and we expect this situation to continue next year.

Risk disclosure and statement: Dolphin Investment Research Disclaimer and General Disclosure.