ByteDance loses ground as Meta undergoes a complete rebirth.

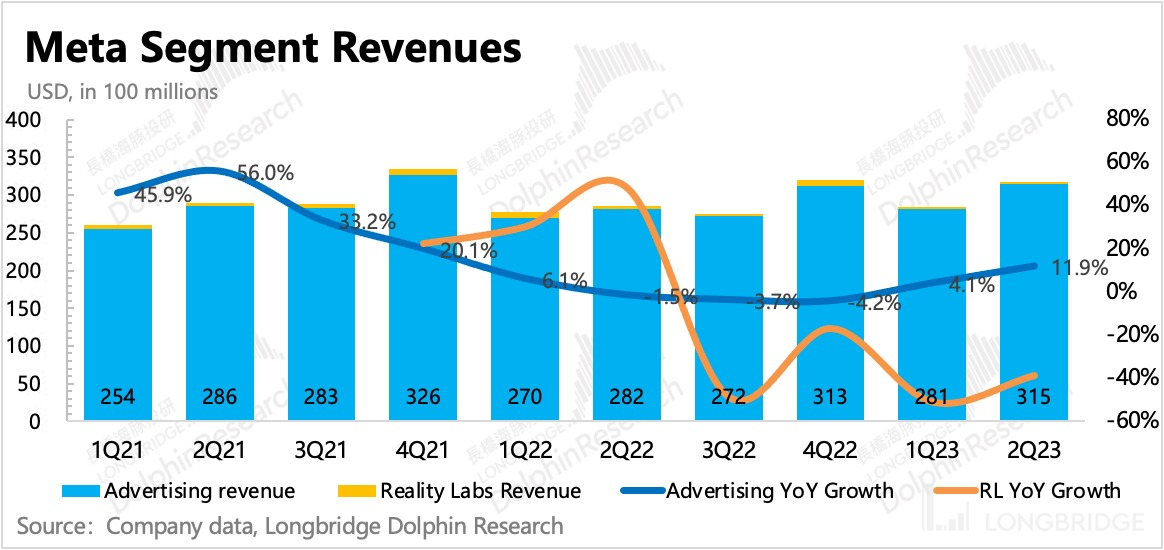

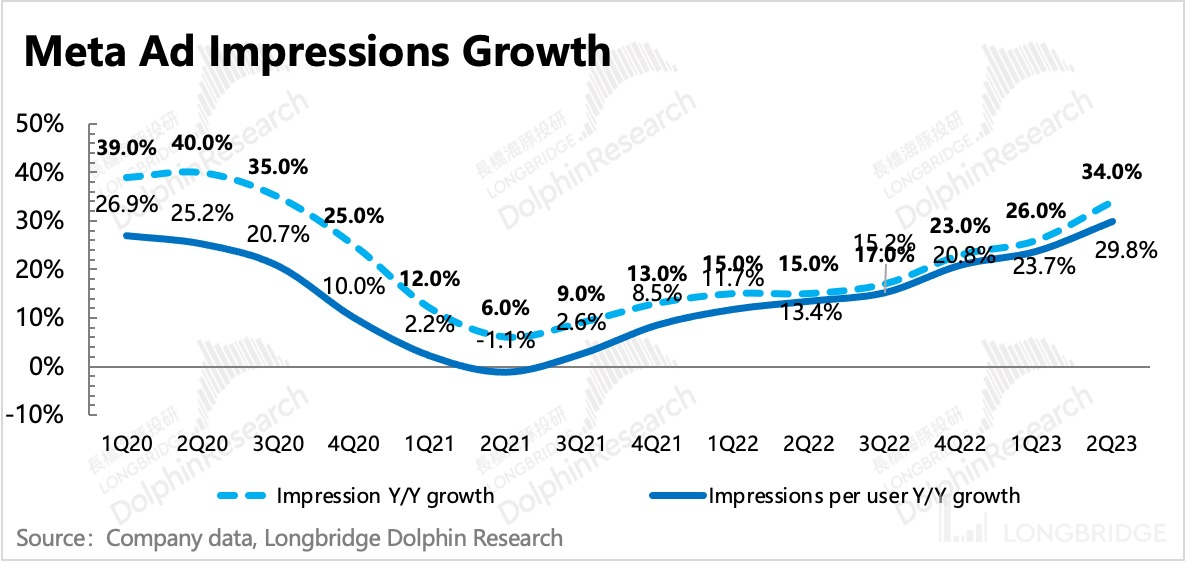

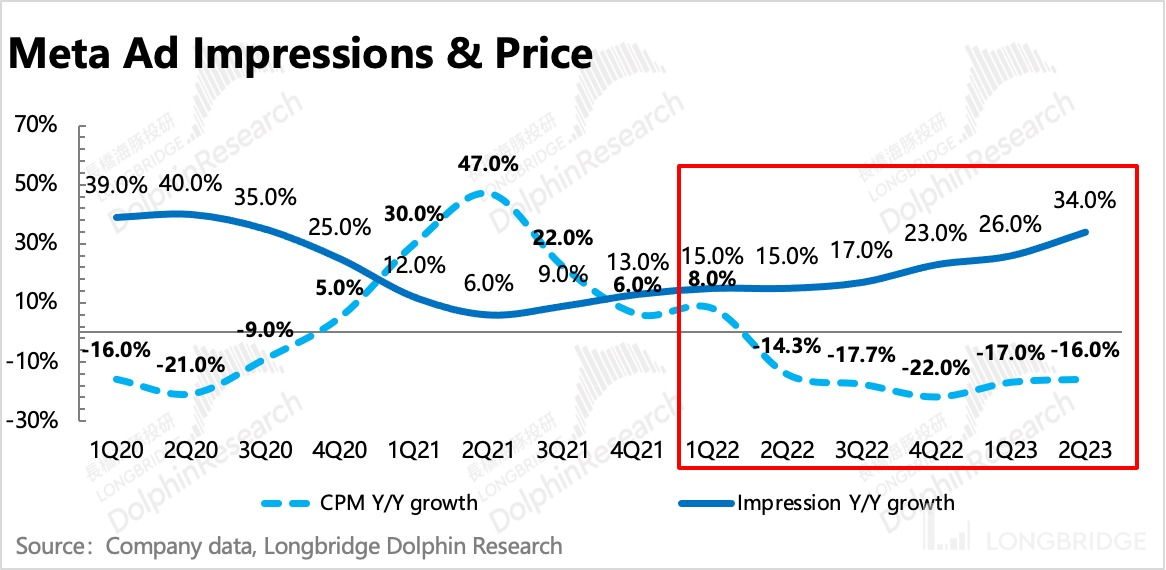

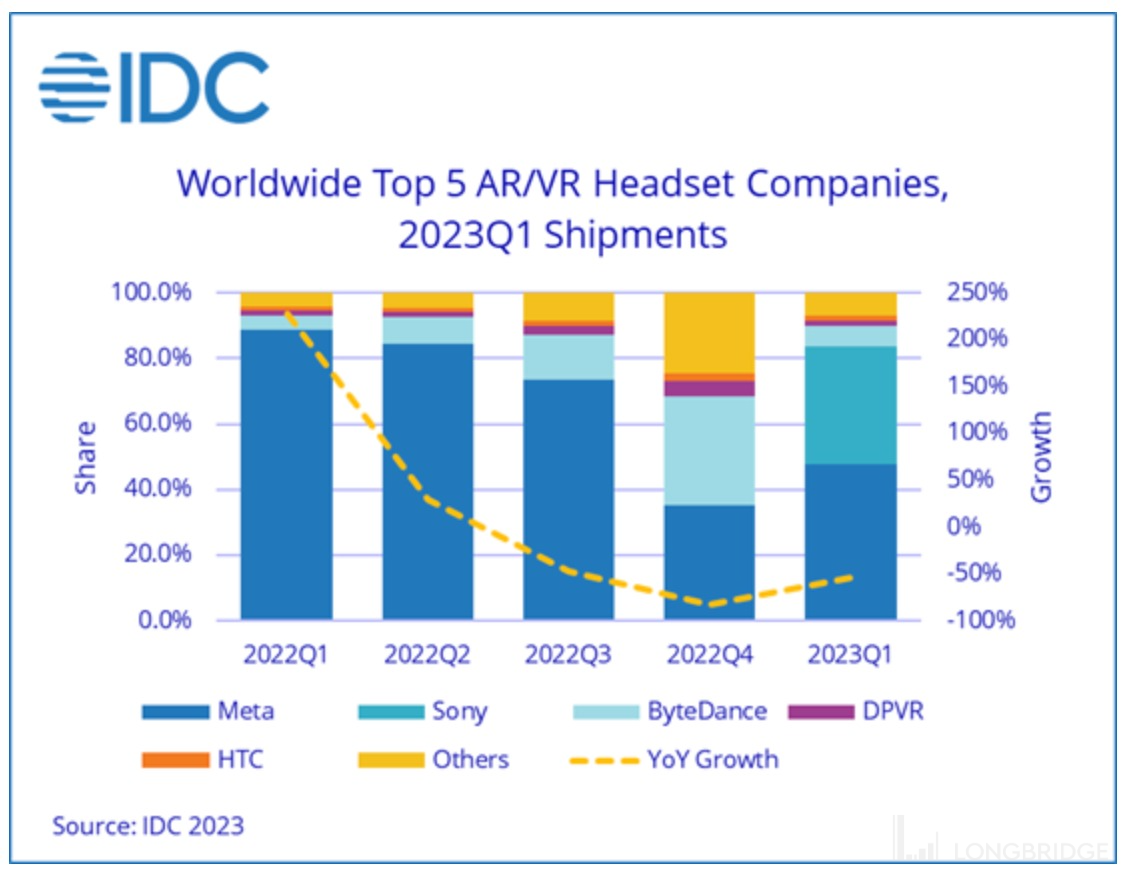

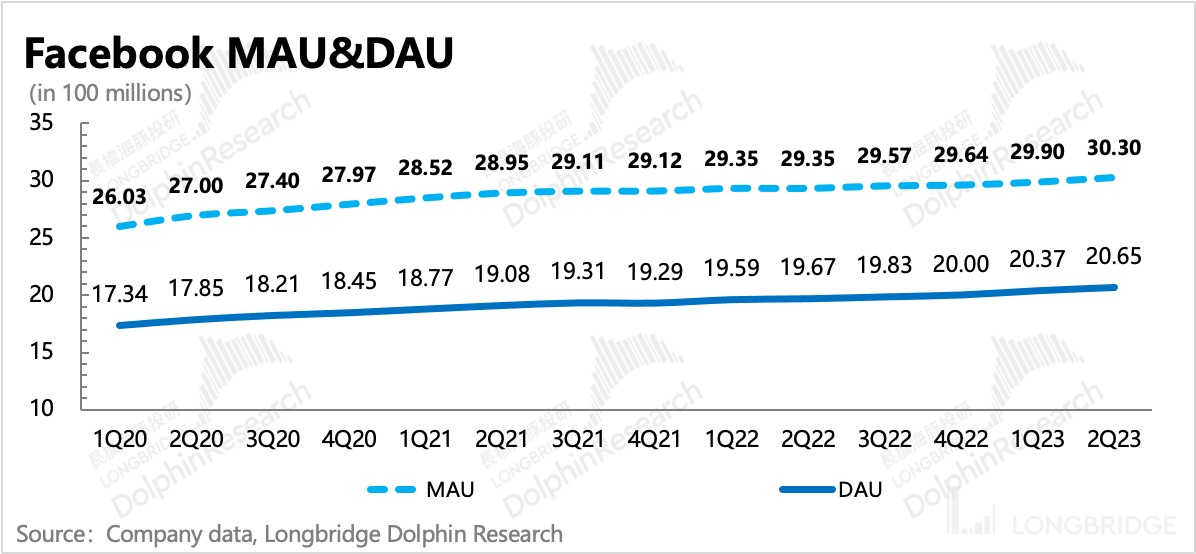

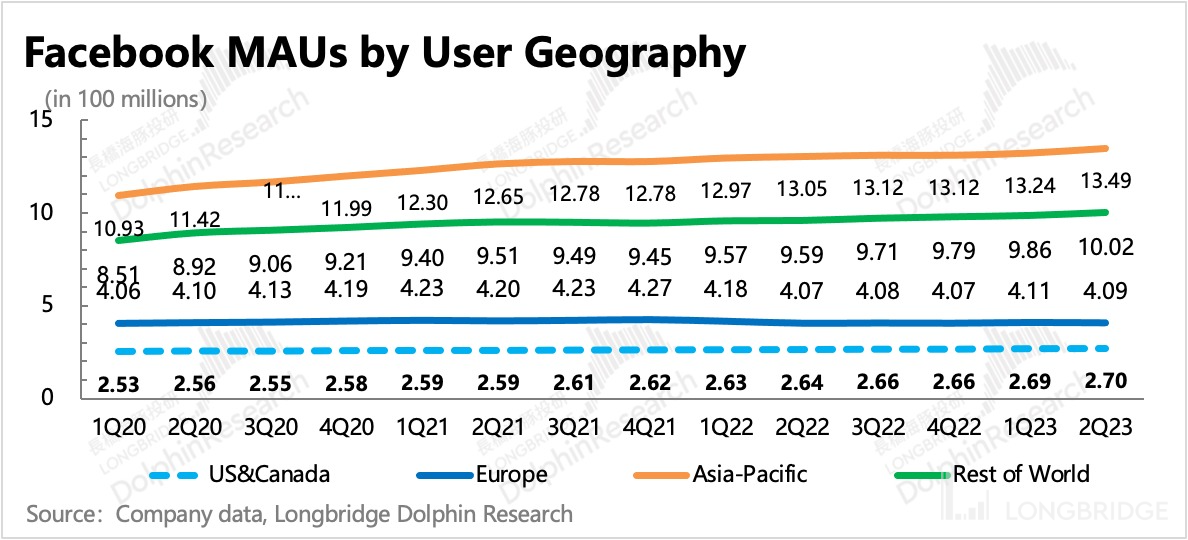

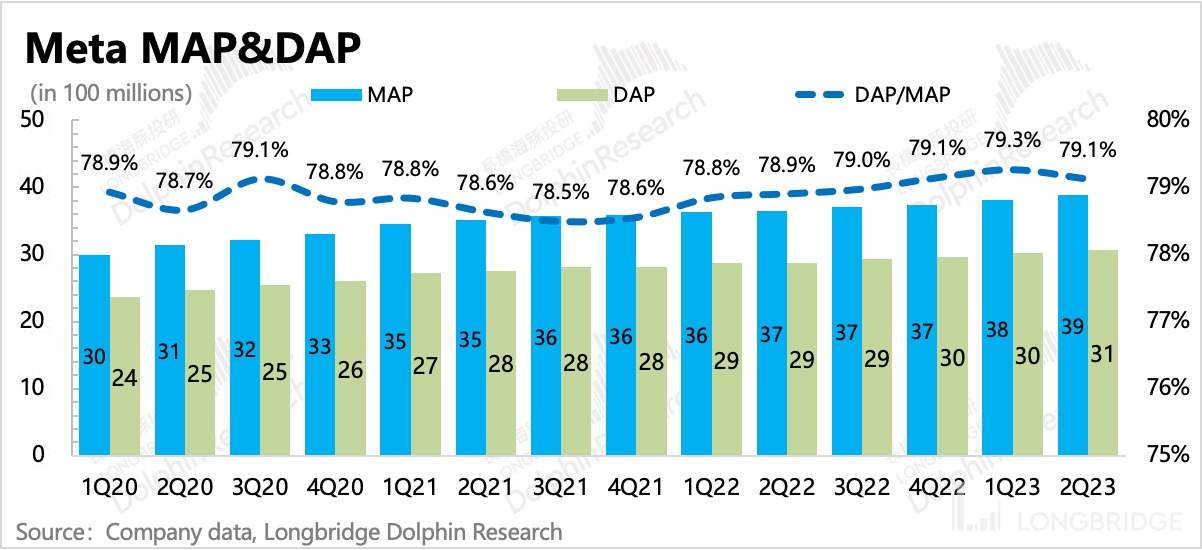

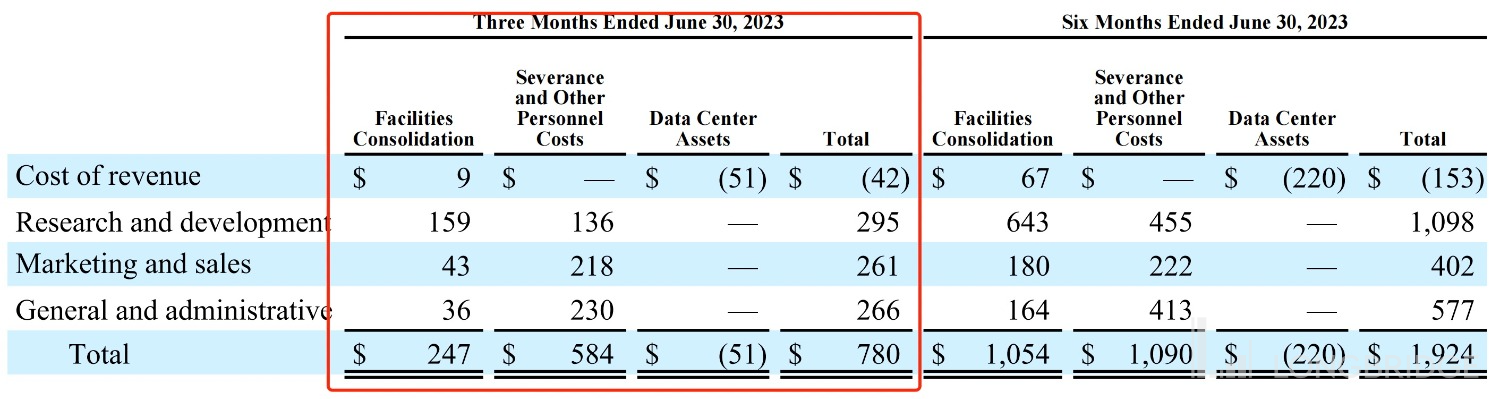

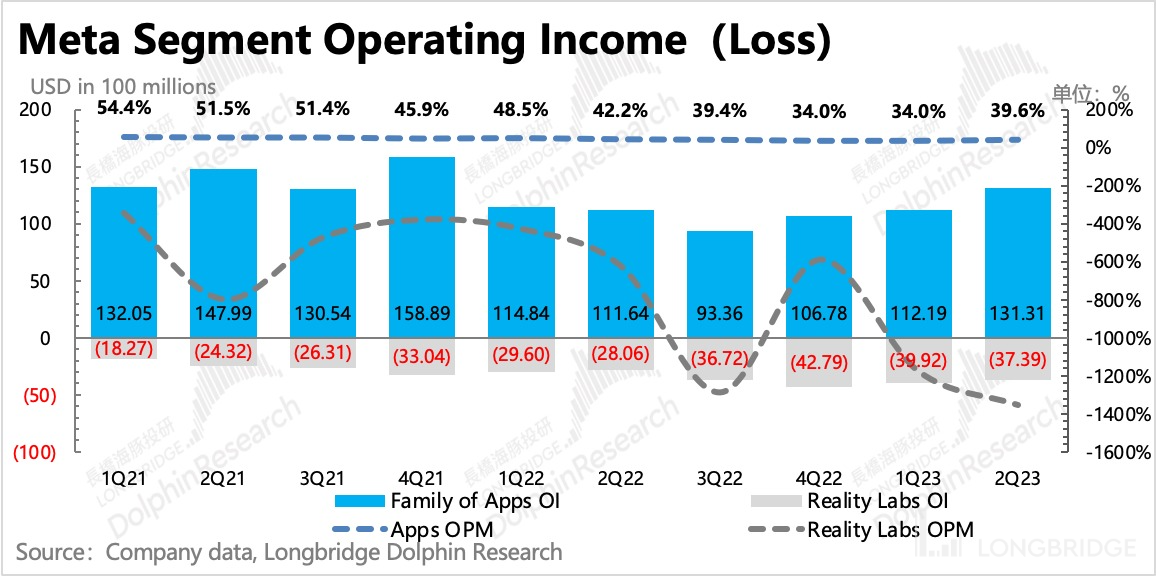

Hello everyone, I am Dolphin King! $ Meta Platforms.US released the second quarter financial report of 2023 this morning (July 27, Beijing time). In addition to the VR business is not surprising, the performance of the advertising business once again far exceeded expectations. Combined with the recent series of Meta operations (Advantage +, Reels), at least in the short to medium term, Meta's social status has been further consolidated and the company's operational efficiency has improved. It can be said that Meta, after downplaying the Metaverse label, has gone extremely smoothly on the road to new life. In the future, as long as the meta-universe department is properly invested, it will not take long for the performance to return to the peak, then it will naturally restore more favor from investors. * * The core points of the financial report are as follows: * * * 1. The revenue guidance for the next quarter is "amazing" * * Meta revenue in the second quarter was on the top of the management guidance, 32 billion, up 11% year on year. Although it is 3% higher than the market consensus expectation (bbg), compared with the company's revenue guidance for the next quarter (2023 Q3), the poor revenue expectation for the second quarter itself is not so amazing. 2, advertising has Beta, but also Alpha current and next quarter guidance exceeded expectations, all from the advertising business's resurgence. Meta advertising revenue 31.5 billion in the second quarter, up 12% year-on-year, higher than the 30.4 billion expected by the market. At the same time, advertising also contributed 98% of the revenue share. The high growth in third-quarter revenue guidance also benefited from advertising. Such a rebound speed may not be difficult to attribute to a simple low base. In addition to the factors mentioned by Dolphin Jun in TikTok Falls, Meta Is Full, there should be a contribution from the launch at the beginning of the year. In addition, specifically for advertisers, last quarter's Meta call also emphasized the increase in advertising for Chinese e-commerce customers. * * 3, Reels is still the main driving force of the current growth * * from the advertising volume price relationship, the second quarter advertising can rebound, mainly due to the display volume increased by 34% year-on-year, while the advertising unit price is still-16% decline, close to the decline in the previous quarter. Dolphin Jun said earlier that the volume-price relationship of Meta advertising basically corresponds to the economic cycle, but this is when the platform traffic is stable. The current Meta has Reels, because the ecological flow is growing (MAP increased by 6.3 to 3.88 billion people year on year, accelerating month on month), so the amount of inventory that can be released will be more sufficient. At the same time, Reels's offer is naturally lower than the old platform in the early stages of commercialization, so when Reels's share of revenue contribution increases, it will also lower the overall average offer. * * 4. The demand for Yuan Universe is fierce. It is suggested to be cautiously optimistic about the sales volume of new products. * * Yuan Universe has been in a slump for almost a year since it was renamed Meta in Facebook. In the second quarter, Reality labs revenue was still in a sharp year-on-year decline of-39%, achieving 0.276 billion. The market, on the other hand, clearly has a more optimistic expectation of bottoming out in demand, resulting in a 30 per cent deviation from actual and expected. Meta will start selling the new Quest3 in the next quarter. A press conference has been held in June, offering US $500 and lowering the price of Quest2 to US $299, which is expected to hit a wave of sales in the short term. However, compared with the "grand occasion" when Quest2 was released in the previous two years, we believe that the three-generation sales may be difficult to explode. Therefore, RL revenue in the third quarter may still be very average, but the reverse can also be reflected in the overall high income guidance, the worse the VR, the better the advertising than expected. * * 5. The effect of layoffs continues to be reflected, driving profits to climb * * Meta's gross profit margin and operating profit margin in the second quarter increased by 2.5pct and 4pct respectively compared with the previous quarter. The main reason is that the expenses in the second quarter also include a small part of layoff compensation and more than 0.8 billion integration expenses of property equipment, which affect the current operating profit margin by about 2pct. This also means that there is room for further optimization of expenses in the second half of the year. In addition, due to the EU penalty (1.2 billion euros announced in July), the company's total cost guidance for the whole year has increased by 2 billion US dollars to 880-91 billion US dollars. * * 6, capital expenditure lowered this year, next year to resume growth * * On capital expenditure, Meta further lowered this year's expected 3 billion in the second quarter, the latest range is 270-30 billion. The lower Capex does not mean an overall reduction in investment, and it is mainly adjusted for investment budgets in non-AI areas. Starting next year, the company's Capex will resume growth in response to changes in AI technology.! The table description has been automatically generated Long Bridge Dolphin King's Viewpoint In this financial report, the biggest feeling that Meta gives Dolphin King is: How many surprises do Meta have that the market did not expect? Of course, if you look at the huge amount of user ecology that Meta has, it is more or less understandable. Therefore, this round of dilemma reversal, the dilemma is entirely due to the "irrationality" of the management, under such a large flow advantage, it is very natural to do a good job of cashing in. **** At the same time, Meta's results in business efficiency are also going well, and when technical talent is used to focus on the things that bring the most value, the efficiency of business realization will leap forward. Compared to Dolphin Jun's previous hypothesis ( ** TikTok Falls, Meta Is Full ** **),Meta actually performed significantly better than we expected. * * * Therefore, considering the previous assumptions, except Reels, the increase in advertising demand for AI tool Advantage + and the possible commercialization space of the Threads have not been taken into account: * * * * Dolphin King has increased his revenue forecast by 5%/8% for this year and next respectively. The current market value (closing price on July 26) corresponds to PE 17x in 2024. At the moment when profits rebound sharply in these two years (2023-2026 CAGR 21%), the valuation is not particularly high. If at 20x PE, the corresponding 885 billion valuation is $345 per share. Therefore, in the case of no major problems in the macro environment, although Meta has doubled its growth rate, it still has some room for growth. *_This article is an original article for Dolphin Investment Research, which cannot be reproduced without authorization. After the interpretation of the financial report, the contents of the telephone conference compiled by Dolphin Jun will be presented immediately. Please look forward to it. _ * The following is a detailed interpretation of * * * * 1.'s revenue guidance for the next quarter is "amazing" * * Meta's revenue for the second quarter was 32 billion, up 11% year on year, accelerating the recovery under a low base. The main exceeding expectation is still the advertising business, which accounts for 98%, while VR business continues to decline 39% year-on-year. Although there is a high base in the same period last year, the weaker demand for VR is a more core drag factor. Expectations for 3Q23: Total revenue is expected to range from 320 to 34.5 billion, with a corresponding change of 15.5 to 24.5 percent year-on-year, significantly better than market expectations 31.2 billion.! Chart, Histogram Description Automatically Generated * * 1. In addition to competition relief and IDFA pains, Reels accelerated contribution of effective share * * is still the driving factor from the relationship between the volume and price changes of advertisements: (1) Advertising display volume accelerated by 34%, and the average single user display volume increased significantly, which can only be brought by filling Reels advertising inventory.! The picture contains a graphical user interface description that has been automatically generated (2) The unit price of advertising fell 16% year on year. We said earlier that the unit price of advertising is related to whether the economy is an upward cycle and whether the competitive advantage of the platform is improved, but this is under the condition of steady flow of Meta platform. In the second quarter of this year, there was more formal commercialization of Reels than last year. And Reels' offer itself is much lower than Facebook and Instagram, so when Reels' revenue contribution comes up, it will naturally pull down the average advertising unit price.! Schedule description has been automatically generated So combining the two drivers behind the volume and price movements, it is clear to conclude that the commercialization of Reels is progressing well and is deepening rapidly. * * 2, VR is still at a low point * * Reality Labs' revenue has collapsed in the last quarter, down 51% year-on-year. Although it slowed to-39% in the second quarter, it is still at a low point. Dolphin Jun simply estimated that the sales volume in the second quarter was 1 million units, compared with 2.4 million units in the same period last year (for reference only).! Chart, diagram, histogram description has been automatically generated! Chart, bar chart description has been automatically generated As the leader of VR head display, Meta's dismal situation is basically equivalent to the industry situation. According to IDC data, the first quarter of 2023 industry-wide AR/VR head-show shipments fell 54% year-on-year, the head of the top five manufacturers only in the current period of strong promotion can have more bright shipments, but it is difficult to have continuity. ! 0 Short-term overall industry growth may not be much, and although Meta will start selling Quest 3 in the next or fourth quarter, it may be more of a squeeze on other head sales, which is a grab between stock markets. Apple MR's entry is expected to awaken some vitality, but it will not be until 2025 until the low-cost MR is shipped. * * 2. traffic basic disk is still expanding * * With Reels's blessing, Meta's all-platform traffic is still expanding steadily, and there is a faint acceleration trend in the second quarter. 1, the core platform Facebook in the loading of Reels video, the platform reinvigorated, traffic in the post-epidemic era has reached new highs. In the second quarter, FB's monthly life increased by 40 million to 3.03 billion, up 3.2 from the same period of last year, and the growth rate was significantly accelerated from the previous quarter. The number of daily active users 2.065 billion, up 5% year-on-year, so the user stickiness DAU/MAU continues to increase.! Graphical user interface, text, email description has been automatically generated In terms of regional segmentation, Asia Pacific is the largest source of new users, followed by other regions except Europe and the United States. In the second quarter, the net growth rate of mature regions in Europe and the United States slowed down, and the European region was a net loss month-on-month.! The picture contains a text description that has been automatically generated 2. The monthly live MAP of the whole platform reached 3.88 billion, up 6.3 year on year, with a net increase of 70 million users in the quarter, more than half of which came from Facebook. Daily DAP reached 3.07 billion, up 6.6 year on year.! Chart, bar chart description has been automatically generated * * The impact of 3. cost reduction and efficiency increase continues, but the market has already expected * * Since Zuckerberg's letter of apology to shareholders last year, Meta's cost reduction and efficiency increase expectations have been gradually priced into the stock price. The gross profit margin and operating profit margin in the second quarter continued to improve from the previous quarter on a "step-by-step" basis. The actual optimization range and market expectations are not much different, so it can be regarded as a smooth performance without surprises. * * 1. Gross profit margin has recovered to the highest level in previous years * * Meta improved the overall gross profit margin to 81.4 in the second quarter by optimizing the cost of data centers and specializing in advertising business with high gross profit margin, which has reached the peak level in the past three years. Of course, there is still a long way to go from the period when it has not invested much in the universe, but it is still a little difficult to continue to significantly improve.! Chart Description Automatically Generated * * 2. There is compensation for layoffs in the current period, which affects the profit margin by 2 points * * Meta's operating profit margin reached 29.4 in the second quarter, up 4pct from the previous quarter. Mainly due to layoffs, the increase in R & D expenses has slowed rapidly to single digits, while sales expenses are still declining year-on-year. However, there was also a portion of layoff compensation and property equipment integration costs in the second quarter, which affected operating margins by nearly 2 points.! Chart, schedule medium confidence description has been automatically generated! Table Description Automatically Generated According to the two major business segments of advertising and Yuanuniverse, Yuanuniverse's losses are still in high losses. Management expects Labs' operating losses in Reality this year to be higher than last year's (US $13.7 billion), because despite the indifferent demand in the industry, some investment is still in progress.! chart, schedule description has been automatically generated * * long bridge dolphin investment research "meta" part of historical articles: * * * financial report season (nearly one year) * * April 27, 2023 telephone conference "" year of efficiency "implementation results are good, Reels makes great efforts (Meta 1Q23 minutes of telephone conference)" financial report review "Meta: Du Jie is completed on April 27, 2023, full Blood Resurrection" February 2, 2023 Telephone Conference "Full of" Efficiency ", Xiao Zha has learned" Lovely "(Meta 4Q22 Performance Telephone Conference Minutes)" February 2, 2023 Financial Report Review "Good Buff,Meta Gorgeous Turn?" Call on October 27, 2022 "Under Questioned" Siege ", Xiao Zha Still Insists on Betting on Yuan Universe (Meta 3Q22 Call Minutes)" Financial Report Review on October 27, 2022 "Meta of Head Iron, Still Betting on Yuan Universe under Severe Blood Loss" Call on July 28, 2022 Macro, Apple ATT, Competition Multiple Headwinds, the management's short-term outlook is very conservative (Meta call) July 28, 2022 financial report review "no" Google-style "expected reversal, Meta decadence hard to hide" April 28, 2022 financial report review "in order to cope with competition, don't rush to promote Reels commercialization (Meta call minutes)" April 28, 2022 financial report review "skyrocketing to change faith? Meta inflection point has not yet arrived" February 3, 2022 conference call "can you expect Reels to activate Meta user growth again Stories 3 years ago? (Minutes of Telephone Meeting)" February 3, 2022 Financial Report Review "Lei Shang Garay, Rename Meta Facebook to" Decline God "" * * Depth * * June 27, 2023 "TikTok Falls, Meta Is Full" February 21, 2023 "US Stock Advertisement: After TikTok, ChatGPT to Start a New" Revolution "?" July 1, 2022 "TikTok to Teach" Big Brothers "to Do Things, Google and Meta to change" February 17, 2022 "Summary of Internet Advertising-Meta: Low Fighting Capacity Is Original Sin" September 24, 2021 "Apple Pulling out Sword, Facebook Is the First" Blood Seeing "Giant?" August 6, 2021 "Facebook: Digging Deep into the" Business Content "of the World's Top Netizen Harvester" November 23, 2021 "Facebook: Heavy Money Turns" Meta ", Inflection Point Not Far After Double Pressure" Dolphin Investment Research Disclaimer and General Disclosure