CITIC Securities: Concerns about the Fed's unexpected tightening easing, A-share overseas liquidity expected to improve significantly

The Fed's unexpectedly tight monetary policy easing concerns, A-share overseas liquidity is expected to improve. Bank of China Securities stated that the marginal easing of dollar liquidity will benefit emerging market assets. It is expected that the impact of A-share overseas liquidity will significantly ease. In addition, domestic demand expectations may fluctuate, and fiscal efforts are expected to accelerate. Overall, industries related to external demand are significantly strong

According to the Wise Finance APP, CICC released a research report stating that the latest FOMC statement has eased market concerns about the Fed's unexpectedly tightening policy. The April non-farm data shows a marginal weakening in labor market demand, one of the most important policy indicators for the Fed, leading to an increase in short-term interest rate cut expectations in the market. The marginal easing of USD liquidity is expected to continue to benefit under-allocated emerging market assets, with Hong Kong stocks benefiting from USD liquidity during the holidays surging. It is expected that the overseas liquidity impact on A-shares will be significantly eased in the near future.

01 Trends and Styles

Fed tightening concerns eased, A-shares expected to benefit. The holiday non-farm data and the May FOMC meeting have led to changes in market interest rate cut expectations. From the meeting minutes and Powell's post-meeting statements, it is clear that while the possibility of a rate hike has been ruled out, it is also acknowledged that inflation will take time to fall. After the meeting, market sentiment improved, leading to a significant rebound in US stocks. Compared to the continuously postponed interest rate cut expectations, market concerns about the Fed's unexpectedly tightening policy have been alleviated. Furthermore, the April non-farm data shows a marginal weakening in labor market demand, one of the most important policy indicators for the Fed, leading to an increase in short-term interest rate cut expectations in the market. The marginal easing of USD liquidity is expected to continue to benefit under-allocated emerging market assets, with Hong Kong stocks benefiting from USD liquidity during the holidays surging. It is expected that the overseas liquidity impact on A-shares will be significantly eased in the near future.

Domestic demand expectations still volatile, fiscal efforts expected to accelerate. Although the April PMI data fell marginally compared to March, it was stronger than the seasonal average, with the recovery in production intensity being the main reason for the stronger April PMI. In addition, the demand-side new order index fell marginally by 1.9 percentage points, with the previously strong new export orders showing a marginal decline in April. Furthermore, the factory prices and raw material purchase price indices rebounded significantly compared to March, to some extent showing a repair in the current domestic economic supply-demand situation. Overall, industries related to external demand have been significantly stronger since the beginning of the year, with some industries already entering the restocking cycle, while industries related to domestic demand still require further policy efforts.

The April Political Bureau meeting, compared to the December meeting, placed more emphasis on reform, proposing that the 20th Third Plenary Session will be held in July to focus on further comprehensive deepening of reform and promoting China's modernization. In addition, the meeting once again emphasized differentiated policies for different cities and the protection of housing transactions, and for the first time proposed "coordinated research to digest existing housing inventory and optimize policy measures for new housing." In terms of economic positioning, the meeting pointed out both positive factors such as increasing positive factors since the beginning of the year and improving social expectations, as well as issues such as insufficient effective demand. On the policy front, it still emphasizes proactive fiscal policy, specifically mentioning the "early issuance and effective use of ultra-long-term special government bonds, accelerating the progress of special bond issuance and use." In addition, on the monetary policy front, it clearly emphasizes the "flexible use of interest rates and reserve requirements" and maintains the expression of "prudent monetary policy." It is expected that fiscal efforts will accelerate in the near future, potentially leading to a peak in the issuance of special government bonds

02 Industry and Economic Outlook

During the "May 1st" long holiday, A-shares in China were closed, while Chinese Hong Kong stocks and overseas Chinese stocks continued to show strength during the holiday period. The Hang Seng Information Technology sector rose by 6.4% over two trading days, with the healthcare, non-essential consumption, real estate construction, and financial sectors recording gains of over 3.0%. However, sectors such as energy and telecommunications, which had previously benefited more from dividend strategies, lagged behind.

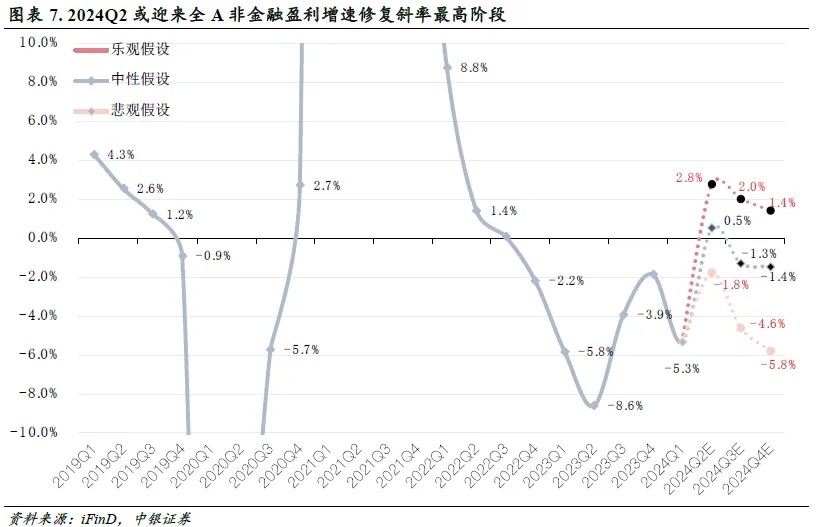

The profit factors behind the return of "China trades". Before the May 1st holiday, the disclosure of the 2023 annual reports and 2024 first quarter reports in the two markets was completed. The first quarter reports still show a "bottoming out" trend, while the A-shares and Hong Kong stock markets have recently shown significant strength, leading to the reemergence of "China trades" from a global perspective. In addition to factors such as "policy", "funds", and "expectations", China Merchants Securities believes that trading on the second quarter A-share earnings growth rate is also one of the reasons behind this.

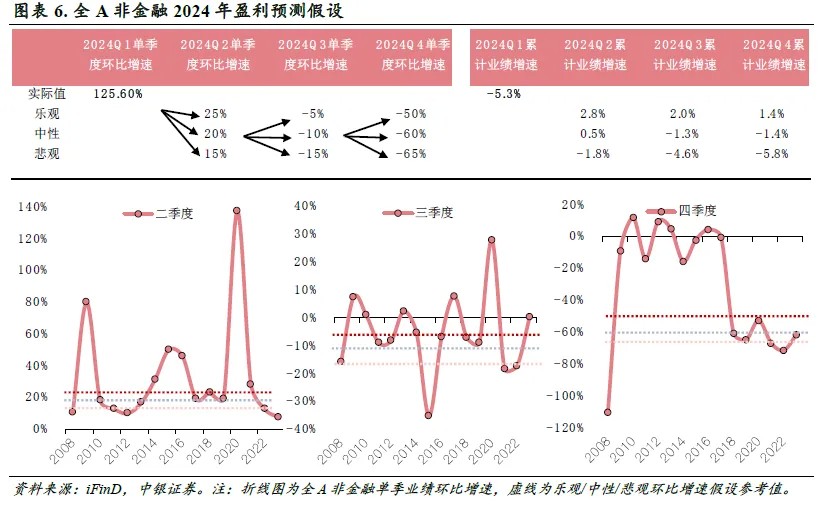

Looking at the pace of cumulative performance growth in the four quarters of 2023, the year followed a "√" shape, with the lowest profit point in 2023 appearing in Q2. In 2024, based on the experience of 2023 and the content of the political bureau meeting held on April 30, macro policies still emphasize proactive measures. Considering the effects of large-scale equipment updates and policies such as replacing old consumer goods with new ones, the neutral assumption is that the Q2 2024 single-quarter earnings growth rate will recover to the average level of around 20% in recent years. With the low base effect in Q2 2023, the overall non-financial performance growth rate can turn positive in the interim report (0.5% E).

The Q3 2023 single-quarter performance growth rate was recorded at -1.0% below the historical average level due to the low base effect. Therefore, under the neutral assumption, the Q3 2024 single-quarter performance growth rate is -10%, and the Q4 2024 single-quarter performance growth rate is taken at the average value of -60.0% over the past six years. Under the comprehensive neutral assumption, the forecasted full-year performance growth rate for all A non-financial sectors in 2024 is -1.4%. Q2 2024 will see the highest point in annual profits, and it is the quarter window with the highest slope of year-on-year growth rate recovery in this round of profit bottoming out phase If there is a significant boost in macroeconomic policy intensity and price factors in the future, further positive growth in annual performance is still worth looking forward to.

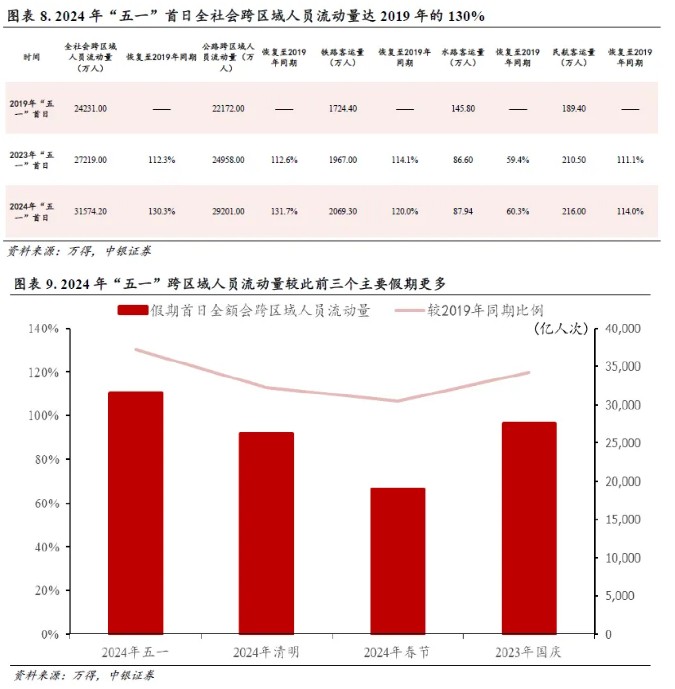

On the first day of the May Day holiday, the inter-regional population flow of the whole society remained high, reaching 130.3% of 2019. According to the Ministry of Transport, on May 1, 2024 (the first day of the May Day holiday), the inter-regional population flow of the whole society was 315.742 million person-times, an increase of 16.0% compared to the same period in 2023 (the first day of the May Day holiday, the same below), and 130.3% of the same period in 2019. Compared with the "Qingming" in 2024, "Spring Festival" in 2024, and "National Day" in 2023, the inter-regional population flow during the "May Day" holiday in 2024 was higher, and the ratio compared to the same period in 2019 was also the highest.

Specifically, there was a certain increase in highway and civil aviation passenger traffic compared to the same period in 2023, while water transport showed a more significant contraction. In terms of highways, on May 1, the inter-regional population flow on highways was 292.01 million person-times, 131.7% of the same period in 2019, an increase of 17.0% compared to the same period in 2023; railway passenger traffic on May 1 was 20.693 million person-times, 120.0% of the same period in 2019, an increase of 5.2% compared to the same period in 2023; waterway passenger traffic was 0.8794 million person-times, 60.3% of the same period in 2019, an increase of 1.5% compared to the same period in 2023; in terms of civil aviation passenger traffic, on the first day of the holiday, the number of civil aviation passengers was 2.16 million person-times, 114.0% of the same period in 2019, an increase of 2.6% compared to the same period in 2023.

During the "May Day" holiday, the consumption of flight and hotel packages showed a trend of "increased quantity and decreased price." Data from Qunar shows that as of April 29, the average payment price for flight tickets to popular cities during the "May Day" holiday decreased by 5% year-on-year. According to Tongcheng Travel, as of 2 p.m. on April 29, the average price of domestic flight tickets during the "May Day" holiday decreased by about 10% year-on-year. The accommodation prices during the "May Day" holiday in China also saw a significant decrease. Data from Qunar shows that as of April 29, the average payment price for hotels in popular cities during the "May Day" period decreased by 15% year-on-year Compared to the decline in air ticket prices, the number of flights has significantly increased compared to previous years during the May Day holiday this year. Tongcheng Travel stated that there has been an increase of over 30% in domestic flight takeoffs and landings during this year's May Day holiday compared to the same period in 2019. According to Feichangzhun data, during the 2024 May Day holiday, domestic airports are expected to see an 8.99% year-on-year increase in total flight takeoffs and landings, compared to a 36.2% increase in 2019. It is expected that this year's May Day holiday in Chinese civil aviation will break last year's record and usher in the busiest May Day holiday ever.

The overall trend of "increased quantity and decreased price" is observed in hotel and flight prices, mainly due to a more abundant market supply compared to before, while demand remains relatively stable. According to The Paper, the 2023 May Day holiday not only saw a "retaliatory travel" trend but also a significant increase in business travel, leading to a sharp rise in demand for hotels in many areas. On the other hand, the supply in 2023 has not fully recovered, resulting in a situation of "supply shortage" to some extent. In 2024, there has been significant restoration in flight frequencies and hotel supply.

"Outbound travel" and "county travel" have become the hot trends for the 2024 May Day holiday. Compared to the previous year's May Day holiday, more tourists are choosing outbound travel this year. Data from Qunar shows that the number of international flight bookings departing on May 1, 2024, has exceeded that of 2019, setting a new single-day record for the May Day holiday. During the holiday, bookings for multiple visa-free destinations have exceeded 30% of 2019 levels, with Chinese travelers visiting over 1000 cities worldwide. Additionally, according to CCTV, "county travel" has become a new trend in tourism for this May Day holiday. Meituan data shows that in the past month, searches related to "county travel" have increased sixfold compared to 2023. During the May Day holiday, hotel bookings in counties increased by 47% year-on-year, while orders in local supermarkets increased by 55%. "Off-the-beaten-path attractions," "local specialties," and "high cost-performance ratio" have become the hottest keywords for county tourism.

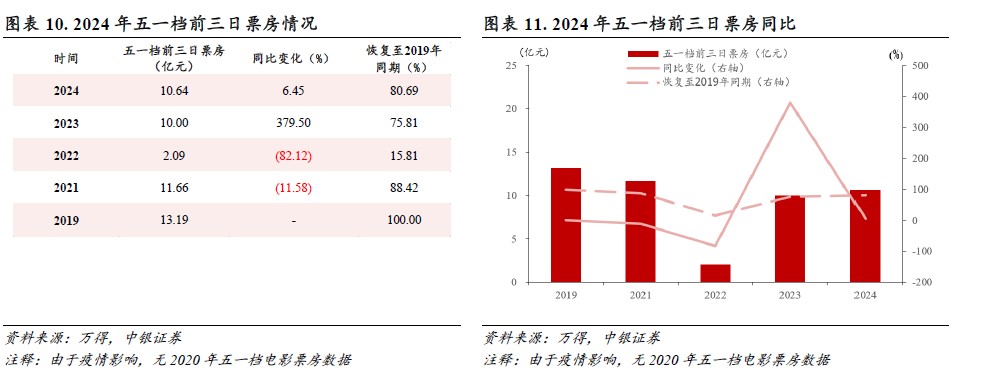

The box office revenue for the first three days of the May Day holiday reached 1.064 billion yuan, remaining flat compared to 2023 and approximately 80% of the same period in 2019. The box office revenue for the first three days of the 2024 May Day holiday in the film market reached 1.064 billion yuan, a 6.45% increase compared to the same period in 2023, recovering to 80.69% of the same period in 2019. The top three films in terms of box office share were the action film "Peacekeeping Riot Team" starring Huang Jingyu and Wang Yibo, the domestic comedy "Money Mad Flowers at the End of the Road," and the action film "The Siege of Kowloon Walled City." The film "Peacekeeping Riot Team" grossed approximately 307 million yuan in the first three days, accounting for 28.89% of the total box office revenue, "Money Mad Flowers at the End of the Road" grossed around 258 million yuan in the first three days, accounting for 24.25%, and "The Siege of Kowloon Walled City" grossed approximately 156 million yuan in the first three days, accounting for 14.66%.