Financial Report Preview | Is Palantir Riding the "AI Wave" and Continuing to Soar in Stock Price?

Palantir Technologies 將於北京時間週二晨間公佈第一季度財報。投資者關注該公司商業收入增長情況,以及人工智能 (AI) 業務的可持續性。預計第一季度商業部門總收入將達到 2.904 億美元,高於去年同期。Palantir 商業業務的強勁增長可能增強投資者對該公司拓展能力的信心。

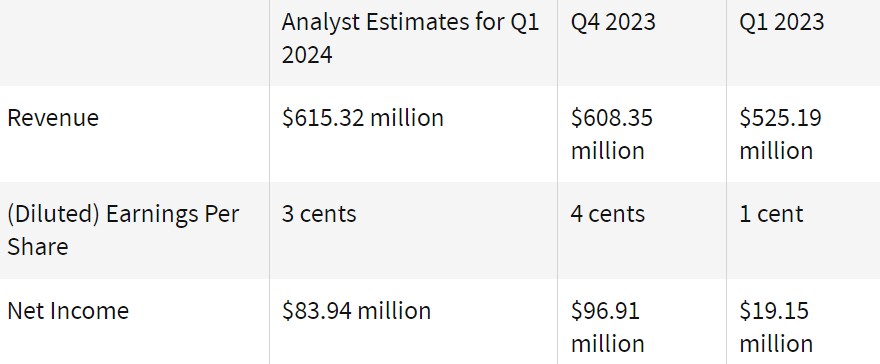

智通財經獲悉,Palantir Technologies(PLTR.US) 將於北京時間週二晨間公佈第一季度財報,投資者可能會關注該公司的商業收入增長情況,以及這家大數據分析軟件製造商能否證明其人工智能 (AI) 業務的增長是可持續的。根據 Visible Alpha 編制的估計,分析師預計 Palantir 在 2024 年第一季度的收入將達到 6.1532 億美元,高於上年同期;預計淨利潤為 8394 萬美元,合每股 3 美分,高於上年同期的 1915 萬美元和每股 1 美分。

關鍵指標:商業收入增長

投資者將關注 Palantir 商業部門的持續增長。由於對其人工智能平台的商業需求激增,該公司公佈的 2023 年最後一個季度的收益好於預期。2023 年全年,商業收入約佔 Palantir 總收入的 45%,其餘部分由政府業務收入所貢獻。今年 3 月,Palantir 宣佈與美國陸軍簽訂了一份價值 1.784 億美元的合同。

Palantir 首席執行官亞歷克斯·卡普在 2 月份給股東的一封信中寫道:“我們的美國商業業務仍然是我們增長的重要推動力,我們預計這一趨勢將持續下去。”

2023 年最後一個季度,Palantir 在美國的商業收入飆升至 1.31 億美元,同比增長 70%。根據 Visible Alpha 編制的估計,分析師預計 Palantir 第一季度的商業部門總收入將達到 2.904 億美元,高於 2023 年第四季度的 2.84 億美元和去年同期的 2.361 億美元。

Palantir 商業業務的強勁增長可能會增強投資者對該公司向政府客户以外拓展能力的信心。高盛分析師表示,他們認為,隨着 Palantir 在數據拼接方面的優勢與客户的人工智能項目交叉,圍繞該股的關鍵爭論將是其業務增長的持久性。

商業焦點:保持人工智能發展勢頭

投資者將在業績會議上關注該公司高管評論,以判斷人工智能的勢頭是否能維持 Palantir 的增長。在人工智能需求激增的背景下,人們對 Palantir 的潛力充滿熱情,Palantir 的股價因此上漲。一些分析師表示,它是一個關鍵的有利因素,而另一些人則認為,它在人工智能炒作方面被高估了。

Wedbush 的分析師稱 Palantir 是 “人工智能中的梅西”——以足球明星萊昂內爾·梅西 (Lionel Messi) 為比喻。他們説:“每十年都有那麼幾次,科技公司如此領先於競爭對手,處於未來增長的最佳時機。”

相比之下,傑富瑞分析師表示,該股對人工智能潛力的 “誇大” 了,他們寫道,該公司此前 “低估了 Palantir 商業和政府業務放緩的嚴重程度,這導致需求復甦時間超過預期,可能會在 2024 年之前繼續限制增長”。

Palantir 股價上週五上漲 3.46%,至 23.33 美元;自 2024 年初以來,已經上漲了 31% 以上。