Can I still buy gold now? UBS conducts in-depth research on the Chinese gold market

瑞銀指出,中國投資者傾向於在黃金價格回調時買入,預計未來投資者將在每盎司 2250 美元附近的跌勢中有意願買入。

今年創紀錄的金價上漲行情,市場普遍認為中國投資者扮演了重要角色。中國央行連續 18 個月增加黃金儲備,成為備受關注的主要央行買家之一;散户對黃金 ETF 產品顯示出旺盛的購買熱情;金店的黃金首飾銷售也異常火爆。

華爾街大行瑞銀在去年 4 月底實地考察了中國黃金市場中心北京和上海,獲得了第一手的市場情報和客户反饋。9 個月後,金價歷史性飆升之際,瑞銀又對中國市場進行了一個後續深度調研。

瑞銀指出,中國投資者傾向於在黃金價格回調時買入,預計未來投資者將在每盎司 2250 美元附近的跌勢中有意願買入。

據瑞銀表示,有投資者傾向於認為美聯儲不會降息,將維持更高水平更長時間的觀點,這將進一步支撐黃金價格的回調,長期持有黃金的理由仍然成立。

中國市場情緒——逢低買入

中國是全球最大的黃金消費國和生產國之一:全球每年生產約 3500 噸黃金,中國消費站三分之一,生產約 350 噸,剩餘的缺口需要靠進口滿足。

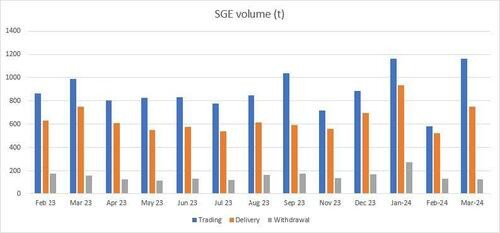

上海黃金交易所(SGE)是中國黃金零售進口的主要渠道。目前有 15 家國內銀行持有黃金進口許可證,它們通過 SGE 進行黃金進口。SGE 要求的標準金條是 99.99% 純度的 1 公斤金條,大小約為一部 iPhone。

此外,還有 4 家外資銀行在華的子公司擁有進口許可證——它們有義務滿足中國企業的需求,並在合適的時候進行 SGE/倫敦黃金套利交易。

市場需求通常會在農曆新年前和黃金週前達到高峰。中國人民銀行通過控制進口配額數量和時間,對市場活動產生重大影響。

瑞銀客户指出,在最近黃金價格暴漲期間, SGE 對倫敦市場溢價十分強勁。2023 年底,SGE 溢價一度接近每盎司 150 美元,目前仍保持在每盎司 30 美元以上的水平。

瑞銀指出,農曆新年的黃金進口配額已經用完,但由於黃金對散户來説仍然具有不可替代性,潛在需求將持續存在。

中國投資者傾向於在黃金價格回調時買入。因此,未來投資者可能更容易對價格產生彈性反應,有意願在每盎司 2250 美元附近的跌勢中買入。

客户更傾向於認為美聯儲不會降息,將維持更高水平更長時間的觀點,這將進一步支撐黃金價格的回調,長期持有黃金的理由仍然成立。

金價突破 2400,SHFE 不是關鍵推手?

最近西方的看法是,上海期貨交易所 (SHFE) 黃金合約是推動金價突破每盎司 2400 美元的關鍵因素,即所謂的 “上期所效應”。有評論員指出,其黃金合約的交易量大幅上升,多頭未平倉合約量大得驚人。

但瑞銀在中國之行中對大多數客户進行了調查後,發現所謂的 “上期所效應” 似乎純屬偶然,並沒有確鑿的因果關係。

國內銀行是上海期貨交易所 (SHFE) 黃金期貨市場的主要做市商。這些銀行的自營交易部門經常進行一種套利交易,即在 SGE 和 SHFE 之間進行黃金差價交易 (類似於西方市場的黃金 EFP 交易)。國內銀行對 SHFE 和 SGE 市場的深入參與,使得他們的觀點具有足夠的可信度。

值得注意的是,在 SHFE 的黃金期貨市場中,大多數參與者並不是為了獲得實物黃金,而是為了對沖風險等目的。當合約到期時,他們通常不會選擇提取實物黃金。

相反,這些參與者往往會將他們的頭寸 “滾動” 到下一個交割月份的合約,或者在合約到期前以現金結算的方式平倉。這意味着 SHFE 的黃金期貨交易量雖然很大,但實際上很少涉及實物黃金的交割。

因此它與全球其他主要的實物黃金市場 (如倫敦黃金市場和 COMEX 黃金期貨市場) 缺乏直接實物黃金互換,因此儘管 SHFE 的黃金期貨交易量很大,但它對全球實際黃金供需和價格的影響非常有限。

此前媒體文章指出,近幾個月來,大量多頭未平倉合約已經積累,相當於 300 噸黃金,但沒有提到淨多頭未平倉頭寸,目前相當於 100 噸黃金。相比之下,最具流動性的全球合約 COMEX 黃金目前的淨投機多頭為 700 噸。