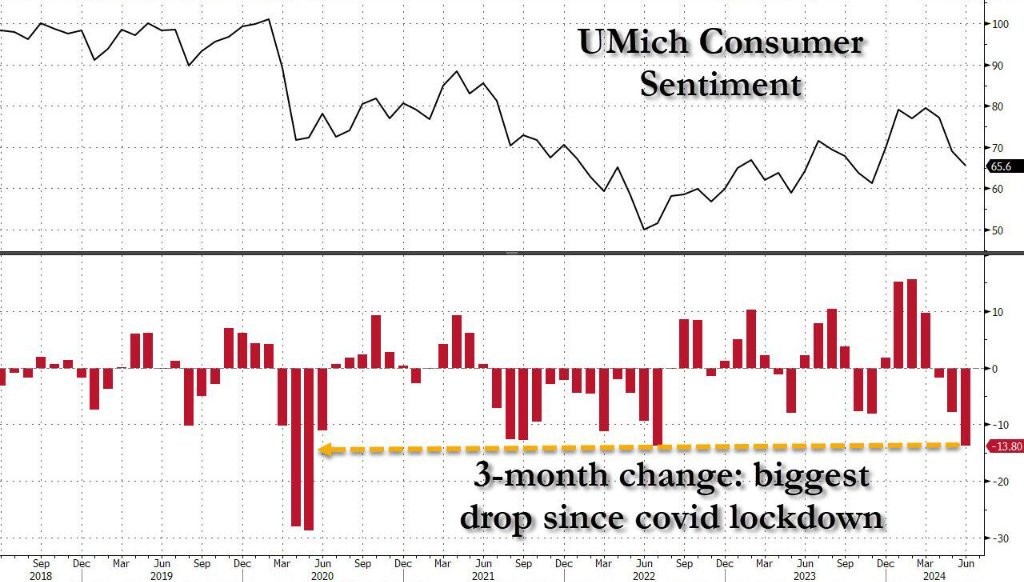

The US consumer confidence unexpectedly fell to a seven-month low, while long-term inflation expectations saw a slight rebound

分析稱,美國消費者情緒的下降與勞動力市場疲軟的跡象相吻合。雖然低收入家庭有顯著的工資增長,但即使通脹放緩,在物價持續高企的情況下,他們的預算仍然緊張。中等收入消費者的觀點與低收入消費者的觀點相似,這與歷史模式不同。

由於高物價水平繼續影響個人財務狀況,美國密歇根消費者信心指數在 6 月初又一次意外下挫,跌至七個月低點,長期通脹預期小幅上升。

美國 6 月密歇根大學消費者信心指數初值 65.6,大幅不及預期的 72,5 月前值為 69.1。上個月公佈的數據顯示,美國 5 月密歇根大學消費者信心指數終值位於六個月低點,較 4 月暴跌。

分項指數方面,6 月現況指數初值 62.5,為 2022 年以來新低,預期 72.2,前值 69.6;預期指數初值 67.6,降至今年最低水平,預期 72,前值 68.8。

市場備受關注的通脹預期方面,美國 6 月密歇根大學 1 年通脹預期初值 3.3%,預期 3.2%,5 月前值 3.3%;5 年通脹預期初值 3.1%,預期 3%,5 月前值 3%。

消費者們對當前個人財務狀況的評估指標下滑 12 點至 79,為去年 10 月份以來的最低水平,反映出對收入的擔憂。人們對經濟狀況的看法降至 2022 年底以來的最低水平。

密歇根大學的報告還顯示,人們對耐用品購買條件的衡量指標降至 2022 年 12 月以來的最低水平。

分析稱,美國消費者情緒的下降與勞動力市場疲軟的跡象相吻合,勞動力市場在過去一年推動了消費者支出。美國非農就業數據顯示,上個月失業率升至 4%,為兩年多以來的最高水平。

密歇根消費者信心數據的調查主任 Joanne Hsu 在一份聲明中表示:

雖然低收入家庭作為一個羣體在強勁的勞動力市場環境下有顯著的工資增長,但即使通脹放緩,在物價持續高企的情況下,他們的預算仍然緊張。

中等收入消費者的觀點與低收入消費者的觀點相似,這與歷史模式不同,在歷史模式中,他們的觀點恰好介於高收入和低收入消費者之間。

消費者信心影響着未來幾個月的經濟增長。悲觀的消費者情緒會抑制支出水平、從而影響經濟復甦,樂觀的消費者情緒則有助於未來經濟。