Analysis of US Stock IPOs | Continuously incurring losses and high debt, Zhongchi Carfu is "overwhelmed" in intense market competition

中馳車福是一家面臨嚴重負債和持續虧損的公司,其赴美上市計劃面臨困境。自 2024 年以來,中國汽車市場競爭加劇,導致傳統豪華汽車品牌遭受重創。中馳車福在尋求資本市場的支持,但募資規模多次變動,顯示其赴美上市遇冷。公司基於供應鏈數字化服務領域建立了全程供應鏈數字化服務的商業模式。總結來説,中馳車福面臨着劇烈的市場競爭和赴美上市的困難。

自 2024 年以來,我國汽車市場競爭進一步加劇。國產汽車品牌卷新車、卷流量、卷銷量,各展所長;與之對應的,則是傳統豪華汽車品牌 BBA 迎來大潰敗,輪番降價的同時,經銷商門店也在不斷縮減。

面對劇烈的市場競爭,汽車產業中的企業紛紛加速進軍資本市場,以尋求新助力,這其中便包括了多個造車新勢力以及產業鏈上的其他玩家,比如剛完成港股上市的汽車街 (02443)、正在招股階段的廣聯科技 (02531)、剛遞表港交所的博泰車聯網,以及奔赴美股的中馳車福。

不過,中馳車福的赴美征程十分曲折,其於 2023 年 7 月 7 日首次向 SEC 遞交了公開版的招股説明書,至今已有一年之久仍未完成上市。且中馳車福的募資規模幾經變動。

2023 年 8 月份時,中馳車福表示欲募資 2300 萬美元,但至今年 4 月,其修改了 IPO 條款,計劃以每股 4 美元至 5 美元的價格發行 130 萬股股票,募資額大幅降至 600 萬美元。但至 6 月份時,中馳車福上調發行股份數量至 250 萬股,募資額升至 1100 萬美元,不過仍較初始計劃募資額度 “腰斬”。

募資規模持續變動的背後,或已間接説明中馳車福赴美上市遇冷。若基於招股説明書深度剖析中馳車福基本面,對此情景便也不會再意外。

平行進口汽車銷售成核心業務

成立於 2010 年的中馳車福是國內較早進入產業互聯網領域的高新技術企業,其持續深耕於汽車產業供應鏈數字化服務領域。截至目前,中馳車福已搭建起了 S2B2C 的全程供應鏈數字化服務的商業模式,其基於在線供應鏈雲平台、SaaS 平台和 MBS 門店網絡,實現了對產業鏈上主機廠、配件工廠、保險公司、MBS 門店以及車主等的廣泛連接和有效賦能,從而形成了汽車全生命週期服務生態系統。

在該生態系統中,主機廠、汽車零部件廠商、保險公司作為 “供應商”,

MBS 門店和車主作為 “商家”,而而中馳車福自身扮演中間連接的身份,其將上述多方串聯起來,實現汽車供應鏈和服務鏈各交易主體之間的流程同步和優化,服務於商品採購、訂購和付款、庫存控制、物流和履行管理等環節,從而於其中獲得收益。

據招股書顯示,截至 2023 年 9 月 30 日,中馳車福雲平台上註冊的參與者包括了 3409 家零部件製造商,17244 家零部件經銷商或轉售商,79279 家門店,77 家保險公司。同時,中馳車福的 MBS 授權店有 252 家,覆蓋了全國 5 個省份的 17 個城市,主要位於三四線城市及縣鄉。

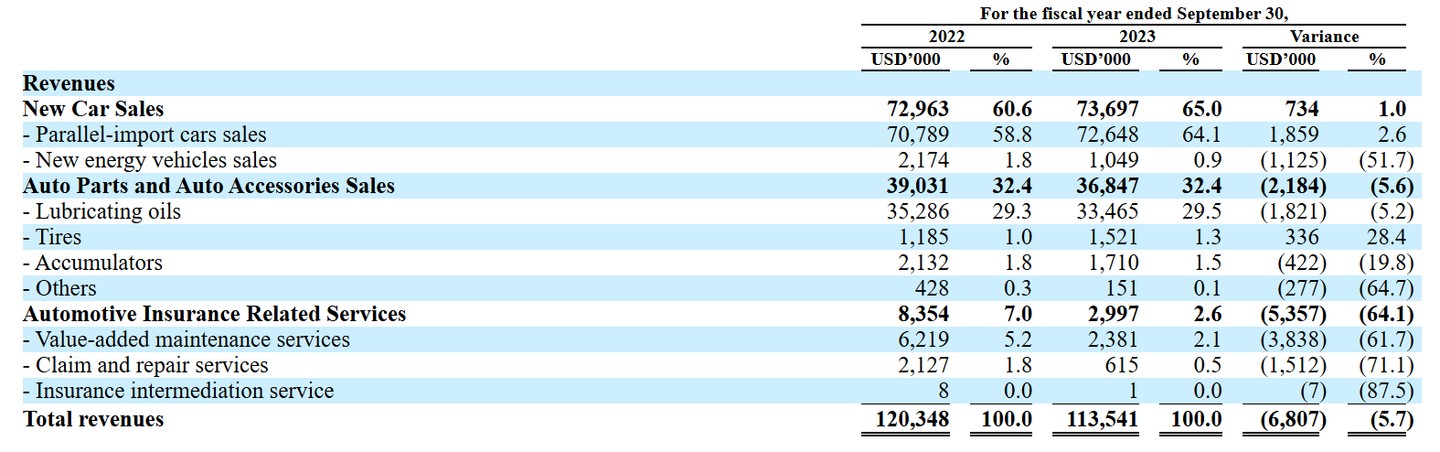

從業務結構上看,中馳車福目前有三大收入來源,分別是新車銷售、汽車零部件及配件銷售、以及汽車保險相關服務。2023 財年 (截至 9 月 30 日止 12 個月) 時,中馳車福上述三大業務的收入佔比分別為 65%、32.4%、2.6%。

顯然,新車銷量為中馳車福的核心業務,該業務又包括了平行進口汽車銷售以及新能源汽車銷售,二者 2023 財年時的收入佔比分別為 64.1%、0.9%。而在汽車零部件及配件銷售中,潤滑油的銷售佔了大部分,2023 財年時的收入佔比為 29.5%,輪胎收入佔比 1.3%、蓄電池收入佔比 1.5%。

從收入來看,中馳車福 2023 財年的營收約為 1.14 億美元,同比下滑 5.7%。其中,汽車零部件及配件銷售收入下滑 5.6%,這主要是因為匯率的波動以及部分客户的合作到期所致;汽車保險相關服務收入同比大降 64.1%,這主要是因為業務量萎縮以及部分門店受疫情影響。

新車銷量收入則增長 1%,這主要是因為公司為應對市場競爭,更加集中於高價位的豪華平行進口汽車,單車價格的上升抵消了銷量的下降從而穩住了收入規模,2023 財年,平行進口汽車的銷量減少 42 輛至 586 輛,新能源汽車的銷量減少 128 輛至 73 輛,由於下半年現金流緊張,中馳車福暫時停止了新能源汽車的銷售。

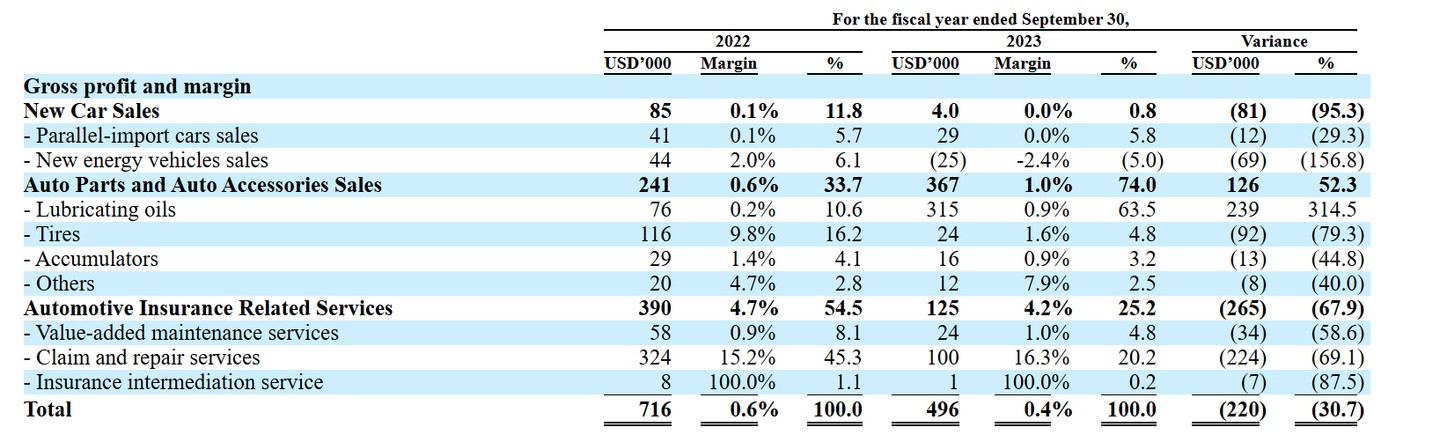

從毛利率來看,中馳車福 2022、2023 財年的毛利率分別為 0.6%、0.4%,這主要是因為平行進口車和潤滑油銷售市場長期劇烈競爭,中馳車福為了吸引客户並擴大市場份額從而戰略性的設定了相對較低的毛利率。2023 財年時,中馳車福新車銷量的毛利率為 0%,即該業務接近毛虧邊緣。

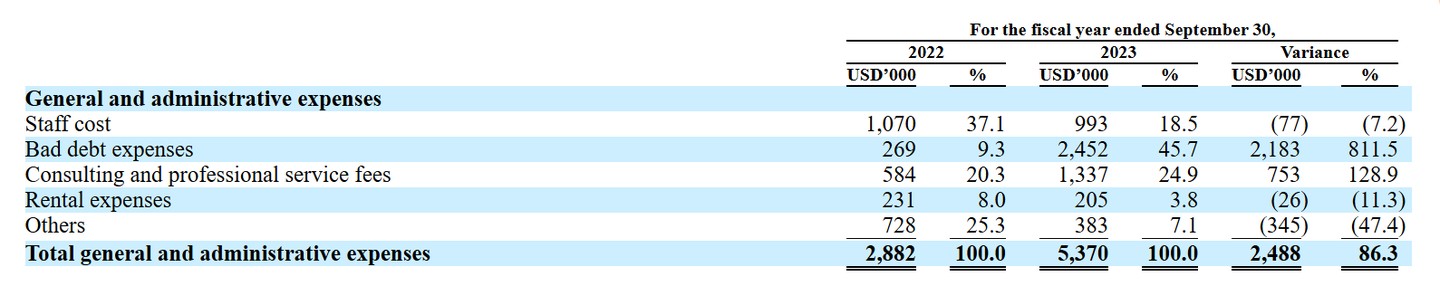

由於整體收入的下滑以及毛利率的下降,再加上公司總運營費用大增 45.5%,這就導致中馳車福 2023 財年時的淨虧損擴大 71.1% 至 1054.9 萬美元。值得注意的是,總運營費用的增長主要由於上市相關開支以及壞賬計提、研發支出增加所致。其中,2023 財年的壞賬大增 811.5% 至 245.2 萬美元。

劇烈競爭下的 “不堪重負”

從上文的分析中不難看出,即使中馳車福花費十多年通過 S2B2C 的全程供應鏈數字化服務商業模式構建的生態系統已連接起了汽車產業鏈上的諸多玩家,但由於劇烈的市場競爭,中馳車福仍未實現盈利,且多個指標表明其在劇烈的競爭下 “不堪重負”。

除了僅百分之零點幾的毛利率水平嚴重製約了中馳車福實現盈利外,其經營現金流持續流出。據招股書顯示,2022、2023 財年,中馳車福的經營現金淨額分別為-486.4 萬美元、-728.1 萬美元。同時,持續的虧損以及現金流出導致了中馳車福負債高企。據招股書顯示,截至 9 月 30 日止 12 個月的 2023 財年,中馳車福的總資產為 1903.5 萬美元,總負債為 4744.6 萬元,資產負債率高達近 250%,期內在手現金僅 212 萬美元,從該等數據也能看出中馳車福赴美上市的緊迫性。

不過,即使成功在納斯達克完成上市,中馳車福雖可稍微緩解公司資金的緊張,但市場環境的持續惡化將讓中馳車福的壓力倍增,其 2024 財年的業績或將再度遭遇打擊。

與 2023 年相比,我國 2024 年的汽車行業競爭持續加劇,已進入 “白熱化” 階段,且國際豪華品牌已呈現出了明顯的頹勢。除了 BBA 輪番降價外,其他高端品牌也難以倖免。以保時捷入門級 Macan 為例,其起售價為 57.8 萬元,但直營店和經銷商能給到的折扣大概在 11%-19%,實際折算裸車價格在 45 萬元-50 萬元。50 萬元以內的保時捷,這在以前難以想象。

而保時捷大幅降價的背後,是其在華銷量的持續低迷。數據顯示,2023 年保時捷在華銷量 79283 輛,同比下滑 15%,成為其全球唯一負增長的細分市場。2024 年第一季度,保時捷全球銷量為 77640 輛,同比下降 4%;但在中國市場,保時捷僅交付了 16340 輛車,同比下滑幅度高達 24%。由此可見市場競爭的劇烈程度,而保時捷的大降價僅是國際豪華品牌在華敗潰的 “冰山一角”,隨着國產豪華品牌的持續崛起,未來這一進程或將加速,國產豪華品牌或將完成對國際豪華品牌的 “絞殺”。

而平行進口汽車銷售是中馳車福的核心業務,這也是公司的優勢所在,但隨着 2024 年國際豪華汽車品牌在國內的 “量價齊跌”,中馳車福的平行進口汽車業務將迎來嚴峻挑戰,畢竟該業務 2023 財年時便錄得了 0% 的毛利率,那麼 2024 財年該業務有較大可能直接轉為毛虧,從而進一步擴大公司虧損。

由此看來,中馳車福頻繁變動募資額便已不奇怪,畢竟公司面臨着盈利水平低、持續虧損、負債高企以及競爭持續加劇、惡化等多方面的壓力,這對於公司的經營是不小的挑戰。能否調整公司的業務佈局,緊抓國產品牌汽車的快速崛起趨勢或許是中馳車福能否走出泥潭的關鍵,讓我們拭目以待。