Review of the premium war in the first 7 months: Ping An, China Life surpass 500 billion yuan again, Sunshine's growth rate approaches 13%

8 月 16 日,中國平安、新華保險、陽光保險(06963.H…

8 月 16 日,中國平安(601318.SH)、新華保險(601336.SH)、陽光保險(06963.HK)披露前 7 個月保費數據。

至此,公示保費的 A 股及 H 股上市保險公司已達 8 家。

信風(ID:TradeWind01)統計發現,中國平安、中國人壽(601628.SH)、中國人保(601319.SH)、中國太保(601601.SH)、新華保險、天茂集團(000627.SZ)旗下國華人壽、眾安在線(06060.HK)、陽光保險共攬保費 20851.45 億元,較上年同期增長 3.65%。

中國平安、中國人壽在規模上持續保持領先身位,收入 5508.66 億元、5235 億元,漲幅為 5.66%、4.39%。

這是繼 2023 年後,兩家頭部機構第 2 次在前 7 月突破 5 千億保費大關。

陽光保險以 12.96% 的同比增速持續領跑行業;眾安在線次之,為 6.14%。

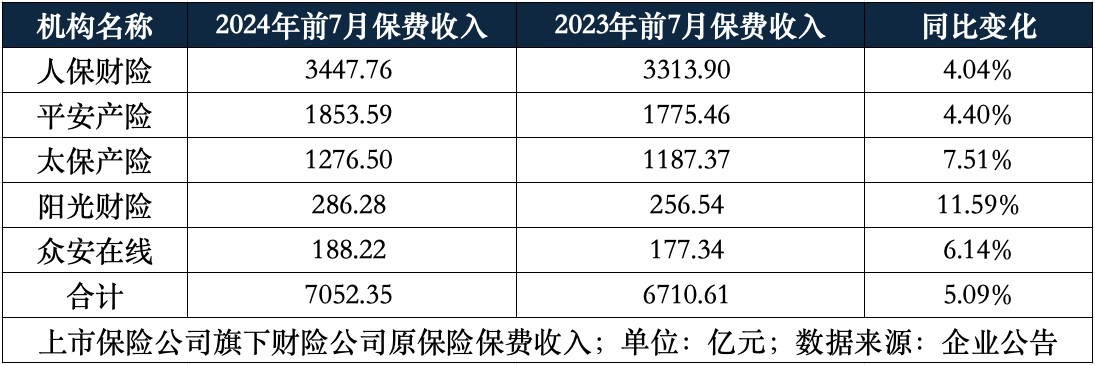

人身險方面,受上年同期基數較高與 “報行合一” 影響,7 家人身險公司保費收入 13184.67 億元,漲幅為 2.75%;財險方面,5 家險企收入 7052.35 億元,漲幅為 5.09%。

3 家人身險增速掉隊

整體增速上,上市險企壽險業務依舊處於轉型 “深水區”,保費收入整體增速為 2.75%,遠低於財險的 5.09%。

從各公司表現看,平靜的水面下早已暗流洶湧。

頭部險企在規模上仍保持絕對的領先優勢。

在上年高基數的基礎上,作為 “壽險一哥” 的中國人壽保費規模與增速仍維持在行業前列,前 7 月共攬保費 5235 億元、增幅達 4.39%,較上半年的 4.13% 再有提升。

平安人壽緊隨其後,保費收入為 3428.03 億元、同比增長 6.43%,增幅為 A 股上市險企人身險子公司之首。

第二梯隊也在發力。

陽光人壽保費規模雖未突破千億,在上市險企人身險子公司中位列倒數第二,但保費增速卻高達 13.64%,為上述人身險機構之最。

人保壽險保費增速雖僅為 1.47%,但已高於前 6 個月的 0.31%、前 5 個月的-3.62%,可見其單月收入正持續回温。

幾家歡喜幾家愁。

仍有國華人壽、新華保險、太保壽險 3 家機構保費不及上年同期。

上述 3 家險企保費規模為 271.52 億元、1118.75 億元、1705.97 億元,同比下滑 11.41%、6.43% 與 2.56%。

不過國華人壽、新華保險 7 月單月保費較上年同期已有回温,漲幅分別為 11.95%、2.77%。

僅太保壽險 7 月單月保費同比下滑 12.83%。

有豺狼在前,亦有虎豹在後。

上半年,行業中已有瑞眾人壽、泰康人壽、中郵人壽 3 家非上市險企保費規模突破千億。

這一數字已超越新華保險、人保壽險當期成績。

其中瑞眾人壽為新設立公司、暫無同期可比業績;泰康人壽、中郵人壽上半年增速則高達 20.97%、32.81%。

太保壽險目前依舊處於領先狀態,但也需要儘快調整策略,挽回保費下滑的頹勢。

針對人身險業務,太保壽險曾在 3 年前推出 “長航行動” 尋求轉型,將產説會銷售變為一對一銷售、短期激勵轉變為常態化經營、人海戰術轉變為優增優育。

當下 “長航行動” 已進展至二期,核心已轉向內勤轉型,主導者也由前總經理蔡強變更為 7 月新上任的前副總經理李勁松。

代理人數量持續下滑的當下,“羣狼環伺” 的太保壽險將以何種方式挽回頹勢,依舊是市場焦點。

強化銀保合作或是路徑之一。

“報行合一” 下,各公司銀保渠道均遭受衝擊,但長期來看,這一政策有利規範業務、增強銀保渠道價值。

上半年,以銀保渠道為核心的陽光人壽及多家 “銀行系” 壽險公司在保費增速上均有突破。

蔡強在任時曾表示,太保壽險的未來在於個險、銀保 “兩條腿跑步”;新任總經理李勁松也曾帶隊公司銀行保險部,在 2021 年至 2023 年實現保費規模 223.5%、308.7%、12.5% 的增長。

個險的增員培優不可少。

隨着代理人數量鋭減、行業水分 “擰乾”,平安人壽、中國人壽、泰康人壽、人保壽險、友邦人壽在內的多家頭部險企已開啓績優人力搶奪戰,推出代理人品牌。

例如去年 6 月,平安發佈高端代理人品牌 “平安 MVP”、今年一季度太平人壽招募 “醫康養代理人”、新華保險發佈 “新華有 WE 來優計劃”。

太保壽險也曾於 7 月初發布 “CA 企業家計劃”,欲打造 “符合新形勢下市場需要的 80、90 後高素質金融人才隊伍。

不過上述計劃收效如何,仍待市場檢驗。

財險增速放緩

相較人身險公司的波動,各上市保險公司財產險業務增、速雖不及去年同期,但已趨於穩定。

信風(ID:TradeWind01)統計發現,5 家上市險企旗下財險公司前 7 個月共攬保費 7052.35 億元,增幅為 5.09%。

保費規模斷層的 “老三家”(人保、平安、太保)中,太保產險、人保財險去年前 7 個月保費增速分別為 13.05%、7.65%,今年已回落至 7.51%、4.04%。

平安產險保費增速較去年有增長,但僅高出 0.06 個百分點。

頭部機構承壓同時,規模較小的陽光財險、眾安在線均貢獻了高於 5% 的增速。其中陽光財險保費同比增長 11.59%,領先其餘公司。

車險仍是財險公司收入主力的背景下,財險保費增速回落源於車險增速收窄。

例如,人保財險前 7 月車險收入 1622.96 億元,佔總保費收入比重達 47.07%。

上年同期,人保財險車險業務增速達 5.2%,但今年已回落至 2.74%。

當下車險增速回落原因大致有三:一是 “報行合一” 後費用率下降,銷售人員積極性減弱;二是新車銷量增速回落;三是 2023 年上半年正值疫情結束、居民消費意願復甦,增速高基數較高。

車險新勢力的加入則有可能影響車險市場的未來格局。

例如比亞迪財險已披露,其二季度保險業務收入 0.67 億元、淨利潤 0.06 億元;上半年整體淨利潤已達 0.18 億元,利潤規模較 2023 年同期增長 0.45 億元。

雖然對比 “老三家”,比亞迪財險的保費規模明顯 “不成氣候”,但未來依舊有巨大潛力。

一是比亞迪財險自 5 月中旬才開啓投保,在投保僅限安徽、江西、陝西等有限地區的情況下,5 月中旬至 6 月末出單量已達到約 1.37 萬件、件均保費為 4900 元。

可見行業內首位新勢力 “玩家” 的實力不容小覷。

二是隨着新能源汽車的佔比逐步提升,車險市場結構勢必發生相應改變,智能駕駛滲透率的提高讓海量駕駛員行為數據成為新能源車企的優勢稟賦。

東吳證券研報總結指出,新能源車企進入保險市場優勢眾多。

例如可簡化新能源車理賠流程、可設計風險和理賠更匹配的創新產品、可對銷售場景壟斷,直接獲取車主的信息。

比亞迪財險成立之初,曾有 “老三家” 高管在業績發佈會後表示,“我們和市場上的朋友們一樣期待他們的成績。車企要做保險很難,我們也好奇,他們的架構、策略、方向會是什麼樣的。”

目前,車險市場中的唯一主機廠選手比亞迪財險已交出首份 “成績單”。

或許在很長一段時間裏,“車企入險” 所達成的保費規模仍無法與頭部險企抗衡;

但在更久的未來,財險公司車險業務將如何發展、車企與險企又將在競閤中碰撞出何種火花,有待關注。