Compared to the booming nuclear energy sector, the stock prices of European and American hydrogen energy companies have plummeted

Affected by negative factors such as lower-than-expected demand, regulatory uncertainty, and poor performance, the stock prices of many hydrogen energy companies like Plug Power have almost halved since the beginning of the year. Meanwhile, nuclear power has gained favor from investors, with SMR developer NuScale Power rising by 486% since the beginning of the year

Affected by factors such as lower-than-expected demand, regulatory uncertainty, and poor performance, the stock prices of European and American hydrogen energy companies have plummeted, contrasting sharply with the hot nuclear power stocks.

Under consecutive quarters of losses, hydrogen energy companies such as Plug Power, Ballard Power Systems, and Green Hydrogen Systems have seen their stock prices nearly halved since the beginning of the year, hitting historical lows. Companies like Nel, Bloom Energy, and ITM Power have also experienced a drop of about one-third in their stock prices.

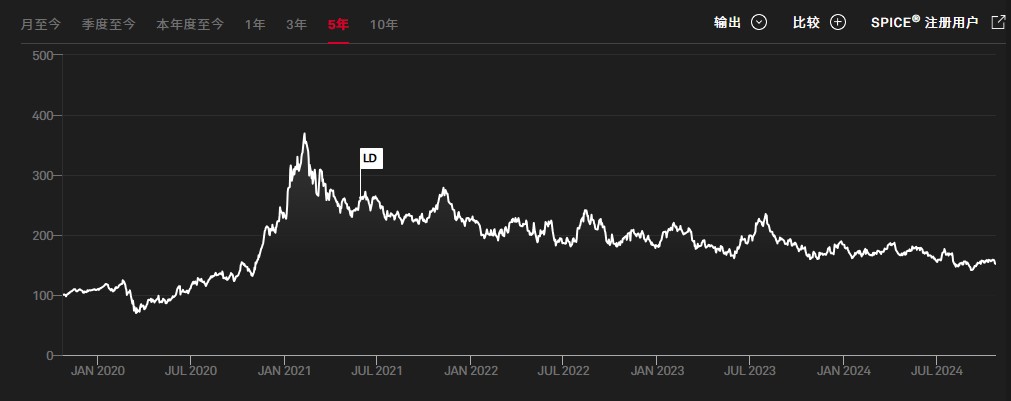

Tracking companies in the low-carbon hydrogen value chain, the S&P Kensho Global Hydrogen Economy Index has returned to mid-2020 levels, erasing the gains made during the green energy boom at the end of 2020 and early 2021.

Last month, McKinsey lowered its forecast for U.S. green hydrogen energy in 2030 by 70%, predicting that the country will not be able to achieve the Biden administration's target of producing 10 million tons of clean hydrogen energy. In July, the European Court of Auditors warned that the EU's goal of producing 10 million tons of green hydrogen energy by 2030 is "unrealistic" and requires a "reality check."

Uncertainties in U.S. tax credit rules and strict EU regulations, coupled with weak demand, have hindered project progress. According to reports from McKinsey and the Hydrogen Council, only 18% of clean hydrogen energy projects in North America and 5% of projects in Europe are planned to come online before 2030.

While the hydrogen industry is struggling and the market is sluggish, nuclear power is gaining favor from investors. Amid the AI boom, electricity demand is surging, and nuclear energy, as a cleaner and more efficient energy source, is back in the spotlight.

According to a report by Bank of America, since 2019, companies related to nuclear power have consistently outperformed their peers. The nuclear energy ETF tracked by the institution has risen by 27% annually, while the MSCI World Index, which tracks global stocks with the same industry weight, has only risen by 14%.

The recent surge in the market is directly driven by Amazon and Google announcing investments in small modular reactors, promoting the deployment of the first batch of SMRs in the United States. As a result, many U.S. nuclear energy stocks have surged significantly, reaching historic highs.

Among them, SMR developers Oklo Inc and NuScale Power have seen their stock prices rise by 80% and 486% respectively since the beginning of the year.