Consensus and Expectation Differences in U.S. Treasuries

Trump's victory has raised concerns about high inflation and high deficits, with U.S. Treasury yields quickly rising to 4.6%. The fundamentals of the U.S. economy are beginning to cool, and inflation is expected to slightly decrease in the first quarter of 2025, while the debt ceiling may limit the supply of U.S. Treasuries. It is recommended to seize trading opportunities when the 10-year U.S. Treasury yield exceeds 4.5%. In the short term, interest rates still have upward momentum, requiring defensive countermeasures. The domestic economy is steadily improving, and expectations for interest rate cuts by the Federal Reserve next year are being adjusted, with ample fiscal policy space

Core Viewpoint

Trump's victory has brought concerns of high inflation and high deficits, coupled with the Federal Reserve's hawkish shift, leading to a rapid rise in U.S. Treasury yields to 4.6%, reaching a six-month high. However, the current U.S. fundamentals have begun to cool marginally, creating a divergence with the still rising rates. For Q1 2025, U.S. inflation is expected to slightly cool, and the debt ceiling may limit the supply of U.S. Treasuries. In terms of allocation advice, we believe that 10-year U.S. Treasuries above 4.5% could present trading opportunities, but short-term rates still have some upward inertia, maintaining a defensive counterattack stance. In asset allocation, overseas markets have priced in the Federal Reserve's hawkish rate cuts sufficiently, while domestic focus is gradually shifting from loose monetary policy to loose fiscal policy. The Federal Reserve's hawkish statements have driven U.S. Treasury yields significantly higher, leading to a pullback in U.S. stocks and increased volatility; domestically, there was previously higher confidence in next year's loose monetary policy, and the market has reflected this relatively fully, paying attention to subsequent incremental statements on fiscal strength.

Core Theme: Consensus and Expectation Differences in U.S. Treasuries

The logic supporting the rise in U.S. Treasury yields mainly consists of three short-term logics and three long-term logics. The short-term logics include: the overall strength of the U.S. economy, Trump's attempt to stimulate "animal spirits" after his victory; strong consumer demand, with broad inflation still high; and a hawkish monetary policy. The long-term risk lies in the potential for secondary inflation under Trump's policy mix, changes in the supply-demand relationship of U.S. Treasuries may push term premiums higher, and investors may demand higher yields to compensate for potential sovereign credit risks. However, we believe that the vast majority of these factors have already been priced in by the market. Looking ahead, some new marginal changes may gradually accumulate; the momentum of the U.S. economy has shifted to marginal cooling since mid-November, and the continued cooling of the labor market is expected to further slow wage growth. The debt ceiling may limit the supply of U.S. Treasuries, potentially creating an environment for a phase of decline in U.S. Treasury yields in Q1 next year.

Market Condition Assessment: Domestic Economy Overall Steady Progress, Fed Rate Cut Expectations Adjusted for Next Year

The domestic economy is generally showing steady progress and moderate improvement, although endogenous momentum such as consumption and price signals still needs to be strengthened. The risk in the U.S. labor market is decreasing, inflation is moderately rebounding, and expectations for Fed rate cuts next year are being adjusted. In terms of domestic monetary policy, the December LPR remains unchanged, and monetary policy is expected to gradually loosen next year. Regarding domestic fiscal policy, November fiscal data continues to show early recovery characteristics, and there remains ample space for loose fiscal policy next year. In terms of real estate policy, changes in real estate policy last week mainly focused on the demand side, with attention on whether the policy attitude towards "rescuing the main body" will change.

Allocation Advice: Domestic Focus Shifting from Loose Monetary Policy to Loose Fiscal Policy, Increased Volatility in Overseas Assets

For the domestic bond market, recent interest rate movements have been rapid, with both short and long ends entering an "unmanned zone," but there has been a pullback after expectations for loose fiscal policy have warmed up. The odds for 10-year government bonds below 1.7% have weakened, and chasing the rise is not recommended. In the domestic stock market, it is advised to maintain a barbell allocation before the Spring Festival, with high dividend yields and broad technology themes on both ends, while moderately positioning for supply-demand clearing and recovery opportunities in the middle. For 10-year U.S. Treasuries above 4.5%, pay attention to "counterattack" opportunities after defense, but short-term rates still have some upward inertia, with a relatively high probability of running at elevated levels in the medium term The outlook for the U.S. economy remains solid, and the upward trend in U.S. stocks has not yet reversed. Seasonally, market sentiment for U.S. stocks may cool in January, and technology stocks have already accumulated significant gains post-election, potentially leading to a more balanced style. U.S. Treasury yields are rising, the U.S. dollar index is at a two-year high, and the global manufacturing cycle's recovery pace still faces fluctuations, with commodities generally in a headwind situation.

Main Text

Consensus and Expectation Gap in U.S. Treasuries

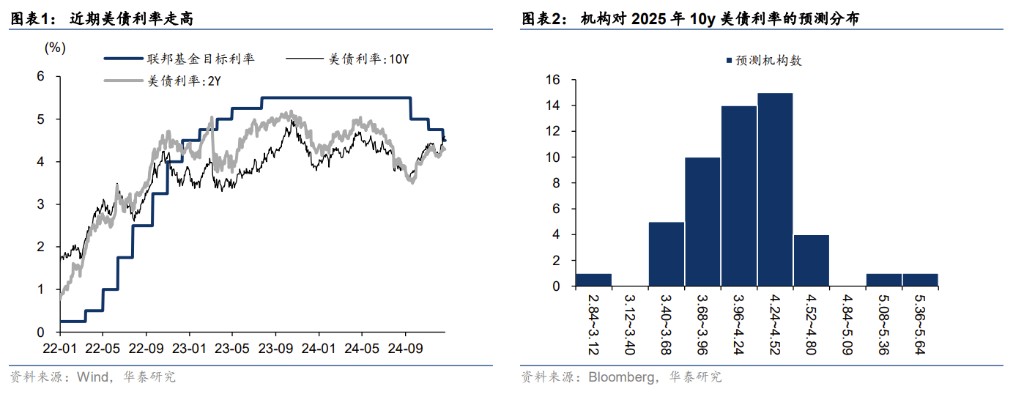

Following Trump's victory, the market generally raised its expectations for the range of U.S. Treasury yields, and after the December FOMC meeting, U.S. Treasury yields accelerated upward, exceeding many investors' expectations. According to a Bloomberg survey on December 24, market institutions generally believe that U.S. Treasury yields will remain high, with over 50% of institutions expecting the 10-year U.S. Treasury yield to fall within the 4-4.5% range by the end of 2025. However, as of December 24, the 10-year U.S. Treasury yield has already broken above 4.6%.

In summary, the logic supporting the rise in U.S. Treasury yields mainly consists of three short-term logics + three long-term logics, with the three short-term logics as follows:

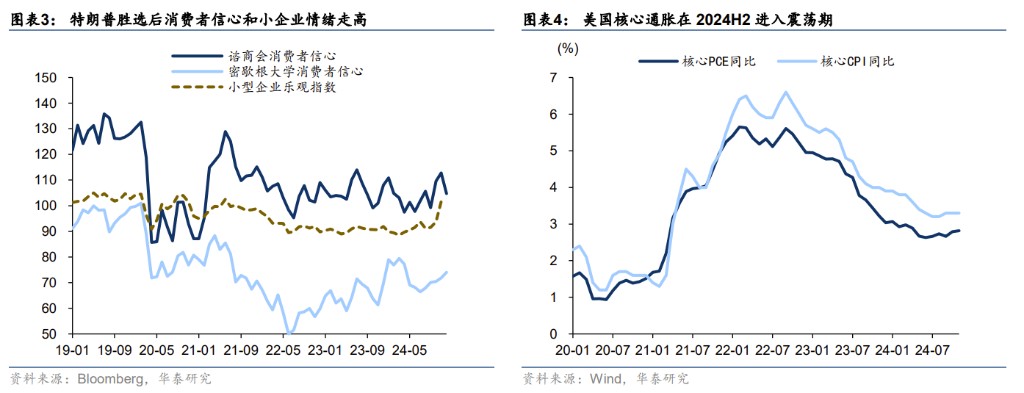

First, from a fundamental perspective, the overall strength of the U.S. economy, coupled with Trump's victory attempting to stimulate "animal spirits," has further supported the short-term fundamentals under optimistic sentiment. The Atlanta Fed's GDPNow model on December 24 projected a year-on-year growth rate of 3.1% for U.S. GDP in Q4 2024, roughly in line with Q3 2024.

Second, regarding inflation, U.S. prices are expected to maintain fluctuations starting in H2 2024, losing momentum for further declines, driven by strong consumer demand + widespread inflation remaining high.

Third, from a monetary policy perspective, the Federal Reserve adopted a hawkish stance at the December FOMC meeting, with a clear focus on the risks of excessively high inflation outweighing concerns about high unemployment rates.

From a long-term perspective, investors may be more concerned about three aspects of risk:

First, under Trump's policies of expelling immigrants + increasing tariffs + domestic tax cuts, the U.S. may face a scenario of strong demand + weak supply by 2025, potentially leading to sustained inflationary pressures.

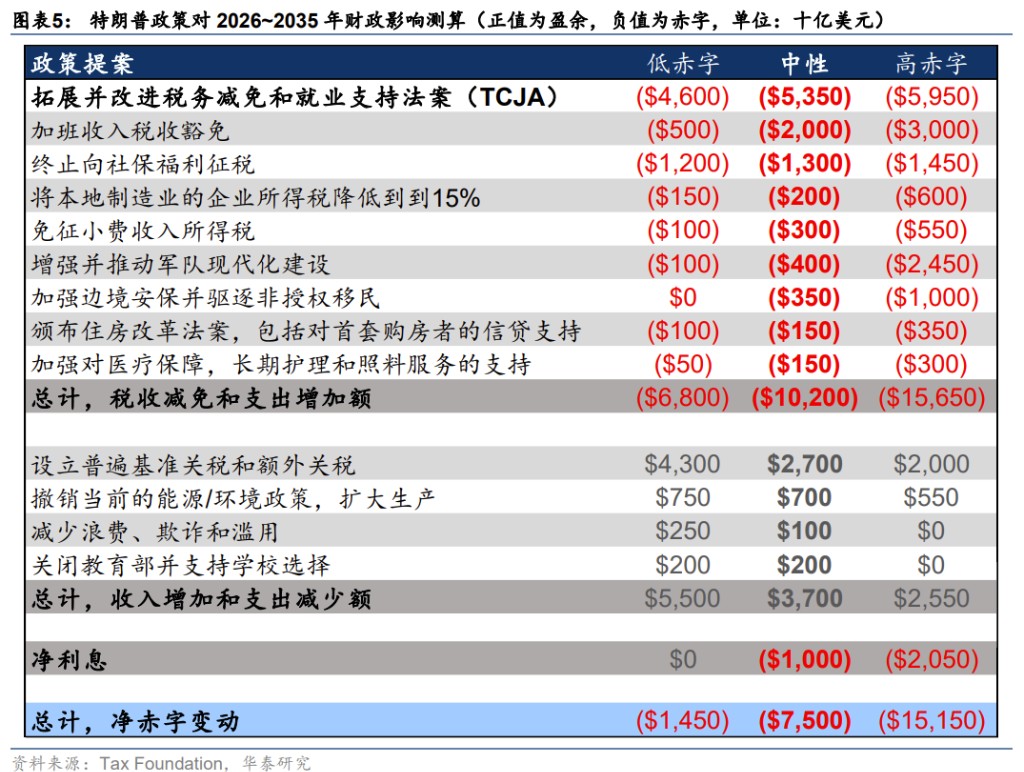

Second, if Trump implements large-scale tax cuts and other policies after taking office, the U.S. government's deficit may further expand. Coupled with non-U.S. central banks potentially selling U.S. Treasuries to address exchange rate pressures, changes in the supply-demand relationship for U.S. Treasuries may push up term premiums.

Third, the rising U.S. fiscal deficit in recent years makes debt sustainability one of the most important long-term risks, and investors may demand higher yields to compensate for potential sovereign credit risks. The proposed Treasury Secretary, Bentsen, has also elaborated on this, noting that the return of U.S. manufacturing raises financing demand, while tariffs and oil prices reduce the willingness of China and the Middle East to purchase U.S. Treasuries, leading to an imbalance in supply and demand for U.S. Treasuries

However, we believe that the vast majority of the above factors have already been priced in by the market. Looking ahead, some new marginal changes may gradually accumulate and bring about a phase of decline in U.S. Treasury yields in the first quarter of next year.

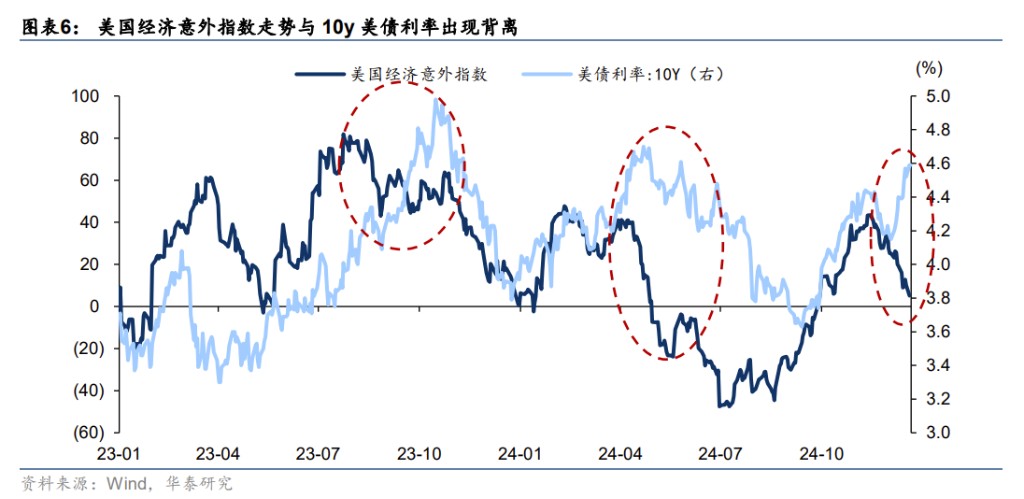

First, in terms of economic momentum, the U.S. has shifted to marginal cooling since mid-November, diverging from the continuously rising U.S. Treasury yields. This divergence may subsequently converge through an accelerated decline in U.S. Treasury yields. If we measure the marginal changes in fundamentals using the economic surprise index, we can see that for most of 2023, it has maintained a good synchronization with the 10-year U.S. Treasury yield. However, there have been three notable divergences: from August to October 2023, from April to May 2024, and in December 2024. The first divergence was mainly due to the scale of U.S. Treasury issuance exceeding market expectations, with supply pressures pushing the term premium to rise beyond expectations, and this divergence lasted for a long time, during which U.S. Treasury yields still had significant upward movement; the second divergence was primarily due to market concerns about commodity inflation risks, which lasted for a shorter duration, with U.S. Treasury yields quickly declining after fluctuating at high levels. Starting January 1, 2025, the U.S. debt ceiling will be triggered, and the U.S. Treasury will suspend issuance, resulting in little supply-demand pressure on U.S. Treasuries. Therefore, we believe this divergence is likely to converge in a short period, possibly more similar to the situation in April to May 2024.

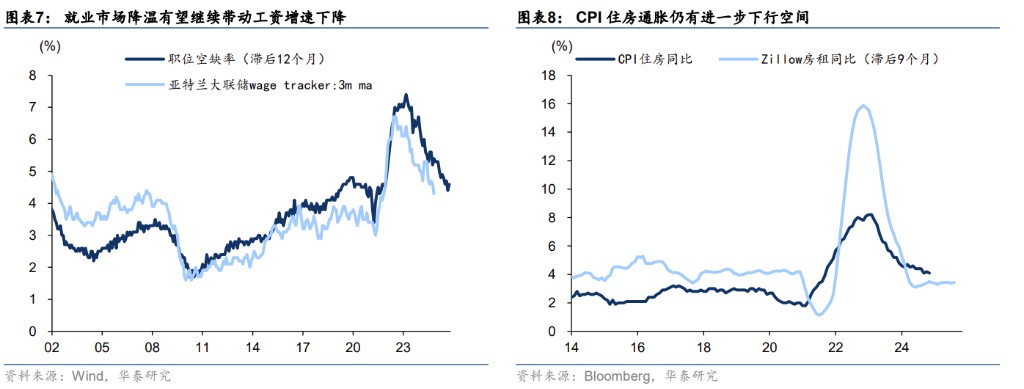

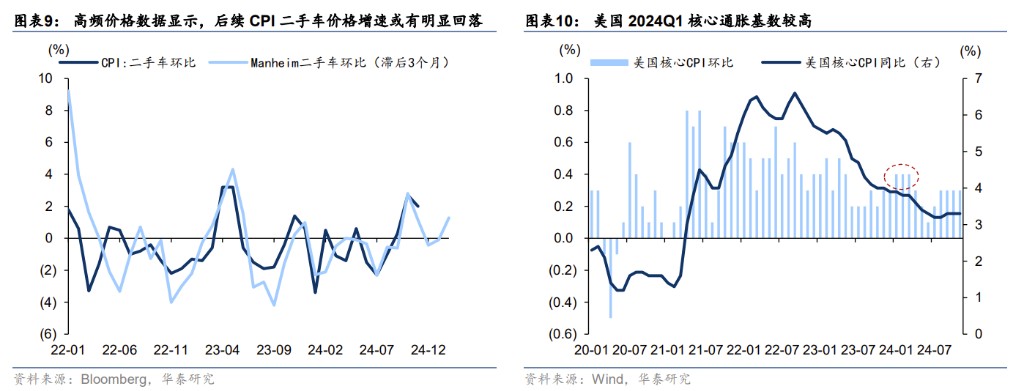

Second, in terms of inflation, the continued cooling of the labor market is expected to further slow wage growth, housing inflation continues to decline + used car prices are likely to fall + high base in Q1 2024, U.S. prices may achieve slight cooling in Q1 2025, with uncertainty mainly regarding the timing and intensity of tariff implementation. The job vacancy rate is still on a downward trend, which may lead to further softening of wage growth, thereby reducing inflation risks. In November, the U.S. CPI for housing year-on-year was 4.1%, still a certain distance from the Zillow rent year-on-year growth of around 3.4%. Based on pre-pandemic experience, the CPI rent growth may ultimately fall below the Zillow rent growth. The month-on-month growth rates for used cars in CPI for October and November were 2.7% and 2.0%, respectively; however, high-frequency price data indicates that the subsequent growth rate of used car prices may show a significant decline. In Q1 2024, the U.S. core CPI remained at 0.4% for three consecutive months, with high base + disinflation effects continuing, and the core CPI reading in Q1 2025 is expected to decrease.

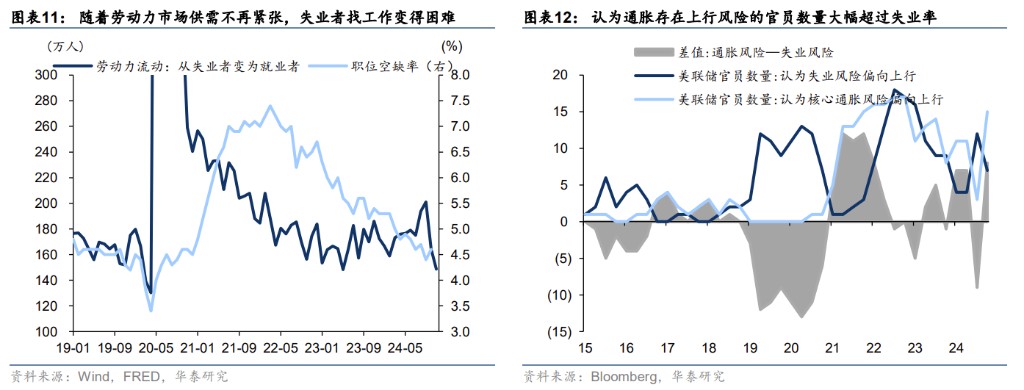

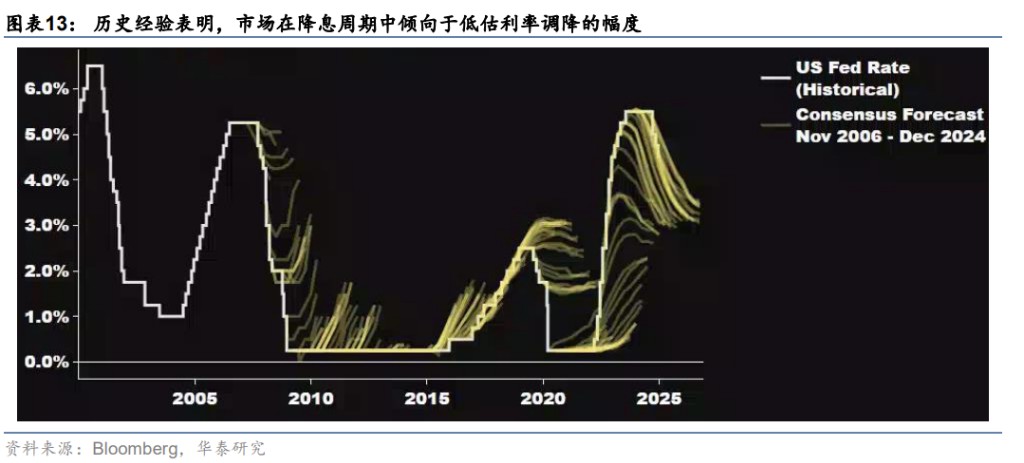

Third, in terms of monetary policy, the Federal Reserve selectively ignored the risks in the labor market during the December FOMC, and historical experience also indicates that the market tends to underestimate the extent of interest rate cuts during a rate-cutting cycle. Currently, the U.S. labor market is in a delicate balance of "hard to find a job, hard to lose a job," with indicators reflecting the supply and demand of the labor market, such as the job vacancy rate, having fallen to pre-pandemic levels. The number of unemployed individuals finding jobs in November was recorded at 1.487 million, nearly a post-pandemic low, while the unemployment rate in November was 4.24%, just behind July's 4.25%, marking the second-highest since 2022. In the December FOMC, the number of officials who believed that core inflation risks were skewed to the upside exceeded those who believed that unemployment risks were skewed to the upside by as much as 8. The last time the gap was this large was in March 2022, when core PCE was as high as 5.6% and the unemployment rate was only 3.6%. Now, the readings are 2.8% and 4.2%, respectively. A comparison reveals that the Federal Reserve may have relatively underestimated the risks of a softening labor market.

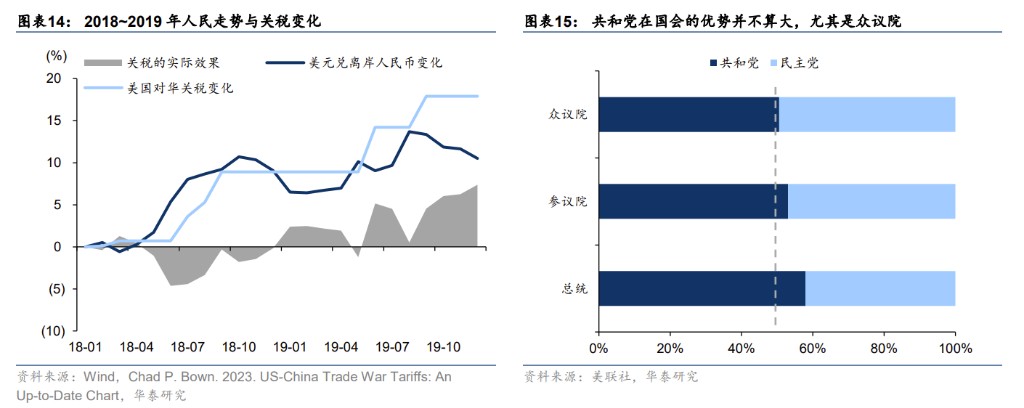

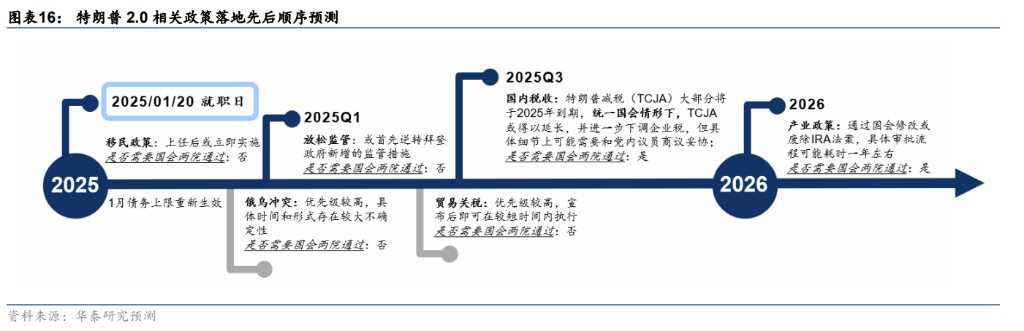

Fourth, there is still considerable discussion space regarding the inflation effects of Trump's policies. We believe there are at least several key points to observe: ① Against the backdrop of a relatively balanced labor supply and demand, the upward pressure on overall wages from expelling immigrants may be relatively limited and may not offset the original demand from these immigrants; whether this results in inflation or deflation still needs to be observed; ② The inflation effect of tariffs is largely influenced by the scope of tax increases (global or specific countries) and the extent of depreciation of non-U.S. currencies; if the scope of increased tariffs is limited + the depreciation of non-U.S. currencies offsets most of the tariff effects, the final impact on inflation may be very mild; ③ Tax cuts require the approval of both houses of Congress, and with the Republican Party holding a slim majority, Trump may have to compromise on some relatively radical tax cut provisions to achieve consensus within the party.

Fifth, it is important to note that due to the impact of the pace of Trump's policy implementation, the U.S. fundamentals may face certain downward risks in the first half of 2025. Policies that may take effect early next year include expelling illegal immigrants, relaxing regulations, increasing tariffs, and improving government efficiency. Except for relaxing regulations, both expelling illegal immigrants and increasing tariffs have a negative impact on economic growth, and improving government efficiency through spending cuts may also create a certain level of chaos in the initial implementation phase

Sixth, the supply and demand for U.S. Treasury bonds in H1 2025 is likely to achieve a tight balance, and the pressure of fiscal bond issuance may only partially manifest in H2 2025 or even Q4 2025. On the supply side, Trump's potential significant increase in deficit policies is mainly through tax cuts, and the TCJA legislation itself does not expire until the end of 2025, along with other incremental tax reduction measures needing Congressional discussion, which may lead to a noticeable increase in the deficit only in FY2026. The Treasury Department also expects in its QRA for Q4 2024 that there will be no need to increase the scale of Treasury bond auctions in the coming quarters. On the demand side, the Federal Reserve is expected to stop balance sheet reduction in H1 2025, combined with selling pressure from non-U.S. central banks (geopolitical + currency stabilization) and the non-U.S. private sector potentially inclined to increase holdings (positive carry on the U.S. Treasury curve + widening spreads with non-U.S. assets). Overall, these factors affecting the demand for U.S. Treasury bonds may offset each other to some extent, ensuring that there will be no significant mismatch in supply and demand in H1 2025.

Seventh, there is currently no need to overly worry about the rollover of U.S. government debt, as high economic growth may alleviate the pressure brought by high deficits. In the long term, if the new Treasury Secretary's vision of "3-3-3" is to be realized, lowering interest rates may also be essential. For example, in 2024, the fiscal deficit rate is around 6.6%, while the actual GDP growth rate is 2.7% + CPI year-on-year at 2.9% (Bloomberg consensus), with nominal GDP growth potentially reaching around 5.6%. This means that the net increase in the government's leverage ratio is only about 1 percentage point, which will not cause significant shock. The new Treasury Secretary, Becerra, proposed a target of 3% real growth + 3% deficit + an increase in crude oil production of 3 million barrels per day, essentially hoping to achieve low deficit + low inflation + low interest rates + high growth, referred to as "three lows and one high." Of course, this target has low feasibility in the short term and will require a significant improvement in economic supply-side efficiency in the long term. In the context of the U.S. government's leverage ratio exceeding 100%, guiding interest rates lower to control debt servicing costs is a key part of achieving a low deficit.

Asset Allocation Insights

First, Trump's victory brings concerns of high inflation + high deficits, leading to an increase in the central level of U.S. Treasury bond yields + amplified volatility, compounded by the Federal Reserve turning hawkish, which may result in U.S. Treasury bond yields lingering at high levels for an extended period, recently rising rapidly to reach a six-month high.

Second, however, the current U.S. fundamentals have begun to cool marginally, creating a divergence with the still rising interest rates. In Q1 2025, inflation is expected to cool slightly, and the supply of U.S. Treasury bonds may be constrained due to the debt ceiling, while U.S. stocks, in a state of high congestion, may experience a phase of adjustment, providing trading opportunities for U.S. Treasury bonds Third, in terms of allocation suggestions, we believe that U.S. Treasury bonds with a 10-year yield above 4.5% can be considered for trading opportunities, but short-term interest rates still have a certain upward inertia, so we should maintain a defensive counterattack. The short end (such as 2-year) has already aligned with money market rates, and there is a high degree of certainty during the interest rate cut cycle. The long end is more suitable for grid-like accumulation, retaining some bullets to control costs, while investors concerned about inflation risks can choose to allocate TIPS.

Fourth, looking at the whole year, we believe that the two key nodes affecting U.S. Treasury bond trends are in the second and third quarters of next year. The former focuses on observing the actual impact of tariffs after they are implemented on inflation, while the latter assesses the impact of tax cuts and future deficits.

Fifth, the rise in U.S. Treasury yields will exert certain pressure on the RMB exchange rate and non-U.S. stock markets. If U.S. Treasury yields subsequently decline, some interest-sensitive assets may welcome opportunities. It is recommended to pay attention to U.S. cyclical + small-cap stocks, Hong Kong stocks and other emerging markets, as well as opportunities in assets like gold.

Authors of this article: Zhang Jiqiang S0570518110002, Tao Ye S0570522040001, He Yingwen S0570522090002, Yang Jingxi S0570123070295, Source: Huatai Securities, Original title: "Consensus and Expectation Differences of U.S. Treasury Bonds"

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at your own risk