The easing of inflation in the United States reignites expectations for the Federal Reserve to cut interest rates, with funds flowing back into global equity funds

美國通脹緩解重燃美聯儲降息預期,全球股票基金在截至 12 月 25 日的一週內出現 343.8 億美元的資金流入,逆轉了前一週的 368.4 億美元淨賣出。美國股票基金吸引 205.6 億美元,歐洲和亞洲基金分別獲得 51.1 億美元和 28.4 億美元。全球債券基金連續第二週淨流出 14.7 億美元,而短期債券基金則吸引 17.8 億美元。黃金和貴金屬基金吸引 12.5 億美元,為九周來最大單週資金流入。

智通財經 APP 注意到,LSEG 的數據顯示,截至 12 月 25 日的一週,全球股票基金見證了顯著的資金流入,這一趨勢逆轉了前一週的大規模淨賣出情況。美國發布的温和通脹報告以及政府避免停擺的消息均提振了投資者信心,促使他們重新擁抱風險資產。

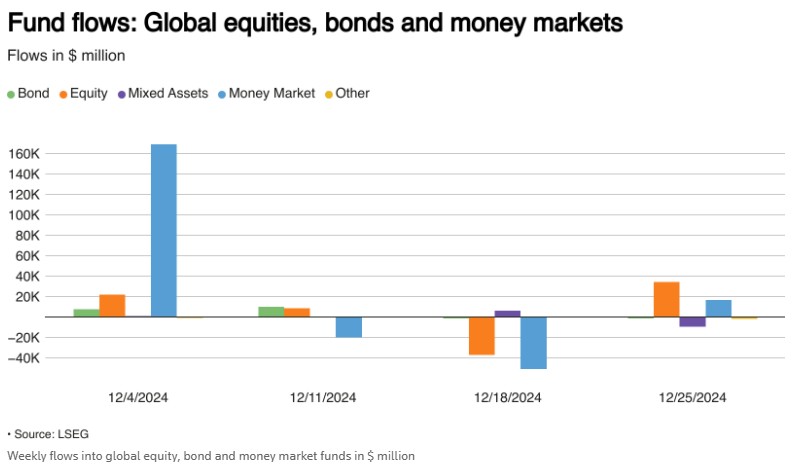

根據 LSEG 的數據,投資者向全球股票基金注入了 343.8 億美元的鉅額資金,為六週以來的最大規模,此前一週淨賣出 368.4 億美元。

美國商務部發布的報告顯示,11 月份個人消費支出價格指數上漲 0.1%,低於分析師預期,這讓市場對美聯儲明年進一步降息重燃希望。

美國股票基金吸引了 205.6 億美元的資金流入,這是八週以來第七次淨流入。與此同時,歐洲和亞洲基金也獲得了大量資金流入,分別獲得 51.1 億美元和 28.4 億美元。

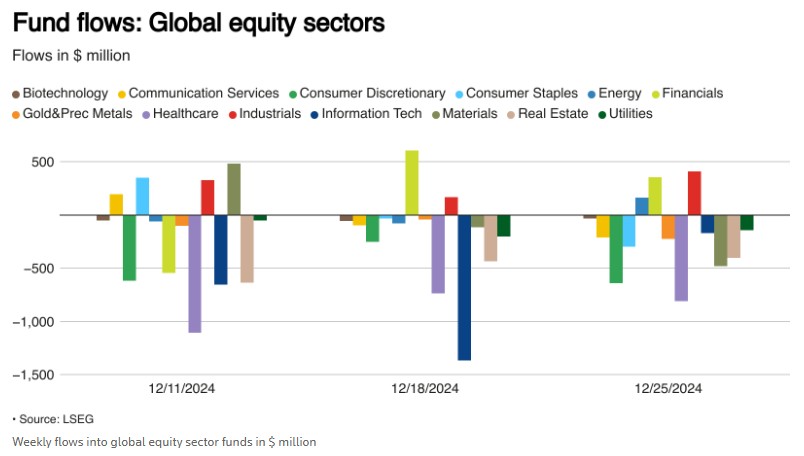

全球行業股票基金連續第三週出現淨流出,總計 24.8 億美元。具體而言,投資者從醫療保健基金撤出了 8.1 億美元,從非必需消費品基金撤出了 6.39 億美元,從金屬和礦業基金撤出了 4.8 億美元。

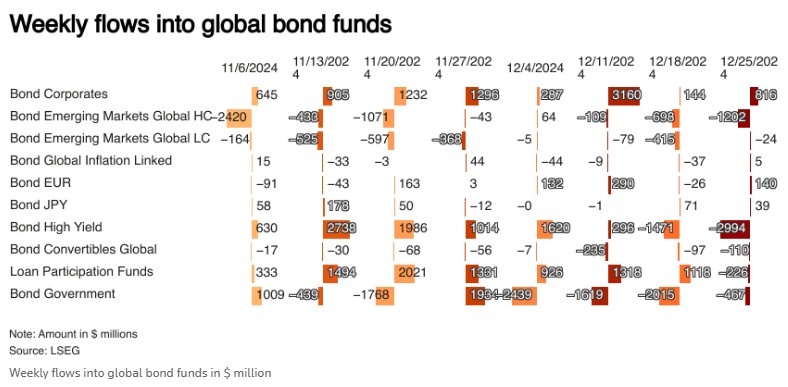

全球債券基金連續第二週淨流出 14.7 億美元,此前截至 12 月 11 日的連續 51 周資金流入。

全球高收益債券基金出現 8 個月來最大的資金流出,本週淨賣出 29.9 億美元。相反,投資者向短期債券基金注入了 17.8 億美元。

投資者向貨幣市場基金淨注入 169.5 億美元,扭轉了兩週的淨拋售。

大宗商品方面,黃金和貴金屬基金淨吸引 12.5 億美元資金流入,為九周來最大單週資金流入,能源基金淨賣出 2.12 億美元。

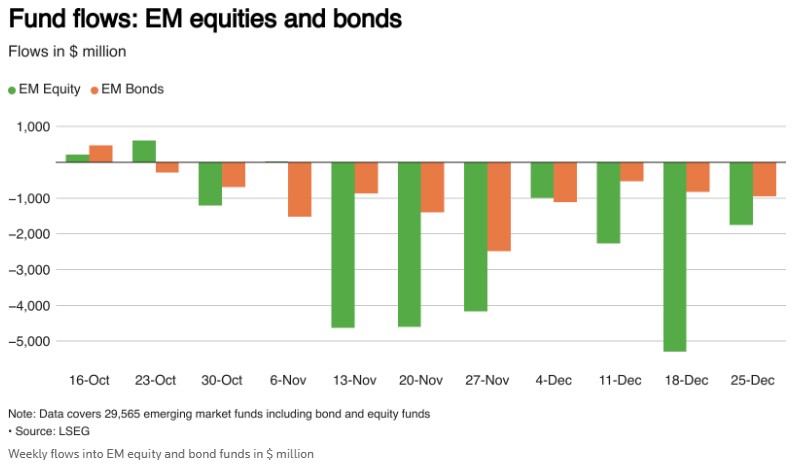

與此同時,涵蓋 29565 只新興市場基金的數據顯示,股票基金繼續保持趨勢,連續第七週淨賣出 17.5 億美元,債券基金也經歷了總計 9.57 億美元的淨流出。