Who is the most profitable highway in China, earning over 14 million a day?

China's total highway mileage has reached 183,600 kilometers, with annual toll revenue exceeding 660 billion yuan. Shandong Expressway, Zhejiang Hu-Hang-Yong, and Ning-Hu Expressway are the companies with the highest revenue. The profitability of highways in the Yangtze River Delta and the Pearl River Delta is strong, with Shenzhen Expressway's Guang-Shen Expressway generating an average daily income close to 8 million yuan, while Ning-Hu Expressway's Hu-Ning Expressway has an average daily income exceeding 14.3 million yuan, making it the most profitable highway in China. Nevertheless, the highway industry as a whole still faces a revenue-expenditure gap of 600 billion yuan

China's expressways are becoming increasingly dense, with a total length of 183,600 kilometers, equivalent to 4.5 laps around the Earth's equator.

The massive mileage corresponds to an annual toll revenue exceeding 660 billion yuan. The "2021 National Toll Road Statistical Bulletin" shows that an average of over 1.8 billion yuan in tolls is collected daily.

Caijing has sorted through the financial reports of about 20 listed expressway companies and found that expressway companies located in the eastern coastal regions have higher revenues. Shandong Expressway (600350.SH), Zhejiang Hu-Hang-Yong (00576.HK), and Ninghu Expressway (600377.SH) rank in the top three, with operating revenues of 26.55 billion, 16.97 billion, and 15.19 billion yuan respectively in 2023.

Focusing on specific routes, the expressways in the Yangtze River Delta and the Pearl River Delta are the most profitable. The Guangshen Expressway under Shenzhen Expressway (600548.SH), which connects Guangzhou and Shenzhen, has a total length of 122.8 kilometers, with an average daily traffic volume of 630,000 vehicles from January to September 2024, contributing nearly 8 million yuan in toll revenue each day.

The traffic volume on the Huning Expressway under Ninghu Expressway is slightly lower, with an average of 115,000 vehicles per day from January to September 2024. However, due to its longer length of 248 kilometers connecting Shanghai and Nanjing, its average daily revenue is higher, exceeding 14.3 million yuan, making it one of the most profitable expressways in China.

Although these two transportation arteries are incredibly lucrative, the expressway industry as a whole has been operating at a loss, with a revenue shortfall of 600 billion yuan in 2023. This is due to the high costs of road construction, with 80% of the earnings used to repay principal and interest.

01 The Most Profitable Expressways in the Yangtze River Delta and Pearl River Delta

According to the "2023 Transportation Industry Development Statistical Bulletin" released by the Ministry of Transport, the domestic expressway mileage reached 183,600 kilometers, an increase of 6,400 kilometers from the previous year, with the vast majority being toll roads.

Traffic volume is higher in economically developed areas, and expressways have stronger revenue-generating capabilities. For example, based on 2019 data, economically developed provinces and cities such as Beijing, Tianjin, Zhejiang, Jiangsu, and Guangdong have significantly higher revenue per kilometer, with surrounding provinces also ranking high in toll revenue per kilometer.

Toll fees depend on three factors: toll mileage, traffic volume, and toll prices.

Toll revenue per kilometer for expressways in various regions in 2019. Source: Dongguan Securities

The Guangshen Expressway is located in the core area of the Guangdong-Hong Kong-Macao Greater Bay Area and serves as a golden passage connecting the four major cities of Guangzhou, Dongguan, Shenzhen, and Hong Kong. Due to its economic development and frequent population movement, it has an average daily traffic volume exceeding 600,000 vehicles, making it one of the busiest expressways in the country year-round.

According to Shenzhen Expressway's Q3 2024 report, the average daily toll revenue for the Guangshen Expressway reached 7.687 million yuan in the first nine months of 2024, with an expected annual toll revenue of 2.8 billion yuan The Guangzhou-Shenzhen Expressway has been in operation since 1997, and it has been over 20 years now, with the 30-year toll period set to expire in 2027. If the expressway undergoes reconstruction and expansion, the toll period can be extended.

There are mainly two ways to expand and renovate expressways: one is to build a new parallel line next to the existing expressway; the other is to expand on the original site, modifying the existing expressway to increase the number of lanes. Expanding along the old road can make full use of existing resources, save land, and best adapt to the existing road network and economic belt. Currently, most expressway expansions and renovations adopt this method.

In this regard, the Guangzhou-Shenzhen Expressway expansion project was approved by the Guangdong Provincial Development and Reform Commission in 20223, and it is expected to expand from the existing six-lane bidirectional road to eight to twelve lanes in different sections, taking about five years and costing over 40 billion yuan.

Looking at the most profitable Hu-Ning Expressway, the financial report shows that the traffic volume from January to September 2024 is 115,000 vehicles, an increase of 2.32% compared to the same period last year, with both passenger and freight traffic showing varying degrees of improvement. However, the average daily revenue decreased from 14.47 million yuan to 14.31 million yuan, a decline of 1.47%.

The listed company explained that the free passage time increased by two days. Last year, the number of days with waived tolls for small passenger vehicles during major holidays was 15 days, while in the first nine months of 2024, it increased to 17 days.

Listed companies primarily focused on expressways differ from many other companies, characterized by strong geographical monopolies, high entry barriers, and limited competition. This leads to enterprises not relying on research and development, nor needing sales personnel, and they do not face issues related to inventory, receivables, or raw materials, nor do they face risks of product obsolescence or equipment elimination.

Breaking it down, the costs of an expressway mainly consist of depreciation and amortization (accounting for over 60% of total costs) and operating costs, while the revenue structure is quite simple, referring to toll fees. Therefore, the performance of expressway companies is relatively stable.

From the perspective of listed companies, the top three in revenue are all located in the eastern coastal region. Shandong Expressway had a revenue of 26.55 billion yuan in 2023; Zhejiang Hu-Hang-Yong had a revenue of 16.97 billion yuan, and Ninghu Expressway had a revenue of 15.19 billion yuan.

However, revenue does not equal profit. Caijing found that China Merchants Highway (001965.SZ) stood out with a net profit attributable to the parent company of 6.77 billion yuan in 2023, ranking first. This is not only due to the main business of toll fees but also because of good performance in its side businesses. By the end of 2023, China Merchants Highway had invested in 26 high-quality toll road companies, with investment income reaching 5.99 billion yuan, significantly boosting its performance.

02 Road construction is too expensive, and the income-expenditure gap is widening

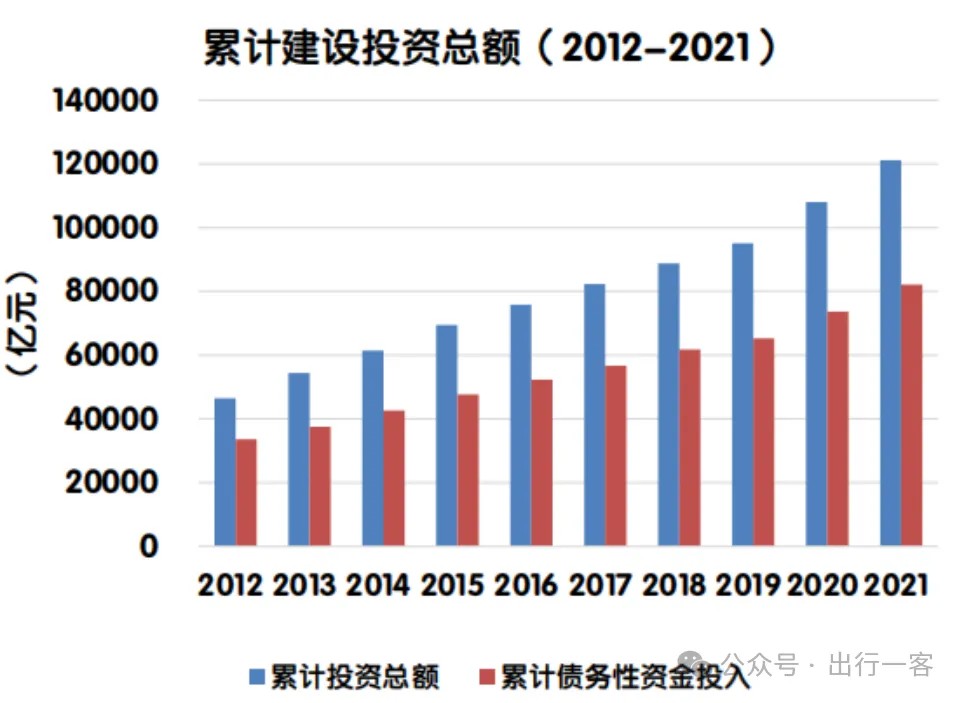

Expressways seem to be making money daily, but the entire industry is still deeply mired in losses because road construction is indeed too expensive In recent years, due to the increase in labor and price levels, newly constructed highways have gradually expanded from two lanes to four lanes, six lanes, etc., resulting in a continuous rise in the cost of new roads. Dongguan Securities calculated the cumulative investment amount and new mileage of toll roads from 2019 to 2021, concluding that the average cost per kilometer is approximately 175 million yuan.

For example, the Shandong Jitai Expressway, which opened in 2020, was questioned for its high tolls. Subsequently, the Shandong Provincial Department of Transportation held a briefing, explaining that the main reason was the higher cost of the Jinan to Tai'an Expressway, which includes four major bridges and tunnels, with a total investment of 11.294 billion yuan, resulting in a cost of 202 million yuan per kilometer, more than twice the average cost of highways in the province.

The investment to build a highway often exceeds 10 billion yuan, and half of the toll roads in the country are still in the loan repayment stage. Statistical bulletins show that by the end of 2021, the mileage of government-repaid roads nationwide was 86,000 kilometers, accounting for 45.9% of the total mileage of toll roads, while the mileage of operational expressways was 101,400 kilometers, accounting for approximately 54.1%.

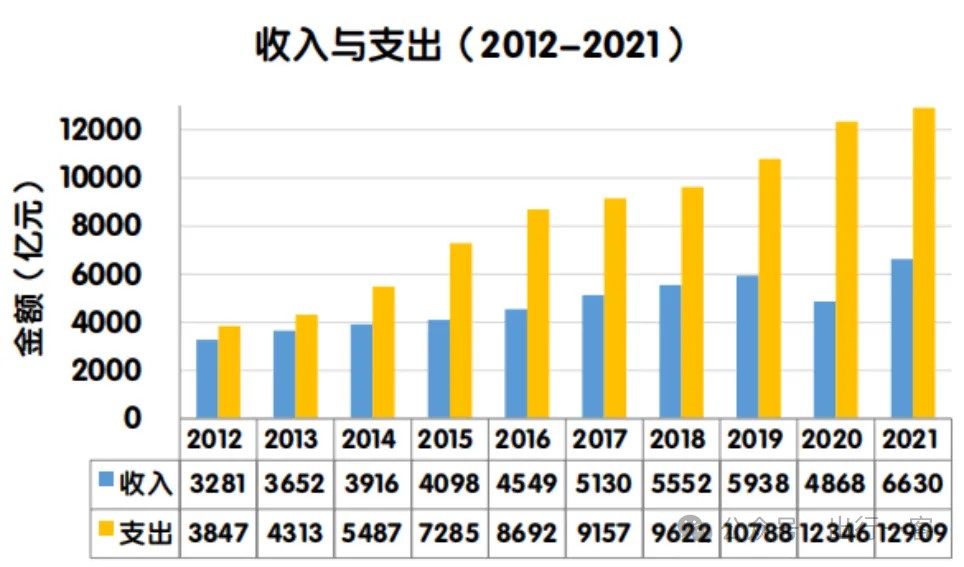

Since 2012, China's highway industry has been operating at a loss, with the revenue-expenditure gap widening year by year. According to statistical bulletins, in 2021, the total revenue from tolls on national toll roads was 663.05 billion yuan, while expenditures were 1.29093 trillion yuan, resulting in a revenue-expenditure gap of 627.88 billion yuan.

The revenue and expenditure gap in the highway industry continues to widen. Source: Ministry of Transport "2021 National Toll Road Statistical Bulletin" Interpretation

Expenditures far exceed revenues due to excessive debt. In 2021, out of a total expenditure of over 1.2 trillion yuan, more than 82% was used for principal and interest repayment, including 716.48 billion yuan for principal repayment and 342.68 billion yuan for interest repayment.

Compared to principal and interest repayment, other expenditures for highways are relatively small, including annual maintenance expenditures of 73.91 billion yuan, expenditures for road and ancillary facility renovation and expansion projects of 30.73 billion yuan, operational management expenditures of 83.88 billion yuan, and tax expenditures of 43.25 billion yuan, accounting for 5.7%, 2.4%, 6.5%, and 3.4% respectively.

The Shandong Provincial Department of Transportation once responded to the public that highway companies, due to their large investment scale, high total assets, and long operating periods, have extremely low asset turnover rates, resulting in a "return on net assets" that does not accurately reflect the company's profitability.

According to Caijing's analysis, the highway company with the highest net profit, China Merchants Highway, has a return on net assets of only 11.41%; while Hunan Investment, which ranks last in net profit, has a weighted average return on net assets of only 7.7% in 2023.

According to data disclosed by the Ministry of Transport, by the end of 2021, the cumulative construction investment in national toll roads reached 12.11844 trillion yuan, but the total revenue from tolls on national toll roads in 2021 was only 663.05 billion yuan This means that, without considering inflation, debt interest, and other factors, it would take approximately 20 years to flatten the construction costs of toll roads based on the toll revenue from 2021.

The total accumulated construction investment refers to the sum of the toll road construction investments from previous years and the current year. Source: Ministry of Transport "2021 National Toll Road Statistical Bulletin" Interpretation

To solve the problem of insufficient income, extending the toll collection period of existing highways is one solution. In recent years, many toll roads built in the 1990s are approaching their toll collection deadlines, making this issue particularly prominent.

For example, the Guangfo Expressway managed by Guangdong Expressway (000429.SZ) expired in 2022 and has transitioned to free use, but maintenance and management are still the responsibility of the listed company. How the specific costs will be paid remains an important issue unresolved by the government.

The current "Regulations on the Administration of Toll Roads" is from 2004. The new version of the "Regulations on the Administration of Toll Roads" has been listed as a major task for transportation legislation in 2024 and is being accelerated. It is expected to extend the operating period of toll roads to 40 years, addressing the medium- and long-term profitability issues of many highway listed companies.

Authors of this article: Wang Jingyi, Shi Zhiliang, etc. Source: Finance Magazine, Original title: "Earning over 14 million a day, who is China's most profitable highway?"

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk