HTSC: The benchmark figure for incremental fiscal spending next year may be around 3 trillion

HTSC expects that the benchmark figure for incremental fiscal spending next year may be around 3 trillion, mainly considering factors such as the actual budget deficit, external demand hedging, and tariff impacts. At the same time, the benchmark figure for broad fiscal spending is unclear, and attention needs to be paid to the incremental effects of debt reduction, off-budget maneuvering methods, and the coordination of micro policies

This week continues to be in a policy window period, with the market influenced by rumors of special government bonds, policy financial bonds, and other fiscal matters, leading to a rise in the stock market, while the bond market mainly experienced fluctuations. The two forces of profit-taking and buying on dips formed a balance, and the liquidity also had a certain driving effect.

Based on the information from the fiscal side this week, we discuss several guidelines for judging next year's fiscal strength. This year, the overall pattern of fiscal policy is in a state of "budget expansion + off-budget contraction = overall tightness." Next year, the market tends to use the current expected deficits and bond issuance figures to assess next year's fiscal strength, and we believe there are roughly several guidelines.

First, from the perspective of actual deficits within the budget, consider the fiscal maneuvering.

According to rough estimates of the revenue and expenditure growth rates of the two accounts from January to November this year, the actual deficit of the first account is about 6.6 trillion yuan, and the actual revenue and expenditure gap of the second account is about 4.1 trillion yuan. This is higher than the initial target of a 3% deficit ratio (about 3.9 trillion yuan) + 1 trillion yuan in special government bonds + 3.9 trillion yuan in special bonds for next year, mainly due to maneuvering methods such as carryover surpluses. Part of this comes from the 800 billion yuan in additional government bonds and 300 billion yuan in special bonds carried over from last year (issued last year but not used); another part may be related to the increase in central enterprise profit remittances mentioned in previous fiscal press conferences, all of which constitute part of this year's budgetary fiscal intensity.

Therefore, when we use next year's government bond increment to judge fiscal strength, this portion of maneuvering capacity (about 2 trillion yuan) needs to be compensated first, which is the first guideline for understanding next year's fiscal strength. Of course, there may also be a certain amount of fund carryover this year, which still needs further information confirmation.

Second, from the perspective of hedging external demand, consider the impact of tariffs.

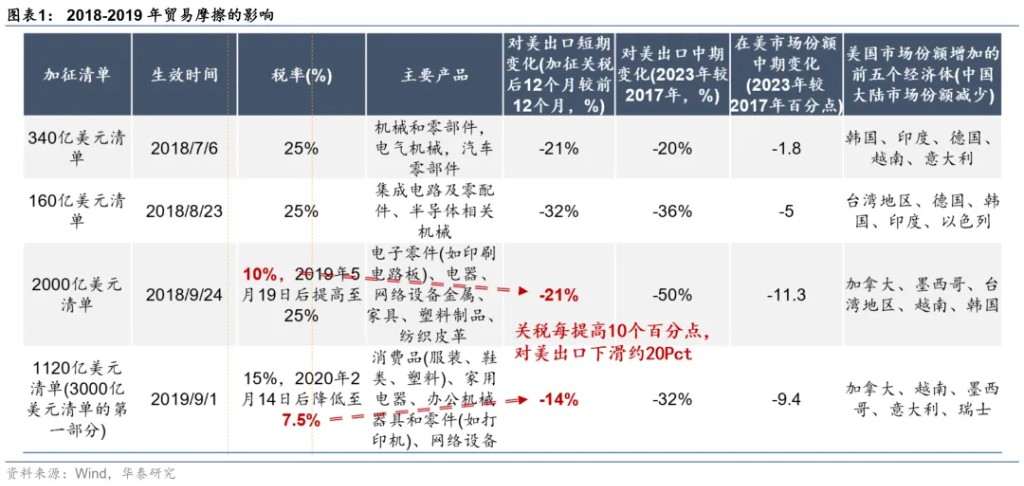

The impact of tariffs depends on two aspects: (1) The extent of tax increases: affecting direct exports to the U.S. Based on the experience of the last round of tariffs (Chart 1), for every 10 percentage point increase in tariffs → exports to the U.S. decline by about 20 percentage points → dragging down total exports by about 3 percentage points → dragging down GDP by about 0.3 percentage points (but the impact may be nonlinear); (2) Whether there is "origin supervision" or "equity penetration": affecting whether it can be circumvented through transshipment or going overseas.

Assuming a fiscal multiplier of 0.6, we can roughly calculate the fiscal strength needed to hedge various tariff scenarios, which is the second guideline for understanding next year's fiscal strength.

(1) Neutral scenario: Increasing tariffs by 20% to 40% + stricter origin controls, dragging GDP down by about 0.6 percentage points, or requiring an additional 1 trillion yuan in fiscal stimulus.

(2) Optimistic scenario: Only increasing tariffs by 10% to 30%, with other conditions unchanged, can hedge through industrial chain advantages and transshipment, possibly requiring little additional stimulus.

(3) Pessimistic scenario: Increasing tariffs by 40% to 60% + imposing a 10% tariff globally + origin controls, dragging GDP down by about 1.2 percentage points, or requiring an additional 2 trillion yuan in fiscal stimulus Of course, the impact of tariffs may be nonlinear, and the above is only an estimated result.

Based on the above two dimensions, the benchmark figure for incremental fiscal spending may be around 3 trillion (actual deficit of 2 trillion from the two accounts + 1 trillion needed for the tariff baseline scenario), which needs to be provided comprehensively by funds carried over from this year to next year + the incremental government debt next year.

Third, for the broader fiscal part, the benchmark figure is not clear, and several issues need to be considered:

(1) The incremental effect of debt conversion. A common understanding is that in next year's incremental government debt, the portion for debt conversion and capital injection needs to be deducted, which is logically reasonable, but the potential incremental effects need to be considered: (1) annual interest savings of about 120 billion, (2) from a contractionary policy of "selling assets" to the current "neutral policy" of "shifting resources," the squeeze on grassroots three guarantees spending has decreased, which may have a certain incremental effect marginally. This year, the gap in livelihood spending in the general public budget is about 350 billion, and the combined incremental effect of the two is expected to be around 500 billion, but there is still considerable uncertainty in the implementation process.

(2) Off-budget shifting methods are relatively more, such as recent information about government financial bonds, which also have a certain quasi-fiscal effect; in addition, the trend of some central enterprises increasing leverage next year is relatively clear, which can provide certain incremental stimulus. Of course, the characteristics of off-budget methods may be more discretionary, thus the uncertainty is also relatively greater.

(3) More crucially, the coordination of micro policies is still key, such as the use of local debt for project capital, the effects of delegating project reviews to provincial levels, local governments "tightening their belts," and incentive mechanisms, the high growth of non-tax revenue reflecting the business environment, the game between central, local, and real estate companies in reserve policies, and the endogenous willingness of residents and enterprises to increase leverage, all of which have a significant impact on the transmission of macro policies. This issue is more critical and still needs to be observed.

Next steps of focus: In January next year, pay attention to this year's fiscal data, the actual revenue and expenditure gap of the two accounts this year will be clarified, and the carryover surplus amount can also be roughly estimated; before the two sessions, the amount of this year's carryover surplus may be further clarified; at next year's two sessions, the specific figures for next year's incremental fiscal spending will be announced, which can be referenced against tariff expectations and benchmark figures to judge the impact. The more critical focus is whether micro policies can form coordination.

Article authors: Zhang Jiqiang S0570518110002, Wu Jing S0570523070006, Source: HTSC Fixed Income Research, Original Title: “【HTSC Fixed Income】Judging Several Benchmark Figures for Next Year's Fiscal Policy—Fundamental Observation December Issue 3”

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account individual users' specific investment goals, financial conditions, or needs. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances Invest based on this information at your own risk