美银预警美股 “危险信号”:势头太猛,估值过高,崩盘难以避免!

Bank of America believes that the policies of Trump 2.0, combined with the artificial intelligence revolution, have created a new landscape that has not been seen since the roaring 2020s. However, while this combination may foster prosperity, it will also amplify the "right tail risk" of 2025, potentially larger than many expect

As 2024 is about to come to an end, Bank of America has conducted an in-depth analysis of the market dynamics of the year and issued a warning for the upcoming year.

Bank of America believes that 2024 will be a bumper year for the U.S. stock market, with prosperity continuing into next year. However, considering the current combination of the Trump 2.0 policy and the AI revolution, which will lead to risk accumulation, the expected price-to-earnings ratio of the S&P 500 index exceeding 25 indicating overvaluation, and the volatility shown by the VIX index indicating market fragility, a bubble in 2025 may burst and be difficult to avoid.

Prosperity Momentum Continues, Risk Accumulation May Exceed Expectations

Bank of America believes that the "right-tail risk" faced by the U.S. stock market may be greater than many expect.

The upward trend in the U.S. stock market in 2024 is evident, with the S&P 500 index achieving over 20% growth for the second consecutive year, primarily led by large tech stocks. Bank of America believes that the policies implemented after Trump's inauguration will fuel the post-election stock market boom, which also means that this prosperity will continue into 2025.

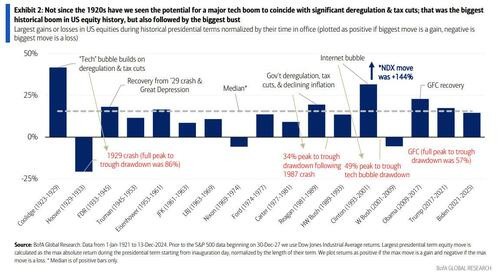

It is worth noting that the laissez-faire economic policies, deregulation, and tax cuts implemented during the presidencies of Reagan and Coolidge once drove rapid increases in asset prices. The technological booms of the 1920s and 1990s similarly created this phenomenon. In 2025, a rare overlap of both will occur, as the Trump 2.0 policy meets the AI revolution, creating a new landscape not seen since the roaring 20s.

However, Bank of America points out that while this combination will fuel prosperity, it will also amplify the "right-tail risk" in 2025, which may be greater than many expect.

Additionally, after the U.S. elections, the trend of small-cap stocks emerging did not last long, as large-cap stocks regained their "dominance." Bank of America believes that the AI boom and high interest rates may help large-cap tech stocks in the U.S. continue to outperform the market, but this also represents an underestimated right-tail risk:

"Because many investors either cannot achieve market weight in large-cap tech stocks or feel nervous about the excessive optimism and valuations in this sector. For years, holding insufficient U.S. stocks, large-cap stocks, or tech stocks has been a painful situation."

Momentum Too Strong, Overvaluation, Crash Inevitable

Bank of America believes that the expected price-to-earnings ratio of the S&P 500 index has exceeded 25, indicating overvaluation and making a crash inevitable.

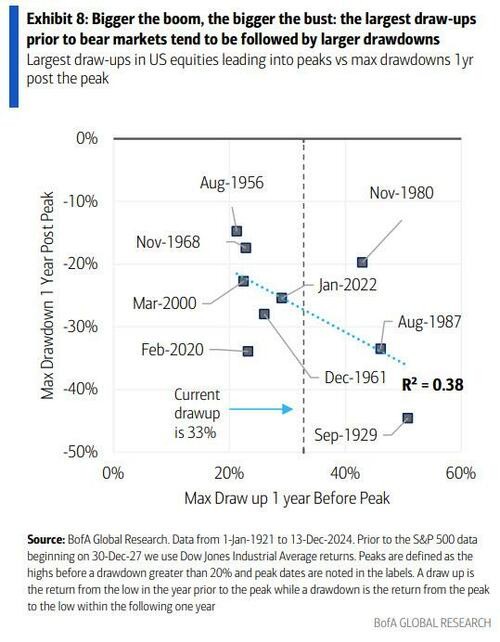

Bank of America points out that the S&P 500 index is expected to rise over 20% for two consecutive years, and the upward momentum seems to remain strong. However, recently, the expected price-to-earnings ratio of the S&P 500 index has exceeded 25, reaching historical highs. Historical data also indicates that such prosperity is often followed by a recession.

Bank of America warns that historically, it is already too late to avoid a recession now. Additionally, due to signs of both a crash and a bubble burst in this decline, Bank of America reminds that while hedging, one should also plan for any possible scenario.

Bank of America warns that historically, it is already too late to avoid a recession now. Additionally, due to signs of both a crash and a bubble burst in this decline, Bank of America reminds that while hedging, one should also plan for any possible scenario.

The market remains fragile, and the shock has already arrived

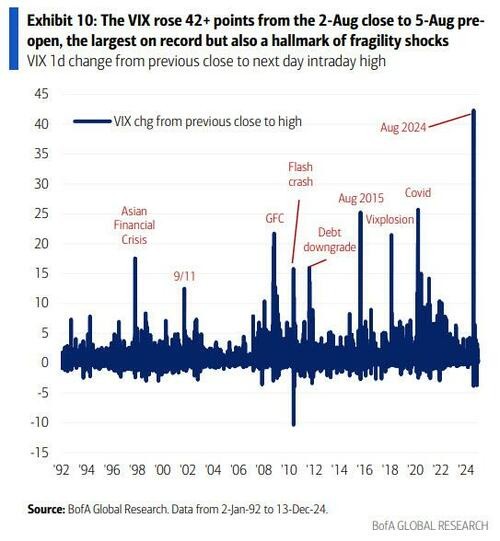

Bank of America believes that the VIX index shock on August 5 this year is a dangerous signal, indicating that the roots of market vulnerability still exist.

Bank of America analysts emphasize that the market has become more fragile over the past few years, characterized by prolonged calm followed by more severe volatility. This fragility is driven by investors flooding into limited momentum trading, then facing a feedback loop of liquidity exhaustion when exiting.

In particular, the VIX index has shown dangerous signs, experiencing a VIX index shock on August 5 this year, when the S&P futures only fell by 4.4%, yet the VIX index surged by 42 points before the market opened, marking the largest increase in its 34-year history; moreover, VIX options information also indicates that position risks still exist, with the degree of disconnection between the VIX index and stock market movements reaching the highest level since February 2018.

Historically, large volatility shocks like those in February 2018 and March 2020 are usually liquidation events, with several years between each event. However, the VIX options positions do not seem to have been eliminated this August, which also means that the next pressure event involving the VIX ecosystem may occur in the coming years.

Bank of America states that the market turmoil on August 5 serves as a stark reminder that the roots of market vulnerability still exist, liquidity may quickly disappear when most needed, and shocks may have already arrived, which is also the main "left tail risk" for 2025.